- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Ceramics Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Ceramics Market Size, Share & Trends Report]()

Ceramics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Traditional, Advanced), By Application (Abrasives, Tiles), By End-use (Industrial, Medical), By Region, And Segment Forecasts

- Report ID: 978-1-68038-621-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ceramics Market Summary

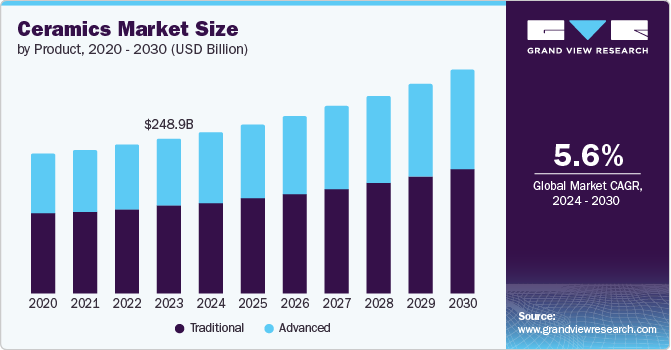

The global ceramics market size was estimated at USD 248.89 billion in 2023 and is projected to reach USD 359.35 billion by 2030, growing at a CAGR of 5.6% from 2024 to 2030. The expansion of the building and construction industry, where ceramics play a vital role in tiles, sanitary ware, and bricks, is anticipated to propel the market in the forthcoming years.

Key Market Trends & Insights

- The ceramics market in North America is anticipated to register a CAGR of 4.4% during the forecast period.

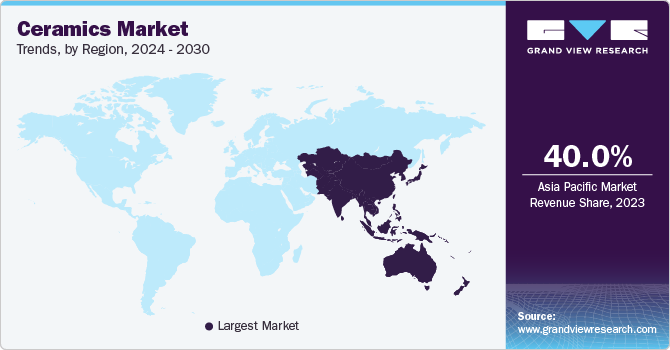

- The Asia Pacific ceramics market dominated the market with a share of above 40% in 2023.

- Based on product, traditional Ceramics held the largest revenue share of over 56% in 2023.

- In terms of application, tiles held the largest share of over 48% of the global ceramics market.

- Based on end-use, medical is anticipated to register fastest growth rate of 6.1% during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 248.89 billion

- 2030 Projected Market Size: USD 359.35 billion

- CAGR (2024-2030): 5.6%

- Asia Pacific: Largest market in 2023

- China: Fastest growing market

Recently, changes in indoor home decoration at a global scale have affected how ceramics are used in the construction sector. Bathroom fixtures like sinks, bathtubs, toilet bowls, and shower trays are made from kaolin and clay, with the addition of quartz and feldspar before being painted. This creates a material that is very hard, durable, and easy to clean, with good resistance to wear and chemicals. Over the forecast period, rising demand for ceramic tiles, mainly due to residential and commercial construction activities, is anticipated to drive the market expansion. Ceramic tiles have many uses, including on walls and floors. They are a blend of heat-hardened clay and other minerals, like sand and quartz.

Infrastructure construction activities around the world have increased significantly. For instance, the Government of India has undertaken many initiatives, such as the Smart City project, to ensure rapid urbanization in the country. Rising construction and infrastructure activities drive the demand for ceramic tiles, boosting market growth.

Drivers, Opportunities & Restraints

The growth of the medical industry is one of the key drivers for the market. Ceramics have been utilized for a very long time for medical applications. The growth of healthcare systems in various economies and high spending on medical equipment and devices have positively impacted product demand. For instance, amidst the growing demand for ceramic components in joint replacements, CeramTec expanded its manufacturing operations and, in October 2023, held a groundbreaking ceremony for its new extension building in Marktredwitz, Germany.

Ceramics are also used in the aerospace industry as they are lighter than metals. This enables longer time in space, especially for exploration, larger payloads, low fuel consumption, and faster speeds. Therefore, the prevalence of ceramics in the aerospace industry is expected to create lucrative growth opportunities for the product in the global market.

