- Home

- »

- Next Generation Technologies

- »

-

Unmanned Surface Vehicle Market Size, Share Report, 2030GVR Report cover

![Unmanned Surface Vehicle Market Size, Share & Trends Report]()

Unmanned Surface Vehicle Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Autonomous, Semi-autonomous), By Application (Defense, Commercial), By Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-416-6

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Unmanned Surface Vehicle Market Summary

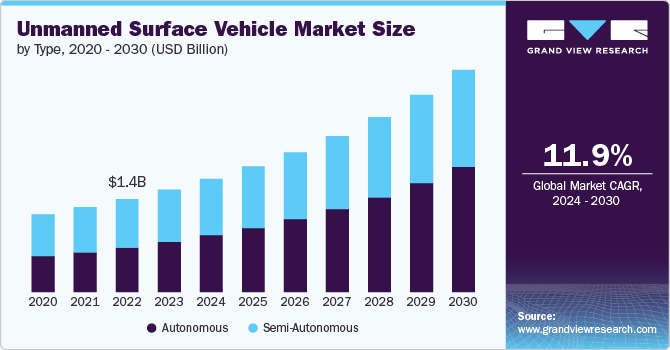

The global unmanned surface vehicle market size was estimated at USD 1,586.1 million in 2023 and is projected to reach USD 3,449.1 million by 2030, growing at a CAGR of 11.9% from 2024 to 2030. The market is witnessing significant growth driven by the increasing adoption of defense and security applications.

Key Market Trends & Insights

- North America accounted for a significant revenue share of over 38% in 2023.

- The U.S. is anticipated to grow at a CAGR of over 10% from 2024 to 2030.

- By type, the semi-autonomous segment dominated the market in 2023 with a market share of around 51%.

- By size, the medium size segment held the largest revenue share in 2023.

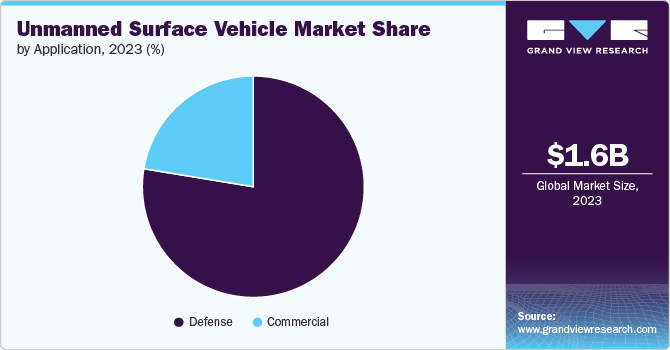

- By application, the defense segment held the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1,586.1 Million

- 2030 Projected Market Size: USD 3,449.1 Million

- CAGR (2024-2030): 11.9%

- North America: Largest market in 2023

Navies and maritime security agencies are increasingly deploying unmanned surface vehicles (USV) for surveillance, reconnaissance, and countermeasures. The ability of USVs to operate in hazardous environments without risking human lives makes them an invaluable asset for modern naval operations, driving their demand.

Technological advancements in autonomous navigation and control systems are propelling the USV market. Innovations in AI and machine learning have enhanced USVs' capabilities, enabling them to perform complex missions with minimal human intervention. These advancements are improving operational efficiency and reducing the cost of operations, making USVs more attractive to various end-users.

The use of USVs is expanding beyond defense to include commercial and scientific research applications. In the commercial sector, USVs are increasingly used for offshore oil and gas exploration, environmental monitoring, and marine data collection. Scientific researchers are leveraging USVs to study oceanography and marine ecosystems, benefiting from the vehicles' ability to cover vast areas and gather data in real-time.

Moreover, the need for enhanced maritime infrastructure and port security is driving the growth of the USV market. Ports and harbors are investing in USVs for tasks such as underwater inspection, pollution monitoring, and security patrols. USVs' ability to operate continuously and provide detailed real-time data makes them an essential tool for maintaining and securing maritime infrastructure.

USVs are increasingly being equipped with advanced sensor systems, including sonar, radar, and cameras, to enhance their functionality. These sensors enable USVs to perform a wide range of tasks, from underwater mapping to surface surveillance. The integration of these advanced sensors is driving the demand for USVs in various sectors, as they provide critical data for decision-making processes.

