- Home

- »

- Clothing, Footwear & Accessories

- »

-

Toddler Wear Market Size And Share, Industry Report, 2030GVR Report cover

![Toddler Wear Market Size, Share & Trends Report]()

Toddler Wear Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Apparel, Footwear, Others), By Distribution Channel (Online, Offline), By Region (North America, Europe, Asia Pacific, Latin America, MEA) And Segment Forecasts

- Report ID: GVR-3-68038-732-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Toddler Wear Market Size & Trends

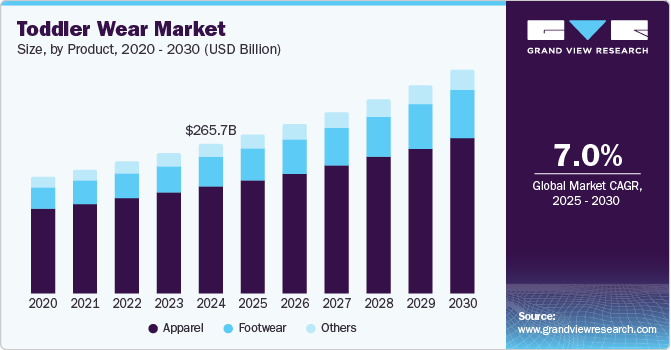

The global toddler wear market size was valued at USD 265.71 billion in 2024 and is projected to grow at a CAGR of 7.0% from 2025 to 2030. Increasing availability of wide variety of products facilitated by the online shopping platforms and e-commerce and continuously rising in population in emerging economies such as India and others are primarily driving the growth. Rapidly evolving consumer goods industry in regions such as Asia Pacific and Middle East and Africa, trends such as product premiumization and technology transformation embraced by manufacturers are expected influence growth during forecast period.

Innovation plays vital role in growth of apparel industry, and toddler wear is no exception. In recent years, multiple companies and brands have introduced novel collections characterized with unique feature and varieties in terms of designs and materials. Technology advancements such as availability of 3D printing, wearable technology, organic fabrics and more have also added significant growth opportunities to this market.

Multiple businesses have eliminated the excessive utilization of chemicals in conventional manufacturing that might lead to skin irritations and other health issues among children. Numerous brands and companies have prioritized environment-friendly sourcing and other processes, using natural or organic fabrics and developing chemical-free industrial techniques. For instance, Greendigo, a brand that provides range of sustainable products designed with diligence and made to last long. The company has eliminated harmful chemicals and unreasonable designs while adding features such as fresh colors, comfortable designs, and striking print. Its diverse product portfolio entails bedtime and bath essentials, baby apparel and more.

Rising consumer awareness regarding the harmful effects of chemical-based materials and processes is projected to drive the demand for toxin-free and organic cotton wear, especially in developed countries. The strong influence of social media on the apparel industry drives the sales of toddler clothing. Adopting pop culture trends in infant clothing is also expected to drive growth. Manufacturers focus on high-quality fabrics, unique designs, and vibrant colors to attract more consumers. Factors such as the influence of celebrity fashion and the rising number of child artists are expected to create growth opportunities for the toddler wear market.

Continuous rise in world population has been adding growth opportunities for this market. According to UNICEF, 3,657,476 babies were born in the U.S., and the number of children born in India was 23,219,489. Increasing disposable income levels of parents, the growing participation of both parents in the workforce, and persistent additions in major market players' product portfolios are likely to drive the growth of this market in the approaching years.

Product Insights

The apparel segment dominated the global toddler wear industry with a revenue share of 71.8% in 2024. Baby or toddler apparel products have been gaining significant attention from urban parents. Effective distribution through shopping malls, specialty stores, brick-and-mortar brand stores, and other points of sale, including online shopping platforms, has added a large number of growth opportunities to this market. In recent years, the emergence of dedicated toddler wear brands has also contributed to the growth of this segment. For instance, in October 2024, SUPERDRY, one of the British apparel brands and sustainable style destinations, partnered with Next Retail Ltd., a clothing, beauty products, and homeware products company, to launch Superdry Kids. The newly launched premium range of kidswear products is available through Next's online shopping website. For the offline shopping experience, the products are available in selected brands starting in November.

The footwear segment is projected to grow fastest from 2025 to 2030. This growth is primarily driven by the increasing availability of brand products through online shopping experiences. Multiple retail businesses and fashion and footwear industry participants also focus on adding recently styled innovation-based products and designs to their diverse portfolios. Effective marketing strategies driven by modern technologies such as artificial intelligence and others are also expected to significantly influence this segment's growth.

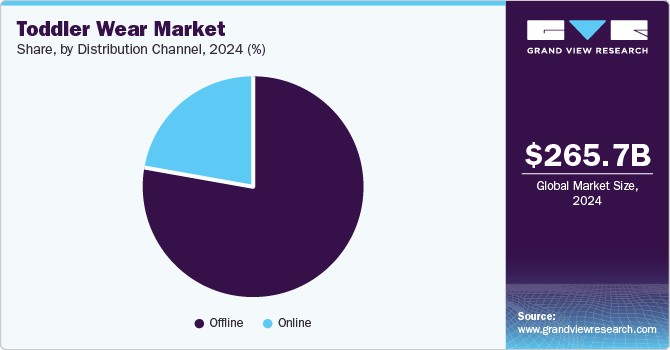

Distribution Channel Insights

Offline distribution held the largest revenue share of the global toddler wear industry in 2024. Parents often prefer offline shopping as it allows physical examination of the products, materials used in the making, safety offered by the product, and aspects associated with clothing such as color, comfort, texture, designs, and more. Additionally, services provided by brick-and-mortar stores, such as replacements after the sale, assistance at the time of purchase, and others, also play a vital role. These aspects have driven the growth of this market over the last few years.