The ceramics market, however, faces challenges owing to high energy costs. Surging prices of raw materials like coal and natural gas directly impact the cost of ceramics production. For instance, in August 2021, the Morbi cluster in India faced a burden of approximately INR 100 crores (~USD 12.25 million) on account of the hike in gas prices. Also, as of January 2024, the gas crisis in Bangladesh led to an approximate drop of 20% in the quality of ceramics production.

Price Trends

The cost of ceramic products fluctuates amidst the surge and drop in raw material prices. For instance, kaolin prices have grown due to increased regulatory scrutiny and rising labor, energy, and logistical costs. To ensure the market's long-term viability, companies like KaMin and CADAM announced a rise in the price of kaolin goods. In November 2023, both companies announced an increase of up to 9% on their kaolin products, which were anticipated to be effective from January 2024.

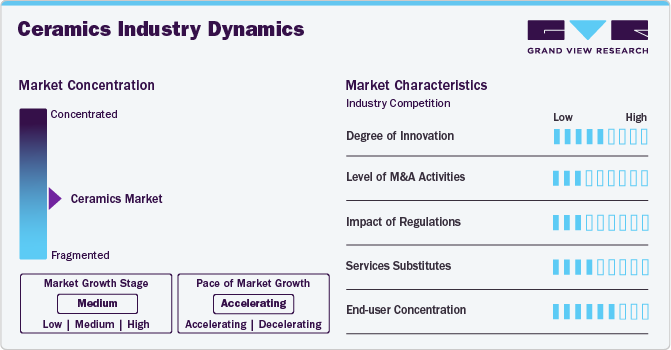

Market Concentration & Characteristics

The ceramics market is experiencing a moderate growth phase characterized by an accelerated pace. It is notable for its fragmented structure, with diverse clusters operating across various regions. Intense competition is pervasive within the industry, as entities cater to local and export markets.

The market is competitive. The players operating in this market continuously carry out product developments to stay ahead of their competitors. For instance, in May 2022, CeramTec GmbH launched a new product named AIN HP, a relatively new high-performance substrate. This ceramic substrate is ideal for use in power converters in rail vehicle production.

Product Insights

“Traditional Ceramics held the largest revenue share of over 56% in 2023.”

According to the University of New South Wales (UNSW), traditional ceramics consist of three basic materials or compounds: silica (quartz), clay, and feldspar. Out of the aforementioned compounds, clay is the most commonly used material. This product type is widely used in manufacturing porcelain tiles, clay bricks, and tableware.

Advanced ceramics are an excellent choice for various professional applications across several industries. They are distinguished by more than just their remarkable characteristics, including inorganics and high-purity compounds in pottery and tableware manufacturing. Owing to their high corrosion resistance, advanced ceramics are extensively preferred in aviation, vehicles, and armor.

Moreover, due to high temperatures and changes in surroundings, faults typically occur due to thermal expansion in various energy and power, aerospace, defense, and automotive components, leading to component failure. Advanced ceramics exhibit substantially lower thermal expansion under the same environmental conditions as other standard alloys and metals. This aspect has affected product consumption across a range of end-use industries.

Application Insights

“Tiles held the largest share of over 48% of the global ceramics market.”

There is a huge demand for wall-tiling patterns in living spaces, mainly to cater to new application areas outside bathrooms and kitchens. Modern home application settings use ceramic wall tiles, including hallways, lobbies, and bedrooms. Moreover, as a more affordable option, these tiles have replaced traditional stone materials in commercial spaces, including corporate offices, hotel lobbies, and museums.

Sanitary ware is another key application segment of the market, which is anticipated to expand at a CAGR of 5.3% during the forecast period. Ceramic-based sanitary ware is cost-effective, durable, easy to clean, and offers a glossy finish. It is a basic necessity in public, private, and commercial spaces. Growing economic development and rising health concerns have augmented sanitary ware manufacturing, which in turn is anticipated to propel segment growth over the coming years.

The bricks & pipes segment held the third-largest share of the market in 2023. Bricks are inert products made of nontoxic and natural materials that do not release volatile organic compounds (VOCs) and promote a healthy interior environment. Ceramic bricks are highly fire resistant and offer insulation from sound, vibrations, electricity, electrostatic discharge, and ionizing radiation, making them ideal for sustainable housing.

