- Home

- »

- Medical Devices

- »

-

Tonometer Market Size, Share, Growth & Trends Report 2030GVR Report cover

![Tonometer Market Size, Share & Trends Report]()

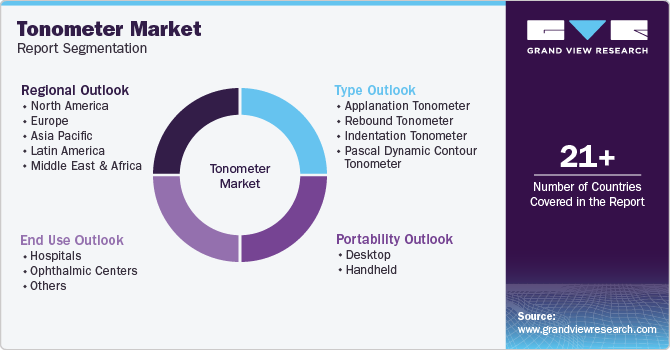

Tonometer Market (2024 - 2030) Size, Share & Trends Analysis By Type (Applanation Tonometer, Rebound Tonometer), By Portability (Desktop, Handheld), By End Use (Hospitals), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-064-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tonometer Market Size & Trends

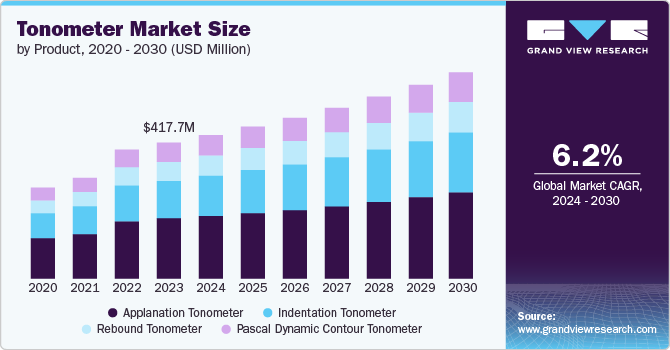

The global tonometer market was valued at USD 417.7 million in 2023 and is expected to grow at a CAGR of 6.2% from 2024 to 2030. This growth is attributable to the increasing incidence of glaucoma. Tonometers are used to diagnose and evaluate patients at risk of developing chronic eye condition. The timely diagnosis helps prevent it from damaging the optic nerve. These devices accurately measure intraocular pressure (IOP) in early detection and management and prevent irreversible vision impairment.

Furthermore, the rising geriatric population, coupled with the prevalence of diabetes have significantly contributed to the market growth. Both geriatric and diabetic patients are more susceptible to eye-related disorders, including glaucoma. This has led to a surge in the demand for tonometers as regular monitoring of IOP becomes crucial for preventing vision loss. Moreover, these devices are widely used in hospitals, eye clinics, and ophthalmic centers to assess patients’ eye health.

In addition, the market witnessed significant shifts owing to the heightened patient awareness about the benefits of regular IOP monitoring and early glaucoma diagnosis. Patients have increasingly recognized the importance of preventive measures to safeguard their vision. As a result, eye checkup camps and glaucoma screening programs have become more prevalent, encouraging people to seek timely evaluations.

Type Insights

Applanation tonometers have dominated the market with a 46.1% share in 2023. These tonometers with their portability and user-friendly design significantly influenced market growth. Applanation devices are easy to handle and offer accurate IOP measurements, without the need for fluorescein dye or topical anesthesia, enhancing patient comfort and streamlining eye examinations. By measuring the force required to temporarily flatten a portion of the cornea, it provides reliable IOP readings. Healthcare professionals have increasingly relied on this tonometer type for routine eye assessments, driving market demand.

Rebound tonometers are projected to emerge at the fastest CAGR during the forecast period owing to the rising awareness among patients regarding the benefits of regular monitoring and early diagnosis of excessive IOP. Patients have progressively recognized the importance of preventing vision loss associated with conditions including glaucoma. Rebound tonometry, with its non-invasive nature, has become a valuable tool for assessing IOP without discomfort or anesthesia. Furthermore, these devices are suitable for various patient groups, including children and patients with disabilities as they allow measurements at different corneal locations and provide flexibility and accuracy.

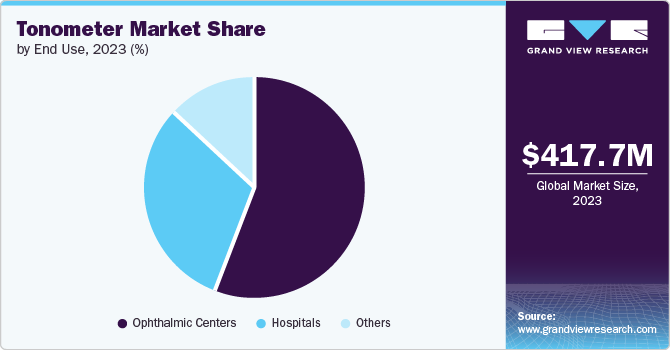

End Use Insights

Ophthalmic centers have accounted for the dominant share with 56.3% of the market in 2023 as they addressed the increasing prevalence of eye-related diseases, including glaucoma and ocular hypertension. These centers essentially specialize in eye care, hence, they have actively participated in glaucoma screening programs and utilized tonometers for accurate IOP measurements, emphasizing preventive measures. Regular IOP assessments using tonometers allowed timely identification of patients at risk. By detecting elevated IOP early, these centers contributed to better management and reduced vision loss associated with glaucoma.

