- Home

- »

- Healthcare IT

- »

-

Clinical Trials Market Size And Share, Industry Report, 2033GVR Report cover

![Clinical Trials Market Size, Share & Trends Report]()

Clinical Trials Market (2025 - 2033) Size, Share & Trends Analysis Report By Phase (Phase I, Phase II, Phase III, Phase IV), By Indication, By Study Design, By Indication By Study Design, By Service, By Sponsor, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-975-3

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Trials Market Summary

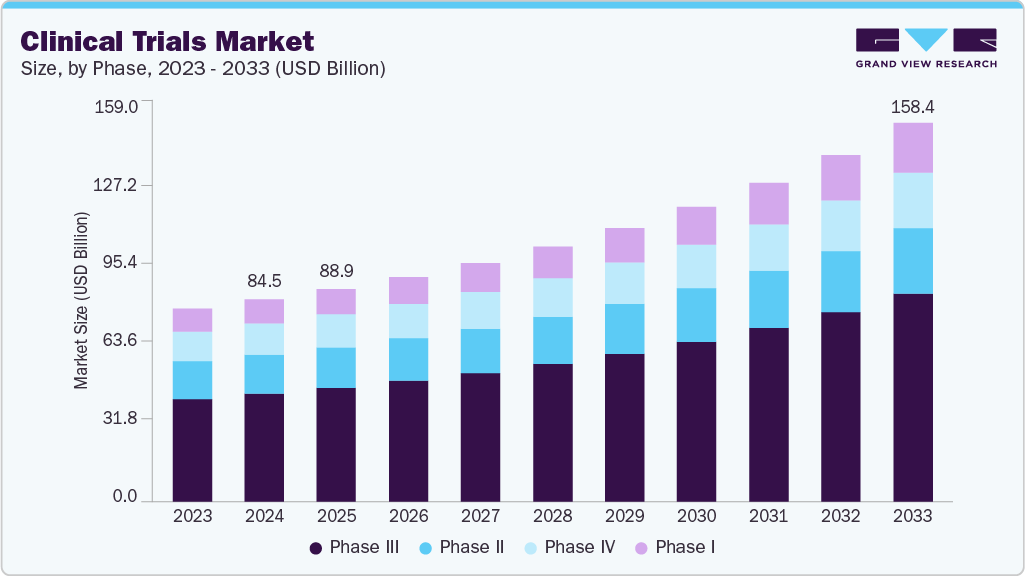

The global clinical trials market size was estimated at USD 84.54 billion in 2024 and is projected to reach USD 158.41 billion by 2033, growing at a CAGR of 7.5% from 2025 to 2033. The growth of the market is driven by rising prevalence of chronic and rare diseases, advancements in precision medicine and biotechnology, expansion of decentralized and virtual trials, and growing R&D investments by pharmaceutical and biotech companies.

Key Market Trends & Insights

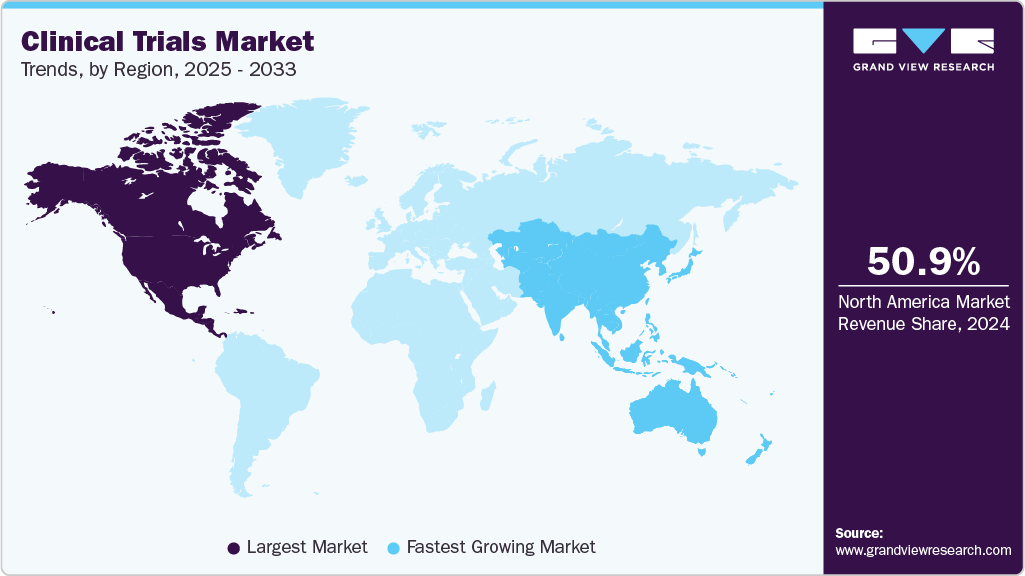

- North America clinical trials market held the largest share of 50.90% of the global market in 2024.

