- Home

- »

- Advanced Interior Materials

- »

-

Thermal Interface Materials Market Size, Share Report, 2030GVR Report cover

![Thermal Interface Materials Market Size, Share & Trends Report]()

Thermal Interface Materials Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Tapes & Films, Metal Based, Elastomeric Pads, Phase Change Materials), By Application (Telecom, Computers), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-289-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermal Interface Materials Market Summary

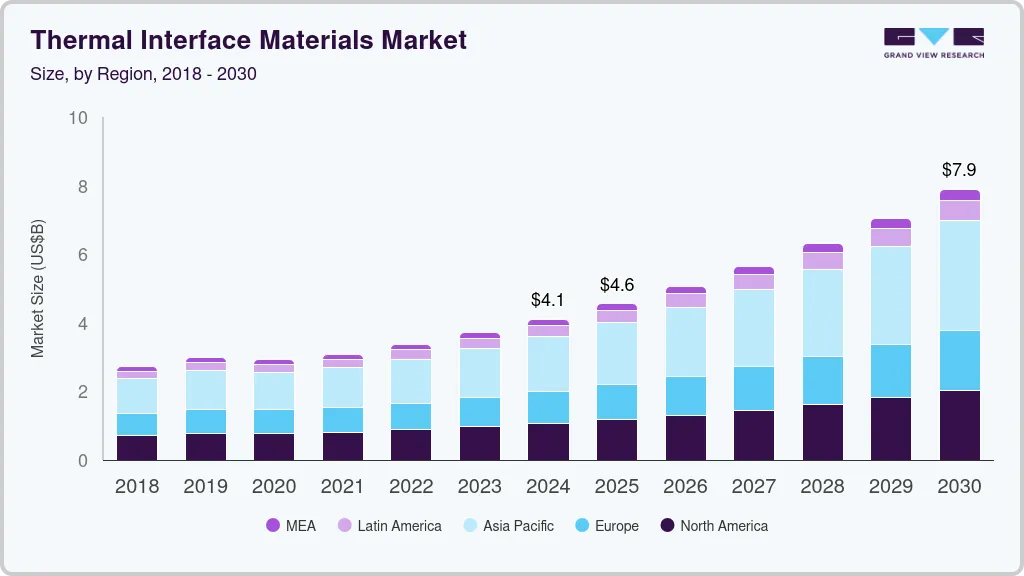

The global thermal interface materials market size was estimated at USD 4.10 billion in 2024 and is projected to reach USD 7.89 billion in 2030, growing at a CAGR of 11.6% from 2025 to 2030. The increasing use of electronic consumer products such as smartphones and laptops, the use of automation in industries in developing countries, and the rising expendable income of the middle-class population are expected to increase the demand for thermal interface materials in the forecast period.

Key Market Trends & Insights

- Asia Pacific dominated the market with a share of over 39.0% in 2024.

- The North America thermal interface materials market is anticipated to grow significantly over the forecast period.

- By product, the thermal greases and adhesives segment led the market with a share of over 34.5% in 2024.

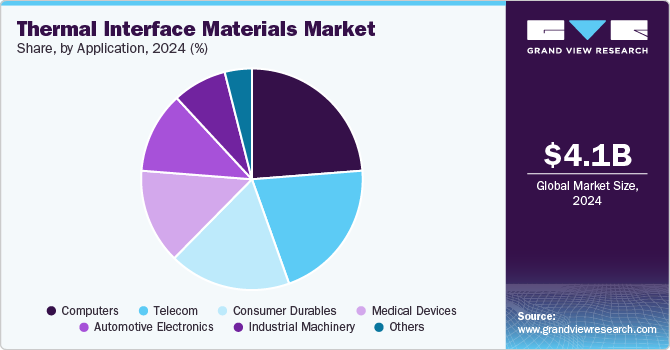

- By application, the computers segment accounted for a significant share of over 24.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.10 Billion

- 2030 Projected Market Size: USD 7.89 Billion

- CAGR (2025-2030): 11.6%

- Asia Pacific: Largest market in 2024

Thermal interface materials are applied between two hard surfaces for conducting heat and find usage at times of greater demand for modern electronic devices. Commercial availability of different thermal interface materials in an array of forms, coupled with growing applications in the electronic industry, is anticipated to drive the demand over the coming years.

