- Home

- »

- Animal Health

- »

-

UK Veterinary Medicine Market Size,, Industry Report, 2030GVR Report cover

![UK Veterinary Medicine Market Size, Share & Trends Report]()

UK Veterinary Medicine Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Biologics, Pharmaceutical), By Animal Type (Production, Companion), By Route Of Administration, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-422-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Veterinary Medicine Market Trends

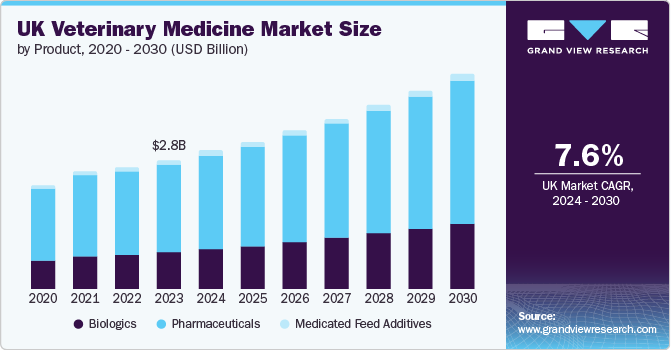

The UK veterinary medicine market size was estimated at USD 2.64 billion in 2024 and is projected to grow at a CAGR of 7.8% from 2025 to 2030. This growth can be attributed to several key factors, including the rising livestock population, increasing rates of pet ownership, ongoing innovation in veterinary medicine, and the growing prevalence of animal diseases. In the UK, pet adoption is on the rise, leading to a higher number of pets per household. According to the PDSA, approximately 28% of UK adults own a dog, while 24% own a cat. This high level of pet ownership is expected to drive demand for veterinary medicine throughout the forecast period.

The UK government has initiated several funding programs in 2024 and 2025 to enhance animal health and welfare, further supporting the development and use of veterinary medicines. For instance, the Animal Health and Welfare Pathway, introduced in 2023, provides financial assistance to livestock farmers to enhance animal health and welfare standards. As of January 2025, the program has been extended to cover follow-up support for endemic diseases, offering annual payments including £923 (USD 1,015.32) for pigs, £639 (USD 702.91) for sheep, and varying amounts for cattle depending on the specific disease identified.

Furthermore, animal disease outbreaks in the UK significantly drive the market by increasing the demand for therapeutic and preventive treatments, such as antibiotics, vaccines, and diagnostic tools. These outbreaks heighten awareness among farmers and pet owners, leading to more frequent veterinary consultations and proactive health management. For instance, in March 2025, the UK reported the world's first known case of H5N1 avian influenza in a sheep farm in Yorkshire. The infected ewe was culled, and no further infections were detected in the flock. Authorities have implemented strict biosecurity measures, and the risk to the public is considered low.

List Of Veterinary Medicines Approved In The Uk In 2024

Product Name

Active Substance

Target Species

Approval Date

Pyrocam 20 mg/ml Solution for Injection

Meloxicam

Cattle, Pigs, Horses

June, 2024

Flunex 50 mg/ml Solution for Injection

Cattle, Pigs, Horses

Cattle, Pigs, Horses

August, 2024

Triquest 333 mg/ml + 67 mg/ml Oral Suspension

Trimethoprim, Sulfadiazine

Horses

August, 2024

Omeprogard 370 mg/g Oral Paste

Omeprazole

Horses

May, 2024

ArthriCox Chewable Tablets

Firocoxib

Dogs

November, 2024

Bovilis Cryptium Emulsion for Injection

Cryptosporidium parvum

Cattle

August, 2024

Source: United Kingdom Veterinary Medicines Directorate, Grand View Research

In addition, rising pet expenditure in the UK is a key market driver, as pet owners increasingly prioritize their animals' health and wellbeing. For instance, in 2024, pet owners in the UK spent an average of £1,486 (USD 1,634.63) on their dogs and £1,479 (USD 1,626.93) on their cats. For dog owners, essential expenses totaled around £713 (USD 784.31), which included £352 (USD 387.21) in food, £133 (USD 146.30) in vaccinations, and £228 (USD 250.80) in veterinary bills. This surge in spending also reflects the humanization of pets, prompting owners to invest in routine checkups, vaccinations, and chronic disease management, fueling consistent market growth.