- The clinical trials industry in the U.S. is expected to grow lucratively over the forecast period.

- By phase, the phase III segment held the largest market share of 53.48% in 2024.

- Based on study design, the interventional trials segment held the highest market share in 2024.

- By indication, the oncology segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 84.54 Billion

- 2033 Projected Market Size: USD 158.41 Billion

- CAGR (2025-2033): 7.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market growth spiked post COVID-19 pandemic. Several companies invested heavily in novel drug development to minimize COVID-19 patient burden. In 2020, Synairgen plc and Parexel collaborated on a Phase III study of Interferon-beta (IFN-beta) treatment for COVID-19. Such strategic initiatives by CROs boosted market revenue growth. Furthermore, the market is expected to grow owing to factors such as rapid technological evolution, prevalence of chronic diseases, globalization of clinical trials, and a rise in demand for CROs for conducting research activities.In addition, significant changes in the ways of conducting upcoming or ongoing clinical trials is also one of the factors contributing to market growth. Regulatory agencies including the U.S. FDA, the European Medicines Agency (EMA), the National Institutes of Health (NIH), and China’s National Medical Products Administration among several others issued various guidelines for conducting trials to support the implementation of decentralized clinical trials and virtual services. The current scenario for research and development activities across the globe and the need for several new treatment options have also led to the adoption of fast-track clinical trials. Thus, aforementioned factors are estimated to open new opportunities to the clinical trials market growth.

Furthermore, the utilization of CRO services enables manufacturers and sponsors to focus their resources on strengthening core production capabilities and optimizing in-house operational processes. The availability of the vast array of services from drug discovery to post marketing surveillance has further simplified processes for mid-size & small-scale pharmaceutical and biotechnological organizations by providing them the option to outsource research and development activities to reduce infrastructure investment. For instance, in November 2023, Syneos Health entered into a collaboration agreement with GoBroad Healthcare Group. This collaborative initiative extended the company’s clinical trial capabilities into a more extensive array of therapeutic areas in China.

Market Opportunities

The clinical trials market presents significant growth opportunities driven by rising demand for innovative therapies, personalized medicine, and an expanding pipeline of biologics, gene therapies, and vaccines. Increasing prevalence of chronic and rare diseases globally fuels the need for new treatments, while regulatory reforms and streamlined approval processes in regions like the US, Europe, and China enable faster trial initiation. Emerging markets in Asia, Latin America, and the Middle East offer cost-effective sites with large, diverse patient populations. Additionally, advancements in digital health, decentralized trials, AI, and wearable technologies enhance data collection, patient engagement, and trial efficiency, creating new avenues for investment and expansion.

Technology Landscape

Decentralized Clinical Trials (DCTs) enable remote participation, as seen in Pfizer’s COVID-19 outpatient studies. AI/ML optimizes recruitment and predicts outcomes, exemplified by IBM Watson Health’s trial analytics. Wearables and remote monitoring, used in Medtronic’s cardiac device studies, allow real-time patient data collection.

EDC and cloud platforms, like Medidata Rave, streamline data capture and regulatory reporting. Genomics and precision medicine integration, employed by Roche’s oncology trials, targets patient subgroups based on genetic profiles, enhancing efficacy and safety. These technologies collectively reduce timelines, increase efficiency, and improve patient-centric trial designs worldwide.

