- Home

- »

- Automotive & Transportation

- »

-

Turret System Market Size, Share & Trends Report, 2030GVR Report cover

![Turret System Market Size, Share & Trends Report]()

Turret System Market (2024 - 2030) Size, Share & Trends Analysis Report By Platform (Land, Naval), By Component (Turret Drive, Turret Control), By Type (Manned, Unmanned), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-405-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Turret System Market Summary

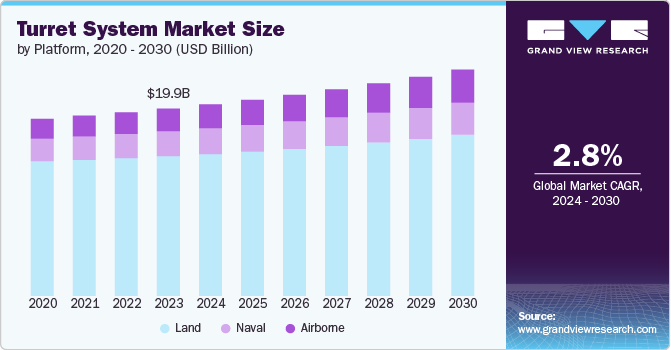

The global turret system market size was estimated at USD 19.87 billion in 2023 and is projected to reach USD 24.01 billion by 2030, growing at a CAGR of 2.8% from 2024 to 2030. Turret systems are essential components of armored vehicles, providing platforms for mounting and operating weapons.

Key Market Trends & Insights

- North America dominated the turret system market, with a revenue share of over 30.0% in 2023.

- The turret system market in Asia Pacific is anticipated to register the highest CAGR over the forecast period.

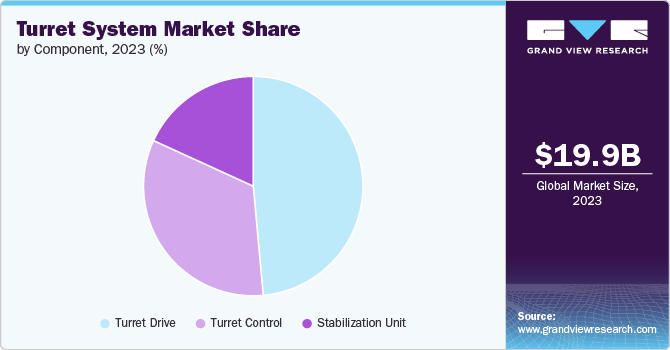

- Based on component, the turret drive segment accounted for the largest market revenue share in 2023.

- In terms of type, the manned segment accounted for the largest market revenue share in 2023.

- Based on platform, the land segment led the market in 2023, accounting for over 74.0% share of the global revenue.

Market Size & Forecast

- 2023 Market Size: USD 19.87 Billion

- 2030 Projected Market Size: USD 24.01 Billion

- CAGR (2024-2030): 2.8%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Numerous factors, such as increased defense spending, technological advancements, and growing emphasis on situational awareness, drive market growth. Growing geopolitical tensions and the need to modernize military arsenals drive substantial investments in defense technologies, including turret systems. The need for improved situational awareness on the battlefield drives the development of turret systems equipped with advanced sensors and targeting capabilities. Moreover, innovations in areas such as sensor fusion, AI, and automation are enhancing the capabilities of turret systems, making them more effective and efficient.

Turret systems come with multi-mission capabilities, allowing for customization to boost the performance of combat vehicles. They feature a modular mission package built on an open architecture, facilitating integration with additional systems for a variety of operations. Combat vehicles can further connect with external payloads like the Remote Weapon System (RWS), interrogation devices, and Reconnaissance, Surveillance, Targeting, and Acquisition (RSTA) technologies to assist in combat, chemical, biological, radiological, and nuclear (CBRN) defense, RSTA, and route clearing tasks.

Turret systems offer the flexibility to swap weapon systems according to the specific needs of a mission. For instance, infantry fighting vehicles can be outfitted with heavier weapons and advanced situational awareness tools to increase combat effectiveness. The capability to accommodate various payload systems not only improves the operational effectiveness of armored vehicles but also significantly cuts down their life cycle expenses and lightens the burden on soldiers. The modularity of turret systems has spurred the creation of adaptable new systems that seamlessly integrate with existing ones.

