- Home

- »

- Pharmaceuticals

- »

-

Thyroid Gland Disorder Treatment Market Size Report, 2030GVR Report cover

![Thyroid Gland Disorder Treatment Market Size, Share & Trends Report]()

Thyroid Gland Disorder Treatment Market (2024 - 2030) Size, Share & Trends Analysis Report By Indication (Hypothyroidism), By Drug (Levothyroxine), By Distribution Channel, By Route of Administration, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-118-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

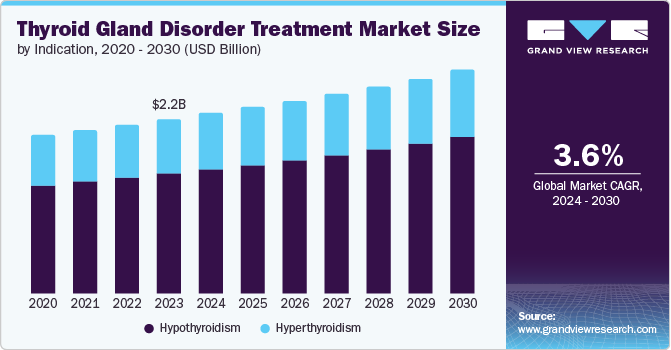

The global thyroid gland disorder treatment market size was valued at USD 2.22 billion in 2023 and is projected to grow at a CAGR of 3.6% from 2024 to 2030. The rising incidences of hypothyroidism and hyperthyroidism globally, driven by factors such as the aging population, autoimmune diseases, and iodine deficiency, play a significant role in boosting market growth. In addition, the growing awareness programs and advancements in treatment options, including precision medicine and targeted drug development, are anticipated to fuel the thyroid gland disorder treatment market in the forecast period.

The prevalence of thyroid cancer due to hyperthyroidism has been increasing in recent times, and the requirement for diagnosis and treatment is much needed, which is expected to drive the growth of this market. For instance, according to the American Cancer Society’s estimates, as of 2024, there are about 44,020 new cases of thyroid cancer and about 2,170 deaths due to it.

According to the journal Value in Health, in 2023, the total management cost of patients with thyroid cancer was about USD 216.8 million in France. In addition, initiatives to create awareness and implement promotional strategies by pharmaceutical companies and government institutes have boosted this market to grow over the forecast period. For instance- National Cancer Institute’s “My Pediatric and Rare Tumor Network” has a tumor clinic that helps people who remain untreated or those whose disease recurs after treatment for medullary thyroid cancer. It also developed a drug called vandetanib that can slow tumor growth in adolescents and children.

In addition, the Food and Drug Administration (FDA) has also approved two targeted drugs for papillary or follicular thyroid cancer drugs such as Sorafenib tosylate and Lenvatinib. Further research and development in this field is expected to boost market growth. Government organizations such as the Thyroid Foundation of Canada, the American Thyroid Foundation, and the American Academy of Otolaryngology are also involved in creating awareness about thyroid gland disorders and the available treatment options. For instance, Thyroid Foundation International and Merck had launched a global campaign to create awareness of thyroid disorders and their available treatment options in 2018. These factors are expected to impact the thyroid gland disorder treatment market to grow positively in the forecast period.

Indication Insights

Hypothyroidism dominated the market and accounted for a market share of 68.7% in 2023. Hypothyroidism is a disease that is more common in women and increases its prevalence with age. For instance- according to the journal “Nature Reviews Disease Primers” published in 2022, the National Health and Nutrition Examination Survey stated that the prevalence of hypothyroidism is 4.6% in the U.S. The advent of new R&D techniques and methods and the launch of new products for treating the disease are further expected to drive segmental growth. For instance, in December 2022, Hikma Pharmaceuticals PLC, a pharmaceutical company, launched Levothyroxine Sodium Injection in the U.S. for the treatment of hypothyroidism.

The hyperthyroidism segment is expected to grow significantly during the forecast period. It is attributed to the rising prevalence of disease-causing factors such as iodine supplementation, autoimmune diseases such as Grave’s disease, and certain medications, including Amiodarone. About 60% to 80% of hyperthyroid cases are caused due to Grave’s disease. For instance, according to a report published by the National Center for Biotechnology Information (NCBI), the overall prevalence of hyperthyroidism has an incidence of 20/100,000 to 50/100,000 and 1.2% in the U.S. This creates the need for treatment and awareness among people, further driving market demand.

Drug Insights

Levothyroxine accounted for the largest market revenue share of 50.5% in 2023. It is attributed to the growing awareness of thyroid disorders. Levothyroxine is the primary treatment for hypothyroidism, subclinical hypothyroidism, and thyroid cancer treatment. Factors including age, gender, smoking status, and the presence of other medications or conditions can influence levothyroxine dosing and management. The advancement of digital therapeutics and the knowledge of hypothyroidism therapy with cutting-edge technology, levothyroxine personalized treatment could be possible in the coming years. Thereby, treatment methods would become more precise, on-point, and easily accessible.

