- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Adhesive Equipment Market Size, Industry Report 2030GVR Report cover

![U.S. Adhesive Equipment Market Size, Share & Trends Report]()

U.S. Adhesive Equipment Market (2024 - 2030) Size, Share & Trends Analysis By Product (Industrial Hot Melt, Adhesive Controllers, Adhesive Pumping Systems, Application Guns), By Application And Segment Forecasts

- Report ID: GVR-4-68040-219-7

- Number of Report Pages: 92

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Adhesive Equipment Market Trends

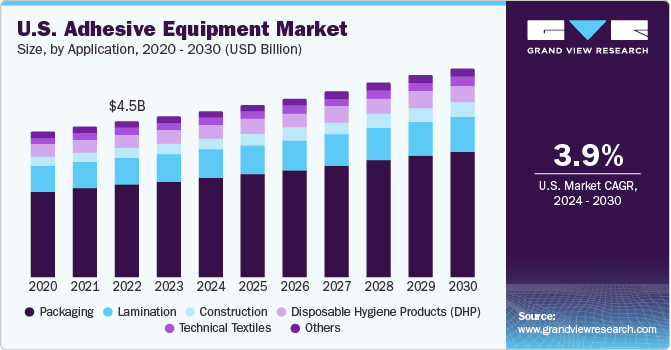

The U.S. adhesive equipment market size was evaluated at USD 4.68 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.9% from 2024 to 2030. This growth is attributed to the creation of new adhesives and their applications across diverse industries. In addition, the escalating demand from sectors such as packaging and construction is predicted to boost growth in the country. Furthermore, an increase in expenditure on construction for the refurbishment and renovation of existing buildings and infrastructure in the U.S. is expected to propel the market's growth.

The adhesive industry has seen a consistent shift from traditional joining methods like mechanical fasteners to more modern adhesive technologies in a variety of manufacturing, assembly, and industrial applications. This shift is anticipated to continue, driven by positive trends in key markets such as paper and paperboard packaging, automotive, DHP, and lamination, among others.

The market is also witnessing a surge in the incorporation of advanced technologies to improve product quality and efficiency. State-of-the-art technologies such as artificial intelligence, machine learning, and blockchain are being employed to create superior products that outdo conventional alternatives in terms of performance and efficiency. Moreover, the growing demand in various sectors like automotive, construction, electronics, and packaging is propelling the need for sophisticated adhesive technology and equipment to meet performance standards. The development of environmentally friendly and high-performance adhesives is further propelling market expansion.

There's been a notable consumer preference shift from solvent-based adhesives to hot melt adhesives, attributed to their lack of solvents and environmental advantages. In addition, polyurethane adhesives, which are effective for bonding non-porous materials such as metals and wood, are seeing increased demand, making them a popular choice across various industries and applications.

Market Concentration & Characteristics

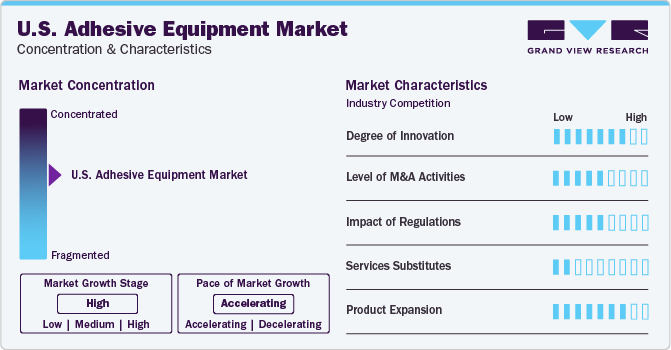

The U.S. adhesive equipment market is characterized by a moderate level of fragmentation, with a mix of key players holding substantial market shares and numerous small to medium-sized businesses adding to the diversity of the competitive environment. This fragmentation is fueled by the varied applications and needs of the industries that utilize adhesives, along with a steady stream of newcomers and innovations.

The market is marked by a high degree of innovation, driven by manufacturers' continuous investment in research and development to ensure the functionality, efficiency, and environmental sustainability of adhesive equipment. Developments such as automation, environmentally friendly adhesive formulations, and advanced dispensing technologies are driving market growth. For Instance, In May 2023, Henkel broadened its extensive range of EV battery system solutions by introducing an innovative injectable thermally conductive adhesive, the Loctite TLB 9300 APSi. This novel adhesive offers dual benefits - it not only ensures structural bonding but also facilitates thermal conductivity within the battery system. A leading global manufacturer of EV batteries has already incorporated this pioneering product.