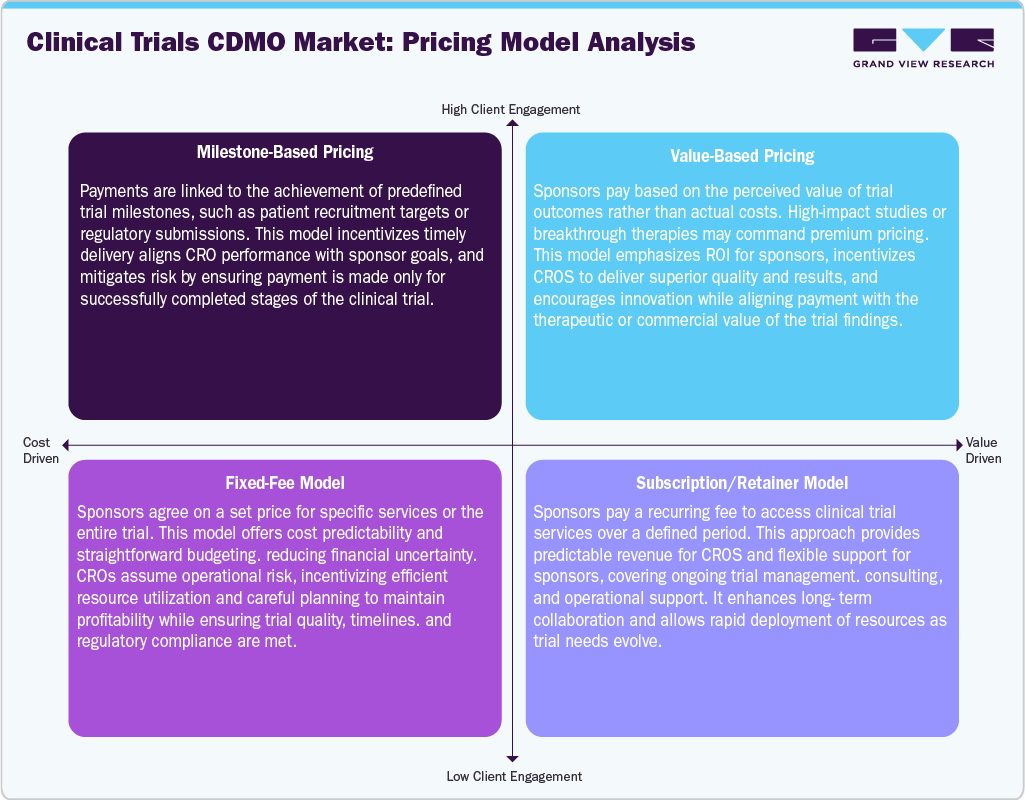

Pricing Analysis

In the clinical trials market, milestone-based pricing links payments to specific achievements, incentivizing timely delivery and aligning CRO performance with sponsor goals. Value-Based Pricing sets fees based on the therapeutic or commercial impact of trial outcomes, rewarding high-quality, innovative results.

Subscription/Retainer Models provide recurring fees for ongoing services, ensuring flexible support and long-term collaboration. Fixed-Fee Models establish predetermined costs for trials or services, offering budget predictability while placing operational efficiency responsibility on CROs. Together, these models enhance financial planning, align incentives, and encourage quality, innovation, and efficiency across clinical development, benefiting both sponsors and service providers.

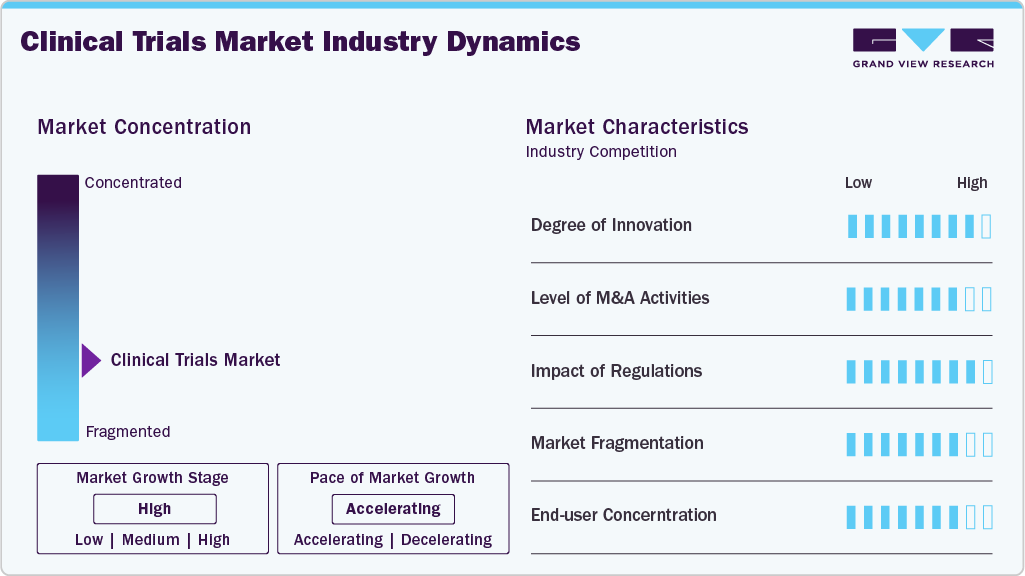

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The clinical trials market is characterized by evolving technologies and therapeutics, regulatory considerations, growing need for advanced therapeutics, increasing demand for personalized medicine, and increasing outsourcing of development processes to leverage cost advantages and specialized capabilities.

