- Home

- »

- Next Generation Technologies

- »

-

Unmanned Ground Vehicles Market Size Report, 2033GVR Report cover

![Unmanned Ground Vehicles Market Size, Share & Trends Report]()

Unmanned Ground Vehicles Market (2025 - 2033) Size, Share & Trends Analysis Report By Operation (Teleoperated, Autonomous, Tethered), By Mobility, By Size, By System, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-022-6

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Unmanned Ground Vehicles Market Summary

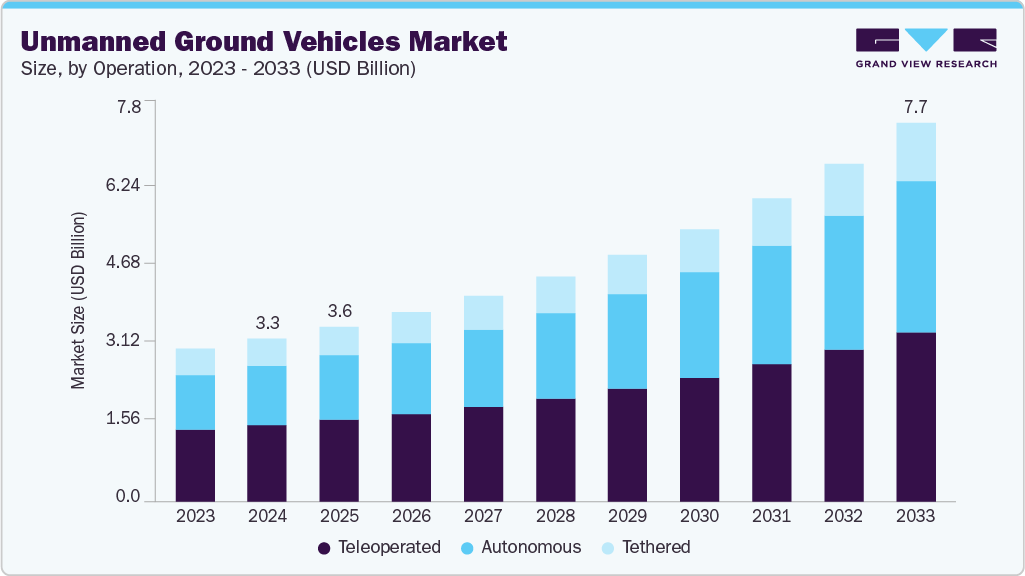

The global unmanned ground vehicles market size was estimated at USD 3.33 billion in 2024 and is projected to reach USD 7.73 billion by 2033, growing at a CAGR of 10.1% from 2025 to 2033. The increasing demand for UGVs, reconnaissance, and logistics support primarily drives the market growth.

Key Market Trends & Insights

- North America dominated the global unmanned ground vehicles market with the largest revenue share of over 45.0% in 2024.

- The unmanned ground vehicles industry in the U.S. led the North America market and held the largest revenue share in 2024.

- By operation, the teleoperated segment held the largest revenue share of over 46.0% in 2024.

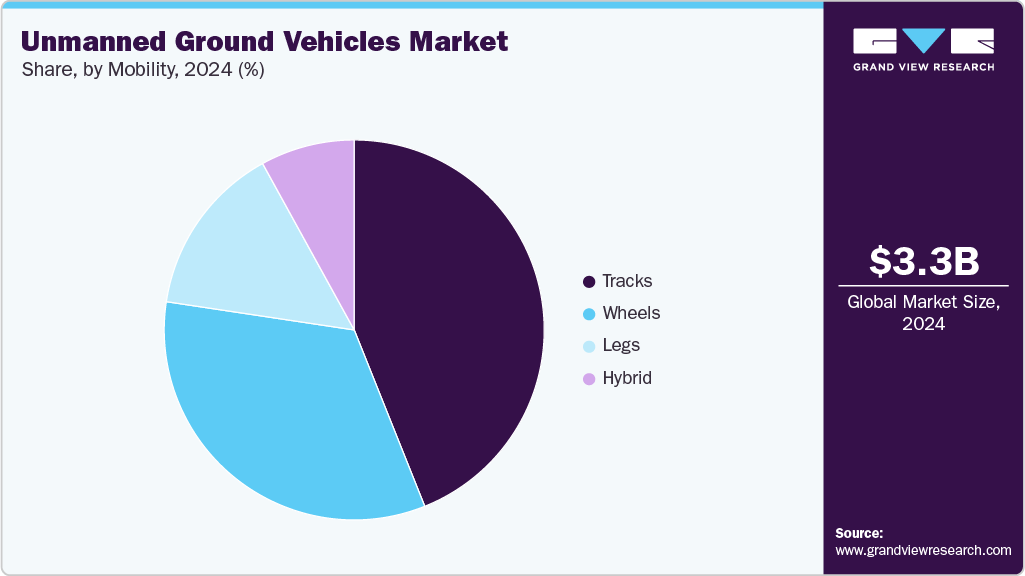

- By mobility, the tracks segment led with the largest revenue share of over 43.0% in 2024.

