- Home

- »

- Medical Devices

- »

-

Transcatheter Devices Market Size, Industry Report, 2030GVR Report cover

![Transcatheter Devices Market Size, Share & Trends Report]()

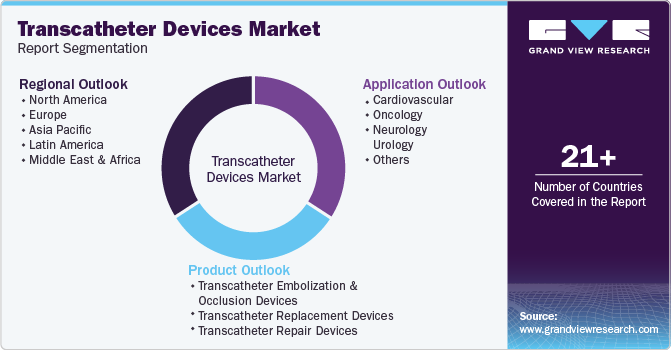

Transcatheter Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Transcatheter Embolization & Occlusion Devices, Transcatheter Replacement Devices), By Application (Cardiovascular, Oncology), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-109-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Transcatheter Devices Market Size & Trends

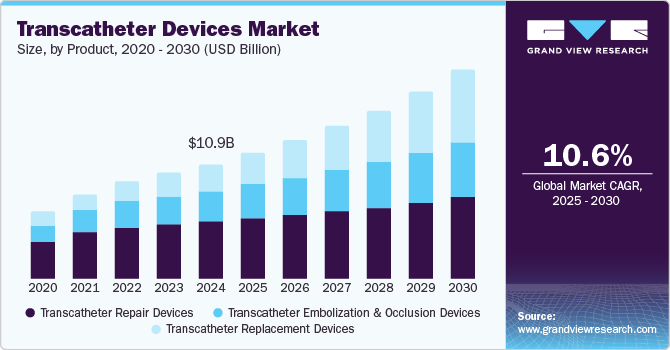

The global transcatheter devices market size was estimated at USD 10.85 billion in 2024 and is projected to grow at a CAGR of 10.55% from 2025 to 2030. The increasing demand for Minimally Invasive Procedures/Surgeries (MIS) is one of the key factors propelling market growth. These procedures cause less trauma to the patient and facilitate quicker recovery than invasive procedures such as open-heart surgeries. MIS requires fewer hospital stays, providing better patient outcomes and economic viability from micro and macro perspectives.

Moreover, it involves fewer post-surgery complications and lower mortality rates, owing to which healthcare practitioners and patients prefer these surgeries. Increased usage of less invasive surgical procedures has been observed in various fields such as gynecology, urology, neurosurgery, gastrointestinal surgeries, cardiology, and pulmonary medicines.

Cardiovascular, urologic, and neurologic diseases are among the major causes of mortality and morbidity in the world over the past three decades. People with a sedentary lifestyle are more susceptible to conditions such as diabetes, Cardiovascular Disorders (CVDs), urologic disorders (including ESRD), and other chronic conditions. For instance, according to the article published by the American Heart Association, Inc. in April 2024, valvular heart disease is prevalent in around 2.5% of adults in the U.S., wherein aortic and mitral valvular diseases are two of the most diagnosed conditions in recent times. However, owing to various innovations and regulatory approvals of transcatheter devices, treatments, such as valve replacement and valve repair, have improved, which has resulted in a decreased mortality rate due to valvular heart disease in the U.S. over the last two decades.

High blood pressure and diabetes are the two prime factors contributing to the increasing prevalence of chronic disorders, such as kidney failures. Most kidney disorders are due to conditions such as urinary infections, glomerulonephritis, polycystic kidney problems, lupus, and other malformations. ESRD is more prevalent in people aged 70 years & above. Negative lifestyle habits, such as lack of physical activity & high consumption of alcohol, coupled with the rising number of smokers and increasing obese population with dietary irregularities, are a few factors boosting the incidence of cardiovascular & neurovascular diseases. With the increasing prevalence of these diseases, the use of transcatheter devices is expected to grow during the forecast period.