Market Concentration & Characteristics

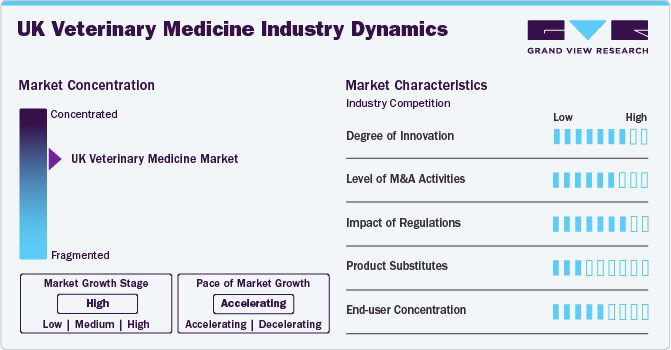

The UK market exhibits moderate concentration, driven by advancements in biotechnology, increased research funding, regulatory development, and the growing demand for improved animal healthcare. For instance, according to an article published by the UK Parliament in April 2024, the Veterinary Medicines (Amendment, etc.) Regulations 2024 were introduced to update the legislative framework governing veterinary medicines in Great Britain, ensuring that regulations remained effective in safeguarding animal health, public health, and the environment.

The market demonstrates a moderate to high degree of innovation, characterized by ongoing technological advancements, collaboration between market players, and supportive initiatives. For instance, in October 2023, MSD Animal Health launched Bovilis Nasalgen-C, a new vaccine for calves in the UK aimed at combating bovine coronavirus (BCoV), which significantly contributes to respiratory diseases in cattle. This vaccine can be administered from birth and helps reduce clinical signs and viral shedding associated with BCoV. Recent studies indicate BCoV's prevalence in respiratory disease outbreaks, highlighting the need for better vaccination practices in the UK cattle sector. The vaccine offers a quick immune response, starting five days post-administration, and can be used alongside other vaccines, providing farmers with an effective tool to manage this costly disease.

Within the market, a significant level of mergers and acquisitions activity exists, indicative of ongoing consolidation and strategic partnerships among industry players. For example, in June 2023, Swedish private equity firm EQT agreed to acquire UK veterinary drug producer Dechra Pharmaceuticals. The acquisition will allow EQT to strengthen its presence in the pet industry, with Dechra generating 74.6% of its revenue from companion animal products.

Regulations play a crucial role in shaping the UK market by ensuring safety, efficacy, and quality control while also influencing innovation and market access. Regulatory clarity and streamlined approval processes (e.g., under the Veterinary Medicines (Amendment, etc.) Regulations 2024) provide a stable framework for pharmaceutical companies to invest in R&D. This encourages innovation in new drug development, vaccines, and diagnostic tools, provided they comply with safety and efficacy standards.

Product substitutes, such as alternative therapies, herbal remedies, and nutraceuticals, are creating moderate pressure on the UK market by offering pet owners and livestock farmers non-pharmaceutical options for managing animal health. While these substitutes are often perceived as more natural or cost-effective, especially for preventive care or chronic conditions, they may lack conventional veterinary drugs' clinical efficacy and regulatory backing.

The UK market exhibits significant end-user concentration, with various end-users of veterinary medicines, such as pet owners, cattle farms, and others. These end-users associated with different animal types increase the demand for vet medicine that addresses their needs, significantly contributing to market growth.

Product Insights

The pharmaceutical segment accounted for the largest revenue share of 67.5% in 2024 due to its wide range of clinically approved drugs that effectively treat and prevent various animal diseases. This includes anti-inflammatory, anti-infectives, analgesics, and antiparasitic drugs essential for companion animals and livestock. For example, products like Simparica Trio (a widely used parasiticide for dogs) and Nobivac vaccines (for dogs and cats) are highly trusted by veterinarians and pet owners alike for their proven efficacy. The strong regulatory framework and continuous innovation by leading companies such as Zoetis, Elanco, and Boehringer Ingelheim further reinforce the dominance of this segment by ensuring product safety, effectiveness, and availability across the UK.

Biologics is anticipated to grow at the fastest CAGR over the forecast period, owing to the increasing awareness among pet owners and livestock farmers about the importance of preventive healthcare. Vaccines play a crucial role in controlling infectious diseases, which can significantly impact animal health and agricultural productivity. The rising efforts by the government and companies operating in the market to develop biologics targeting specific animal health conditions are further anticipated to drive segment growth. For instance, in October 2024, Zoetis launched Protivity, the UK's first authorized modified-live vaccine for Mycoplasma bovis in cattle. This vaccine represents a breakthrough in controlling a pathogen known for causing respiratory disease, arthritis, and mastitis in cattle.