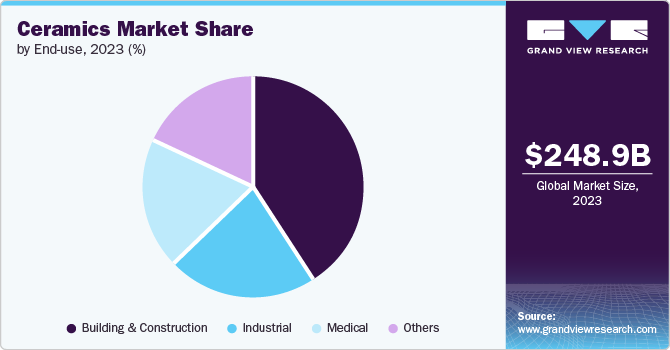

End-use Insights

“Medical is anticipated to register fastest growth rate of 6.1% during the forecast period.”

The growth of the medical end-use segment is attributed to ceramics' inorganic, non-metallic composition. Ceramics are preferable for producing medical instruments and tools, dental implants, and bioceramics. Owing to exceptional wear resistance and chemical inertness, they are also primarily preferred for use inside human bodies.

The industrial segment held the second-largest share of the market in 2023. The product is used in various industries, such as energy, mechanical, metallurgy, and chemical. Its high wear and corrosion resistance, hardness, chemical resistance, thermal and electrical insulation, temperature resistance, and compressive strength make it useful in these industries.

The key industrial application area of ceramics is refractories, which are defined as substances that can endure operating temperatures of 1,000°C or above. Although the metallurgical industry accounts for over 80% of the overall refractor market for processing ferrous and non-ferrous metals, refractories are also used in the glass and cement manufacturing and energy generation industries.

Regional Insights

“U.S. held over 23% revenue share of the overall Global ceramics market.”

The ceramics market in North America is anticipated to register a CAGR of 4.4% during the forecast period. Heavy investments from domestic and international investors in North America's residential/commercial construction activities are anticipated to fuel the region's requirements for artware and tableware. Further, growing infrastructural developments are expected to prove fruitful for segment growth.

U.S. Ceramics Market Trends

Tile is one of the major applications of this market. However, growth in this segment was low in the U.S., as the country's consumption of tiles dropped in 2023. According to the Tile Council of North America, Inc., the overall consumption of ceramic tiles in the U.S. was approximately 2.85 billion square feet, a 7.3% drop compared to 2022.

Europe Ceramics Market Trends

The Europe ceramics market is another prominent market for ceramics, where the product demand is expected to be highest in tiles. Around 28% of the European ceramics industry's overall employee strength is tile manufacturing. In addition, the region consumes approximately 1.8 million units of ceramic roof tiles every year. The region holds a strong position in the global tiles industry, with Italy, Germany, France, and Spain being the leading exporters of ceramic tiles.

The market for ceramics in Germany is poised to grow significantly during the forecast period, owing to increased healthcare expenditures. Germany is one of the leading countries in Europe with a robust healthcare system. According to the OECD, the country spends USD 8011 per capita on health, which equals 12.7% of GDP.

Asia Pacific Ceramics Market Trends

The Asia Pacific ceramics market dominated the market with a share of above 40% in 2023. This large share is due to the rapidly expanding manufacturing sector in the region's developing economies. The surging demand for advanced ceramics from semiconductor manufacturers is further fueling the market growth. For instance, in February 2022, Taiwan-based UMC announced intentions to invest USD 5 billion in the expansion of its chip production capacity in Singapore.

China ceramics market is anticipated to register the fastest growth rate over the forecast period. The surging demand for advanced ceramics from semiconductor manufacturers based in China is one of the key growth drivers. Moreover, plasma is produced as part of the manufacturing process of semiconductors in a hostile environment. Due to the risk of unintentional contaminants in semiconductors, plasma corrosion resistance is a crucial characteristic of semiconductor manufacturing equipment parts. Therefore, the manufacture of semiconductors is better suited to highly reliable fine ceramics with exceptional plasma resistance than resins, glass, and metals.

Central & South America Ceramics Market Trends

The Central & South Americaceramics market is expected to witness growth due to rising investments in infrastructure and construction industries by domestic and international investors. The rise in residential and commercial sectors propels the need for ceramic products such as sanitary ware and tiles. For instance, the sales of newly built properties rose by over 32% in 2023 compared to the previous year in Brazil.

Middle East & Africa Ceramics Market Trends

The ceramics market in Middle East & Africa is expected to be driven by the increasing number of hotels, luxury resorts, and luxurious residential spaces in countries like the U.A.E., Saudi Arabia, and Qatar. For example, a U.A.E.-based real estate developer, OMNIYAT, announced the beginning of its luxury residential projects in Palm Jumeirah, Dubai, in 2021. Such developments are expected to drive the demand for ceramics in producing decorative tiles, 3D-printed flooring, sanitary ware products, and other interior décor products.

