- Home

- »

- Electronic Devices

- »

-

Thermal Management Technologies Market Size Report 2030GVR Report cover

![Thermal Management Technologies Market Size, Share & Trends Report]()

Thermal Management Technologies Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Adhesive Material, Non-adhesive Material), By Device, By Service, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-068-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermal Management Technologies Market Summary

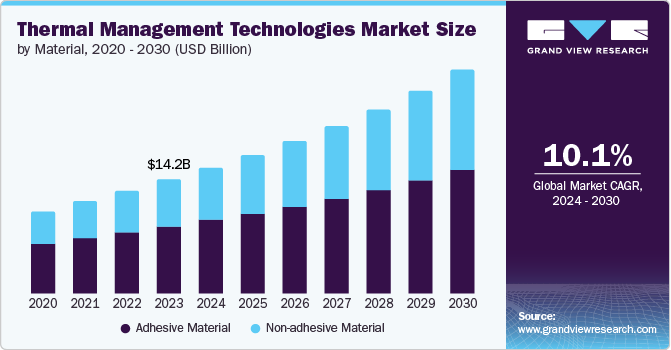

The global thermal management technologies market size was estimated at USD 14,165.8 million in 2023 and is projected to reach USD 27,753.8 million by 2030, growing at a CAGR of 10.1% from 2024 to 2030. The market is proliferated by the increasing demand for high-performance electronic devices across various industries, such as automotive, aerospace, consumer electronics, and telecommunications.

Key Market Trends & Insights

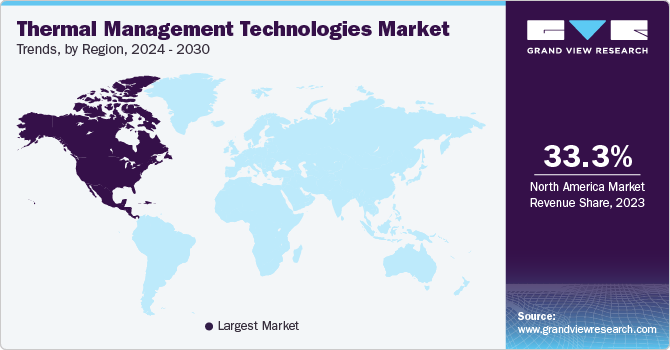

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, adhesive material accounted for a revenue of USD 14,165.8 million in 2023.

- Adhesive Material is the most lucrative material segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 14,165.8 Million

- 2030 Projected Market Size: USD 27,753.8 Million

- CAGR (2024-2030): 10.1%

- North America: Largest market in 2023

As these industries continue to innovate and develop more advanced products with higher power densities and smaller form factors, the need for effective thermal management solutions becomes crucial.

Modern electronic devices and high-performance semiconductors generate substantial amounts of heat, leading to reduced efficiency and potential damage if not properly managed. As electronics become more compact and powerful, the demand for effective thermal management solutions, such as heat sinks, thermal interface materials, and advanced cooling systems, continues to rise. This need is fueled by the growth of consumer electronics, such as smartphones and laptops, and by the increasing complexity of high-performance computing systems and data centers, which require sophisticated cooling mechanisms to maintain optimal operational temperatures.

Electric vehicles and hybrid vehicles require efficient thermal management systems to maintain battery performance, extend lifespan, and ensure driver safety. Innovations in battery thermal management solutions, such as liquid cooling systems and phase-change materials, are critical for managing the heat generated during charging and discharging processes. Additionally, advancements in vehicle powertrains, autonomous driving technologies, and increasingly stringent emissions regulations are pushing the automotive industry to seek and implement advanced thermal management solutions.

The consumer electronics sector, which includes smartphones, tablets, wearables, and smart home devices, drives the market growth of thermal management technologies. Managing the heat they produce becomes more challenging as these devices become increasingly sophisticated with higher processing power, larger displays, and more features. Advances in miniaturized cooling solutions, such as micro-fans and thermal management coatings, are necessary to maintain device performance and user comfort. Additionally, integrating advanced features such as augmented reality (AR) and virtual reality (VR) drives the need for innovative thermal management strategies to handle the increased thermal output of high-performance processors and graphics units.

Material Insights

Adhesive material dominated the market and accounted for a share of 59.4% in 2023. As electronic devices become more powerful and compact, there is a growing need for high-performance adhesive materials that can effectively manage heat dissipation. These adhesives are crucial in applications such as thermal interface materials (TIMs), which facilitate heat transfer between electronic components and heat sinks. The continuous evolution of consumer electronics, including smartphones, tablets, and wearables, and the expansion of high-performance computing systems drives the need for innovative adhesive solutions that offer superior thermal conductivity and reliability.

