- Home

- »

- Renewable Energy

- »

-

Thin Film Battery Market Size, Share & Growth Report, 2030GVR Report cover

![Thin Film Battery Market Size, Share & Trends Report]()

Thin Film Battery Market (2025 - 2030) Size, Share & Trends Analysis Report By Voltage (Below 1.5V, Above 3V), By Battery Type (Disposable, Rechargeable), By Application (Medical, Smart Cards, Wearables), And Segment Forecasts

- Report ID: GVR-1-68038-622-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thin Film Battery Market Size & Trends

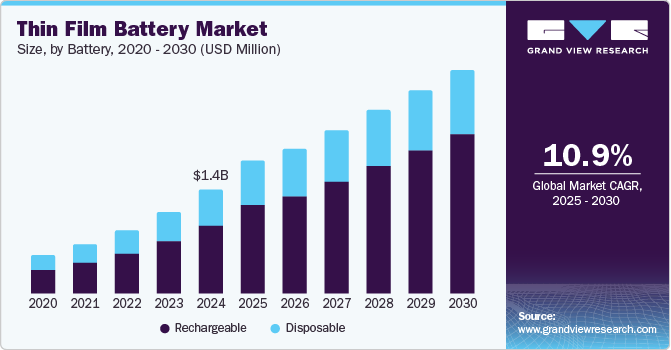

Theglobal thin film battery market size was estimated at USD 1.36 billion in 2024 and is expected to expand at a CAGR of 10.9% from 2025 to 2030. This growth is attributed to the rising demand for compact and efficient energy solutions in consumer electronics, particularly smartphones, wearables, and IoT devices. In addition, technological advancements enhancing battery performance, safety, and flexibility are crucial. Furthermore, the increasing focus on environmentally friendly alternatives to traditional batteries aligns with regulatory trends and consumer preferences for sustainable products, further propelling market growth globally.

Thin film batteries, also known as solid-state batteries, consist of ultra-thin layers of solid materials functioning as electrolytes and electrodes. They are advantageous due to their higher energy density, improved safety, and flexibility, making them ideal for compact devices such as wearables and medical equipment. Their lightweight design allows seamless integration into various applications, ensuring reliable power sources for modern technology. The trend toward miniaturization in devices such as mobile phones, medical devices, and smartwatches is significantly driving the demand for smaller electronic components. As manufacturers focus on developing increasingly compact systems, conventional batteries pose challenges in achieving the desired size reductions. In addition, thin film battery technology advancements have emerged, enhancing attributes such as energy density, lifespan, and safety. These improvements are essential as the demand for thin and flexible batteries grows across various electronic applications, including consumer electronics and medical devices.

Furthermore, the global rise in wireless sensor adoption, fueled by technological innovations in Internet of Things (IoT) devices and wireless sensor technologies, has created a robust market for thin film batteries. These batteries serve as viable power supply options for embedded systems, facilitating the increasing implementation of wireless sensors. The trend towards energy-harvesting wireless sensors also presents significant growth opportunities for thin film batteries.

Moreover, the expanding use of smart cards and e-cards across government and transportation sectors to enhance security will further boost the adoption of these batteries. Smart cards require reliable power sources for functions such as personal identification, authentication, data storage, and application processing. As their use becomes more prevalent, especially with major payment networks such as Europay, Mastercard, and Visa, the demand for thin film battery technology is set to rise significantly.

Battery Type Insights

The rechargeable battery segment dominated the market and accounted for the largest revenue share of 65.3% in 2024. This growth is attributed to the increasing consumer demand for sustainable energy solutions pushing manufacturers to innovate and improve battery efficiency and lifespan. In addition, technological advancements have led to enhanced energy density and faster charging capabilities, making rechargeable batteries more attractive for portable electronics, electric vehicles, and renewable energy applications. Moreover, government regulations promoting eco-friendly products and incentives for using rechargeable batteries further stimulate market growth, as consumers become more environmentally conscious.

The disposable battery is expected to grow at the fastest CAGR of 7.3% over the forecast period, owing to its convenience and affordability, making it a popular choice for everyday devices such as remote controls, toys, and medical equipment. Their long shelf life and reliability in low-drain applications contribute to their sustained demand. Furthermore, advancements in battery technology have improved performance characteristics, making disposable batteries more efficient. Moreover, the ongoing need for portable power sources in emerging economies drives market expansion, as urbanization and rising disposable incomes increase consumer electronics usage.

Voltage Insights

Below 1.5 V voltage segment dominated the market and accounted for the largest revenue share of 45.1% in 2024. This growth is attributed to the increasing demand for low-power applications. These batteries are ideal for powering small electronic devices such as wearables, medical sensors, and IoT devices, where compact size and lightweight design are crucial. In addition, technological advancements have improved the performance and energy density of below 1.5 V batteries, making them more efficient and reliable. Furthermore, the rising trend of miniaturization in consumer electronics further accelerates this segment's growth, as manufacturers seek efficient power sources that fit within limited space constraints.

