- Home

- »

- Automotive & Transportation

- »

-

Telehandler Market Size, Share, Trends, Growth Report 2030GVR Report cover

![Telehandler Market Size, Share & Trends Report]()

Telehandler Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Large, Compact), By Propulsion Type (ICE, Electric), By Lift Capacity, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-109-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Telehandler Market Summary

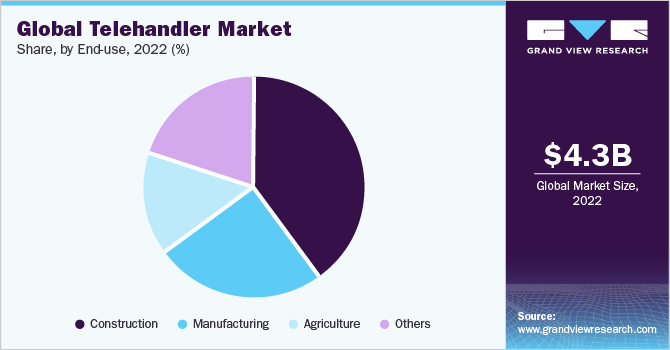

The global telehandler market size was estimated at USD 4.31 billion in 2022 and is anticipated to grow at a CAGR of 5.8% from 2023 to 2030. The market has experienced remarkable growth, primarily propelled by the booming construction industry, especially in emerging economies.

Key Market Trends & Insights

- North America dominated the market share exceeding 35.0% in 2022.

- By propulsion type, the internal combustion engine (ICE) segment held the largest market share of over 59.0% in 2022.

- By lift capacity, the 3-10 ton segment held the largest market share of over 53.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4.31 Billion

- 2030 Projected Market Size: USD 6.74 Billion

- CAGR (2023-2030): 5.8%

- North America: Largest market in 2022

The phenomenon of urbanization has led to a surge in construction projects, including the construction of residential complexes, commercial buildings, and infrastructure development. As cities expand and populations increase, a greater demand for modernized and well-equipped structures exists. Furthermore, infrastructural development projects, such as the construction of highways, bridges, airports, and rail networks, require versatile equipment capable of efficiently managing various tasks.

Moreover, these machines offer adaptability in challenging terrains, allowing construction projects to proceed smoothly in uneven or restricted spaces. The need for telehandlers arises from the construction sector's demand for effective and safe material handling, improved productivity, and flexibility in various job site conditions, ultimately contributing to streamlined construction processes and successful project outcomes.

The agricultural sector is currently undergoing a profound transformation driven by rapid technological advancements and growing demand for heightened productivity, resulting in the adoption of innovative practices and precision farming techniques. Farmers globally are actively embracing mechanization solutions to optimize their operations and maximize output. Telehandlers enable farmers to accomplish tasks that were previously time-consuming such as loading & unloading, material handling, stacking & storage, as well as labor-intensive tasks with relative ease and speed.

The ability to lift and transport heavy hay bales or move bulky materials swiftly not only saves valuable time but also minimizes manual labor requirements. Moreover, telehandlers offer considerable cost savings for farmers by streamlining and automating various agricultural processes such as crop management, palletizing & storage; these machines reduce the need for additional labor, resulting in reduced labor costs. Farmers can allocate their resources more efficiently and effectively, optimizing their budget while achieving higher productivity levels.

The market is characterized by a significant level of fragmentation, with a multitude of manufacturers operating on a global scale. This landscape fosters intense competition, resulting in frequent price wars and mounting pressures on profit margins. Established players in the market constantly encounter challenges from emerging regional competitors who provide cost-effective solutions, further intensifying the competitive environment. As a result, this cutthroat competition often leads to diminished profit margins and limited opportunities for market share expansion.

The telehandlers industry is experiencing a remarkable surge in technological advancements, bolstering their capabilities, and enhancing operational efficiency. Manufacturers have recognized the potential of automation, telematics, and remote monitoring systems and are actively integrating these cutting-edge technologies into telehandlers. This integration gives operators superior control over the machines while facilitating comprehensive data collection and predictive maintenance.

By incorporating automation features, telehandlers can perform various tasks with minimal human intervention. This includes automated lifting, lowering, and positioning of loads and precise movement control. These automated functions increase the efficiency of operations and reduce the risks associated with human error.