Non-adhesive material is expected to register the fastest CAGR of 11.7% during the forecast period. Non-adhesive materials such as thermal interface materials (TIMs), heat spreaders, and thermal pads manage the heat generated during battery charging and discharging cycles and in various automotive electronic components. The automotive sector's push towards more efficient and longer-range electric vehicles and advancements in autonomous driving technologies create a substantial market for these non-adhesive materials that ensure thermal stability and system efficiency.

Device Insights

Conduction cooling device accounted for the largest market revenue share in 2023. Data centers and high-performance computing (HPC) systems house dense clusters of servers and processors that generate significant amounts of heat. Conducting cooling devices such as heat sinks, cold plates, and thermal interface materials is essential for managing this heat to maintain system efficiency and prevent thermal throttling. As data centers scale up to meet increasing demands for data processing, storage, and cloud computing services, there is a growing need for effective cooling solutions that can manage high heat loads and ensure the reliable operation of computing infrastructure.

Advance cooling device is expected to register a significant CAGR during the forecast period. The expansion of the aerospace and defense sector contributes to the growth of advanced cooling devices. The demand for thermal management solutions has surged with the development of sophisticated avionics, radar systems, and electronic warfare equipment. Advanced cooling devices are vital to ensure the reliability and performance of these critical systems, especially in harsh operating environments, thus propelling the market segment's growth.

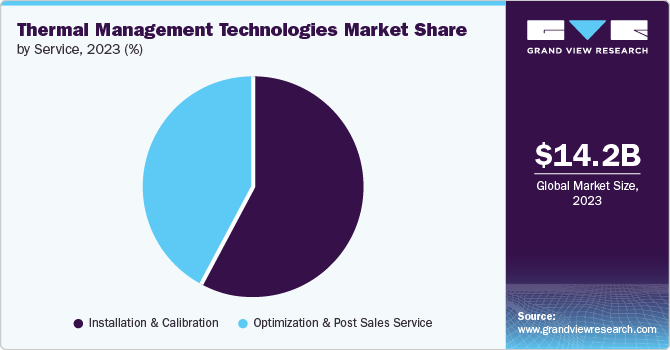

Service Insights

Installation & calibration accounted for the largest market revenue share in 2023. The increasing complexity of modern thermal management systems necessitates specialized expertise for proper installation and calibration. As technologies advance, precise setup and tuning become crucial to ensure optimal performance, driving demand for professional installation and calibration services.

Optimization & post-sales service is expected to register the fastest CAGR during the forecast period. Organizations across different sectors increasingly focus on reducing their environmental impact and improving energy efficiency. Optimization services help companies design and implement more efficient thermal management systems that minimize energy consumption and extend the lifespan of components. Post-sales services support ongoing efforts to maintain and enhance the efficiency of these systems. As regulations and consumer preferences shift towards greener and more energy-efficient solutions, there is a rising demand for services that help businesses achieve their sustainability goals through effective thermal management strategies.

End-use Insights

Consumer electronics segment dominated the market in 2023 due to the progress in the electronics sector. The increasing demand for smaller and more powerful electronic devices has led to higher heat generation within these products. As a result, there is a growing need for efficient thermal management solutions to ensure optimal performance and prevent overheating issues. This trend is particularly evident in smartphones, laptops, gaming consoles, and other portable electronic gadgets, where compact size and high performance are crucial selling points.

The automotive sector is projected to grow at the fastest CAGR over the forecast period. As EVs gain popularity due to increasing environmental regulations and consumer demand for sustainable transportation options, there is a growing need for advanced thermal management solutions to ensure battery performance, safety, and longevity. Thermal management technologies, including advanced liquid cooling systems, battery thermal management units, and high-performance heat shields, are crucial for managing the heat generated during battery charging and discharging.

Regional Insights

North America thermal management technologies market accounted for the largest revenue share of 33.3% in 2023. As businesses and organizations increasingly rely on data centers for data storage, processing, and cloud services, there is a rising need for effective thermal management solutions to handle the heat generated by high-density server environments in the region. Advanced thermal management technologies such as liquid cooling systems, heat sinks, and air-cooled systems are critical for maintaining optimal operating temperatures, improving energy efficiency, and ensuring system reliability.

U.S. Thermal Management Technologies Market Trends

The U.S. thermal management technologies market dominated the North America market in 2023. With rapid technological advancements leading to smaller and more powerful electronic devices, there is a growing need for effective thermal management solutions to dissipate heat generated by these devices. This trend is expected to drive the adoption of advanced thermal management technologies to maintain optimal operating temperatures and ensure the reliability and longevity of electronic components. The Consumer Technology Association (CTA) released new research projecting U.S. technology retail revenues accounted for USD 485 billion in 2023. This figure represents a slight increase from pre-pandemic levels, following three years of significant growth in consumer technology spending.