Advancements in drug development, adoption of advanced therapies such as cell and gene therapy and rising demand for personalized medicine are likely to influence the market growth. The clinical trials market has seen a surge in innovative technologies such as AI, big data analytics, and remote monitoring. Companies are investing highly in advanced technologies and effectively utilizing these technologies often gain a competitive edge, driving market growth. Such advancements and innovations in clinical trials drive market growth.

Stringent quality protocols and regulatory norms by several nations to ensure patient safety and data integrity, which highly impact operational capabilities in the clinical trials market. Market participants with robust compliance measures and a track record of fulfilling regulatory standards gain credibility and preference from biopharmaceutical sponsors. Compliance with these regulations demands substantial resources, leading to barriers for smaller or newer firms.

Mergers and acquisition activities in the clinical trials market are increasing and witness similar growth during the analysis timeframe. Several companies are acquiring development-stage companies to enhance the company’s service portfolio to cater large patient pool. Moreover, these firms are integrating advanced facilities and form strategic alliances to achieve synergies in capabilities and resources, enhancing their competitiveness.

The market comprises a large number of bio-pharmaceutical, medical device manufacturers and CROS specialized in drug development leads to a fragmented market scenario.

Pharmaceutical, biotech, medical device firms, and academic research centers are major consumers of clinical trial services. Their preferences, bargaining power, and concentration can significantly influence the market. Concentration among these end users might favor specific service providers or trial conductors.

Phase Insights

On the basis of phase, phase III segment led the market and accounted for 53.48% of the total revenue share in 2024. The segment growth is owing to phase III trials are the most expensive and involving large number of subjects. The median cost for a single-phase III trial is over USD 19.0 million. Also, phase III requires a higher number of patients and often a longer treatment period. According to a clinical trial logistics survey by Nice Insights, 35.0% of phase III clinical trials are outsourced and the number is likely to increase owing to the growing number of investigational drugs advancing to the next phase.

Phase II segment is expected to witness considerable growth over the analysis period. Phase II is the second most expensive stage after phase III studies. This study is performed in two parts; the first part includes exploring a range of doses along with efficacy studies and the second part includes finalizing the dose. Phase II plays a crucial role, especially in oncology-related studies. The FDA estimated that around 33.0% of the investigational drugs are usually under phase II trial. Furthermore, there are numerous therapeutics and vaccines currently in phase II that are indicated for the treatment of oncology thereby boosting the market growth. The growing number of industry-sponsored and non-industry-sponsored clinical trials in phase II, complexity associated with phase II clinical trials, and globalization of clinical trials are factors expected to drive the growth of the clinical trials market.

Study Design Insights

On the basis of study design, interventional studies segment dominated the market in 2024. It is one of the most prominent methods used in clinical trials. Interventional studies comprised over 75.0% of the total registered studies in 2022, out of which most were for drug or biologics, followed by clinical procedure, behavioral, and device interventional studies. These studies contribute to 94.0% of the total studies that posted results, out of which drug or biologics contribute the most, followed by behavioral, devices, and Clinical procedure intervention studies.

The expanded access trials segment, also called compassionate use trials, is anticipated to register notable CAGR during the forecast period. It is a potential pathway for patients with serious disease conditions where lack of satisfactory therapies to undergo treatment outside the trial. Increasing innovation in clinical trial methods will drive the expanded access trials segment. Numerous oncology drugs are regularly administered to patients before their approval by the U.S. FDA and are considered part of the expanded access trial, thereby accelerating segmental revenue growth.

Indication Insights

On the basis of indication, oncology segment accounted for largest market revenue share in 2024. As per the U.S. FDA and various other sources, more than USD 38.0 billion is currently being spent by the pharmaceutical industry on the pre-clinical and clinical development of oncology therapy products. The cardiovascular condition segment is also anticipated to witness lucrative growth over the forecast period. The growing prevalence and increased demand for cost-effective medications worldwide have led to significant investment in R&D in this segment with more than 190 drugs in the pipeline. The majority of the drugs in the pipeline are indicated for heart failure, lipid disorders, vascular diseases, and stroke. Growing demand for cost-effective medicines in low- and middle-income countries is expected to boost the R&D investment by the government, thereby strengthening the market growth.

