- Home

- »

- Medical Devices

- »

-

Tourniquet Systems Market Size, Share, Industry Report 2030GVR Report cover

![Tourniquet Systems Market Size, Share & Trends Report]()

Tourniquet Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Tourniquet Instrument, Tourniquet Cuffs), By Cuff Type (Pneumatic, Non-pneumatic), By Application (Hospitals, Ambulatory Setting), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-817-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tourniquet Systems Market Summary

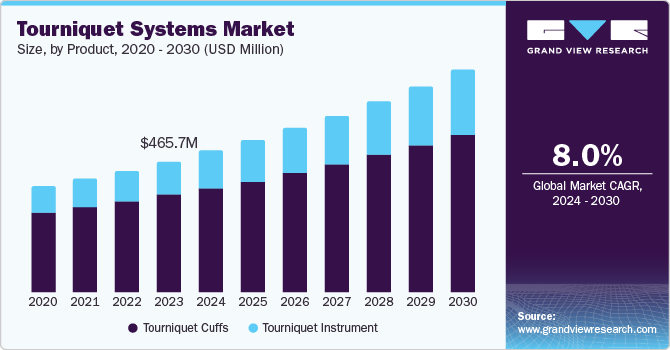

The global tourniquet systems market size was estimated at USD 514.4 million in 2023 and is projected to reach USD 794.7 million by 2030, growing at a CAGR of 8.0% from 2024 to 2030. Key factors such as the increasing geriatric population's increased susceptibility to orthopedic conditions and growing patient awareness are driving the market growth.

Key Market Trends & Insights

- North America led the global market capturing a significant revenue share of 45.5% in 2023.

- Based on product, the tourniquet cuffs segment emerged as the market leader, capturing the highest revenue share of 73.8% in 2023.

- Based on cuff type, the pneumatic segment accounted for the largest market revenue share of 88.3% in 2023.

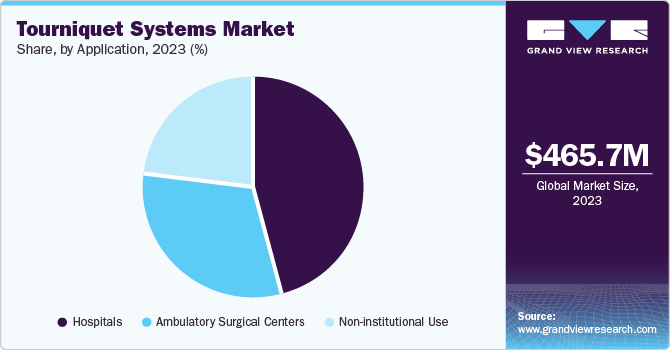

- Based on application, the hospitals segment led the market share and accounted for 46.0% of the total revenue generated in 2023.

Market Size & Forecast

- 2023 Market Size: USD 514.4 Million

- 2030 Projected Market Size: USD 794.7 Million

- CAGR (2024-2030): 8.0%

- North America: Largest market in 2023

The rising incidence of road accidents and sports injuries has contributed to an increased demand for surgical tourniquets.Emergency and trauma care require the adoption of surgical tourniquets to control severe bleeding, which is crucial for saving lives in critical situations. Advancements in technology have improved the effectiveness and safety of surgical tourniquets, offering better pressure control and monitoring to reduce complications like nerve damage and ischemia.

Tourniquets are crucial in hospitals, particularly during orthopedic surgeries, where external bleeding needs to be controlled through direct pressure. These devices are also essential in emergency situations involving life-threatening limb hemorrhages or limb amputations with multiple bleeding points, providing immediate management for breathing and airway issues.

The economy has seen a rise in recent years, resulting in a higher average income for people globally. The U.S. Food and Drug Administration (FDA) enforces Good Manufacturing Practice (GMP) guidelines for tourniquets to safeguard patient safety and product efficacy. Other regulatory entities, such as public health systems, state and local health departments, and medical device manufacturers, also uphold industry standards.

Product Insights

In 2023, the tourniquet cuffs segment emerged as the market leader, capturing the highest revenue share of 73.8%. The rising utilization of tourniquet cuffs in orthopedic procedures, lower limb injuries, and joint replacement surgeries is projected to propel the growth of this segment in the coming years.

On the contrary, the tourniquet instrument segment is anticipated to exhibit a CAGR of 9.6% from 2024 to 2030. Technological advancements are making tourniquet instruments more efficient, user-friendly, and safer. Increasing surgical procedures and rising trauma cases are projected to aid their growth in the forecast period.

Cuff Type Insights

The pneumatic cuff type accounted for the largest market revenue share of 88.3% in 2023, attributable to higher demand. They are widely used due to their ability to provide standardized pressure. Technological advancements, such as SourceMark Medical's disposable cuffs, are expected to drive segment growth further. These sterile, single-use cuffs reduce costs, infection risks, and bacterial transfer, making them a valuable asset for clinicians.

Non-pneumatic cuffs are expected to witness significant growth with a CAGR of 7.5%. Non-pneumatic tourniquets, using mechanical or guide structures, are gaining popularity for their minimal invasiveness and cost-efficiency. They are often used in prehospital and point-of-care scenarios but can also be used in operating rooms. Their affordability makes them increasingly desirable in healthcare settings where finances are a concern.

Application Insights

Hospitals led the market share and accounted for 46.0% of the total revenue generated in 2023. Tourniquet systems are widely utilized in hospitals as a crucial tool for addressing life-threatening external hemorrhages resulting from lower limb injuries. Increasing average income levels guarantee convenient access and affordability within hospital environments. The advancement of diagnostics with improved functionality and a diverse array of treatments, such as tourniquet systems, is anticipated to fuel growth in this sector.