Platform Insights

The land segment led the market in 2023, accounting for over 74.0% share of the global revenue. The global surge in defense expenditure to counter evolving threats and modernize military capabilities fuels the demand for advanced turret systems for land platforms. Moreover, the increasing adoption of Unmanned Ground Vehicles (UGVs) for various military and civilian applications is creating a demand for unmanned turret systems, contributing to the overall market growth. In addition, continuous advancements in sensor technology, AI, and automation led to developing more advanced turret systems with improved accuracy, range, and survivability.

The airborne segment is predicted to foresee the highest growth in the coming years. Airborne turret systems are primarily integrated into helicopters and fixed-wing aircraft, providing fire support, reconnaissance, and surveillance capabilities. These systems are equipped with a range of weapons, sensors, and countermeasures. Moreover, the growing use of helicopters for various military operations, including counterinsurgency, search and rescue, and medical evacuation, drives demand for advanced turret systems. Furthermore, the integration of advanced sensors, electro-optical/infrared (EO/IR) systems, and laser designators is enhancing the capabilities of airborne turrets.

Type Insights

The manned segment accounted for the largest market revenue share in 2023. Complex battlefield situations often require the judgment and adaptability of human operators. Moreover, manned turrets have a long history of dependable performance in various operational environments. In addition, various countries are upgrading their armored vehicles with advanced manned turret systems rather than replacing them entirely. Certain specialized missions, such as counter-terrorism and urban warfare, may still heavily rely on manned turrets due to the nature of the environment.

The unmanned segment is anticipated to exhibit the highest CAGR over the forecast period. The integration of artificial intelligence and advanced automation systems is enhancing the capabilities of unmanned turrets, enabling them to perform complex tasks independently. In addition, improved sensor technologies, such as radar, thermal imaging, and laser rangefinders, provide unmanned turrets with superior target acquisition and tracking abilities. Moreover, unmanned turrets can operate in hazardous environments without risking human lives, making them ideal for missions with high levels of danger.

Component Insights

The turret drive segment accounted for the largest market revenue share in 2023. The turret drive is a critical component of a turret system, responsible for rotating the turret and positioning the weapon. It is a complex system that requires precision and durability to withstand the rigors of combat conditions. Improvements in electric motors, hydraulic systems, and control systems are leading to more efficient and powerful turret drives. Furthermore, advanced warfare demands accurate and rapid target engagement, which drives the development of high-precision turret drives.

The stabilization unit segment is anticipated to Texhibit the highest CAGR over the forecast period. Stabilization units are critical components of turret systems, ensuring accurate weapon targeting and firing, especially in dynamic environments. They counteract the effects of vehicle movement, terrain, and other disturbances, maintaining a steady platform for weapons. Turret system incorporates a wider array of sensors, weapons, and countermeasures, demanding more advanced stabilization systems to maintain accuracy.

Regional Insights

North America dominated the turret system market, with a revenue share of over 30.0% in 2023. The market is expected to grow, driven by sustained defense spending, technological innovation, and the increasing adoption of unmanned systems. The focus on modernization and the potential for export expansion further contribute to the market's positive outlook.

U.S. Turret System Market Trends

The turret system market in the U.S. is anticipated to exhibit a significant CAGR over the forecast period. The U.S. is a hub for technological innovation, fostering the development of advanced turret systems with enhanced capabilities. Moreover, the presence of established defense contractors creates a competitive landscape in the country.

Europe Turret System Market Trends

The turret system market in Europe is expected to witness significant growth over the forecast period. Europe has been a longstanding hub for defense technology and manufacturing, making it a significant market for turret systems. The region's robust defense industry, coupled with geopolitical tensions, has fostered a conducive environment for the growth of this sector. Moreover, various European countries have substantial defense budgets, allocating significant funds for modernizing their armed forces. This investment directly drives demand for advanced turret systems.

Asia Pacific Turret System Market Trends

The turret system market in Asia Pacific is anticipated to register the highest CAGR over the forecast period. The Asia Pacific region is experiencing rapid growth in its market, driven by a complex interplay of geopolitical factors, economic development, and technological advancements. Various countries such as China, India, South Korea, and Australia are key contributors to the region's market. Local defense manufacturers are increasingly focusing on developing indigenous capabilities while also collaborating with global players.