Indication by Study Design Insights

On the basis of indication by study design, interventional trials market for autoimmune/inflammation accounted for largest market revenue share in 2024. This can be attributed to large number of interventional studies on autoimmune/inflammation worldwide. Numerous advantages of interventional studies, such as minimization of confounding effects, avoidance of bias in allocation to exposure groups, and efficient detection of small to moderate clinically important effects. There are over 8,900 interventional studies listed on Clinicaltrails.gov related to autoimmune/inflammation.

Service Insights

On the basis of service, patient recruitment and retention segment garnered significant market share in 2024. The growing number of clinical studies globally is one of the key reasons supporting the demand for clinical trial patient recruitment services. Moreover, there is a growing amount of funding for clinical research, and the wide adoption of digital technologies in clinical research further supports the market's growth. The market is further fueled by major investments in R&D and government support for clinical trials. The presence of leading Contract Research Organizations (CROs) that offer comprehensive support services, including patient recruitment, along with the active participation of multinational pharmaceutical & biopharmaceutical companies, has contributed to the market expansion.

Data management segment held significant market share in 2024 and is anticipated to show a similar trend over the forecasted period. The segment growth is owing to increasing adoption of data management services coupled with a growing trend towards decentralized trials. Moreover, integration of advanced technologies such as Artificial Integration (AI) and Machine Learning (ML) for data entry and analysis and quality control. Thus, abovementioned factors are expected to drive segmental demand.

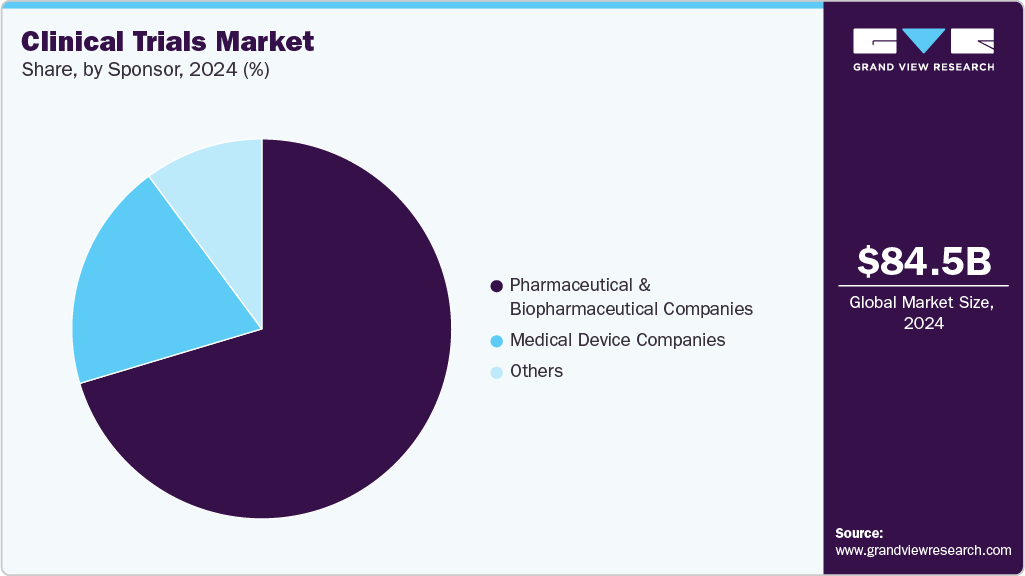

Sponsor Insights

On the basis of sponsor, pharmaceutical & biopharmaceutical companies accounted for largest market revenue share in 2024. This can be attributed to the greater interest of the pharmaceutical industry in the research field. In addition, there has been an increase in the number of clinical trials funded by pharmaceutical & biopharmaceutical companies. The pharmaceutical industry plays a vital role in financing the research for the development of new drugs.

Medical device companies is anticipated to grow at the considerable CAGR over the forecast period. The segment growth is driven due to the increasing demand for advanced diagnostic and therapeutic devices, growing investment in R&D activities, and continuous technological innovations aimed at enhancing device accuracy, safety, and patient outcomes. In addition, rising prevalence of chronic diseases, favorable regulatory reforms, and the growing adoption of digital health technologies such as remote monitoring and AI-based diagnostics are further supporting market expansion.