The level of mergers and acquisitions in the market is moderate, with significant transactions among players aimed at bolstering their market position and broadening their product offerings. However, the frequency of these transactions is not as high as in industries with greater consolidation.

The market has a low availability of service substitutes. While some consumers may choose to outsource adhesive application services, most industrial users opt to invest in their own equipment for reasons of cost-effectiveness, production flexibility, and quality control. Furthermore, specialized adhesive equipment often provides unique features tailored to specific applications, thereby reducing the feasibility of service substitutes.

The market is characterized by a high degree of product expansion, with manufacturers continually launching new products or variants to meet the changing needs of customers. This includes broadening product lines to provide equipment for various types of adhesives, applications, production scales, and levels of automation, serving a wide array of industries and needs.

Application Insights

The packaging sector dominated the market and accounted for the largest revenue share of 59.6% in 2023, due to a surge in consumer preference for quick, portable food and compact FMCG packages. This trend is anticipated to boost the packaging industry, leading to an increased need for adhesive equipment for fast and reliable package sealing. The packaging market is also projected to be propelled by technological advancements such as the introduction of high-barrier materials, smart packaging, digital printing for packaging, and other packaging materials. Adhesives are extensively used in the industry for various purposes, such as sealing cartons and cases, connecting foils, bonding foil manufacturers, gluing folding boxes for suppliers, and labeling bottles.

The lamination segment also had a substantial market share in 2023. Adhesive lamination, typically involves the use of extruders, gravure application cylinders, pattern controllers, pumping systems, and other equipment, is the preferred bonding process when a specific film composition cannot be effectively achieved in a co-extrusion system due to equipment or temperature constraints.

Furthermore, Disposable Hygiene Products (DHP) held a significant market share in 2023. This is attributed to the growing aging population and increased birth rate, which has led to a surge in demand for products such as adult incontinence products and disposable baby training pants or diapers. Additionally, the rise in the number of working women and the female population has also contributed to the demand for pressure-sensitive adhesives in women's sanitation products, such as incontinence pads and tampons. As a result, adhesive equipment like applicator systems, pumps, pattern controllers, and other applicators are expected to see a rapid increase in demand in the DHP sector.

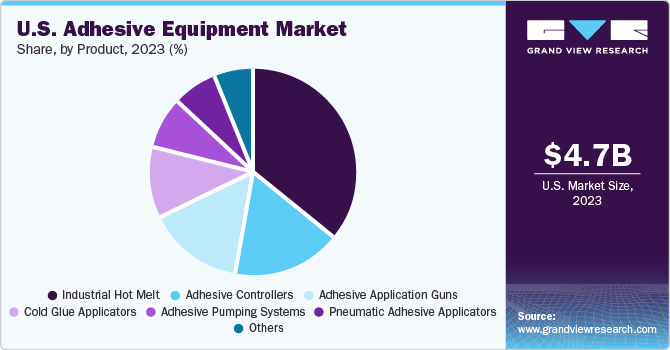

Product Insights

The industrial hot melt sector dominated the market in 2023. This growth is due to the surge in product demand due to its increasing use in industries like packaging, lamination, and DHP, which is projected to propel the market's growth. Consumer applications, such as household repairs and bonding, have made hot melt adhesive sticks and glue guns extremely sought after, contributing to the market's expansion. In addition, the rise in consumer disposable income and swift industrialization are predicted to increase the demand for hot melt adhesives, subsequently leading to a surge in demand for related processors, melters, and equipment. The unique fast-melt and processing characteristics of hot melt adhesives are expected to provide them with a distinct edge over other adhesives.

Adhesive controllers held a substantial market share in 2023, driven by escalating crude oil prices and the growing need for optimal resource utilization. This is anticipated to stimulate product demand in industrial uses such as packaging, lamination, and DHP, among others. These applications enable precise and accurate adhesive application, either intermittently or continuously, reducing waste or maintaining bond strength with less adhesive. Moreover, adhesive pattern controllers, which produce adhesive designs and innovative textures, are experiencing high demand for aesthetic applications in home décor, consumer goods, and more.