- By size, the large segment held the largest revenue share of over 32.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.33 Billion

- 2033 Projected Market Size: USD 7.73 Billion

- CAGR (2025-2033): 10.1%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

Advancements in AI, sensors, and hybrid-electric systems are enhancing performance in the UGV market. The growth of the unmanned ground vehicles industry is primarily driven by the rising demand for UGVs across defense, surveillance, and border security applications due to their ability to operate in dangerous and hostile environments. The growing integration of automation and AI in military and commercial operations is fueling the adoption of advanced UGV platforms with autonomous navigation and decision-making capabilities. The incorporation of IoT, real-time data transmission, and remote-control technologies is significantly improving operational efficiency, mission responsiveness, and safety. The shift toward hybrid and electric UGVs is driving innovations focused on enhanced mobility, energy efficiency, and reduced operational noise, which is expected to accelerate the market expansion.

The rising demand for automation and precision in defense and industrial operations is significantly fueling the growth of the unmanned ground vehicle industry. UGVs are being increasingly utilized for tasks such as surveillance, reconnaissance, explosive ordnance disposal (EOD), and material handling in high-risk environments where human presence is dangerous or impractical. Defense strategies are evolving toward unmanned and autonomous platforms, and UGVs offer a reliable solution with high maneuverability and minimal operator involvement. This shift is expanding the adoption of UGVs across armed forces and security agencies globally.

The increasing emphasis on reducing human risk and operational costs in commercial sectors is becoming a major growth driver for the unmanned ground vehicles market. Industries such as mining, agriculture, logistics, and oil & gas are deploying UGVs to automate repetitive and hazardous tasks. These vehicles enhance safety, reduce labor dependency, and improve efficiency in remote or extreme conditions. Regulatory support for automation and growing labor shortages in critical sectors is further driving investments in commercial-grade UGVs with robust capabilities.

Advancements in AI, robotics, and autonomous navigation systems are revolutionizing the capabilities of UGVs. These technological breakthroughs enable real-time obstacle avoidance, path planning, object recognition, and decision-making without constant human input. The integration of LiDAR, radar, thermal imaging, and GPS has greatly enhanced situational awareness and precision in UGVs. The technologies become more cost-effective and scalable, thereby unlocking new application areas for the unmanned ground vehicle industry in both civil and military domains.

Growing collaborations between UGV manufacturers, technology providers, and government agencies are accelerating product innovation and market expansion. Joint ventures and strategic partnerships enable the development of mission-specific UGVs equipped with modular payloads, extended battery life, and ruggedized designs suitable for various terrains and environments. These collaborations also facilitate pilot programs, funding opportunities, and the standardization of autonomous systems, which collectively strengthen the global UGV ecosystem and support long-term market growth.

Operation Insights

The teleoperated segment dominated the unmanned ground vehicles industry with a revenue share of over 46.0% in 2024, owing to its widespread use in defense, disaster response, and hazardous industrial environments. The need for enhanced situational awareness, precision handling, and reduced risk to personnel in high-threat zones drives this dominance. Growing government investments in remotely operated military systems and the adoption of UGVs for critical civilian operations further reinforce the segment's leading position.

The autonomous segment is expected to witness the fastest CAGR of over 11% from 2025 to 2033. This growth is fueled by advancements in AI, machine learning, and sensor fusion technologies that enable real-time decision-making, obstacle avoidance, and precision navigation without human intervention. The push for reducing operator risk in combat zones and hazardous industrial environments is accelerating the adoption of fully autonomous UGVs. The increasing investments in smart infrastructure, precision farming, and warehouse automation are reinforcing the segment’s rapid growth.

Mobility Insights

The tracks segment accounted for the largest share of the unmanned ground vehicles market in 2024, owing to the growing demand for enhanced stability, traction, and maneuverability. The increasing use of UGVs for missions requiring stealth, load-carrying capacity, and precise movement, such as reconnaissance and payload transport, further drives the adoption of track-based designs. The advancements in lightweight materials and modular track systems are enhancing durability, thereby reinforcing their dominance in the unmanned ground vehicle industry.