Regional Insights

North America clinical trials market accounted for 50.90% of the global market in 2024 and is expected to continue its dominance over the forecast period. This can be attributed to an increase in R&D investments and a rise in the adoption of new technologies in clinical trials in this region. For instance, the implementation of virtual services in various stages of clinical trials by market players, such as IQVIA and PRA Health Sciences, is anticipated to further propel the North America’s market growth.

U.S. Clinical Trials Market Trends

Moreover, favorable government support in the U.S. market for clinical trials is anticipated to boost the demand. For instance, in February 2024, National Cancer Institute (NCI) launched the Virtual Clinical Trials Office, a centralized remote staffing initiative to address clinical trial workforce shortages, enhance patient enrollment, and support cancer research across NCI-designated centers and community programs nationwide. This initiative is expected to strengthen trial efficiency, expand access in underserved regions, and accelerate cancer research progress across the U.S.

The clinical trials market in Canada is the advancing fueled by strong government funding and innovation focused initiatives. For instance, in August 2024, the Government of Canada invested over USD 43 million to support 14 new clinical trials addressing major health threats. This strengthened national R&D capabilities, bolstered the life sciences sector, and enhanced preparedness for future health emergencies.

Europe Clinical Trials Market Trends

Europe’s clinical trials market is expanding steadily driven by strong regulatory support, rising investments in rare disease research, and the adoption of decentralized and digital trial models. For instance, in July 2025, European clinical trial organizations urged urgent implementation of the Life Science Strategy to address regulatory fragmentation, recruitment challenges, and administrative burdens threatening Europe’s clinical research ecosystem and competitiveness. Such initiatives are crucial to restore efficiency, foster innovation, and ensure Europe remains a competitive and attractive hub for global clinical research.

The clinical trials market in UK is expected to grow significantly over the forecast period with highest CAGR. The country’s growth is influenced by regulatory reforms and streamlined approval processes and adoption of artificial intelligence and digital platforms. According to Gov.UK report of October 2025, clinical trials in UK strengthened with faster approval timelines driven by MHRA reforms and AI integration, reducing approval times from 91 to 41 days. These advancements enhance patient access, accelerate trial setup, and boost research efficiency. UK positions itself as a global leader in modernized, AI-enabled clinical research, supported by the 10-Year Health Plan.

The clinical trials market in Germany dominated the region with largest revenue share in 2024. The market is fueled by strong R&D infrastructure, supportive regulatory frameworks, and high investment in neurodegenerative research. For instance, in August 2025, Eisai and Biogen launched LEQEMBI, the first anti-amyloid Alzheimer’s therapy in Germany, following EU approval. Such advancements emphasize Germany’s leadership in clinical innovation and early-stage therapeutic development.

Asia Pacific Clinical Trials Market Trends

Asia Pacific region is anticipated to grow at the fastest CAGR over the forecast period owing to the availability of a large patient pool allowing easy recruitment. The global COVID-19 pandemic is one of the major factors driving the market. Asia Pacific’s largest, expertized biotech CRO “Novotech”, has reported an increase in demand from biotechnology sponsors for studies due to good quality and quick turnaround. An increasing number of biotechnology firms prefer the APAC region for conducting COVID-19 trials to leverage a large patient pool and fast-track procedures.

China dominated the region with largest revenue share in 2024. The clinical trials market witnessed rapid expansion driven by regulatory reforms, government funding, and digital innovation. The 2025 Outsourcing in Clinical Trials China and Clinical Trial Supply China events in Suzhou highlighted the nation’s growing global influence. According to GlobalData, China accounted for 11% of global drug development, nearly double the 5EU share. Initiatives such as the 2015 policy and major deals such as AstraZeneca’s USD 5.2 billion collaboration with CSPC fueled innovation, global partnerships, and biotech ecosystem growth.

The market for clinical trials in Australia is boosted with strong government support, advanced research infrastructure, and a focus on innovative studies. For instance, in June 2025, studies focused trials reflected Australia’s dominance in neurological research and drug repurposing. The country’s streamlined regulatory framework, skilled clinical workforce, and initiatives such as MS Trial Screen enhanced patient recruitment and positioned Australia as a preferred destination for complex, high-impact clinical research.