Product Insights

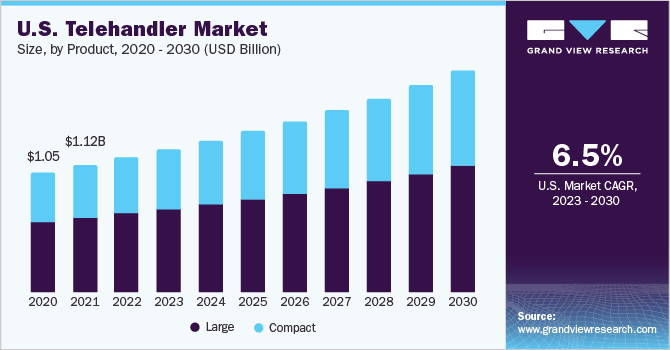

Amongst the product, the large segment held the largest market share in 2022 of over 58.0%. The construction industry's rapid growth and increasing infrastructure projects require versatile and powerful machinery capable of lifting heavy loads and reaching high elevations. Large telehandlers provide the necessary lifting capacity and height, making them indispensable for tasks such as material handling, placing construction materials, and operating in confined spaces.

The compact segment is anticipated to register the fastest CAGR over the forecast period. Compact telehandlers offer a compelling solution, combining the lifting capabilities of traditional telehandlers with the compact size and maneuverability needed for urban environments. With their ability to navigate narrow access points, reach high elevations, and handle various materials, compact telehandlers are becoming indispensable for construction, agriculture, warehousing, and maintenance tasks.

Propulsion Type Insights

Amongst the propulsion type, the internal combustion engine (ICE) segment held the largest market share of over 59.0% in 2022. The ICE segment’s growth is due to its superior power and torque, which enables it to handle heavy loads and operate in challenging terrain conditions. The ICEs provide extended range and quicker refueling times compared to their electric counterparts, making them suitable for long work shifts and remote locations where infrastructure for EV charging is limited. The ICE often comes at a lower initial cost than electric models, making them a more affordable choice for businesses.

The electric segment is anticipated to register the fastest CAGR of 7.5% over the forecast period. The increasing focus on environmental sustainability has led to a notable shift toward electric power. Electric telehandlers have emerged as a significant solution with their zero-emission operation, effectively curbing carbon footprints and promoting improved air quality. Furthermore, the rapid advancements in battery technology have resulted in improved performance and longer operating times, making electric telehandlers a viable option for various applications.

The lower operating costs associated with electric telehandlers, including reduced fuel consumption and maintenance requirements, make them economically viable for businesses. The increasing demand for quieter and more efficient machinery in urban construction and industrial settings further drives the transition to electric telehandlers, as they offer reduced noise levels and enhanced operational efficiency. Hence, these factors are propelling the global adoption of electric telehandlers.

Lift Capacity Insights

Amongst the lift capacity, the 3-10 ton segment held the largest market share of over 53.0% in 2022 and it is anticipated to register the fastest CAGR of 6.5% over the forecast period. The construction industry relies heavily on these versatile machines to lift and move heavy materials precisely, enhancing job site efficiency and productivity.

Also, the logistics & warehousing sectors benefit from the ability of the 3-10 ton type to maneuver in confined spaces, enabling efficient loading and unloading of goods. The 3-10 ton telehandler adaptability extends to the mining and extraction industries, where they assist in transporting equipment and materials across rugged terrains. The increasing emphasis on safety and ergonomics has driven the demand for telehandlers, as their advanced features and comfortable operator cabins enhance operator well-being and reduce the risk of accidents.

The more than 10-ton segment is expected to grow at a significant CAGR over the forecast period. These heavy-duty telehandlers offer enhanced lifting capacities, allowing them to handle substantial loads in various construction, mining, and logistics industries. Their ability to lift and maneuver heavy materials and equipment efficiently contributes to increased productivity and cost-effectiveness on job sites. The growing need for larger telehandlers is propelled by the expansion of infrastructure projects worldwide, including the construction of buildings, roads, bridges, and airports. These projects often require the movement of heavy materials, making high-capacity telehandlers an indispensable asset.

End-use Insights

In terms of end-use, the construction industry segment held the largest market share of over 39.0% in 2022 and it is anticipated to register the fastest CAGR of 6.5% over the forecast period. The growing emphasis on infrastructure development, particularly in emerging economies, has propelled the need for versatile and efficient machinery capable of lifting heavy loads and maneuvering in tight spaces. The increasing focus on safety and productivity in construction sites has led to the adoption of telehandlers, which offer enhanced operator visibility, stability, and lifting capacities. Technological advancements in telehandler design, such as improved fuel efficiency, advanced control systems, and telematics integration, offer enhanced performance and operational benefits, driving their widespread adoption across construction projects worldwide.