The Above 3V voltage segment is expected to grow at a CAGR of 13.0% over the forecast period, driven by its suitability for higher-power applications. These thin film batteries are increasingly used in consumer electronics, electric vehicles, and renewable energy systems, where greater energy output is essential. Furthermore, technological advancements have enhanced the safety, stability, and lifespan of above 3V batteries, making them more appealing to manufacturers and consumers. Moreover, the growing adoption of smart cards and advanced medical devices requiring reliable power sources drives demand in this segment. As industries continue to innovate and expand their use of high-performance batteries, the above 3V segment is poised for significant growth globally.

Application Insights

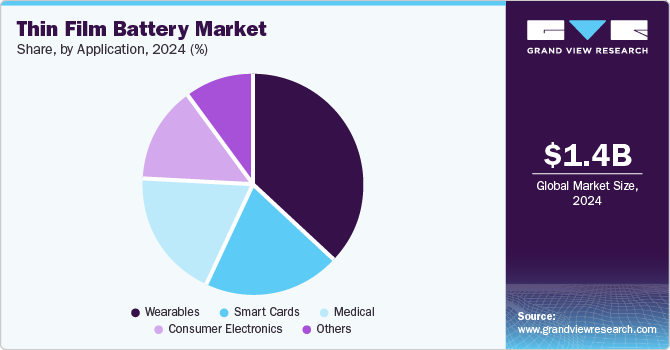

The wearable applications dominated the market and accounted for the largest revenue share of 37.4% in 2024. This growth is attributed to the rising demand for compact and efficient power sources. As wearable technology, such as smartwatches and fitness trackers, becomes increasingly popular, lightweight and flexible batteries are paramount. In addition, thin film batteries offer high energy density and can be seamlessly integrated into small devices without compromising design or comfort. Furthermore, their solid-state construction enhances safety, making them ideal for prolonged use in wearables requiring reliable power for health monitoring and GPS tracking.

The medical applications are expected to grow at a CAGR of 11.4% over the forecast period, owing to their reliability and safety in critical devices. These batteries are essential for powering implantable devices, such as pacemakers and biosensors, where consistent performance is crucial for patient health. In addition, the solid-state nature of thin film batteries minimizes risks associated with leakage or combustion, ensuring patient safety. Furthermore, advancements in battery technology have improved their lifespan and energy density, making them suitable for long-term medical monitoring solutions. As healthcare increasingly incorporates wearable technology for real-time patient data collection, the need for efficient and safe power sources such as thin film batteries will continue to grow.

Regional Insights

The thin-film battery market in North America dominated the global market and accounted for the largest revenue share of 39.8% in 2024, attributed to the region's strong emphasis on technological innovation and research. The presence of leading technology companies and extensive investment in R&D foster advancements in battery technologies. In addition, the increasing demand for portable electronics, wearables, and IoT devices propels the need for compact and efficient power solutions. Furthermore, regulatory support for sustainable energy technologies further enhances market opportunities. As the thin-film battery market in North America dominates the global market and accounts for the largest revenue share, companies seek to develop batteries that meet stringent environmental standards.

U.S. Thin Film Market Trends

U.S. thin film battery market dominated the North American market and accounted for the largest revenue share in 2024, driven by the growing consumer electronics sector and the rise of smart devices. In addition, the demand for lightweight and flexible batteries is increasing as manufacturers aim to enhance product design and functionality. Furthermore, government initiatives promoting clean energy solutions and funding for battery technology research contribute to market growth. Moreover, the U.S. also benefits from a robust supply chain and skilled workforce, facilitating the development and production of advanced thin film batteries.

Asia Pacific Thin Film Market Trends

The thin film battery market in Asia Pacific is expected to grow at a CAGR of 13.7% from 2025 to 2030, owing to its growing consumer electronics industry. Countries such as China, Japan, and South Korea are at the forefront of adopting innovative technologies, driving demand for efficient power sources in wearables and smart devices. Furthermore, rapid urbanization and increased disposable incomes fuel consumer interest in advanced electronics. The region's strong manufacturing capabilities and favorable regulatory environment further support the expansion of thin film battery applications across various sectors.

China Thin Film Market Trends

China thin film battery market led the Asia pacific market and held the largest revenue share in 2024. This growth is attributed to rapid industrialization and a burgeoning demand for wearable technology. In addition, the country's focus on developing smart devices has led to significant investments in research and development of advanced battery technologies. Furthermore, government policies encouraging innovation in energy storage solutions contribute to market growth. Moreover, the increasing adoption of IoT applications across various industries also creates a substantial demand for compact and efficient power sources, positioning China as a key player in the global thin film battery landscape.