The hybrid segment is expected to witness the fastest CAGR from 2025 to 2033. This rapid growth is primarily driven by the segment's versatile configuration capabilities, which enable it to perform a wide range of critical roles. The demand for hybrid systems in these applications stems from their flexibility and adaptability in diverse operational scenarios. Their ability to integrate different functionalities into a single platform makes them highly valuable in modern defense and strategic environments. Technological advancements, such as improved sensor integration, communication systems, and autonomous capabilities, are further fueling the adoption of hybrid platforms.

Size Insights

The large segment accounted for the largest share of the unmanned ground vehicles industry in 2024, driven by increasing deployment of heavy-duty UGVs in defense, mining, and logistics operations. The growing demand for enhanced endurance, higher towing capacity, and integrated weapon or sensor systems is propelling the segment. Rising defense budgets, border security concerns, and infrastructure automation projects are fueling the need for robust, large-scale UGVs capable of operating in complex and hazardous environments.

The small segment is expected to witness the fastest CAGR from 2025 to 2033, owing to its increasing use in tactical missions that require agility and maneuverability. These UGVs are ideal for applications such as bomb disposal, tunnel inspection, and indoor surveillance where larger vehicles are impractical. The advancements in miniaturized sensors, lightweight materials, and battery technologies have enhanced the performance of small UGVs. Growing demand from special forces and emergency response teams is further driving the segment's dominance.

System Insights

The navigation and control segment accounted for the largest share of the unmanned ground vehicles market in 2024. This growth is primarily driven by the advanced navigation systems that enable UGVs to operate in GPS-denied areas and perform tasks with minimal human intervention. The integration of AI-powered algorithms, inertial navigation systems (INS), and sensor fusion technologies enhances path planning and situational awareness. Mission complexity increases across defense, industrial, and commercial sectors, and robust navigation and control systems are becoming essential for reliable and safe UGV operations.

The payloads segment is expected to witness the fastest CAGR from 2025 to 2033, driven by the increasing integration of advanced sensors, weapon systems, communication modules, and specialized equipment into unmanned ground vehicles. The need for versatile and high-capacity payloads has surged. The demand for modular, swappable payloads that allow rapid configuration for varied mission requirements is also rising, supported by advancements in miniaturization and energy-efficient components. This growing reliance on intelligent and adaptable payload systems is solidifying their dominance in the UGV market.

Application Insights

The military segment accounted for the largest share of the unmanned ground vehicles industry in 2024, primarily due to the growing reliance on unmanned ground vehicles for high-risk and mission-critical operations. Defense agencies worldwide invest heavily in advanced robotic systems equipped with AI and real-time communication capabilities. The rising focus on modernizing armed forces and enhancing battlefield efficiency is further driving the dominance of the military application segment in the unmanned ground vehicle industry.

The commercial segment is expected to witness the fastest CAGR from 2025 to 2033. This growth is driven by the increasing use of unmanned ground vehicles in sectors such as mining, agriculture, logistics, and construction. The rising demand for uninterrupted operations, along with growing investments in infrastructure automation, is propelling UGV adoption. Technological advancements in navigation, connectivity, and remote monitoring are making these commercial deployments more reliable and scalable.

Regional Insights

The North America unmanned ground vehicles market accounted for the largest revenue share of over 45.0% in 2024, primarily driven by robust defense spending, technological leadership in robotics and AI, and the presence of leading UGV manufacturers. The increasing homeland security initiatives and cross-border surveillance needs are propelling the demand for tactical and modular UGVs. The region’s well-established R&D infrastructure and frequent military modernization programs further solidify North America's leadership in the global UGV market.

U.S. Unmanned Ground Vehicles Market Trends

The U.S. unmanned ground vehicles industry is expected to grow at a CAGR of over 7.0% from 2025 to 2033, driven by the country’s strong defense spending, technological leadership in robotics and AI, and increasing emphasis on autonomous military systems. The U.S. Department of Defense continues to invest heavily in unmanned ground platforms for surveillance, reconnaissance, and combat support operations. Supportive government programs and military modernization initiatives, such as the U.S. Army's Next Generation Combat Vehicle (NGCV), are further accelerating the adoption of the unmanned ground vehicle industry.