Industry Dynamics

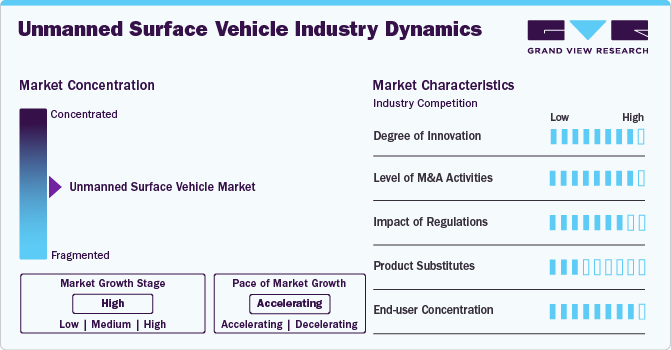

The degree of innovation in the USV market is high. This is primarily due to rapid advancements in autonomous navigation, AI, machine learning, and sensor integration. In addition, the continuous development of new applications in defense, commercial, and scientific research further underscores the market's high level of innovation, attracting substantial investment and collaboration across industries.

The level of mergers and acquisitions in the market is high. This is primarily due to the rapidly evolving technological landscape and the need for companies to enhance their capabilities and market presence. Firms are increasingly engaging in M&A activities to acquire advanced technologies, expand their product portfolios, and gain access to new markets.

The impact of regulation in the market is high. This is due to the critical nature of ensuring safety, security, and environmental compliance in maritime operations. Regulatory bodies impose stringent guidelines and standards for the design, deployment, and operation of USVs to mitigate risks such as collisions, environmental damage, and unauthorized activities. Compliance with these regulations is essential for market participants, influencing the development and commercialization of USV technologies and potentially affecting market dynamics and growth.

The level of product substitutes in the market is low. USVs offer unique capabilities such as autonomous operation, advanced navigation, and real-time data collection that are not easily replicated by other technologies. Traditional manned vessels and other unmanned systems, like aerial or underwater drones, cannot fully substitute the specialized functions and efficiencies provided by USVs in maritime applications such as surveillance, research, and defense. This lack of viable alternatives reinforces the distinct position of USVs in the market.

The end user concentration in the market is relatively high. The primary users of USVs are concentrated in specific sectors such as defense, maritime security, environmental monitoring, and scientific research. These sectors require specialized and advanced technological solutions that USVs provide. The focused application in these key areas leads to a high concentration of end users, as the demand is driven by specific operational needs and capabilities unique to these industries.

Type Insights

The semi-autonomous segment dominated the market in 2023 with a market share of around 51% due to its balanced approach to automation and human oversight. This segment benefits from increased reliability and operational flexibility, combining autonomous capabilities with the option for manual control, which is particularly appealing in complex or uncertain environments. Semi-autonomous USVs are often preferred for applications requiring real-time human intervention, such as search and rescue missions or intricate survey tasks, driving their dominance in the market.

The autonomous segment is expected to record a significant CAGR of over 14% from 2024 to 2030, due to advancements in artificial intelligence, machine learning, and sensor technology. These improvements are enhancing the capabilities of autonomous USVs, making them more reliable and efficient for various applications, including environmental monitoring and defense operations. The growing demand for fully autonomous systems that can operate independently with minimal human intervention, coupled with reduced operational costs and increased operational efficiency, is driving the market growth.

Size Insights

The medium size segment held the largest revenue share in 2023 due to its balanced capabilities and versatility, making it suitable for a wide range of applications. Medium-sized USVs offer an optimal mix of payload capacity, endurance, and maneuverability, making them ideal for tasks such as environmental monitoring, survey operations, and defense missions. Their adaptability to various operational needs, combined with cost-effective deployment and maintenance, has driven their dominance in the market.

The small size segment is expected to register the fastest CAGR from 2024 to 2030 due to its cost-effectiveness, ease of deployment, and suitability for niche applications. These compact USVs are increasingly used for tasks such as environmental monitoring, shallow-water surveys, and coastal inspections, where their smaller size allows for operation in restricted or challenging environments. Their lower operational costs and flexibility, combined with advances in technology that enhance their capabilities, are driving their rapid adoption and growth in the market.

Application Insights

The defense segment held the largest revenue share in 2023, owing to the increasing demand for advanced maritime security and surveillance solutions. USVs are used for a range of defense applications, including mine countermeasures, anti-submarine warfare, and border patrol, offering high operational efficiency and reduced risk to human personnel. Their ability to perform critical tasks autonomously or with minimal human intervention, along with advancements in technology, has made them a preferred choice for military operations, driving significant investment and revenue growth in this sector.