Animal Type Insights

The production animal segment dominated the market with the largest revenue share of over 58% in 2024, as livestock health is directly tied to food safety, productivity, and economic returns for farmers. With the UK’s substantial population of cattle, sheep, pigs, and poultry, there is a consistent demand for vaccines, antibiotics, antiparasitic, and nutritional supplements to prevent and treat diseases, enhance growth rates, and ensure regulatory compliance in meat and dairy production. The increasing demand for high-quality meat, milk, and other animal products drives farmers to invest in advanced veterinary care to ensure optimal health and productivity of their livestock.

Companion animals is expected to grow fastest over the forecast period. As pet ownership continues to rise, there is an increasing demand for innovative veterinary care that prioritizes animal health and well-being. In addition, there is a surge in pet insurance adoption in the UK. For instance, according to an article published by Insurance Times, in August 2023, the number of insured pets reached a record 4.4 million, reflecting a growing commitment to pet health. This increase in insured pets has led to higher utilization of veterinary services, as owners are more inclined to seek preventive and advanced treatments without the immediate concern of out-of-pocket expenses.

Route of Administration Insights

The injectables segment dominated the market, with a revenue share of over 44% in 2024 due to their rapid action, high bioavailability, and effectiveness in treating a wide range of conditions. Injectable antibiotics, anti-inflammatories, and vaccines are widely used in companion animals and livestock for conditions such as bacterial infections, arthritis, and disease prevention. For instance, long-acting injectable antibiotics like tulathromycin are commonly administered in cattle and pigs to control respiratory diseases, improving herd health and productivity.

Other routes is expected to witness the fastest growth over the forecast period. Others include intranasal, controlled-release implants, etc., The intranasal segment offers several benefits, such as ease of administration, rapid immune response, and increased compliance among pet owners and veterinarians. Intranasal vaccines, such as those used for kennel cough (Bordetella bronchiseptica) in dogs, are widely favored for their non-invasive delivery and fast-acting protection, especially in high-risk environments like pet boarding facilities and shelters. This method is particularly useful for animals that are difficult to inject or those with needle anxiety, making it a practical choice in both companion animal and livestock settings.

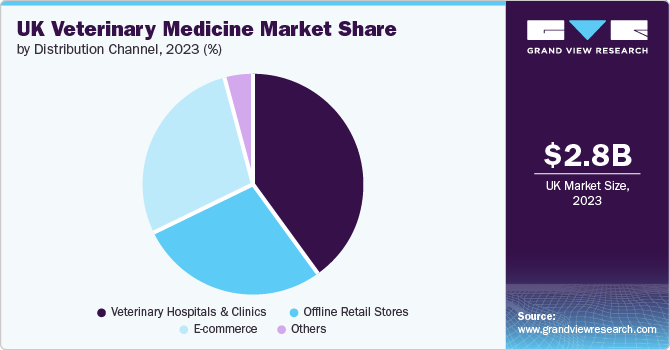

Distribution Channel Insights

The veterinary hospitals and clinics segment dominated the market with the largest share of over 40% in 2024. Veterinary hospitals play a central role in administering veterinary medicines, particularly biologics like vaccines and monoclonal antibodies, which are essential for preventing and treating animal diseases. Growing awareness of zoonotic diseases has increased demand for effective vaccination programs, encouraging more pet owners to utilize hospital-based veterinary services. In addition, the adoption of advanced technologies in these hospitals has improved their ability to deliver comprehensive care, including precise diagnostics and personalized treatment plans, further propelling the growth of this segment.

E-commerce is expected to grow at the fastest CAGR over the forecast period. E-commerce platforms provide a convenient and efficient way for consumers to access a wide selection of veterinary medicines, including pharmaceuticals, biologics, and other essential treatments for animal health. Enhanced by features like intuitive interfaces, mobile-friendly access, and streamlined navigation, online shopping has become increasingly attractive to pet owners. The ability to compare products, read customer reviews, and receive tailored recommendations makes it easier for buyers to find effective solutions for their animals.