The agricultural industry is expected to grow at a significant CAGR over the forecast period. The growing trend of mechanization in agriculture, aimed at improving efficiency and reducing labor costs, has significantly increased the demand for telehandlers, as they offer a cost-effective solution for multiple tasks that would otherwise require multiple machines or manual labor. In addition, advancements in technology, such as precision farming, automation, and data analytics, are transforming the agriculture sector. These technologies help optimize crop yields, reduce costs, and improve overall productivity. As a result, such factors provide lucrative opportunities for the segment growth.

Regional Insights

Amongst the region, North America dominated the market share exceeding 35.0% in 2022. The region's growing demand for construction and infrastructure development projects has increased the requirement for adaptable and efficient material-handling equipment. In addition, the growing trend towards mechanization and automation in various industries, including agriculture, manufacturing, and logistics, fuels the adoption of telehandlers due to their ability to handle diverse tasks easily. Furthermore, technological advancements such as improved fuel efficiency, advanced control systems, and telematics integration enhance telehandlers' overall performance and productivity, attracting customers looking for modern and innovative solutions.

Asia Pacific is anticipated to register the fastest CAGR of 7.3% over the forecast period. The Asia Pacific region has been experiencing rapid urbanization and infrastructure development, creating a high demand for telehandlers. Growing investments in construction projects, such as residential and commercial buildings, highways, bridges, and airports, drive the need for telehandler operators. The growing agriculture sector in countries such as China and India is fuelling the need for telehandlers for various applications, including the loading and unloading of crops and farm equipment. The expansion of the industrial sector, including manufacturing and logistics, is boosting the adoption of telehandlers for efficient material handling operations. Moreover, the rising trend of urbanization and the need for efficient materials handling in urban construction projects further contribute to market growth.

Key Companies & Market Share Insights

The competitive landscape of the estimation mapping market is fragmented, featuring many regional and global players. The major participants are entering into strategic collaborations, mergers & acquisitions, and partnerships to expand their organization’s footprint and survive the competitive environment. Manufacturers are incorporating features such as advanced control systems, telematics, improved safety features, and better fuel efficiency to meet customer demands.

Integrating smart technologies will continue to open new opportunities for the market. For instance, in April 2023, Manitou.com announced the launch of a fresh lineup of telehandlers specifically tailored to meet the demands of North American construction markets. This new collection comprises seven models that offer lifting heights ranging from 43 to 56 feet and lifting capacities spanning from 6,000 to 12,000 pounds. Among the models included in this range are the TH 8-42 M74, TH 6-42, TH 8-42, TH 10-55, TH 12-42, TH 10-55 M74, and TH 12-55. These models prioritize enhanced safety and have an automatic parking brake feature. Some prominent players in the global telehandler market include:

-

AB Volvo

-

Caterpillar.

-

CNH Industrial N.V.

-

Doosan Corporation.

-

HAULOTTE GROUP

-

J C Bamford Excavators Ltd.

-

Komatsu Ltd.

-

L&T Technology Services Limited.

-

Manitou.com

-

Oshkosh Corporation

-

Terex Corporation.

-

Wacker Neuson SE

Telehandler Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.53 billion

Revenue forecast in 2030

USD 6.74 billion

Growth rate

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, propulsion type, lift capacity, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

AB Volvo; Caterpillar; CNH Industrial N.V.; Doosan Corporation; HAULOTTE GROUP; J C Bamford Excavators Ltd.; Komatsu Ltd.; L&T Technology Services Limited; Manitou.com; Oshkosh Corporation; Terex Corporation; Wacker Neuson SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Telehandler Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global telehandler market report based on product, propulsion type, lift capacity, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Large

-

Compact

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Lift Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 3 Ton

-

3 - 10 Ton

-

More than 10 Ton

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Agriculture

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The telehandler market size was estimated at USD 4.31 billion in 2022 and is expected to reach USD 4.53 billion in 2023.

b. The telehandler market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 6.74 billion by 2030.

b. Large telehandler segment dominated the telehandler market with a market share of more than 58.3% in 2022. Large telehandler growth is anticipated due to increasing demand from construction and forestry sector.

b. Some key players operating in the telehandler market include AB Volvo, Caterpillar., CNH Industrial N.V., Doosan Corporation., HAULOTTE GROUP, J C Bamford Excavators Ltd., Komatsu Ltd., L&T Technology Services Limited, and Manitou.com.

b. Major factor expected to drive the telehandler market is rapid urbanization which has led to a surge in construction projects, including the construction of residential complexes, commercial buildings, and infrastructure development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.