- Home

- »

- Plastics, Polymers & Resins

- »

-

Thermally Conductive Plastics Market Size Report, 2030GVR Report cover

![Thermally Conductive Plastics Market Size, Share & Trends Report]()

Thermally Conductive Plastics Market (2024 - 2030) Size, Share & Trends Analysis Report by Type (Polyamide, Polycarbonate), By End-use (Electrical & Electronics, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-371-9

- Number of Report Pages: 172

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermally Conductive Plastics Market Trends

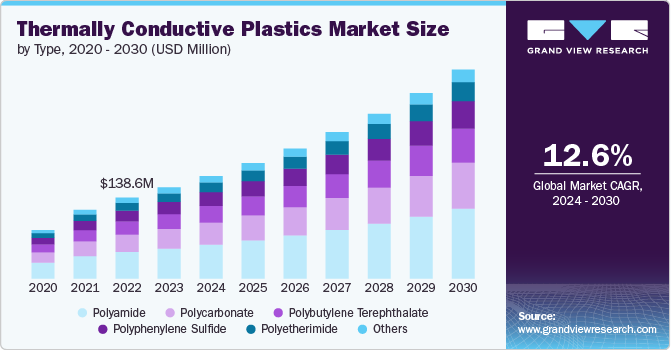

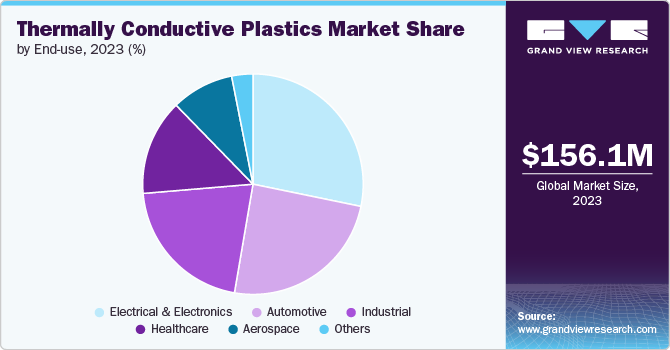

The global thermally conductive plastics market size was estimated at USD 156.10 million in 2023 and expected to grow at a CAGR of 12.6% from 2024 to 2030. The advent of advanced electronics that integrate technologies such as artificial intelligence (AI), machine learning (ML), internet of things (IoT), cloud computing, and others is driving the market. Additionally, the growing demand for automobiles in different economies is fueling the demand for thermally conductive plastics globally.

One of the prominent trend in the market is the emerging popularity and increasing adoption of electric vehicles (EVs) owing to the rising awareness among government and individuals regarding global warming and climate change. As the automotive industry transitions towards electric mobility, effective thermal management becomes crucial to ensure the efficiency and longevity of vehicle systems. Battery management systems are vital for maintaining optimal battery temperature, which directly impacts performance, safety, and lifespan. Thermally conductive plastics are increasingly being used in battery enclosures and modules to facilitate heat dissipation and prevent overheating.

Drivers, Opportunities & Restraints

The healthcare industry is undergoing rapid advancements, leading to a rising demand for innovative materials that can meet the stringent requirements of modern medical devices. Thermally conductive plastics are uniquely positioned to address these needs, offering significant opportunities across various applications. Medical imaging systems, such as MRI, CT scans, and ultrasound machines, generate substantial heat during operation. Effective thermal management is crucial for maintaining image quality and system performance. Thermally conductive plastics can be integrated into these systems to manage heat dissipation, ensuring reliable operation and longevity of the equipment.

The market is expected to witness various opportunities over the forecast period. Emerging technologies are rapidly evolving, and with them, the demand for innovative thermal management solutions is growing. Thermally conductive plastics are well-positioned to meet these needs across various new applications, especially in sectors like wearable electronics and the Internet of Things (IoT).As wearable devices, such as smartwatches and fitness trackers, become more sophisticated, they require effective heat dissipation to ensure optimal performance and user comfort. Thermally conductive plastics can be utilized in housing components and internal circuitry to manage heat generated during operation.

The thermally conductive plastics market is growing at a rapid rate, however the market faced various challenges. For instance, the manufacturing of thermally conductive plastics often involves specialized materials and processes, leading to higher production costs compared to conventional plastics. This can limit adoption, especially in price-sensitive markets. Furthermore, while thermally conductive plastics are effective for specific applications, they may not match the thermal conductivity levels of metals. This limitation can restrict their use in high-performance applications requiring superior thermal management.

Type Insights

Based on type, polyamide (PA) segment dominated the market with a revenue share of 32.97% in 2023. The PA segment is gaining significant traction due to its excellent thermal and mechanical properties. Polyamides, commonly known as nylons, are versatile materials that can be modified to enhance thermal conductivity, making them suitable for various applications across multiple industries. PA-based thermally conductive plastics are widely used in components like circuit boards, housings, and heat sinks in the electrical & electronics industry. These materials help dissipate heat generated by electronic devices, ensuring reliable performance and longevity.

Polycarbonate (PC) is known for its strength, impact resistance, and thermal management capabilities. As vehicles increasingly incorporate advanced electronic systems and electric powertrains, managing heat becomes critical. Polycarbonate is used in various automotive components, including battery housings, lighting systems, and dashboard displays. Its thermal management properties help improve the overall efficiency and reliability of modern vehicles.

Polybutylene terephthalate (PBT) is known for its high strength and rigidity, which contribute to its durability in various environments. When modified with thermally conductive additives, PBT achieves effective thermal conductivity while preserving its lightweight nature. This combination of characteristics makes it an ideal choice for applications that require both mechanical performance and thermal management.