The liothyronine segment is expected to grow significantly during the forecast period. It is attributed to the growing number of thyroid disorder cases and increasing awareness regarding the same. For instance, according to a report published in the National Center for Biotechnology Information in 2022, it was stated that Liothyroxine can metabolize very rapidly, and its effect is also relatively faster. It is used to treat severe hypothyroid states, and in addition, the combined effect of levothyroxine and Liothyroxine therapy is considered if rapid treatment of hypothyroidism is required. Thus, the advancements in R&D and drug development have boosted the market’s growth.

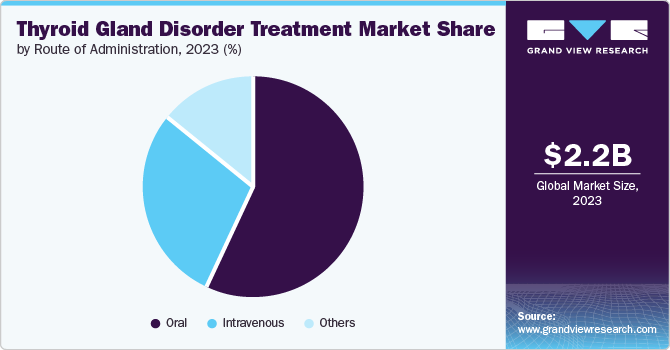

Route of Administration Insights

The oral segment accounted for the largest market revenue share of 57.1% in 2023. This can be attributed to the presence of a strong pipeline and new product development. It has a higher rate of bioavailability, rapid drug delivery, and high efficacy. Oral thyroid medications are generally easy to administer and accessible, making them a practical treatment option for patients. It helps minimize the use of central lines for intravenous drug administration, reducing the risk of associated complications and hospital stays, thereby driving the segment growth. For instance, in December 2023, Tirosint-SOL, which is indicated as a replacement therapy for hypothyroidism, has been updated labeling by FDA.

The intravenous segment is expected to grow at a significant CAGR over the forecast period. It can be attributed to the rapid medication effect and advancements in new product development. For instance, Levothyroxine injection is used to treat severe hypothyroidism/myxedema coma and is used as a substitute for the oral dose usage.

Distribution Channel Insights

Wholesale distribution accounted for the largest market revenue share of 46.7% in 2023. This is attributed to the high discounts on bulk purchases and quick services offered by the channel. It plays an important role in the supply chain of pharmaceutical products including the thyroid disorder treatments. In addition, it maintains extensive networks and logistics capabilities, thus enabling accessibility to both urban and remote areas. Thereby making pharmaceutical products accessible to everyone and driving market growth.

The online pharmacy segment is expected to grow significantly at 3.9% CAGR during the forecast period. The growing popularity of eCommerce channels for prescription medicines significantly contributes to the market’s growth. Factors including convenience, accessibility, and the ability to compare prices across multiple vendors drive the growth of online distribution for thyroid medications.

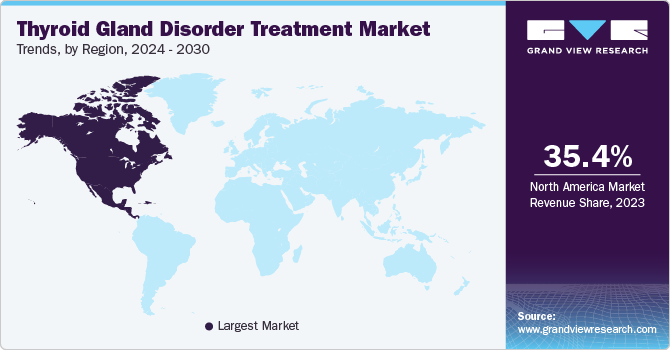

Regional Insights

North America thyroid gland disorder treatment market dominated the global industry with a revenue share of over 35.44% in 2023. It is attributed to the prevalence of thyroid diseases, the presence of improved healthcare facilities, greater public awareness, and the availability of treatment options. In addition, various promotional strategies between governments and pharmaceutical companies to create awareness and develop generic drugs have boosted the market growth in this region.

U.S. Thyroid Gland Disorder Treatment Market Trends

The U.S. thyroid gland disorder treatment market accounted for a 29.4% share of the global market in 2023 owing to improved healthcare facilities and expenditure, new product launches and FDA approvals, and the increasing geriatric population leading to the increasing prevalence of thyroid gland disorders. For instance, in September 2021, Exelixis announced the U.S. FDA approval for CABOMETYX for the treatment of radioactive iodine-refractory differentiated thyroid cancer, which has been previously treated. The development and launching of innovative products have boosted the market growth.

Europe Thyroid Gland Disorder Treatment Market Trends

Europe thyroid gland disorder treatment market was identified as a lucrative region in 2023. It is attributed to the new R&D advancements in this region. In addition, the growing geriatric population and prevalence of various autoimmune diseases have impacted the market’s growth. For instance, in August 2023, according to the European Thyroid Journal, about 60% of people in Europe harbor one or more thyroid nodule disorders.