Latin America Clinical Trials Market Trends

The growth of the region is fueled by a large patient pool, diverse genetic populations, and lower operational costs. Countries such as Brazil, Mexico, and Argentina attracted global sponsors due to streamlined regulations and strong investigator networks. Key players such as IQVIA, Parexel, and Syneos Health expanded operations, enhancing regional trial capacity and global competitiveness.

The clinical trials in Brazil is gaining momentum, supported by a large patient base, strong investigator expertise, and rising demand for biopharma innovations. For instance, in April 2025, Valneva’s single-dose chikungunya vaccine, IXCHIQ, received Brazil’s ANVISA approval, marking the first endemic-country authorization and enabling Phase 4 clinical trials, supported by CEPI, EU, and Instituto Butantan. This strengthened country’s role in global vaccine development and expand access to critical chikungunya prevention in endemic regions.

Middle East & Africa Clinical Trials Market Trends

The Middle East and Africa clinical trials market experienced significant growth, driven by rising investments in oncology research, favorable regulatory reforms, and increasing collaborations between local and global pharma companies. Key players such as Ellipses Pharma in December 2024, advanced oncology studies, exemplified by its inaugural large-scale Phase 1/2 RET inhibitor trial in the UAE at Cleveland Clinic and Tawam Hospital. Patient recruitment and regional partnerships strengthened trial capabilities, while government support and modern infrastructure facilitated faster approvals and enhanced clinical research.

South Africa’s clinical trials market witnessed robust growth, driven by strong government support, advanced research infrastructure, and a rising prevalence of chronic and infectious diseases. Some of the initiatives such as of August 2025, IAVI’s Phase 1 HIV vaccine trial (GRAdHIVNE1) conducted at the Desmond Tutu Health Foundation in Cape Town and the Africa Health Research Institute in Durban. Collaboration with global partners such as ReiThera, the Ragon Institute, and funding from the Gates Foundation enhanced trial quality. Local expertise and state-of-the-art facilities strengthened South Africa’s position as a key hub for clinical research in sub-Saharan Africa.

UAE clinical trials market expanded significantly, due to government-backed funding, strategic partnerships, and investments in advanced healthcare infrastructure. For instance, in February 2025, Cardiogeni PLC signed a USD 26.72M MoU with the Private Office of Sheikh Al Qassimi to fund heart failure clinical trials via a joint venture. Strong regulatory support, international collaborations, and rising demand for innovative therapies enhanced the UAE’s position as a regional clinical research hub.

Key Clinical Trials Company Insights

Some of the key players operating in the market include IQVIA, PPD, Pfizer, Eli Lilly and Company

-

IQVIA offers technology solutions, advanced analytics, and clinical research services in the life sciences sector. The company establishes connections across the healthcare industry through transformative technologies, advanced analytics, and data resources. Its platform, IQVIA Connected Intelligence, provides valuable & rapid insights, empowering customers to enhance the process of developing and bringing innovative medical treatments to market.

-

Eli Lilly and Company discovers, develops, manufactures & markets products in human pharmaceutical products. The company’s products cater to various therapeutic areas like diabetes, immunology, neuroscience, and oncology.

Clinipace, SGS SA, PAREXEL International Corporation are some of the emerging market participants in the clinical trials market.

-

SGS SA provides clinical research services, quality assurance, inspection, testing, and certification services around the world. SGS operates through nine reportable segments: Agriculture, Food & Life, Minerals, Oil, Gas & Chemicals, Consumer Retail, Certification & Business Enhancement, Industrial, Environment, Health & Safety, Transportation, and Governments & Institutions. Under clinical research services, it offers clinical development consultancy, pharmacovigilance & drug safety services.

-

Clinipace is a full-service contract research organization that provides clinical research & development services. The company provides services such as regulatory affairs, clinical development from phase I to Phase IV, and clinical analytics. It provides clinical technology solutions and functional services. It caters to various therapeutic areas, including cardiology, CNS, ENT, immunology, infectious disease & vaccines, nutrition, orthopedics, and respiratory. Its focus area includes gastroenterology, nephrology & urology, oncology, rare diseases, and women’s health.

Key Clinical Trials Companies:

The following are the leading companies in the clinical trials market. These companies collectively hold the largest market share and dictate industry trends.

- Pharmaceutical Product Development, INC. (Thermo Fisher Scientific, Inc.)

- ICON plc

- Charles River Laboratories International, Inc.