The growing demand for automation in the manufacturing of pharmaceuticals and medical machinery is expected to drive the demand for thermal interface materials over the forecast period. Furthermore, the demand for pharmaceuticals and medical products is growing with the increasing incidences of illnesses and diseases among the population in developed as well as developing economies. This is likely to drive the growth of the thermal interface materials industry in the forthcoming years.

The increased use of phones and other smart devices has led to an increased demand for thermal interface materials in developed countries such as the U.S. The need for fast-speed networks, higher bandwidth, and increased system performance due to the boom in the computer industry and increased IT activities is also expected to augment the growth of the market.

Thermal interface materials are widely utilized in consumer electronics for improving performance, sustainability, quality, functionality, and environmental properties. These materials help boost the overall lifespan of consumer electronics on account of their high protection & durability. Moreover, the growing need for thermal conductivity in high-end electronic products is anticipated to support the market over the forecast period.

The pandemic has changed consumer purchase behaviour which has led to increased use of consumer electronics such as tablets, phones, and video games. The demand for automation in applications such as pharmaceutical and medical industries has also seen a rise due to increased demands for drugs and medical equipment during and post-pandemic.

The thermal interface is commonly known to provide efficient heat management solutions required for improving the system’s overall performance and lifespan. Various products of thermal interfaces available in the market include greases, thermal tapes, elastomeric pads, and solders. The materials selection criteria are based on mechanical factors, electrical insulation, quality, thermal resistance, performance, and material compatibility.

The product is anticipated to witness significant gains owing to its thermal conductivity nature which helps in strengthening the life and efficiency of the electronic device or the equipment where it finds its application. The product is usually made of conducting materials like silicone, metal oxides, or metals.

Product Insights

Thermal greases and adhesives led the market with a share of over 34.5% in 2024 owing to the widespread usage in consumer products and the high thermal resistance of the product. The elastomeric pads are expected to have a significant revenue share based on their easy assembly as compared to greases. Also, with elastomeric pads, the handling mechanism is improved and possesses less chance of degrading interface resistance.

Phase change materials are anticipated to expand at a significant CAGR of 12.0% during the forecast period. It finds major application in construction work as demand for cooler buildings is increasing. The material act as heat storage wherein the heat gets absorbed during summer and retained heat can be used in winter times to manage the temperature difference.

The elastomeric pads segment is expected to register a significant CAGR during the projected period owing to their easy handling and installation techniques used for thermal conductivity in electrical and electronic components. However, the limited application scope and the high unit cost of the products are expected to hamper the growth in the estimated time frame.

These interface materials are majorly used for applications in dispensable gels, gap-filling and insulating pads, adhesive tapes, and greases. These are selected based on their toughness, environmental & chemical resistance, hardness, tensile strength, and thermal conductivity. Moreover, compatibility with electronic and mechanical gadgets is considered.

Application Insights

The computers segment accounted for a significant share of over 24.0% in 2024, due to the increasing utilization in office end use. The affordable prices of desktops have revolutionized the demand and supply of products. The post-pandemic times did not dampen the market, rather with the increase in the number of people working from home, the upgradation, sales, and installation figures of the PC market have increased.

The telecom application segment for product utilization is expected to witness significant demand in the estimated time owing to the increasing preference for digital and cashless economy. The banks, e-commerce, utilities, and media rely on the telecom industry for their businesses, and it is seen as their lifeline. Thus, is likely to support the industry’s growth over the projected time.

The products are considered to address the challenge of higher thermal insulation, dissipation, and conductance in medical electronics and other industries. These are broadly classified into polymer matrix composites, metal matrix composites, and carbon composite products. Moreover, technical advancements in the product for providing better thermal management solutions are expected to augment the growth.

The material finds application in medical devices, industrial machinery, consumer durables, and automotive electronics. With the advanced cockpit functionality, the materials are also installed in aerospace components. The recent advancements in military and aerospace applications have led engineers to address the increased thermal management issues.

Regional Insights

The North America thermal interface materials market is anticipated to grow significantly over the forecast period. The market growth is primarily driven by the increasing demand for advanced electronic devices, including high-performance computing systems, consumer electronics, and electric vehicles. As these technologies evolve, efficient heat dissipation systems are critical. TIMs play a vital role in ensuring the thermal management of electronic components, preventing overheating, and improving the overall lifespan and performance of devices.