The increasing incidence of brain aneurysms across several countries is anticipated to positively affect the market growth over the forecast period. Countries such as the U.S. and Canada have witnessed a high prevalence of intracranial aneurysms in recent years. According to the Brain Aneurysm Foundation, around 30,000 people in the U.S. suffer a brain aneurysm rupture every year. It is also reported that the geriatric population and individuals aged 35 to 60 are at a higher risk of developing an intracranial aneurysm. Furthermore, as per the research by the American Academy of Neurology published in April 2024, 2% of people were identified with intracranial aneurysms. People with 40 years of age or above and people who already have hypertension are more susceptible to such aneurysms.

The success of these clinical trials can help improve patient outcomes and lead to the introduction of more effective & targeted treatment options for individuals with intracranial aneurysms, thus driving market growth in the near future.

Study Title

Conditions

Sponsor

Study Type

Completion Date

Comparison of Self- and Balloon-expandable Valves in Patients With Ascending Aortic Dilation Undergoing Transcatheter Aortic Valve Replacement: The AAD-CHOICE

Aortic Stenosis, Ascending Aortic Dilation

National Center for Cardiovascular Diseases

INTERVENTIONAL

2026

Evaluating Edge-to-edge Transcatheter Tricuspid Valve Repair in Patients With Severe Symptomatic Tricuspid Regurgitation (TRACE-NL)

Cardiac Catheterization, Tricuspid Valve Regurgitation, Right Sided Heart Failure,

St. Antonius Hospital

INTERVENTIONAL

2027

Safety and Feasibility of TRISKELE in Severe AS

Aortic Valve Disease

Fudan University

INTERVENTIONAL

2023

A Single-arm Trial of the Flow Diverter (Tonbridge) For Endovascular Treatment of Intracranial Aneurysms

Intracranial Aneurysm

Zhuhai Tonbridge Medical Tech. Co., Ltd.

INTERVENTIONAL

2027

TAVR Vs. SAVR Study of VitaFlow Liberty for Severe BAV Stenosis (PROMIS-BAV)

Aortic Stenosis, Bicuspid Aortic Valve

MicroPort

INTERVENTIONAL

2027

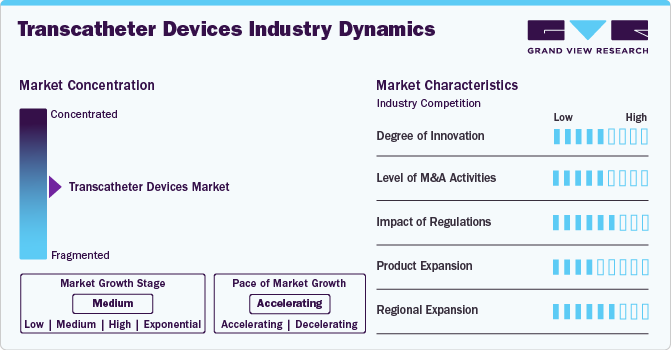

Market Concentration & Characteristics

Valve materials and design innovations have improved outcomes by reducing thrombosis risks and enhancing longevity. Development of valves tailored to different anatomies and conditions, including bicuspid aortic and smaller-diameter valves for patients with narrow anatomies. Innovations in delivery systems, such as smaller catheter diameters, enable procedures in patients with narrow or complex vasculature, improving accessibility and reducing vascular complications.

Regulatory requirements ensure that transcatheter devices meet stringent safety and efficacy standards, fostering trust among healthcare providers and patients. This promotes market adoption. Regulatory pathways such as the FDA's Breakthrough Devices Program encourage innovation by offering expedited review processes for devices addressing unmet medical needs. This accelerates the introduction of novel transcatheter devices.

Product expansion in the transcatheter devices industry involves introducing new products or enhancing existing ones to meet evolving patient needs and advancements in product materials. For instance, in May 2024, Edwards Lifesciences launched the SAPIEN 3 Ultra RESILIA valve in Europe, featuring innovative RESILIA tissue technology aimed at enhancing durability. This transcatheter aortic heart valve is designed for patients with calcific aortic stenosis or those with failing bioprosthetic valves at high surgical risk.