Europe Unmanned Ground Vehicles Market Trends

The Europe unmanned ground vehicles industry is expected to grow at a CAGR of over 11.0% from 2025 to 2033. The market growth is primarily driven by increasing defense modernization initiatives across NATO member states and the region’s emphasis on autonomous and AI-driven military technologies. The EU’s investments in border surveillance, counterterrorism, and disaster response operations are accelerating the deployment of UGVs for tactical and reconnaissance missions, further propelling technological innovation and market expansion across the region.

The UK unmanned ground vehicles market is expected to grow at a significant CAGR in the coming years. The UK’s strong R&D ecosystem, along with collaborations between government agencies, defense contractors, and robotics startups, is accelerating the development of next-generation UGVs. The presence of advanced testing facilities and a skilled robotics engineering workforce is fostering innovation. The integration of UGVs in sectors such as military logistics, border security, and emergency response is further propelling market expansion across the UK.

The unmanned ground vehicles market in Germany is driven by the country’s strong defense sector, emphasis on automation, and robust investment. Germany’s commitment to modernizing its military under NATO obligations is leading to increased adoption of UGVs for surveillance, logistics, and explosive ordnance disposal. The growing collaboration between research institutions, defense contractors, and robotics startups is also playing a crucial role in advancing the UAV market in Germany.

Asia Pacific Unmanned Ground Vehicles Market Trends

The Asia Pacific unmanned ground vehicles industry is expected to grow at the highest CAGR of over 12% from 2025 to 2033, fueled by increasing regional conflicts, cross-border tensions, and the rising need for unmanned patrol and surveillance systems. The region is witnessing a surge in R&D investments from both public and private sectors aimed at developing autonomous ground systems tailored to local terrains and combat needs. The growing partnerships between defense contractors and regional governments are driving the proliferation of UGV technologies across the Asia Pacific.

The Japan unmanned ground vehicles market is gaining traction, driven by the country’s technological leadership in robotics and automation. The nation’s vulnerability to natural disasters such as earthquakes and tsunamis has increased the demand for UGVs in search and rescue operations and hazardous environment inspections. Japan’s aging population and shrinking workforce are accelerating the adoption of unmanned systems in commercial sectors, further supporting the growth of the UGV market in the country.

The unmanned ground vehicles market in China is witnessing robust growth, driven by the country's strategic investments in smart manufacturing. The rapid development of autonomous technologies, AI, and robotics through government-backed initiatives is accelerating UGV innovation. Strong domestic manufacturing capabilities, coupled with a growing demand for automation in industries such as mining and logistics, are positioning China as a key growth hub in the global market.

Key Unmanned Ground Vehicles Company Insights

Some of the key players operating in the market include Northrop Grumman Corporation and BAE Systems among others.

-

Northrop Grumman Corporation is a leading global defense and aerospace company that plays a pivotal role in the unmanned ground vehicle industry. The company develops advanced autonomous systems for military applications, including reconnaissance, logistics, and combat support. Its robust R&D capabilities and integration of artificial intelligence, sensor fusion, and autonomous navigation systems make it a top-tier provider in the UGV sector. Northrop Grumman’s UGV platforms are designed for high-threat environments and are widely used by the U.S. military and allied forces, reinforcing its dominance in the defense-oriented UGV landscape.

-

BAE Systems is a major defense contractor and a top player in the UGV market, offering a range of robotic ground vehicles for both tactical and support roles. The company is known for its investment in AI-driven autonomy and modular UGV systems that can be customized for mission-specific tasks. BAE’s UGV platforms emphasize battlefield resilience and real-time situational awareness. With strong government partnerships and a growing portfolio of land-based autonomous solutions, BAE Systems is shaping the future of ground combat robotics.

Roboteam and Teledyne FLIR LLC are some of the emerging market participants in the unmanned ground vehicles market.

-

Roboteam is an emerging player in the UGV industry, recognized for its lightweight and versatile UGV platforms designed for tactical and urban operations. The company specializes in rapid-deployable robotic systems used by military and law enforcement agencies for surveillance, reconnaissance, and bomb disposal. Roboteam focuses on cost-effective, rugged designs, and its collaborations with global defense organizations position it as a rising innovator in the UGV space, especially in asymmetric and low-intensity conflict scenarios.

-

Teledyne FLIR LLC is quickly gaining ground in the UGV market through its development of mission-critical robotic platforms like PackBot and Kobra. These vehicles are extensively used in explosive ordnance disposal (EOD), search and rescue, and hazardous material handling. Its continual innovation in autonomous sensor technologies makes it a prominent emerging force in the global unmanned ground vehicle industry.