Key Ceramics Company Insights

Some of the key players operating in the market include CoorsTek, CeramTec, and RAK Ceramics.

-

CoorsTek Inc. is a manufacturing company that produces and develops technical ceramic material formulations. It has a long history in the ceramic industry, having been incorporated in 1910 in Colorado, U.S. The company employs over 5,000 people. In June 2022, the company invested USD 50 million to construct a manufacturing campus for the production of advanced materials in its 230,000-square-foot facility in Benton, Arkansas

-

CeramTec GmbH is a manufacturing company engaged in the production and supply of advanced ceramics. Its portfolio includes around 10,000 different products and a wide range of ceramic materials. The company was established in 1996, following the acquisition of Hoechst CeramTec AG by Cerasiv GmbH

-

RAK CERAMICS is one of the largest ceramic brands in the world. The company specializes in the production of porcelain wall and floor tiles, faucets, sanitaryware products, and tableware. It is headquartered in Ras Al-Khaimah, UAE. The company employs around 12,000 staff of 40 different nationalities globally

Key Ceramics Companies:

The following are the leading companies in the ceramics market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- AGC Ceramics Co., Ltd.

- CeramTec GmbH,

- CoorsTek Inc.

- Du-Co Ceramics Company

- Kajaria Ceramics

- MOHAWK INDUSTRIES, INC.

- Morgan Advanced Materials

- RAK CERAMICS

- Saint Gobain

Recent Developments

-

In March 2024, Landmark Ceramics celebrated its USD 72 million investment towards logistics and production capacity. The company will create a new logistics hub and expand tile production near Nashville, Tennessee, U.S.

-

In April 2024, Meghna Ceramic Industries increased its production capacity with an investment worth USD 45 million to capture a larger market share of the tiles market. Since July 2023, the company’s factory near Dhaka has been producing 51,000 square meters of “Fresh Ceramics” tiles daily

Ceramics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 259.68 billion

Revenue forecast in 2030

USD 359.35 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Turkey; China; India; Japan; Brazil; Middle East & Africa; GCC

Key companies profiled

3M, AGC Ceramics Co., Ltd.; CeramTec GmbH; CoorsTek Inc.; Du-Co Ceramics Company; Kajaria Ceramics; Mohawk Industries, Inc.; Morgan Advanced Materials; RAK CERAMICS; Saint Gobain

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ceramics Market Report Segmentation

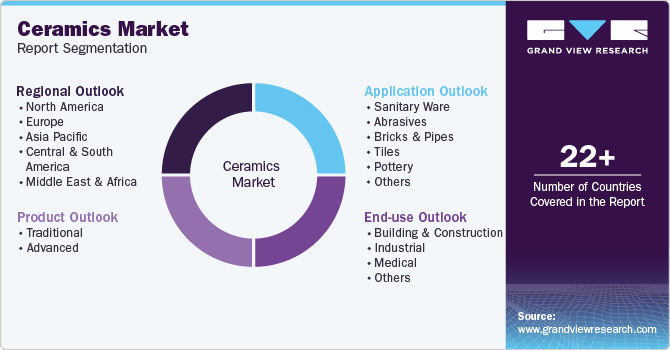

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the ceramics market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Traditional

-

Advanced

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sanitary Ware

-

Abrasives

-

Bricks & Pipes

-

Tiles

-

Pottery

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Building & Construction

-

Industrial

-

Medical

-

Others

-

-

Regional Outlook ( Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

-

Frequently Asked Questions About This Report

b. The global ceramics market size was estimated at USD 248.89 billion in 2023 and is expected to reach USD 259.68 billion in 2024.

b. The global ceramics market is expected to grow at a compound annual growth rate of 5.6% from 2024 to 2030 to reach USD 359.35 billion by 2030.

b. Based on product, traditional dominated the ceramics market with a revenue share of over 56.0% in 2023, owing to tiles consumption for various household applications and sanitary ware fitting.

b. Some key players operating in the ceramics market include AGC Ceramics Co., Ltd., 3M; CoorsTek Inc. CeramTec GmbH, Du-Co Ceramics Company. RAK CERAMICS, Kajaria Ceramics MOHAWK INDUSTRIES, INC. Morgan Advanced Materials, and Saint Gobain, among others.

b. Growth in the global construction industry is expected to propel the demand for tiles and sanitary ware, which is anticipated to augment the ceramics market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.