The adhesive application guns also held a significant market share in 2023. This growth is due to the rising DIY trend in the construction and packaging sectors, which has led to the development of hand-held applicator guns that are easy to use and reliable. Consumers are increasingly turning to cost-effective bonding materials like adhesives for everyday use. As a result, applicator guns are seeing the most growth in the packaging sector, primarily for consumer applications.

Key U.S. Adhesive Equipment Company Insights

The adhesive equipment market in the U.S. is vibrant and competitive, with key players such as Glue Machinery Corporation, Gluefast Company, and 3M Company. The growing environmental consciousness is prompting these companies to develop bio-based alternatives using starch and indirect food sources.

Key U.S. Adhesive Equipment Companies:

- Glue Machinery Corporation

- Gluefast Company

- Fisnar Inc.

- Adhesive & Equipment, Inc.

- ITW Dynatec

- Graco Inc.

- 3M Company

- Dymax Corporation

- Valco Melton

- Royal Adhesives & Sealants LLC

Recent Development

-

In February 2023, 3M introduced a revolutionary medical adhesive, known as 3M™ Medical Tape 4578. This adhesive can adhere to the skin for an impressive 28 days, doubling the previous standard of 14 days. It's designed for a broad range of health monitors, sensors, and long-term medical wearables. An added advantage is its liner-free stability, allowing it to be stored for up to a year, offering more design flexibility to device manufacturers.

-

In April 2023, Dymax, a prominent producer of quick-curing materials and equipment, launched its latest product, the 1045-M adhesive. This addition to its acclaimed MD® line of light-curable materials is specifically designed for medical device assembly. It effectively bonds glass, SS, ABS, and PC substrates used in the assembly of prefilled syringes, single-use devices, and various injectors. The MD® 1045-M adhesive addresses issues related to needle orientation, material overflow, and extended cure times.

-

In November 2023, DAP, a frontrunner in the home improvement and construction products sector, revolutionized spray foam application with the debut of its unique 1-component broadcast spray foam: Wall & Cavity Foam with a Wide Spray Applicator. Utilizing cutting-edge polyurethane sealant technology, Wall & Cavity Foam is a ready-to-spray, user-friendly, single-canister solution that offers the versatility of 2-component spray foam. It provides superior thermal insulation, aiding homeowners in reducing their energy costs.

U.S. Adhesive Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.02 billion

Revenue forecast in 2030

USD 6.08 billion

Growth rate

CAGR of 3.9% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application.

Key companies profiled

Glue Machinery Corporation; Gluefast Company; Fisnar Inc.; Adhesive & Equipment, Inc.; ITW Dynatec; Graco Inc.; 3M Company; Dymax Corporation; Valco Melton; Royal Adhesives & Sealants LLC.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Adhesive Equipment Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. adhesive equipment market report based on, product, and application.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Hot Melt

-

Adhesive Controllers

-

Cold Glue Applicators

-

Pneumatic Adhesive Applicators

-

Adhesive Pumping Systems

-

Adhesive Application Guns

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Lamination

-

Construction

-

Disposable Hygiene Products (DHP)

-

Technical Textiles

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. adhesive equipment market was valued at USD 4.68 billion in the year 2023 and is expected to reach USD 5.02 billion in 2024.

b. The U.S. adhesive equipment market is expected to grow at a compound annual growth rate of 3.9% from 2024 to 2030 to reach USD 6.08 billion by 2030.

b. The packaging sector dominated the market and accounted for the largest revenue share of 59.6% in 2023, due to a surge in consumer preference for quick, portable food and compact FMCG packages. This trend is anticipated to boost the packaging industry, leading to an increased need for adhesive equipment for fast and reliable package sealing.

b. The key market player in the U.S. adhesive equipment market includes Glue Machinery Corporation; Gluefast Company; Fisnar Inc.; Adhesive & Equipment, Inc.; ITW Dynatec; Graco Inc.; 3M Company; Dymax Corporation; Valco Melton; Royal Adhesives & Sealants LLC.

b. The key factors that are driving the U.S. adhesive equipment market include, the creation of new adhesives and their applications across diverse industries. In addition, the escalating demand from sectors such as packaging and construction is predicted to boost growth in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.