Regional Insights

Technological advancements are significantly driving the UK veterinary medicine market by enabling the development of more effective, targeted, and longer-lasting disease prevention solutions. Innovations such as recombinant DNA technology and mRNA-based platforms have created next-generation vaccines that offer broader immunity with fewer side effects. For example, intranasal vaccines for kennel cough in dogs and subunit vaccines for livestock diseases like bluetongue and bovine respiratory disease improve disease control while reducing antibiotic dependence. These advancements enhance animal health and productivity and align with the UK’s regulatory focus on antimicrobial stewardship, further accelerating the adoption of biologics in both the companion and livestock animal segments.

Key UK Veterinary Medicine Company Insights

The market is characterized by intense competition and is fragmented in nature. Several large, medium, and small players implement strategic initiatives to boost their market share. Strategies such as product launches, partnerships, mergers & acquisitions, and expansion activities are playing a key role in propelling market growth.

Key UK Veterinary Medicine Companies:

- Boehringer Ingelheim International GmbH.

- Norbrook

- Merck & Co., Inc.

- Elanco

- Bimeda, Inc.

- Zoetis UK Limited.

- Ceva

- BioZyme, Inc.

- Phibro Animal Health Corporation

- Dechra (EQT)

Recent Developments

-

In October 2023, Zoetis launched CircoMax, a new vaccine in the UK targeting Porcine Circovirus type 2 (PCV2). This vaccine includes protection against genotypes PCV2a, PCV2b, and PCV2d. This vaccine is the only one licensed for these three genotypes, providing broad protection against the evolving PCV2 threat in pig populations. It is a ready-to-use, single-dose vaccine with a duration of immunity of 23 weeks formulated with MetaStim adjuvant.

-

In April 2021, Boehringer Ingelheim announced the availability of Prevexxion RN, a vaccine for Marek's disease, in the EU and UK. This innovative vaccine is designed to enhance protection against Marek's disease, a viral infection that poses significant risks to poultry. Prevexxion RN utilizes a unique formulation that offers improved efficacy and safety profiles. The vaccine is expected to help poultry farmers better manage the disease, reducing mortality rates and improving overall flock health.

-

In March 2024, Merck Animal Health received a positive opinion from the European Medicines Agency's CVMP for its NOBILIS MULTRIVA RT+IBm+ND+Gm+REOm+EDS vaccine. This 9-valent vaccine protects chickens against multiple viral infections, including Newcastle Disease, Infectious Bronchitis, and Egg Drop Syndrome. It is given in a low 0.3 ml dose and aims to reduce waste and streamline the vaccination process.

UK Veterinary Medicine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.80 billion

Revenue forecast in 2030

USD 4.08 billion

Growth rate

CAGR of 7.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal type, route of administration, distribution channel

Key companies profiled

Boehringer Ingelheim International GmbH.; Norbrook; Merck & Co., Inc.; Elanco; Bimeda, Inc.; Zoetis UK Limited.; Ceva; BioZyme, Inc.; Phibro Animal Health Corporation; Dechra (EQT).

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Veterinary Medicine Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the UK Veterinary Medicine market report based on product, animal type, route of administration, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Vaccines

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Medicated Feed Additives

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Production Animals

-

Poultry

-

Pigs

-

Cattle

-

Sheep & Goats

-

Others

-

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Topical

-

Other Routes

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

E-commerce

-

Offline Retail Stores

-

Others

-

Frequently Asked Questions About This Report

b. The UK veterinary medicine market size was estimated at USD 2.64 billion in 2024 and is expected to reach USD 2.80 billion in 2025.

b. The UK veterinary medicine market is expected to grow at a compound annual growth rate of 7.81% from 2025 to 2030 to reach USD 4.08 billion by 2030.

b. The production animal dominated the animal type segment in 2024. This is attributable to the increasing demand for high-quality meat, milk, and other animal products drives farmers to invest in advanced veterinary care to ensure optimal health and productivity of their livestock.

b. Some key players operating in the UK veterinary medicine market include Boehringer Ingelheim International GmbH.; Norbrook; Merck & Co., Inc.; Elanco; Bimeda, Inc.; Zoetis UK Limited.; Ceva; BioZyme, Inc. Phibro Animal Health Corporation, Dechra (EQT).

b. Key factors that are driving the market growth include the rise in livestock population and increasing pet ownership rates, novel product development in veterinary medicine, and the increasing prevalence of animal diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.