The production of thyroid stimulating hormone decreases with age, and with time, deficiency of iodine is also observed in people, which leads to severe thyroid disorders if they remain undiagnosed. For instance- in 2023, according to an article published in Dtsch Arztebl Int, about 8-10% of women aged between 40-49 in an iodine-deficient area in Germany had low levels of thyroid-stimulating hormone, which had increased the prevalence of thyroid disorders, thereby treatment options had widened, and helping the growth of the market.

Asia Pacific Thyroid Gland Disorder Treatment Market Trends

Asia Pacific thyroid gland disorder treatment market is anticipated to witness significant growth in the thyroid gland disorder treatment market. The rising burden of the geriatric population and the focus on developing low-cost products with higher efficiency are the major factors helping the market's growth. Various promotional strategies and collaborations have also impacted the market's growth.

For instance, in May 2023, Indonesia launched the THYROID RAISE program to increase the therapeutic treatment of hyperthyroid by 2.5 times and hypothyroid by 5.5 times by 2030. This program helps in improving healthcare professionals' screening and diagnosis capabilities and treating thyroid disorders in adult populations and congenital hypothyroidism in newborns. For instance, in March 2023, Indira Gandhi Government Medical College and Mayo Hospital started thyroid OPD, which aimed to reduce cases by 90% in the next seven years. All these factors and initiatives have boosted the market growth in this region.

MEA Thyroid Gland Disorder Treatment Market Trends

MEA thyroid gland disorder treatment market is anticipated to witness significant growth in the thyroid gland disorder treatment market. Though it holds a low market share value, it is in greater demand due to growing public awareness. Demographic shifts in the Middle East and Africa, such as urbanization and lifestyle changes, may also contribute to the growing demand for thyroid gland disorder treatment, thereby increasing the market growth in this region. For instance- in May 2021, according to an article published in the Nigerian Quarterly Journal of Hospital Medicine, most African countries (about 80-90%) of people are severely iodine deficient, leading to various thyroid gland disorders. Thereby impacting the market growth.

Key Thyroid Gland Disorder Treatment Company Insights

Some of the key companies in the Thyroid Gland Disorder Treatment market include Abbvie Inc., Amgen Inc., GSK Plc, and Merck KGaA. These companies are growing their market revenue by launching new products, collaborations, and adopting various other strategies.

-

Amgen Inc. is a global biotechnology company engaged in the discovery and development of drugs, including for the treatment of thyroid gland disorders. It launched a product called Tepezza, which became the first FDA-approved thyroid eye disease treatment drug. It also conducts several clinical trials to assess the safety and efficacy of Armour Thyroid compared to synthetic levothyroxine in treating primary hypothyroidism. Thus increasing the market revenue share in the forecast period.

-

Pfizer Inc. is a significant player in the thyroid gland disorder treatment market. Pfizer’s Cytomel is used to treat hypothyroidism, which helps to regulate metabolism and other bodily functions. Thus, its presence in the market contributes to the overall growth and competition in the thyroid gland disorder treatment market.

Key Thyroid Gland Disorder Treatment Companies:

The following are the leading companies in the thyroid gland disorder treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Abbvie Inc.

- Amgen Inc.

- GSK Plc

- Merck KGaA

- Viatris Inc.

- Novartis AG

- Pfizer Inc.

- Takeda Pharmaceutical Company Limited

- Elexis Inc.

- IBSA Pharma (IBSA Group)

Recent Developments

-

In May 2023, Merck KGaA collaborated with the Executive Board of the Indonesian Medical Association and the Central Board of the Indonesian Thyroid Association to improve screening and diagnosis of thyroid disorders in Indonesia.

-

In December 2023, Aspen Pharmacare Holdings Limited made an agreement with Sandoz AG to acquire its Chinese business, helping to expand its presence in China by establishing a portfolio for future growth in the region.

-

In November 2022, Zydus Lifesciences received U.S. FDA approval to market Levothyroxine Sodium injection, used to treat thyroid hormone deficiency.

Thyroid Gland Disorder Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.29 billion

Revenue forecast in 2030

USD 2.84 billion

Growth Rate

CAGR of 3.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Indication, drug, distribution channel, route of administration, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, KSA, UAE, South Africa and Kuwait.

Key companies profiled

Abbvie Inc.; Amgen Inc.; GSK Plc; Merck KGaA; Viatris Inc.; Novartis AG; Pfizer Inc.; Takeda Pharmaceutical Company Limited; Elexis Inc.; IBSA Pharma (IBSA Group)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thyroid Gland Disorder Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Thyroid Gland Disorder Treatment market report based on indication, drug, distribution channel, route of administration, and region.

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypothyroidism

-

Hyperthyroidism

-

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Levothyroxine

-

Liothyronine

-

Propylthiouracil

-

Imidazole-based compounds

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Wholesale Distribution

-

Retail Stores

-

Online Pharmacy

-

-

Route of Administration Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Intravenous

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

APAC

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.