- Home

- »

- Plastics, Polymers & Resins

- »

-

Ultra-high Molecular Weight Polyethylene Fibers Market Report, 2027GVR Report cover

![Ultra-high Molecular Weight Polyethylene Fibers Market Size, Share & Trends Report]()

Ultra-high Molecular Weight Polyethylene Fibers Market Size, Share & Trends Analysis Report By Grade Type (Medical, Industrial), By Product Type, By Application, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-650-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Bulk Chemicals

Report Overview

The global ultra-high molecular weight polyethylene fibers market size was valued at USD 761.11 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 8.6% from 2020 to 2027. Ultra-high molecular weight polyethylene (UHMWPE) fibers are gaining increasing acceptance in the military and defense application owing to their several superior properties, such as high chemical resistance excellent impact, and abrasion resistance, highest strength-to-weight ratio, excellent flexibility and comfort, wear resistance, and protection against handgun threats. UHMWPE fibers are widely used in protective armor applications, such as ballistic helmets, frag knits, bulletproof vests, ballistic shields, ballistic plate inserts, and explosion-resistant blanket.

In addition, government military programs such as the Soldier Protection System-Torso and several governments across the globe have taken initiatives to provide better protective equipment for their military and law enforcement personnel, thereby encouraging the use of UHMWPE fibers for the same. Such initiatives are aimed at reducing the weight of protective armor, along with increasing the efficiency and operability of law enforcement and military personnel.

Extremity Protection (SPS-TEP) program in U.S. for providing full body armor to armed forces is propelling the demand for ultra-high molecular weight polyethylene fibers in protective armor applications. Furthermore, the U.S. Army has been conducting several technological research activities in its U.S. Army Research Laboratory pertaining to advanced protective equipment, such as helmets and body-armor plates. These research activities are creating a high demand for UHMWPE fibers owing to its superior properties.

Industry participants are also playing an active role in shaping the UHMWPE fibers market by taking strong steps and investing in R&D initiatives to develop a superior product. For instance, in May 2017, Koninklijke DSM N.V. announced the expansion of its R&D capabilities of ballistic materials, specific to helmet applications, to create lightweight, high-performance helmet designs, and technologies based on Dyneema material. Thus, all the aforementioned factors together are augmenting the demand for ultra-high molecular weight polyethylene fibers in military and defense applications.

However, volatile prices of raw materials of ultra-high molecular weight polyethylene fibers are expected to hamper the market growth in the coming years. In addition, the recent outbreak of COVID-19 across the globe is negatively impacting the demand for UHMPWE fibers. Stalled industrial output and restriction in supply and transport are impacting the product demand.

Grade Type Insights

The industrial grade segment led the market and accounted for more than 78.0% share of the global revenue in 2019. Rising demand from various applications, such as protective armor, wear and gear, nets, rope, and sports equipment, is fueling the demand for industrial grade ultra-high molecular weight polyethylene fibers. Increasing demand for lightweight protective armor, along with enhanced comfort and efficiency, is creating significant demand for industrial grade UHMWPE fibers in applications, such as helmets, frag knits, bulletproof vests, ballistic shields, ballistic plate inserts, and explosion resistant blanket, in the military and defense sector. Properties such as maximum protection, lightweight, excellent flexibility, and low cost as compared to traditional materials, including HMPE, ceramics, and aramid, are propelling the industrial grade demand in protective armor applications.

Properties such as good strength-to-weight ratio, excellent cut and abrasion resistance, and durability are fueling the product demand in wear and gear applications, such as apparel, footwear, and cut resistant gloves. In addition, higher tensile strength as compared to polyester, safe handling, and durability are driving the demand for industrial grade ultra-high molecular weight polyethylene fibers in nets applications, such as air cargo, trawl nets, and aquaculture nets. Industrial grade ultra-high molecular weight polyethylene fibers are also witnessing high demand in rope and sports equipment applications, such as crane ropes, mooring and tow ropes, sailing ropes, backpack, and tents.

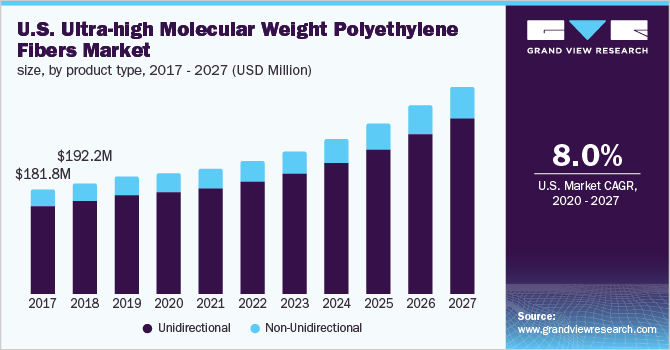

Product Type Insights

The unidirectional fibers product segment led the market and accounted for more than 85.0% share of the global revenue in 2019. ultra-high molecular weight polyethylene fibers are widely used to produce unidirectional UHMWPE laminates and fabrics, which further find applications in soft and hard body armor, lightweight bulletproof helmets, bulletproof armor plate, bulletproof vest, and anti-cutting clothing. Properties such as lightweight, excellent strength, more efficient as compared to traditional materials, including aramids and ceramics, UV resistance, and high resistance to cutting and abrasion are fueling the product demand in the above-mentioned applications.

The unidirectional fabrics are made from multilayer fibers and resin, which further increase the performance against tear and abrasion and reduce weight. In bulletproof vest, the flexible UHMWPE fibers absorb and disperse the energy of bullet to a larger area, thereby reducing the depth of depression on the vest and diminishing the risk of injuries. Maximum protection, lightweight as compared to aramid, excellent flexibility, resistance to UV, and resistance to wear and tear are propelling the demand for unidirectional fibers in bulletproof vest.