Europe Thin Film Market Trends

The thin film battery market in Europe is expected to grow significantly over the forecast period, owing to a strong emphasis on sustainability and green technologies. The region's commitment to reducing carbon emissions drives demand for innovative energy storage solutions in various applications, including electric vehicles and renewable energy systems. In addition, European manufacturers are increasingly focusing on developing lightweight and flexible batteries to meet the needs of modern electronics. Furthermore, collaborative efforts among industry stakeholders to advance battery technology further enhance Europe's position in the global thin film battery market.

Germany Thin Film Market Trends

The growth of Germany thin film battery market is largely influenced by its robust automotive industry, which is shifting towards electric vehicles. The demand for efficient energy storage solutions is increasing as manufacturers seek to enhance vehicle performance while reducing weight. Furthermore, Germany's strong focus on engineering excellence and innovation fosters advancements in battery technology. Moreover, government initiatives supporting research into sustainable energy solutions also play a crucial role in driving the adoption of thin film batteries across various sectors within the country.

Key Thin Film Company Insights

Some of the key players in the market include Blue Spark Technologies, BrightVolt, Enfucell, and others. These are implementing various strategies to enhance their competitive position. These include focusing on new product launches, forming strategic partnerships to foster innovation, and pursuing mergers and acquisitions to consolidate resources and expand their market presence, driving growth and technological advancement in the sector.

-

BrightVolt focuses on developing lithium polymer batteries that are environmentally friendly, non-toxic, and non-combustible. The company primarily operates in the consumer electronics and Internet of Things (IoT) segments, providing power solutions for applications such as medical patches, sensor labels, and smart cards. Their advanced battery technology enables seamless integration into various devices, catering to the growing demand for compact and efficient power sources.

-

LG Chem manufactures various products, including lithium-ion batteries and thin-film batteries designed for various applications. Operating primarily in the automotive, consumer electronics, and energy storage sectors, the company delivers high-performance energy solutions. Their commitment to innovation and sustainability positions them as a key contributor to developing next-generation batteries that meet the evolving needs of modern technology and environmental standards.

Key Thin Film Companies:

The following are the leading companies in the thin film market. These companies collectively hold the largest market share and dictate industry trends.

- Blue Spark Technologies

- BrightVolt.

- Enfucell

- STMicroelectronics

- LG Chem

- LionVolt

- SAMSUNG SDI Co. Ltd.

- Ilika Plc.

- BTRY AG

- NGK Insulators, Ltd.

- The Kurt J. Lesker Company

- Ultralife Corporation

Recent Developments

-

In January 2024, LionVolt, a Dutch company, announced its acquisition of a battery cell production line in Thurso, Scotland. This strategic move complements its pilot production facility at the Brainport Industries Campus in the Netherlands, where it focuses on developing innovative 3D electrodes. Leveraging expertise in thin film technology, LionVolt aims to enhance energy density and charging speed in its next-generation batteries. The new site will help accelerate the commercialization of these advanced battery solutions, including their application in thin film batteries.

-

In January 2024, Btry announced the launch of its innovative thin film battery technology, which promises to revolutionize energy storage solutions. The company highlights the advantages of its ultra-thin batteries, including their lightweight design and high energy density, making them ideal for various applications such as wearables and IoT devices. Btry's focus on sustainability is evident in its commitment to using environmentally friendly materials. This breakthrough positions Btry as a key player in the evolving battery market, particularly in thin film technology.

Thin Film Battery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.74 billion

Revenue forecast in 2030

USD 2.93 billion

Growth rate

CAGR of 10.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Battery type, voltage, application, and region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., China, India, Japan, South Korea, Germany, UK, France, Argentina, and Australia.

Key companies profiled

Blue Spark Technologies; BrightVolt.; Enfucell; STMicroelectronics; LG Chem; LionVolt; SAMSUNG SDI Co. Ltd.; Ilika Plc.; BTRY AG; NGK Insulators, Ltd.; The Kurt J. Lesker Company; Ultralife Corporation.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thin Film Battery Market Report Segmentation

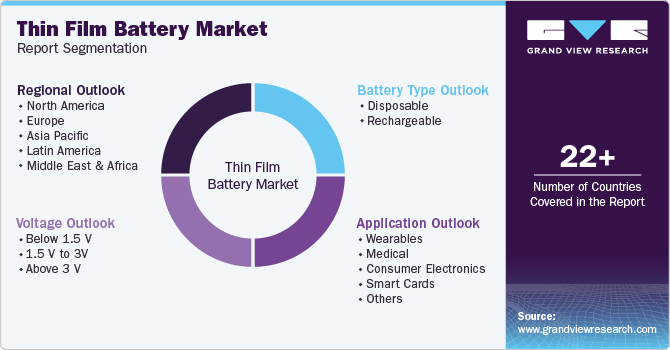

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the thin film battery market report based on battery type, voltage, application, and region:

-

Battery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Rechargeable

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 1.5 V

-

1.5 V to 3V

-

Above 3 V

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Wearables

-

Medical

-

Consumer Electronics

-

Smart Cards

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.