The online distribution segment is projected to experience the fastest growth during the forecast period. This segment is mainly influenced by aspects such as ease of accessibility driven by the growing ubiquity of smartphones and the availability of multiple platforms such as online brand stores, e-commerce websites, brand mobile applications, e-commerce mobile apps, and others. Furthermore, features such as doorstep delivery, availability of multiple payment modes, customer-friendly policies such as refund or return, and display of detailed reviews posted by previous buyers attract large groups of customers.

Regional Insights

North America toddler wear market held the largest revenue share of 33.0% in 2024. This market is primarily driven by the many brands participating and the products and collections offered by applauded brands operating in other clothing categories. This region has a robust textile industry facilitated by large distribution networks, the availability of conventional and sustainable materials, and growing demand from urban customers.

U.S. Toddler Wear Market Trends

The U.S. toddler wear market held the largest revenue share of the regional industry in 2024. This market is mainly driven by aspects such as the country’s strong textile and retail industry, a large number of specialty stores, and dedicated brick-and-mortar brand stores operating in various cities such as New York, Los Angeles, Dallas, Chicago, Denver, and others. The presence of multiple market participants operating in the country, such as Carter’s, Inc., Hanna Andersson, and others, also add to the growth opportunities of this market. Increasing demand from urban consumers and growing online shopping trends are anticipated to generate a surge in growth in the coming years.

Europe Toddler Wear Market Trends

Europe was identified as one of the significant regions in the toddler wear industry. Significant growth in population and availability of multiple brand products originating in countries such as the U.K., France, and others is primarily adding growth to this market. Improved availability through dedicated specialty stores operating in cities such as London, Paris, Milan, Barcelona, Munich, Berlin, Frankfurt, and others is expected to facilitate growing demand. Additionally, the online presence of multiple brands and increasing service areas of e-commerce businesses are expected to drive growth during the next few years.

Germany dominated the regional market with the largest revenue share in 2024. This market is mainly influenced by aspects such as the robust manufacturing industry established in the country and population growth. According to Statistisches Bundesamt (Destatis), the federal statistical office, in 2023, nearly 692,989 births were recorded in Germany. The availability of multiple brand products increases parents’ focus on embracing sustainable clothing for children and enhancing access through online portals and e-commerce websites.

Asia Pacific Toddler Wear Market Trends

Asia Pacific toddler wear industry is anticipated to experience the fastest CAGR during the forecast period. This market is mainly driven by the continuous growth in the population of countries such as China, India, and others. The presence of multiple domestic product manufacturers that offer vast collections of toddler apparel and footwear developed with significant knowledge of customer behavior and preferences also influences this market. A large number of foreign brands have entered the region, with stores in prime cities and an online presence, which also contribute to growth.

China dominated the regional industry, with the largest revenue share in 2024. Multiple private-label children’s clothing brands are present in the country, multiple global brands are entering the country, and a large number of local vendors and domestic brands operate in urban areas of the country. This market is also driven by the participation of China-based manufacturers in global trade and the export of toddler wear products, including apparel and footwear.

Key Toddler Wear Company Insights

Some of the key companies in the global toddler wear industry are Carter's, Inc., Nike, Inc., Greendigo, Aretto (SANOSYZO PVT. LTD.), Hanna Andersson, and others. Multiple market participants have adopted diverse strategies such as product innovation, collaboration and partnership, portfolio enhancements, and more.

-

Aretto (SANOSYZO PVT. LTD.) offers specialized kids' footwear products with SUPER GROOVES technology. The brand's footwear features an expanding sole to complement continuous growth. It also adds a memory foam insole for improved comfort levels. The brand uses patented 3D knit durable fabric to ensure breathability and flexibility.

-

Carter's, Inc. operates multiple toddler wear brands, such as Carter's, Little Planet, and SKIP HOP. These brands offer pajamas, outfit sets, tops, bottoms, jackets & coats, dresses & jumpsuits, shoes, socks, accessories and more.

Key Toddler Wear Companies:

The following are the leading companies in the toddler wear market. These companies collectively hold the largest market share and dictate industry trends.

- Carter's, Inc.

- Greendigo

- Nike, Inc.

- Benetton Group

- Gap Inc.

- BONPOINT

- Mothercare plc

- Aretto (SANOSYZO PVT. LTD.)

- Cotton On

- Diesel

- Hanna Andersson

Recent Developments

-

In October 2024, Mothercare plc, a brand operating in products for parents and young children, and Reliance Brands Holding UK Limited formed a joint venture for part of the Asia Pacific regional market. The newly formed venture now owns the Mothercare brand and related intellectual property assets for key markets in India and other neighboring countries such as Bangladesh, Bhutan, Nepal, and Sri Lanka.

-

In August 2024, Hanna Andersson, a market participant specializing in children’s apparel, joined forces with Crayola, an innovation-based art tools and crafting brand, to launch the Crayola x Hanna Andersson Collection. The newly introduced collection comprises Color-In Pajama sets and 10 Crayola fabric markers.

Toddler Wear Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 283.27 billion

Revenue forecast in 2030

USD 397.30 billion

Growth Rate

CAGR of 7.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, South Africa

Key companies profiled

Carter's, Inc., Greendigo, Nike, Inc., Benetton Group, Gap Inc., BONPOINT, Mothercare plc, Aretto (SANOSYZO PVT. LTD.), Cotton On, Diesel, Hanna Andersson

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Toddler Wear Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global toddler wear industry report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Apparel

-

Footwear

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.