Application Insights

The protective armor application segment led the UHMWPE fibers market and accounted for more than 36.0% share of the global revenue in 2019. ultra-high molecular weight polyethylene fibers are widely used in protective armor applications, such as bulletproof vests, helmets, ballistic shields, ballistic plate inserts, and explosion resistant blankets. Properties such as protection against handgun, shrapnel, and knives, lightweight, excellent strength, and flexibility are paving the way for the use of UHMWPE fibers in the above-mentioned protective armor applications. Moreover, factors such as increasing focus of defense agencies on ensuring soldier survivability, surge in military warfare, and increasing spending on the defense sector are fueling the demand for protective armor in the military and defense sector. In addition, military modernization programs such as U.K.’s Future Infantry Soldier Technology (FIST) program and France’s FELIN program are further creating lucrative opportunities for UHMWPE fibers in protective armor applications.

Rising demand for UHMWPE fibers in crane ropes, lifting slings, draglines and rope shovels, and mooring and tow ropes is expected to fuel the segment growth. Properties offered by UHMWPE fibers including higher strength and lightweight compared to steel wire and polyester ropes, reliability and durability in the most demanding lifting operations, and resistance to corrosion and UV rays are expected to drive the product demand in this application segment. Traditional steel ropes are heavy compared to UHMWPE fibers, which further reduces the lifting capacity of the crane. On the contrary, the lightweight UHMWPE fibers increase the lifting capacity of the crane, thus reducing the downtime.

Regional Insights

Asia Pacific dominated the market and accounted for 37.0% share of the global revenue in 2019. China led the regional market, in terms of both volume and revenue, in 2019. The market in Asia Pacific is primarily driven by the ascending product demand in various applications, including medical devices, ropes, cut resistant gloves, nets, protective armor, apparel, footwear, and sports equipment. Growing manufacturing industry in Southeast Asian countries, including Thailand, Indonesia, and Malaysia, is driving the demand for cut-resistant gloves for employees’ safety, thereby creating lucrative opportunities for the manufacturers of ultra-high molecular weight polyethylene fibers.

In addition, increasing seafood production in Southeast Asian countries, such as Indonesia, Thailand, and Vietnam, is augmenting the demand for aquaculture nets, which, in turn, is likely to drive the demand for UHMWPE fibers in the coming years. Presence of numerous end users, proximity to raw material suppliers, and growing industrialization, especially in India and China, are anticipated to boost the growth of market in the region.

Moreover, the demand for protective armor is high in China and India, which are among the world’s top five military and defense spending countries. This is projected to fuel the demand for UHMWPE fibers in the region. However, the recent outbreak of COVID-19 in countries such as China, India, Japan, Australia, Indonesia, Singapore, and Thailand is hampering the product demand in various applications, such as apparel, sports equipment, footwear, ropes, and nets. The outbreak has resulted in the slowdown or halt in manufacturing operations as well as restrictions on supply and transport, which is expected to negatively impact the demand for UHMWPE fibers in the aforementioned applications in the region.

Key Companies & Market Share Insights

The global market is consolidated with the presence of leading players as well as a few medium-scale and small-scale regional players operating in different parts of the world. The global players face intense competition from each other as well as from the regional players, who have strong distribution networks and good knowledge about suppliers and regulations.

The companies in the market compete on the basis of the quality of products offered. Major players, in particular, compete on the basis of application development capability and new technologies used in product formulation. For instance, in November 2017, DSM and Meister announced innovative fibers braiding technology of ultra-high molecular weight polyethylene fibers marketed under the brand name of Dyneema Purity for application in medical devices. Some of the prominent players in the ultra-high molecular weight polyethylene fibers market include:

-

Koninklijke DSM N.V.

-

Honeywell International Inc.

-

Beijing Tongyizhong Specialty Technology & Development Co., Ltd.

-

Dongyang MFG Co., Ltd.

-

Sinty Sci-Tech Co., Ltd.

-

DuPont de Nemours, Inc.

Ultra-high Molecular Weight Polyethylene Fibers Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 790.17 million

Revenue forecast in 2027

USD 1.41 billion

Growth Rate

CAGR of 8.6% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in tons, Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade type, product type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Koninklijke DSM N.V.; Honeywell International Inc.; Beijing Tongyizhong Specialty Technology & Development Co., Ltd.; Dongyang MFG Co., Ltd.; Sinty Sci-Tech Co., Ltd.; DuPont de Nemours, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ultra-high Molecular Weight Polyethylene Fibers Market Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global ultra-high molecular weight polyethylene (UHMWPE) fibers market report on the basis of grade type, product type, application, and region:

-

Grade Type Outlook (Volume, Tons; Revenue, USD Million, 2016 - 2027)

-

Medical

-

Industrial

-

-

Product Type Outlook (Volume, Tons; Revenue, USD Million, 2016 - 2027)

-

Unidirectional

-

Non-unidirectional

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2016 - 2027)

-

Protective Armor

-

Helmets (includes ballistic helmets)

-

Frag Knits

-

Bulletproof Vests

-

Ballistic Shields

-

Others (includes ballistic plate inserts, explosion resistant blanket)

-

-

Wear & Gear

-

Apparels (includes sport apparels, denims, protective clothing)

-

Footwear (includes shoes)

-

Cut resistant Gloves

-

-

Nets

-

Air cargo Nets

-

Aquaculture Nets (includes fishing nets)

-

Trawl Nets

-

-

Ropes

-

Medical Devices

-

Sports Equipment (includes backpacks and tents)

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."