The commercial segment is anticipated to register the fastest CAGR from 2024 to 2030, owing to increasing adoption in sectors such as environmental monitoring, logistics, and offshore operations. Advances in technology and growing demand for autonomous systems in commercial applications are driving this growth, as businesses seek to leverage USVs for enhanced operational capabilities and data accuracy in various maritime and coastal environments.

Regional Insights

The unmanned surface vehicle market in North America accounted for a significant revenue share of over 38% in 2023 due to the defense sector's increased investment in advanced maritime technologies and the rising need for autonomous surface vehicles for environmental monitoring and commercial applications. The region's strong technological infrastructure and supportive regulatory environment also contributed to this growth.

U.S. Unmanned Surface Vehicle Market Trends

The Unmanned Surface Vehicle (USV) market in the U.S. is anticipated to grow at a CAGR of over 10% from 2024 to 2030, driven by substantial defense spending on autonomous maritime systems and the integration of advanced technologies for coastal surveillance, naval operations, and environmental monitoring. In addition, the presence of major USV manufacturers and research institutions fosters innovation and market expansion.

Asia Pacific Unmanned Surface Vehicle Market Trends

The Unmanned Surface Vehicle (USV) market in Asia Pacific accounted for a significant revenue share of over 20% in 2023 due to increasing defense budgets, particularly in countries like China and India. The region's focus on enhancing maritime security, coupled with the rising adoption of autonomous technologies for commercial applications, is driving market expansion.

The India Unmanned Surface Vehicle (USV) market is anticipated to register the fastest CAGR from 2024 to 2030 due to increased defense spending and a strategic focus on maritime security. The government's investment in autonomous technologies for coastal surveillance and naval operations contributes to market growth.

The Unmanned Surface Vehicle (USV) market in China is projected to grow at a CAGR from 2024 to 2030, due to substantial investments in military modernization and the development of autonomous maritime systems. The country's focus on enhancing its naval capabilities and securing its extensive maritime borders supports the demand for advanced USVs.

The Japan Unmanned Surface Vehicle (USV) market is projected to grow at a CAGR from 2024 to 2030, due to its technological advancements in robotics and autonomous systems. The country's emphasis on maritime research, environmental monitoring, and commercial shipping applications drives the demand for USVs.

Europe Unmanned Surface Vehicle Market Trends

The Unmanned Surface Vehicle (USV) market in the Europe region is anticipated to register a CAGR of around 10% from 2024 to 2030 due to increased funding for maritime research and development projects and a strong focus on environmental sustainability and maritime security. European countries are also investing in autonomous technologies to enhance their naval capabilities and support commercial maritime activities.

The UK Unmanned Surface Vehicle (USV) market is projected to grow at a CAGR from 2024 to 2030, due to increased government funding for autonomous systems in defense and commercial sectors. The UK's strategic focus on enhancing its naval capabilities and improving maritime security through advanced technologies supports this growth.

The Unmanned Surface Vehicle (USV) market in Germany is anticipated to record a CAGR from 2024 to 2030, owing to its strong engineering and manufacturing capabilities, as well as significant investments in maritime research and innovation. The country's emphasis on environmental protection and advanced technological solutions for maritime applications also boosts market growth.

Middle East and Africa (MEA) Unmanned Surface Vehicle Market Trends

The Unmanned Surface Vehicle (USV) market in the Middle East and Africa (MEA) region is anticipated to grow at the fastest CAGR of around 11% from 2024 to 2030 due to rising investments in maritime security and oil & gas exploration. Countries in the region are adopting USVs for border surveillance, environmental monitoring, and commercial applications to enhance their maritime capabilities.

The Saudi Arabia Unmanned Surface Vehicle (USV) market accounted for a considerable revenue share in 2023 due to the increased investment in defense and maritime security. The country's focus on protecting its maritime borders and securing its oil and gas infrastructure drives the demand for advanced USVs.

Key Unmanned Surface Vehicle Company Insights

Some of the key players operating in the market are L3Harris Technologies, Inc. and Kongsberg Gruppen ASA, among others.

-

L3Harris Technologies, Inc. is an aerospace and defense technology company known for delivering innovative solutions in communication, avionics, surveillance, and electronic warfare. Headquartered in Melbourne, Florida, L3Harris operates across various sectors, including defense, civil government, and commercial markets. The company specializes in providing advanced technology and mission-critical solutions that support military and security operations worldwide.

-

Kongsberg Gruppen ASA is a Norwegian technology company renowned for its expertise in delivering advanced systems and solutions across the defense, maritime, and aerospace sectors. Kongsberg's offerings include high-technology products and services such as defense systems, remote weapon stations, digital solutions for the maritime industry, and aerospace systems. The company provides state-of-the-art autonomous and remotely operated systems designed for naval and commercial applications.