Hospitals are expected to grow substantially as the fastest CAGR during the forecast period. As primary care facilities, hospitals have actively participated in glaucoma screening programs which included the increased adoption of tonometers. In addition, government initiatives have led to the implementation of schemes, encouraging hospitals and clinics to adopt tonometers. Such financial incentives facilitated the integration of tonometry into routine eye examinations and glaucoma screenings within healthcare facilities.

Portability Insights

Handheld tonometers have led the market with the propellent share in 2023 as they offer enhanced patient comfort. Despite their smaller size, they offer ease of use and precise IOP) readings. Such portable devices are particularly valuable in busy clinical settings as they are ideal for routine IOP assessments. Their ergonomic design ensures patient comfort during examinations. Moreover, handheld devices such as rebound tonometers, Perkins tonometer, and tono-pen are commercially available. This caters to the growing awareness of patients about the importance of early glaucoma diagnosis, thereby driving market growth.

Desktop tonometers are expected to emerge substantially at a CAGR of 5.2% during the forecast period. These devices, despite their larger size, gained traction due to their enhanced patient comfort. Desktop tonometers including Dynamic Contour Tonometer (DCT) and Ocular Response Analyzer (ORA) are widely utilized in hospitals and ophthalmic centers for ease of use and accuracy in IOP screening of corneal biochemical properties. In addition, the stationary nature of these tonometers allows consistent measurements, making them suitable for routine screenings.

Regional Insights

The North America tonometer market secured 43.0% of the global share in 2023. The region’s competitive landscape, with established players and innovative companies, has primarily driven the market growth. These competitors have continually improved tonometry devices, focusing on accuracy, ease of use, and patient comfort. Additionally, efficient reimbursement systems facilitated the adoption of tonometers in North American hospitals and ophthalmic centers.

U.S. Tonometers Market Trends

The U.S. tonometer market was propelled by the rapidly increasing geriatric population. People aged 60 and above are at higher risk of developing glaucoma, and this risk escalates each year after the age of 40. As a result, tonometers played a crucial role in assessing IOP and preventing vision loss with glaucoma. Moreover, ongoing technological innovations in the country have increasingly focused on enhancing tonometry devices.

Europe Tonometers Market Trends

The tonometer market in Europe registered 23.0% of the market share in 2023. European countries are home to major global companies working on products related to chronic diseases and the rising geriatric population. This focus significantly drove demand for portable tonometer devices that enhance patient comfort.

Asia Pacific Tonometers Market Trends

The Asia Pacific (APAC) tonometer market secured 22.0% of the market share in 2023. The market witnessed a considerable shift in the rise of portable tonometers owing to rapid urbanization and the increased awareness of glaucoma. The geriatric patient population increasingly sought portable tonometers for early prevention of glaucoma and ocular hypertension.

Key Tonometer Company Insights

Key companies including Keeler Ltd., Topcon Corporation, and others have led the fairly fragmented tonometer market. They have increasingly implemented organic strategies including strategic collaborations, product development, acquisitions, and mergers to continue their dominant footprint in the market.

-

Keeler Ltd., based in the UK, manufactures ophthalmic diagnostic equipment. The company specializes in providing tools for eye care specialists, including ophthalmic ultrasound devices (through the addition of Accutome) and cryosurgical equipment.

-

Topcon Corporation, a Japanese manufacturer, focuses on optical equipment for both ophthalmology and surveying. The company specializes in developing optical, sensing, and control solutions powered by digital transformation technologies. They offer advanced multimodal imaging, data management, and remote diagnostic technology for eye health.

Key Tonometer Companies:

The following are the leading companies in the tonometer market. These companies collectively hold the largest market share and dictate industry trends.

- Keeler Ltd.

- Topcon Corporation

- Icare Finland Oy

- AMETEK Inc.

- Reichert, Inc.

- OCULUS

- Kowa American Corporation

- NIDEK CO., LTD

- Ziemer Ophthalmic Systems

Recent Developments

-

In May 2024, Reichert Technologies, a business of AMETEK, Inc. launched Tono-Vera Tonometer - a lightweight, calibration-free handheld tonometer. It aims to deliver quick, automated, and reliable IOP measurements using rebound tonometer technology.

-

In September 2023, Topcon Healthcare introduced its Topcon RDx tele-refraction software platform to the EMEA market. This innovative and secure solution enables eye care specialists to perform comprehensive refractions conveniently from any location and at any time, enhancing efficiency and accessibility to primary eye care.

Tonometer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 440.8 million

Revenue forecast in 2030

USD 630.8 million

Growth Rate

CAGR of 6.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, portability, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Keeler Ltd.; Topcon Corporation; Icare Finland Oy; AMETEK Inc.; Reichert, Inc.; OCULUS; Kowa American Corporation; NIDEK CO., LTD; Ziemer Ophthalmic Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tonometer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tonometer market report based on type, portability, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Applanation Tonometer

-

Rebound Tonometer

-

Indentation Tonometer

-

Pascal Dynamic Contour Tonometer

-

-

Portability Outlook (Revenue, USD Million, 2018 - 2030)

-

Desktop

-

Handheld

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ophthalmic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.