- IQVIA

- SYNEOS HEALTH

- SGS SA

- PAREXEL International Corporation

- Wuxi AppTec, Inc

- Chiltern International Ltd (Laboratory Corporation of America)

- Eli Lilly and Company

- Novo Nordisk A/S

- Pfizer

- Clinipace (Caidya)

Recent Developments

-

In October 2025, Precision BioSciences activated its first U.S. clinical trial site at Massachusetts General Hospital for the Phase 1 ELIMINATE-B study of PBGENE-HBV. The trial evaluates in vivo gene editing therapies for chronic hepatitis B patients. This expansion strengthens clinical development capabilities and accelerates patient access to innovative gene-editing treatments.

-

In October 2025, SeaBeLife secured USD 2.16 million in pre-Series A funding led by iXLife and new investors, supporting development of drug candidates for dry AMD and severe acute hepatitis. The first clinical trial is set to begin in 2026.

-

In May 2025, ImmunityBio partnered with Saudi Arabia’s Ministry of Investment, KFSHRC, and KAIMRC to launch the FDA-approved Cancer BioShield platform, introducing immune-restorative therapies targeting NK and T cells. The initiative aimed to enhance cancer care and foster regional collaboration.

Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 88.97 billion

Revenue forecast in 2033

USD 158.41 billion

Growth rate

CAGR of 7.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, clinical trials outlook, volume analysis

Segments covered

Phase, study design, indication, indication by study design, service, sponsor, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Pharmaceutical Product Development, INC. (Thermo Fisher Scientific, Inc.); ICON plc; Charles River Laboratories International, Inc.; IQVIA; Syneos Health; SGS SA; PAREXEL International Corporation; Wuxi AppTec, Inc; Chiltern International Ltd (Laboratory Corporation of America); Eli Lilly and Company; Novo Nordisk A/S; Pfizer; Clinipace (Caidya)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trials Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global clinical trials market report based on phase, study design, indication, indication by study design, service, sponsor, and region.

-

Phase Outlook (Revenue, USD Million, 2021 - 2033)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Study Design Outlook (Revenue, USD Million, 2021 - 2033)

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Autoimmune/Inflammation

-

Rheumatoid Arthritis

-

Multiple Sclerosis

-

Osteoarthritis

-

Irritable Bowel Syndrome (IBS)

-

Others

-

-

Pain Management

-

Chronic Pain

-

Acute Pain

-

-

Oncology

-

Blood Cancer

-

Solid Tumors

-

Others

-

-

CNS Conditions

-

Epilepsy

-

Parkinson's Disease (PD)

-

Huntington's Disease

-

Stroke

-

Traumatic Brain Injury (TBI)

-

Amyotrophic Lateral Sclerosis (ALS)

-

Muscle Regeneration

-

Others

-

-

Diabetes

-

Obesity

-

Cardiovascular Diseases

-

Others

-

-

Indication by Study Design Outlook (Revenue, USD Million, 2021 - 2033)

-

Autoimmune/Inflammation

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Pain Management

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Oncology

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

CNS Conditions

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Diabetes

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Obesity

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Cardiovascular Diseases

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Others

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Protocol Designing

-

Site Identification

-

Patient Recruitment

-

Laboratory Services

-

Analytical Testing Services

-

Clinical Trial Data Management Services

-

Others

-

-

Sponsor Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biopharmaceutical Companies

-

Medical Device Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Columbia

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global clinical trials market size was estimated at USD 84.54 billion in 2024 and is expected to reach USD 88.97 billion in 2025.

b. The global clinical trials market is expected to grow at a compound annual growth rate of 7.48% from 2025 to 2033 to reach USD 158.41 billion by 2033.

b. North America dominated the market for clinical trials and accounted for the largest revenue share of 50.90% in 2024. The dominance is due to the strong presence of leading pharmaceutical and biotechnology companies, robust regulatory frameworks, and well-established clinical research infrastructure.

b. Some key players operating in the clinical trials market include Pharmaceutical Product Development, inc., (Thermo Fisher Scientific, Inc.), ICON plc, Charles River Laboratories International, Inc., IQVIA, Syneos Health, SGS SA, PAREXEL International Corporation, Wuxi AppTec, Inc, Chiltern International Ltd (Laboratory Corporation of America), Eli Lilly and Company, Novo Nordisk A/S, Pfizer, Clinipace (Caidya)

b. Key factors that are driving the clinical trials market growth include the adoption of personalized medicine, the increasing prevalence of chronic diseases, technological advancements, globalization of clinical trials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.