U.S. Thermal Interface Materials Market Trends

The thermal interface materials market in the U.S. is experiencing significant growth. The U.S. government's focus on renewable energy and sustainability has further supported the growth of the TIM market. The push for energy-efficient technologies and green building practices has led to greater investments in industries that require reliable thermal management, such as renewable energy storage systems, LED lighting, and industrial automation.

Asia Pacific Thermal Interface Materials Market Trends

Asia Pacific dominated the market with a share of over 39.0% in 2024 due to high demand owing to the presence of a large base of manufacturing zone. In addition to the manufacturing base, reduction in corporate tax, GST, rising household incomes, consumer health awareness, changing lifestyle, and government policies have the potential to propel the industry growth in this region.

The China thermal interface materials market is experiencing substantial growth. As China continues to be a global leader in the production of consumer electronics, including smartphones, computers, and wearable devices, the demand for efficient heat management solutions has surged. Thermal interface materials are essential in managing heat dissipation in electronic components such as processors and batteries, thus preventing overheating and ensuring optimal performance.

Europe Thermal Interface Materials Market Trends

The thermal interface materials market in Europe is experiencing notable growth. In Europe, the rise in consumer electronics, including smartphones, laptops, and gaming consoles, as well as the growing adoption of electric vehicles (EVs), has significantly contributed to the demand for advanced thermal management solutions. European manufacturers are also focusing on developing high-performance TIMs to meet the stringent regulatory standards for energy efficiency and sustainability, further propelling the market.

Key Thermal Interface Materials Company Insights

Some of the key players operating in the market include 3M, Indium Corporation, and Honeywell International Inc.

-

3M is a diversified technology company known for its innovative products across various industries, including electronics, automotive, and healthcare. Among its extensive portfolio, 3M offers a range of thermal interface materials designed to enhance thermal management in electronic devices. These materials are crucial for dissipating heat generated by components such as CPUs, GPUs, and power transistors, thereby improving the reliability and performance of electronic systems.

-

Indium Corporation is a global manufacturer of advanced materials for electronics, semiconductors, and solar industries. Among its diverse product offerings, the company specializes in thermal interface materials, critical for enhancing thermal conductivity between heat-generating components and heat sinks or other cooling solutions.

Key Thermal Interface Materials Companies:

The following are the leading companies in the thermal interface materials market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Henkel

- Indium Corporation

- Fujipoly

- The Dow Chemical Company

- Honeywell International Inc.

- SIBELCO

- Shin-Etsu

Thermal Interface Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.55 billion

Revenue forecast in 2030

USD 7.89 billion

Growth rate

CAGR of 11.6% from 2025 to 2030

Base year for estimation

2024

Actual estimates/Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; UK; Italy; China; India; Japan; South Korea; Argentina; Brazil; UAE; Saudi Arabia

Segments covered

Product, application, region

Key companies profiled

The 3M Company; Henkel; Indium Corporation; Fujipoly; The Dow Chemical Company; Honeywell International Inc.; SIBELCO; Shin-Etsu

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermal Interface Materials Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global thermal interface materials market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Tapes And Films

-

Elastomeric Pads

-

Greases And Adhesives

-

Phase Change Materials

-

Metal Based

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Telecom

-

Computer

-

Medical Devices

-

Industrial Machinery

-

Consumer Durables

-

Automotive Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Asia Pacific dominated the global thermal interface materials market with the highest share of 39.0% in 2024. This is attributable to rising industrial bases, automation, and manufacturing activities happening in emerging economies.

b. Some key players operating in the precision guided munition market include Indium Corporation, Fujipoly, The Dow Chemical Company, 3M, Henkel, Honeywell International Inc., among others.

b. Key factors driving the thermal interface materials market growth include rising demand for high-performance and energy-efficient electrical & electronic gadgets and growth in application industries like telecom and computer segments because of the affordable pricing which has revolutionized the demand and supply in these segments.

b. The global thermal interface materials market was estimated at USD 4.10 billion in 2024 and is expected to reach USD 4.55 billion in 2025.

b. The global thermal interface materials market is expected to grow at a compound annual growth rate of 11.6% from 2025 to 2030 to reach USD 7.89 billion in 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.