Europe Thermal Management Technologies Market Trends

Europe thermal management technologies market was identified as a lucrative region in 2023. European countries are at the forefront of global efforts to combat climate change, with stringent emissions regulations and substantial government incentives promoting the transition to EVs. The European Union’s targets for reducing CO2 emissions and increasing the number of EVs on the road necessitate advanced thermal management solutions for managing battery heat, ensuring efficient power electronics operation, and maintaining vehicle safety. Technologies such as advanced liquid cooling systems for batteries, high-performance thermal interface materials, and efficient thermal management modules are critical for addressing these challenges.

The UK thermal management technologies market is expected to grow rapidly in the coming years. The UK government’s initiatives, such as the Energy Efficiency Regulations and the Green Finance Strategy, aim to reduce energy consumption and environmental impact across industries. Thermal management technologies are crucial in achieving these objectives by optimizing cooling systems, reducing energy waste, and supporting the development of energy-efficient products. Solutions such as energy-efficient cooling systems, advanced heat recovery technologies, and sustainable thermal materials are in high demand as businesses and organizations strive to meet regulatory requirements and achieve sustainability goals.

Asia Pacific Thermal Management Technologies Market Trends

The Asia Pacific thermal management technologies market is anticipated to witness significant growth, propelled by rapid industrialization, a growing electronics industry, and the integration of sustainable energy sources. Nations such as China, Japan, South Korea, and India are leading the way in this growth through increasing electronics production, automotive manufacturing, and renewable energy installations. The rising market growth in the region is driven by the increasing demand for consumer electronics and the necessity for effective thermal solutions in these industries.

Japan thermal management technologies market is expected to grow rapidly in the coming years. Japan is home to leading consumer electronics manufacturers continuously innovating with advanced products such as smartphones, tablets, gaming consoles, and augmented reality (AR) devices. These high-performance electronic devices generate significant amounts of heat, necessitating effective thermal management solutions to ensure device reliability, performance, and user comfort.

Middle East & Africa Thermal Management Technologies Market Trends

The Middle East and Africa thermal management technologies market is anticipated to register the fastest CAGR over the forecast period. The increasing focus on energy efficiency and sustainability propels the adoption of thermal management technologies in the Middle East and Africa. With the region's extreme climatic conditions and the rising awareness of environmental impact, there is a growing emphasis on reducing energy consumption and carbon emissions in various industries, including manufacturing, automotive, and construction. This has increased demand for energy-efficient cooling and heating systems, such as thermoelectric coolers, phase change materials, and heat recovery systems.

Key Thermal Management Technologies Company Insights

Some of the key companies in the thermal management technologies market include Advanced Cooling Technologies, Inc., Delta Electronics, Inc., Honeywell International Inc., Siemens AG, and STMicroelectronics. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Advanced Cooling Technologies, Inc. provides a range of thermal management products, which are high-performance heat pipes for enhanced heat transfer, liquid cooling systems with compact channels for crowded electronics and complete immersion for data centers, thermoelectric coolers with better materials and miniaturization for focused cooling, and phase-change materials customized for devices for immediate heat absorption and release.

-

Delta Electronics, Inc. offers a comprehensive range of cooling solutions. This includes fans (DC axial and centrifugal blowers), high-efficiency options for data centers (EC fans and blowers), passive heat transfer solutions (heat sinks and heat pipes), complex thermal management products (thermal modules and cold plates), and liquid cooling solutions for high-powered electronics.

Key Thermal Management Technologies Companies:

The following are the leading companies in the thermal management technologies market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Cooling Technologies, Inc.

- Delta Electronics, Inc.

- Honeywell International Inc.

- Siemens AG

- STMicroelectronics

- Fujikura Ltd.

- Boyd Corporation

- Aavid Thermalloy, LLC

- Vertiv Holdings Co

- Wakefield-Vette, Inc.

Recent Developments

-

In July 2022, Honeywell International Inc. and Reaction Engines Limited, a British aerospace company, collaborated on thermal management technologies to help reduce aircraft emissions. Reaction Engines is creating one-of-a-kind heat exchange technology that can cut weight by over 30%, leading to decreased fuel usage and increased aircraft range or capacity.

Thermal Management Technologies Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.61 billion

Revenue forecast in 2030

USD 27.75 billion

Growth Rate

CAGR of 10.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, device, service, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, South Africa

Key companies profiled

Advanced Cooling Technologies, Inc.; Delta Electronics, Inc.; Honeywell International Inc.; Siemens AG; STMicroelectronics; Fujikura Ltd.; Boyd Corporation; Aavid Thermalloy, LLC; Vertiv Holdings Co; Wakefield-Vette, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermal Management Technologies Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the thermal management technologies market report based on material, device, service, end-use, and region.

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Adhesive Material

-

Non-adhesive Material

-

-

Device Outlook (Revenue, USD Billion, 2018 - 2030)

-

Conduction Cooling Device

-

Convention Cooling Device

-

Advance Cooling Device

-

Others

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Installation & Calibration

-

Optimization & Post Sales Service

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer Electronics

-

Service & Data Centers

-

Automotive

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.