The non-institutional use segment is expected to witness growth at 7.9% CAGR in forecast period. Increasing awareness about first aid and emergency medical procedures among the general public is driving demand for personal medical kits. Technology advancements have led to the development of user friendly and cost effective tourniquet systems, making them more accessible. Moreover, the rise in outdoor activities and adventurous sports has led to the development of user-friendly and cost-effective tourniquet systems, making them more accessible to non-professional users.

Regional Insights

North America tourniquet systems market led the global tourniquet systems market in 2023, capturing a significant revenue share of 45.5%, driven by factors such as a well-established healthcare infrastructure, a large target population, and a high adoption rate of advanced technological systems. A BioMed Central study conducted in North America revealed that the region has a higher prevalence of hip osteoarthritis compared to other regions.

U.S Tourniquet Systems Trends

The tourniquet systems market in the U.S. emerged as a frontrunner, capturing a significant market share of 75.3%. The country’s dominance in the global industry is driven by the presence of well-established healthcare infrastructure and a large patient pool. Physicians in the U.S. promote public awareness and training for rapid bleeding control techniques among laypeople, law enforcement, and firefighters. This effort aims to empower individuals to respond effectively in emergencies, leading to a significant increase in demand for related products.

Europe Tourniquet Systems Trends

The Europe tourniquet systems market is expected to witness a significant growth rate of 7.6% from 2024 to 2030. This growth can be attributed to various factors, including the rising demand for minimally invasive surgeries that require specialized tourniquets capable of controlling blood flow in smaller areas.

The German tourniquet systems market holds a prominent position in the European tourniquet systems market. Sales of surgical tourniquets in Germany are expected to witness a substantial increase in the coming year. The rising demand in Germany can be attributed to renowned tourniquet companies, proficient medical professionals, and the greater utilization of cutting-edge technologies.

The UK tourniquet Systems market is expected to grow rapidly in the coming years owing to the presence of key companies into the region and high technological advancement. The demand for tourniquet cuffs is expected to rise due to the growing prevalence of chronic diseases such as diabetes and cardiovascular diseases. Tourniquet cuffs are commonly used in medical procedures and surgeries to control bleeding and ensure patient safety.

Asia Pacific Tourniquet Systems Market Trends

The tourniquet systems market in Asia Pacific is projected to witness a steady growth rate of 8.6% during the forecast period. This growth can be attributed to various factors, including rapid population growth and increasing healthcare expenditure in countries such as India, China, and Indonesia. As these economies continue to flourish, the demand for medical devices and tourniquets is expected to rise.

The India tourniquet systems market is expected to grow lucratively owing to the surge in road accidents and falls resulting from a larger population and increased number of vehicles on the road. This has created a pressing need for emergency tourniquets. Furthermore, the market is characterized by a mix of global and local players and domestic companies' emergence.

Key Tourniquet Systems Company Insights

The surge in competition is driving rapid technological progress, prompting companies to enhance their products through extensive research and development efforts. Leading companies are adopting various strategic approaches such as mergers and acquisitions, partnerships, and new product introductions to bolster their market presence.

Key Tourniquet Systems Companies:

The following are the leading companies in the tourniquet systems market. These companies collectively hold the largest market share and dictate industry trends.

- Delfi Medical Innovations Inc.

- AneticAid Ltd

- Zimmer Biomet Holdings Inc.

- Dessillons & Dutrillaux

- Stryker Corporation

- VBM Medizintechnik GmbH

- OHK Medical Devices

- Ulrich Medical

- Hammarplast Medical AB

Recent Developments

-

In June 2024, Technimount E.M.S. Holding Inc. signed a distribution agreement in Canada with Compression Works Inc. for the distribution of Abdominal Aortic and Junctional tourniquet-stabilized (AAJT-S).

-

In January 2024, ITL BioMedical launched its new IV Start Kit in the U.S. The kit has a TPE Tourniquet and other aseptic techniques products.

-

In June 2023, SourceMark Medical, a U.S. medical device company and certified Minority Business Enterprise (MBE), announced a new comprehensive line of self-branded disposable single- and dual-port pneumatic tourniquet cuffs.

Tourniquet Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 502.0 million

Revenue forecast in 2030

USD 794.7 million

Growth rate

CAGR of 8.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, cuff type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Delfi Medical Innovations Inc.; AneticAid Ltd; Zimmer Biomet Holdings Inc.; Rudolf Riester GmbH; Dessillons & Dutrillaux; Stryker Corporation; VBM Medizintechnik GmbH; OHK Medical Devices; Ulrich Medical; Hammarplast Medical AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tourniquet Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tourniquet systems market report based on product, cuff type, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Tourniquet Instrument

-

Tourniquet Cuffs

-

Pneumatic

-

Disposable

-

Reusable

-

-

Non-pneumatic

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Setting

-

Non-institutional Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global tourniquet systems market size was estimated at USD 478.0 million in 2022 and is expected to reach USD 514.4 million in 2023.

b. The global tourniquet systems market is expected to grow at a compound annual growth rate of 7.9% from 2023 to 2030 to reach USD 873.4 million by 2030.

b. In terms of application area, Hospitals dominated the tourniquet systems market with a share of 46.3% in 2022. This is attributable to the rising incidence of road accidents that require tourniquet systems to manage a life-threatening injury.

b. Some key players operating in the tourniquet systems market include Delfi Medical, Zimmer Biomet, Hammarplast Medical AB, VBM Medizintechnik GmbH, Stryker, ulrich medical, and Rudolf Riester GmbH.

b. Key factors that are driving the market growth include rise in geriatric population, which is highly susceptible to orthopedic conditions, increasing patient awareness, greater flexibility, and reliability of latest innovative tourniquet systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.