Liquid Robotics and Fugro are some of the emerging market participants in the Unmanned Surface Vehicle (USV) industry.

-

Liquid Robotics is an American company that specializes in the design and manufacture of autonomous ocean robots, particularly its flagship product, the Wave Glider. The company focuses on providing persistent ocean data collection and observation through unmanned surface vehicles (USVs). In the USV market, Liquid Robotics is a significant player, especially in areas like environmental monitoring, defense, and offshore energy, offering innovative solutions that provide real-time data collection and surveillance across vast oceanic regions.

-

Fugro is a Dutch multinational company that specializes in geotechnical, survey, subsea, and geosciences services, primarily for the oil and gas, infrastructure, and renewable energy sectors. Fugro is known for providing high-quality data collection and analysis to better understand the earth's surface and subsurface. In the Unmanned Surface Vehicle (USV) industry, Fugro plays a crucial role, utilizing USVs for a wide range of applications such as hydrographic surveying, environmental monitoring, and offshore construction support.

Key Unmanned Surface Vehicle Companies:

The following are the leading companies in the unmanned surface vehicle market. These companies collectively hold the largest market share and dictate industry trends.

- ECA Group

- Elbit Systems Ltd.

- Fugro

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Liquid Robotics

- Saab AB

- Teledyne Technologies Incorporated

- Textron Systems Corporation

- Thales Group

Recent Developments

-

In April 2024, L3Harris Technologies, Inc. teamed up with Performance Marine to showcase Unmanned Surface Vehicle (USV) capabilities at the eighth Doha International Maritime Defense Exhibition and Conference (DIMDEX). Known for featuring the latest in maritime and defense technologies, DIMDEX served as the perfect venue for unveiling 'Suhail,' the first autonomous USV constructed in Doha. This partnership underscored their cutting-edge innovations and emphasized the growing importance of autonomous systems in maritime defense.

-

In May 2024, Kongsberg Maritime opened a new facility in Kochi, India, as part of its strategic plan to strengthen customer support and lay the groundwork for future assembly of its waterjet products. The facility is poised for further expansion and investment to enable the assembly and overhaul of Kongsberg Maritime’s Kamewa waterjets.

-

In June 2023, the Thales Unmanned Surface Vessel (USV) Apollo successfully concluded a demanding series of autonomous mine countermeasure (MCM) trials, setting the stage for autonomous mine-hunting operations in the Royal Navy and the broader industry. The Thales-built Royal Navy Motor Boat (RNMB) Apollo completed a series of open water assurance tests.

Unmanned Surface Vehicle Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,755.0 million

Revenue forecast in 2030

USD 3,449.1 million

Growth rate

CAGR of 11.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, size, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

ECA Group; Elbit Systems Ltd.; Fugro; Kongsberg Gruppen ASA; L3Harris Technologies, Inc.; Liquid Robotics; Saab AB; Teledyne Technologies Incorporated; Textron Systems Corporation; Thales Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Unmanned Surface Vehicle Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzing the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global unmanned surface vehicle market report based on type, size, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Autonomous

-

Semi-autonomous

-

-

Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small

-

Medium

-

Large

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Defense

-

ISR

-

Mine Countermeasures

-

Anti-ship Warfare

-

Communication Gateway

-

Others

-

-

Commercial

-

Weather and Environment Monitoring

-

Hydrographic Survey

-

Infrastructure Monitoring and Inspection

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global unmanned surface vehicle market size was estimated at USD 1,586.1 million in 2023 and is expected to reach USD 1,755.0 million in 2024.

b. The global unmanned surface vehicle market is expected to grow at a compound annual growth rate of 11.9% from 2024 to 2030 to reach USD 3,449.1 million by 2030.

b. The North America region accounted for the largest share of around 38% in the unmanned surface vehicle market in 2023 and is expected to continue its dominance in the coming years.

b. Some key players operating in the Unmanned Surface Vehicle (USV) market include ECA Group; Elbit Systems Ltd.; Fugro; Kongsberg Gruppen ASA; L3Harris Technologies, Inc.; Liquid Robotics; Saab AB; Teledyne Technologies Incorporated; Textron Systems Corporation; Thales Group.

b. Key factors that are driving the unmanned surface vehicle market growth include the increasing adoption in defense and security applications. Navies and maritime security agencies are increasingly deploying USVs for surveillance, reconnaissance, and countermeasures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.