Manufacturers and companies operating in the industry focus on expanding their presence in numerous countries. Industry players are forming distribution partnerships to increase the reach of their transcatheter devices in numerous markets. For instance, in November 2023, Meril Life Sciences partnered with Japan Lifeline to expand its global presence. Under this strategic alliance, Japan Lifeline gains rights to distribute Meril's next-generation transcatheter heart valve, Myval Octacor, after receiving PMDA approval in Japan.

Product Insights

The transcatheter replacement devices segment dominated the market in 2024. Transcatheter replacement devices offer a less invasive alternative to traditional surgical valve replacements. The shorter recovery time, reduced hospital stays, and lower complication rates of these procedures make them attractive to patients and healthcare providers. Constant technological advancements coupled with increasing product launches by the market players are expected to support market growth. For instance, in February 2024, the U.S. FDA approved Edwards Lifescience’s first transcatheter tricuspid valve replacement device, EVOQUE. The EVOQUE system is intended to enhance the health status of patients experiencing symptomatic severe TR despite receiving optimal medical therapy (OMT), for whom a heart team has determined that tricuspid valve replacement is suitable.

The transcatheter repair devices segment is expected to register the fastest growth during the forecast period.The transcatheter repair devices segment is driven by increasing focus on patient-centered care and the shift towards value-based healthcare. The growing emphasis of healthcare systems to prioritize treatments that enhance quality of life while minimizing hospital stays is further contributing to its increasing demand. These devices enable healthcare providers to offer effective solutions for patients with valvular heart disease, improving functional status and reducing the need for prolonged postoperative care.

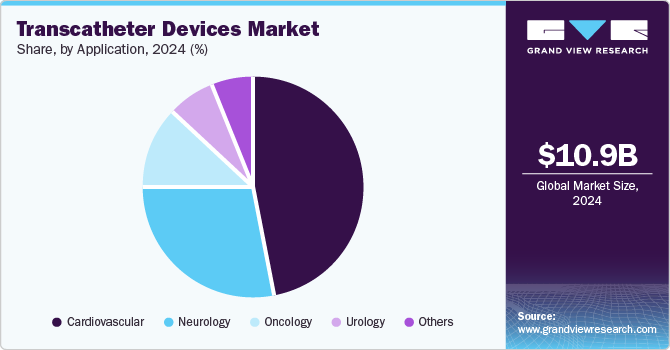

Application Insights

The cardiovascular segment dominated the market in 2024. The increasing prevalence of cardiovascular diseases (CVDs) remains the leading cause of morbidity and mortality worldwide. According to the data published by the America Heart Association in 2024, CVD was identified as the underlying cause of death for 931,578 individuals in the U.S. in 2021. In addition, heart disease and stroke were responsible for more fatalities in that year than all types of cancer and chronic lower respiratory diseases combined. From 2017 to 2020, approximately 127.9 million adults in the U.S. (48.6%) were affected by some form of CVD.

The neurology segment is expected to grow at the fastest CAGR of 13.44% during the forecast period. The growing need for rapid intervention in these cases has accelerated the development of devices designed for immediate use, such as stent retrievers and clot extraction devices. According to the data published by the Journal of the American Heart Association in January 2024, transcatheter aortic valve replacement (TAVR) is an effective treatment option for aortic stenosis despite the risk of periprocedural strokes affecting around 2.5% of patients. The prevalence of silent cerebral infarctions highlights the need for effective cerebral embolic protection devices (CEPD), which capture debris during the procedure and reduce the risk of neurological complications.