Key Unmanned Ground Vehicles Companies:

The following are the leading companies in the unmanned ground vehicles market. These companies collectively hold the largest market share and dictate industry trends.

- Northrop Grumman Corporation

- Lockheed Martin Corporation.

- BAE Systems

- General Dynamics Mission Systems, Inc.

- QinetiQ

- Oshkosh Corporation

- Teledyne FLIR LLC

- Roboteam

- Rheinmetall AG

- L3Harris Technologies, Inc.

Recent Developments

-

In May 2025, QinetiQ advanced the development of its Modular Advanced Armed Robotic System (MAARS), a next-generation unmanned ground vehicle designed for reconnaissance, surveillance, and target acquisition in modern combat environments. MAARS features modular lethality packages, advanced manipulator arms, thermal imaging systems, and extended endurance capabilities. This development highlights QinetiQ’s commitment to delivering versatile and mission-adaptable UGV platforms, reinforcing its strategic role in shaping the future of armed ground robotics within the unmanned ground vehicles industry.

-

In May 2025, Lockheed Martin Corporation advanced its role in the unmanned ground vehicle (UGV) market by emphasizing crewed-uncrewed teaming through new autonomous operations doctrines and field exercises. The company announced investments in software-enabled autonomy, open-architecture systems, and AI-powered decision-making tools to enable seamless integration of UGVs with manned combat platforms. These innovations are aimed at enhancing operational flexibility, mission scalability, and interoperability across modern battlefield environments.

-

In September 2024, BAE Systems introduced the Autonomous Tactical Light Armour System (ATLAS) Collaborative Combat Variant (CCV), a modular 8×8 unmanned ground vehicle designed to advance the capabilities of the unmanned ground vehicle (UGV) market. Engineered for autonomous surveillance and escort missions, the platform supports human-in-the-loop targeting and is compact enough to fit within a standard 20-foot ISO container. This innovation enhances mission flexibility, operational safety, and rapid deployment in combat environments.

Unmanned Ground Vehicles Market Report Scope:

Report Attribute

Details

Market size value in 2025

USD 3.58 billion

Revenue forecast in 2033

USD 7.73 billion

Growth Rate

CAGR of 10.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025- 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Operation, mobility, size, system, application, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Northrop Grumman Corporation; Lockheed Martin Corporation; BAE Systems; General Dynamics Mission Systems, Inc.; QinetiQ; Oshkosh Corporation; Teledyne FLIR LLC; Roboteam; Rheinmetall AG; L3Harris Technologies, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Unmanned Ground Vehicles Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the unmanned ground vehicles market report based on operation, mobility, size, system, application, and region:

-

Operation Outlook (Revenue, USD Million, 2021 - 2033)

-

Teleoperated

-

Autonomous

-

Tethered

-

-

Mobility Outlook (Revenue, USD Million, 2021 - 2033)

-

Wheels

-

Tracks

-

Legs

-

Hybrid

-

-

Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small

-

Medium

-

Large

-

Very Large

-

-

System Outlook (Revenue, USD Million, 2021 - 2033)

-

Payloads

-

Navigation And Control System

-

Power System

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Agriculture

-

Manufacturing

-

Mining

-

Supply Chain

-

Others

-

-

Military

-

Explosive Ordinance Disposal

-

Equipment Carrying

-

Forward Reconnaissance

-

Mobile Weapon Platform

-

Combat

-

Surveillance And Reconnaissance

-

Others

-

-

Government & Law Enforcement

-

Urban Search and Rescue

-

Fire Fighting

-

Nuclear Response

-

Crowd Control

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global unmanned ground vehicle market size was estimated at USD 3.33 million in 2024 and is expected to reach USD 3.58 million in 2025.

b. The global unmanned ground vehicle market is expected to grow at a compound annual growth rate of 10.1% from 2025 to 2033 to reach USD 7.73 million by 2030.

b. North America dominated the unmanned ground vehicle market with a share of around 45% in 2024. This is attributed to the factors including the growing defense budget and increasing investments in the procurement of next-generation military UGVs for numerous countries in the area, notably the U.S.

b. Some key players operating in the unmanned ground vehicle market include BAE Systems plc, Lockheed Martin Corporation, Northrop Grumman Systems Corporation, and Rheinmetall AG among others.

b. Key factors that are driving the unmanned ground vehicle market growth include the rising demands for UGV systems in both commercial and military applications, coupled with advancement in the UGV technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.