End-use Insights

Based on end-use, electrical & electronics segment led the market with a revenue share of 28.24% in 2023. The growing IT industry and the proliferation of various technologies including IoT, AI, ML, and cloud computing is fueling the demand for thermally conductive plastics in the market. Many IoT applications, such as smart home systems and industrial sensors, require compact designs that generate heat. Using thermally conductive plastics in these devices helps maintain optimal operating temperatures, ensuring consistent performance and prolonging the lifespan of the products.

The automotive segment is expected to grow at a rapid CAGR over the forecast period. This can be attributed to the growing disposable income coupled with the increasing demand for automobile in emerging countries. Additionally, as consumers become increasingly aware regarding sustainability, the demand for EVs rises, further propelling the market growth.

Regional Insights

The North America region has a well-established infrastructure and culture that promotes technological innovation, leading to increased adoption of advanced materials, including thermally conductive plastics, in various industries. The region is also one of the largest markets for automobile, further driving the market.

U.S. Thermally Conductive Plastics Market Trends

The U.S. market is characterized by high levels of innovation, with companies investing in research and development to create advanced thermally conductive plastics that meet stringent regulatory requirements while offering superior performance. The country is home to many leading electronics manufacturers that require high-performance materials to manage heat in compact devices. As electronics become more powerful and miniaturized, the need for effective thermal management solutions, such as thermally conductive plastics, continues to grow.

Europe Thermally Conductive Plastics Market Trends

The market in Europe is experiencing significant growth due to several key drivers that align with the region's commitment to innovation and sustainability. One of the prominent drivers is the strict environmental regulations in the region. These regulations encourage manufacturers to adopt sustainable practices and materials, leading to an increased demand for thermally conductive plastics that are lightweight and energy-efficient. Another important driver is the growing focus on renewable energy solutions. Europe is investing heavily in renewable energy sources such as solar and wind power. These technologies require effective thermal management to optimize performance and longevity.

Asia Pacific Thermally Conductive Plastics Market Trends

The Asia-Pacific region is witnessing rapid growth in the market. The region is home to many leading electronics manufacturers, producing everything from smartphones to high-performance computing devices. As these products become more compact and powerful, the need for effective thermal management solutions becomes critical. Thermally conductive plastics are essential for dissipating heat in electronic components, ensuring reliable performance and extending the lifespan of devices.

Key Thermally Conductive Plastics Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include Celanese Corporation, DSM, SABIC, BASF SE, and DuPont. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Thermally Conductive Plastics Companies:

The following are the leading companies in the thermally conductive plastics market. These companies collectively hold the largest market share and dictate industry trends.

- Celanese Corporation

- DSM

- SABIC

- BASF SE

- DuPont

- LANXESS AG

- Ensinger

- TORAY INDUSTRIES, INC

- KANEKA CORPORATION

- RTP Company

- Mitsubishi Engineering-Plastics Corporation

- Nytex Composites Co., Ltd.

Recent Developments

-

In January 2024, Toray Industries, a prominent Japanese materials manufacturer, developed a new ultra-high molecular weight polyethylene (UHMWPE) plastic film that matches the strength and versatility of steel. The film, which is just 0.1 millimeters thick, can be used in a variety of innovative applications, including flexible electronics, automotive parts, and consumer products. The film has a thermal conductivity of 18 watts per meter-kelvin.

-

In September 2022, X2F, a Colorado-based company, announced a collaboration with Covestro, a polymer materials manufacturer, to develop a new thermally conductive plastic-based automotive heat sink with in-mold electronics. This new heat sink is made of Makrolon polycarbonate (PC) and is about half the weight of a typical aluminum part.

Thermally Conductive Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 175.74 million

Revenue forecast in 2030

USD 357.86 million

Growth rate

CAGR of 12.6% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; The Netherlands; Belgium; China; India; Japan; South Korea; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Celanese Corporation; DSM; SABIC; BASF SE; DuPont; LANXESS AG; Ensinger; TORAY INDUSTRIES, INC; KANEKA CORPORATION; RTP Company; Mitsubishi Engineering-Plastics Corporation; Nytex Composites Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermally Conductive Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented global thermally conductive plastics market report based on type, end- use, and region:

-

Type Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Polyamide (PA)

-

Polycarbonate (PC)

-

Polybutylene Terephthalate (PBT)

-

Polyphenylene Sulfide (PPS)

-

Polyetherimide (PEI)

-

Others

-

-

End-use Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Electrical & Electronics

-

Automotive

-

Industrial

-

Healthcare

-

Aerospace

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

The Netherlands

-

Belgium

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global thermally conductive plastics market size was estimated at USD 156.10 million in 2023 and is expected to reach USD 175.74 million in 2024.

b. The global thermally conductive plastics market is expected to grow at a compound annual rate of 12.6% from 2024 to 2030, reaching USD 357.86 million by 2030.

b. Asia Pacific led the global thermally conductive plastics market, accounting for 34.7% of the global revenue in 2023.

b. Some of the major companies in the global thermally conductive plastics market include Celanese Corporation; DSM; SABIC; BASF SE; DuPont; LANXESS AG; Ensinger; TORAY INDUSTRIES, INC; KANEKA CORPORATION, among others..

b. The advent of technologies such as artificial intelligence (AI), machine learning (ML), internet of things (IoT), cloud computing and others is driving the market. Additionally, the growing demand for automobiles in different economies is fueling the demand for thermally conductive plastics globally

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.