Key Turret System Company Insights

Key turret system companies include Rheinmetall AG, Leonardo S.p.A., and Elbit Systems Ltd. Companies active in the market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in June 2023, Leonardo S.p.A. launched LIONFISH, AI-based small- and medium-caliber turrets designed to meet the most stringent requirements of navies. Turrets can be easily mounted on smaller vessels without the need for altering the bridge, offering the advantage of precise targeting accuracy in challenging sea weather conditions. This is achieved through their full stabilization in both elevation and azimuth.

Key Turret System Companies:

The following are the leading companies in the turret system market. These companies collectively hold the largest market share and dictate industry trends.

- BAE Systems

- Elbit Systems Ltd.

- General Dynamics Corporation

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Moog Inc.

- Northrop Grumman

- RAFAEL Advanced Defense Systems Ltd.

- Rheinmetall AG

- Thales

Recent Developments

-

In June 2024, Rheinmetall AG introduced Skyranger 35 turret on a Leopard 2 chassis as a tactical air defense system. It is a highly modular, scalable, and mobile ground-based air defense system.

-

In May 2024, Elbit Systems Ltd. introduced a lightweight version of the unmanned Turret, UT30, which is suitable for transport by both 6x6 and 4x4 tactical ground vehicles. The reduction in weight is achieved through a new design approach and by lowering the levels of protection.

-

In March 2024, the U.S. MARINE CORPS selected General Dynamics Corporation and Textron Inc. to develop prototype vehicles for the Advanced Reconnaissance Vehicle 30mm Autocannon (ARV-30). These vehicles are intended to surpass the capabilities of the existing Light Armored Vehicle 25mm version (LAV-25) and fulfill the requirements set out by the Marine Corps for its Force Design 2030 initiative.

Turret System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 20.32 billion

Revenue forecast in 2030

USD 24.01 billion

Growth rate

CAGR of 2.8% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, type, component, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

BAE Systems; Elbit Systems Ltd.; General Dynamics Corporation; Leonardo S.p.A.; Lockheed Martin Corporation; Moog Inc.; Northrop Grumman; RAFAEL Advanced Defense Systems Ltd.; Rheinmetall AG; Thales

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Turret Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global turret system market report based on platform, type, component, and region.

-

Platform Outlook (Revenue, USD Billion, 2017 - 2030)

-

Land

-

Mobile/Vehicular

-

Fixed/Stationary

-

-

Airborne

-

Attack Helicopters

-

Fighter Aircrafts

-

Special Mission Aircrafts

-

Unmanned Aerial Vehicles (UAVs)

-

-

Naval

-

Destroyer

-

Frigates

-

Offshore Support Vessels (Oosts)

-

Corvettes

-

Patrol & Mine Countermeasure Vessels

-

Amphibious Vessels

-

Submarines

-

Unmanned Surface Vehicles (USAs)

-

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Manned

-

Unmanned

-

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Turret Drive

-

Turret Control

-

Stabilization Unit

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global turret system market size was estimated at USD 19.87 billion in 2023 and is expected to reach USD 20.32 billion in 2024.

b. The global turret system market is expected to grow at a compound annual growth rate of 2.8% from 2024 to 2030 to reach USD 24.01 billion by 2030.

b. North America dominated the turret system market, with a share of 32.3% in 2023. The market is expected to continue growing, driven by sustained defense spending, technological innovation, and the increasing adoption of unmanned systems. The focus on modernization and the potential for export expansion further contribute to the market's positive outlook.

b. Some key players in the turret system market include BAE Systems, Elbit Systems Ltd., General Dynamics Corporation, Leonardo S.p.A., Lockheed Martin Corporation, Moog Inc., Northrop Grumman, RAFAEL Advanced Defense Systems Ltd., Rheinmetall AG, and Thales.

b. Turret systems are essential components of armored vehicles, providing platforms for mounting and operating weapons. Numerous factors such as, increased defense spending, technological advancements, growing emphasis on situational awareness are primarily driving the growth of the turret system market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.