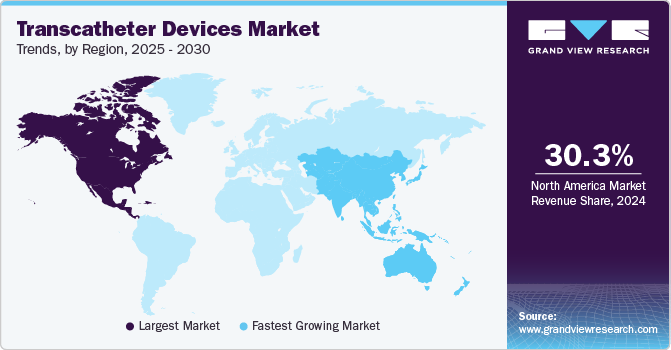

Regional Insights

The North America transcatheter devices market held the largest revenue share of 30.28% in 2024 due to increasing cases of chronic diseases due to lifestyle changes. In addition, the increase in the number of patients undergoing surgeries and the rise in awareness about minimally invasive surgeries are also factors responsible for market growth in the region. Furthermore, growing initiatives by the market players to enter the market are also one of the factors contributing to market growth.

U.S. Transcatheter Devices Market Trends

The transcatheter devices market in the U.S. is expected to dominate the North American region over the forecast period. The presence of several catheter manufacturers and robust healthcare infrastructure are some of the key factors contributing to market growth. Moreover, constant government support towards the authorization of products is also contributing to market growth.

Europe Transcatheter Devices Market Trends

Europe transcatheter devices market is anticipated to grow significantly in the coming years. Europe has a robust healthcare infrastructure and has witnessed a significant shift from in-patient to out-patient care due to an increase in the presence of several medical equipment companies offering catheters in the region. In addition, the increasing geriatric population shifting towards minimally invasive surgeries and better healthcare facilities are also some factors expected to drive market growth.

The transcatheter devices market in the UK is expected to grow moderately over the forecast period. The UK has an advanced healthcare system with a continual need for medical supplies, including catheters. Moreover, several developments by the market players are also contributing to the country’s market growth. For instance, in July 2024, Abbott announced to rollout of its next-generation heart valve technology, Navitor transcatheter aortic valve implantation (TAVI), across Ireland and the UK.

France transcatheter devices market is expected to grow over the forecast period. Continuous innovations in transcatheter technologies, such as improvements in device design, procedural techniques, and imaging technologies, are enhancing the safety and efficacy of transcatheter procedures. This is expected to increase the adoption of these devices in France.

The transcatheter devices market in Germany is experiencing steady growth. The increasing prevalence of cardiovascular diseases such as peripheral artery disease & occlusions in blood vessels and growing awareness about minimally invasive surgeries are some factors responsible for boosting the adoption of catheters in Germany.

Asia Pacific Transcatheter Devices Market Trends

The Asia Pacific transcatheter medical devices market is projected to witness significant growth over the forecast period owing to increasing prevalence of cardiovascular diseases and a rising aging population. The increasing aging population has led to the growing prevalence of age-related conditions, especially symptomatic severe aortic stenosis.

The transcatheter devices market in China is expected to grow over the forecast period owing to the regulatory landscape for transcatheter devices in China having evolved significantly over recent years. The National Medical Products Administration (NMPA) has streamlined its approval processes for innovative medical devices, including transcatheter technologies.

The Japan transcatheter devices market is projected to expand during the forecast period due to growing strategic initiatives by market players such as partnerships and collaborations. For instance, in November 2023, Japan Lifeline Co. Ltd. entered into a partnership agreement with Meril Life Sciences Pvt. Ltd., which aims to introduce the Myval Octacor transcatheter heart valve in Japan.

Middle East And Africa Transcatheter Devices Market Trends

The Middle East and Africa transcatheter devices market is expected to witness significant growth in the coming years. The Middle East and Africa market is majorly driven by improving healthcare infrastructure and increasing investments in medical technology. Many countries in the region are expanding their healthcare facilities and adopting cutting-edge technologies, which fosters the integration of transcatheter devices into clinical practice.

The transcatheter devices market in Saudi Arabia is expected to grow over the forecast period. An increase in cardiac catheterization procedures, favorable government policies, and high healthcare expenditure are a few factors driving the market. The healthcare system in Saudi Arabia is outperforming others due to the continuous efforts of the government and multinational companies.

The Kuwait transcatheter devices market is expected to grow over the forecast period due to the increased the number of healthcare professionals and increased expenditure on the health sector. Moreover, growing government initiatives aimed at advancing hospitals and adopting advanced medical technologies are creating a supportive environment for the integration of transcatheter devices into routine clinical practice.

Key Transcatheter Devices Company Insights

Companies operating in the industry are seeking approvals for their novel products and expanding their manufacturing and production capacities to bolster their presence in the market. In addition, manufacturers are acquiring smaller players and emphasizing supplying their products globally.

Key Transcatheter Devices Companies:

The following are the leading companies in the transcatheter devices market. These companies collectively hold the largest market share and dictate industry trends.

- Edwards Lifesciences Corporation

- Abbott

- Boston Scientific Corporation

- Medtronic

- Meril Lifesciences Pvt. Ltd.

- BioVentrix, Inc.

- Relisys Medical Devices Limited.

- B. Braun Interventional Systems Inc.

- Terumo Corporation

- Stryker

Recent Developments

-

In September 2024, Boston Scientific received the CE Mark for its AcuRite Prime Aortic Valve System, a significant advancement in transcatheter aortic valve replacement (TAVR) technology. This system enhances procedural efficiency and patient outcomes by providing precise valve placement and improved hemodynamics.

-

In August 2024,Edwards Lifesciences acquired JC Medical, a transcatheter aortic valve replacement (TAVR) company, from Genesis MedTech. This acquisition includes the J-Valve System, designed for severe aortic regurgitation treatment.

-

In April 2024, Abbott received FDA approval for the TriClip, a groundbreaking device designed to repair leaky tricuspid heart valves. The TriClip is the first of its kind and is expected to improve patient outcomes by providing a less invasive solution than traditional surgical methods.

Transcatheter Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.88 billion

Revenue forecast in 2030

USD 19.62 billion

Growth Rate

CAGR of 10.55% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Edwards Lifesciences Corporation, Abbott, Boston Scientific Corporation, Medtronic, Meril Lifesciences Pvt. Ltd., BioVentrix, Inc., Relisys Medical Devices Limited., B. Braun Interventional Systems Inc., Terumo Corporation, Stryker

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transcatheter Devices Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global transcatheter devices market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Transcatheter Embolization and Occlusion Devices

-

Coils

-

Pushable coils

-

Detachable coils

-

-

Non Coils

-

Flow Diverting Devices

-

Embolization Particles

-

Liquid Embolics

-

Other Embolization and Occlusion Devices

-

Accessories

-

-

-

Transcatheter Replacement Devices

-

Transcatheter Aortic Valve Replacement

-

Transcatheter Pulmonary Valve Replacement

-

Transcatheter Mitral Valve Replacement

-

-

Transcatheter Repair Devices

-

Transcatheter Mitral Valve Repair

-

Transcatheter Tricuspid Valve Repair

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular

-

Oncology

-

Neurology

-

Urology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Latin America

-

Brazil

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global transcatheter devices market size was estimated at USD 10.85 billion in 2024 and is expected to reach USD 11.88 billion in 2025.

b. The global transcatheter devices market is expected to grow at a compound annual growth rate of 10.55% from 2025 to 2030 to reach USD 19.62 billion by 2030.

b. North America dominated the transcatheter devices market with a share of 30.28% in 2024. This is attributable to the rising prevalence of valvular diseases in the geriatric population, increasing healthcare expenditure, and rising preference for minimally invasive surgeries.

b. Some key players operating in the transcatheter devices market include Edwards Lifesciences Corporation; Abbott, Boston Scientific Corporation; JenaValve Technology, Inc., Terumo Corporation; Neovasc Inc.; and Meril Lifesciences Pvt. Ltd.

b. Key factors that are driving the market growth include an increase in adoption of minimal invasive procedures, high prevalence of chronic diseases, and growing preference for transcatheter replacement or repair procedures over open-heart surgery.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.