- Home

- »

- Consumer F&B

- »

-

Tahini Market Size, Share And Trends, Industry Report, 2030GVR Report cover

![Tahini Market Size, Share & Trends Report]()

Tahini Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Paste & Spreads, Halva & Other Sweets, Sauces & Dips), By Distribution Channel (Online, Offline), By Region (North America, Europe, APAC), And Segment Forecasts

- Report ID: GVR-3-68038-438-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tahini Market Summary

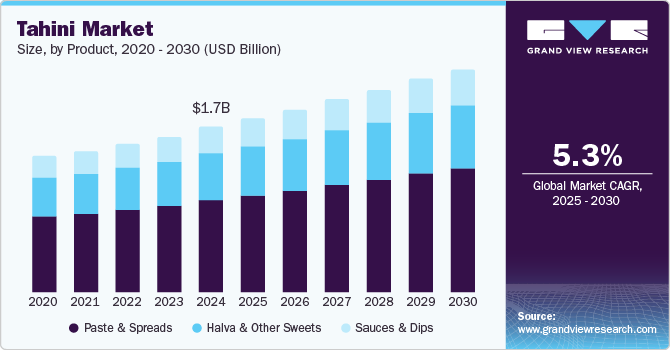

The global tahini market size was valued at USD 1.68 billion in 2024 and is projected to grow at a CAGR of 5.3% from 2025 to 2030. The increasing utilization of tahini, a key ingredient in the preparation of multiple Mediterranean and Middle Eastern culinary servings such as baba ghanoush, halva, hummus, and others, primarily drives the growth of this market.

Key Market Trends & Insights

- North America is expected to experience the fastest CAGR from 2025 to 2030.

- By product, the paste & spreads segment dominated the global tahini industry with a revenue share of 55.7% in 2024.

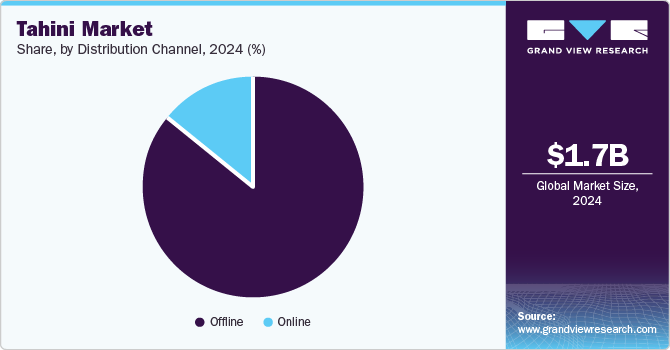

- By distribution channel, offline distribution held the largest revenue share of the global tahini industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.68 Billion

- 2030 Projected Market Size: USD 2.29 Billion

- CAGR (2025-2030): 5.3%

- North America: Largest market in 2024

The availability of vegan-based, gluten-free, and kosher-certified products also contributes to the growth of this market.

A rise in the availability of Mediterranean dishes worldwide, driven by the large number of dining industry participants that serve a variety of foods and beverages originated in multiple cuisines. For instance, in April 2024, Subway Canada launched a globally inspired menu featuring a Shawarma Chicken Rice Bowl with a drizzle of tahini and other hot sauces. The diverse population working and living across various regions fuels the demand for numerous cuisines and preparations, influencing growth in commercial and residential level utilization of ingredients such as tahini. Additionally, tahini is widely used as a major ingredient in various food preparations such as salad dressing, tahini sauce, halvah, ice creams, side dips, and baked goods such as bread, babkas, tarator sauce, etc.

The growth experience of the food services and dining experience industries has driven the demand for tahini in recent years. Increasing demand for healthy dietary products such as salads, grain bowl servings, falafel, and others has significantly influenced the use of tahini sauce and dips. It is also served with food offerings such as roast vegetables, nut squash, baked potatoes, noodles, and others.

An increasing number of individuals are shifting to plant-based diets, and there is growing awareness regarding the role of food intake in human well-being. Trends such as food tourism or exploring a variety of region-specific cuisines have also contributed to the growth of this market. Enhanced availability and accessibility facilitated by the effective distribution of the products and growing market penetration of e-commerce websites also contribute to growth opportunities.

Product Insights

Based on products, the paste & spreads segment dominated the global tahini industry with a revenue share of 55.7% in 2024. Tahini paste is extensively used in the preparation of hummus, and spreads are served with bread, baked goods, and other Asia culinary servings. The rich flavor and nutty texture offered by sesame are well-liked and preferred by multiple users. The rising availability of Middle Eastern food offerings worldwide and the growing inclusion of hummus and other Mediterranean dishes in the regular menu list are expected to drive the growth of this segment.

The sauces and dips segment is expected to experience the highest CAGR from 2025 to 2030. Tahini sauces and dips are widely utilized by commercial and residential users for added flavors, enhanced taste, and improved experience. The availability of multiple tahini sauces and dips offered by diverse portfolios of numerous food industry participants and consumer goods manufacturers has resulted in growing household utilization.

Distribution Channel Insights

Offline distribution held the largest revenue share of the global tahini industry in 2024. This is attributed to effective distribution strategies adopted by key companies and ease of availability through supermarkets, grocery stores, convenience stores, food floors in department stores, and others. Efficient market reach through offline distribution has helped companies in enhancing brand visibility. Customers prefer offline shopping experiences in multiple countries, especially regarding food ingredients and other products used in the kitchen. Commercial buyers prefer buying tahini sauces, dips, pastes, spreads, or other products from manufacturers in bulk quantities. These aspects are anticipated to drive the growth of this segment in the approaching years.

The online distribution segment is projected to experience the fastest CAGR during the forecast period. A large number of e-commerce businesses effectively market their services and offerings through advanced media and technology tools, which have developed significant influences on online distribution. The convenience the online shopping experience offers and ease of use also add to the growing demand. Additionally, pictured or video-based displays of products, detailed descriptions shared on the platform, reviews displayed with the context of time, and value-added services are likely to enhance growth opportunities for this segment.

Regional Insights

North America is expected to experience the fastest CAGR from 2025 to 2030. This market is primarily driven by the region's diverse population, growing food service and dining industry, and increasing availability of global cuisine ingredients such as tahini. Trends of shifting towards plant-based food products and adding taste enhancers such as tahini to household kitchens are expected to drive the demand for this market.

U.S. Tahini Market Trends

The U.S. tahini market held the largest revenue share of the regional industry in 2024. This is attributed to factors such as the presence of multiple food service businesses in the country that serve Mediterranean delicacies and the availability of multiple retail category tahini products, which are delivered in a variety of packaging, product sizes, and specific characteristics, such as organic tahini.

Europe Tahini Market Trends

Europe tahini market held a significant revenue share of the global tahini market in 2024. This market is mainly driven by increasing demand for Mediterranean culinary servings in the region and a growing retail presence of tahini products such as paste or pure tahini, seasoned tahini, paste & spreads tahini, organic tahini, and others. The availability of multiple-category products such as tubes, jars, bottles, and others is expected to facilitate growing demand from household users in the coming years.

Turkey held the largest revenue share of the regional tahini industry in 2024. This market is mainly driven by aspects such as increasing demand for Middle Eastern culinary offerings by the food & beverages industry and a significant utilization of tahini as a condiment. The availability of tahini products through various retail channels also influences the growth of this market.

Middle East And Africa Tahini Market Trends

The Middle East and Africa tahini market held a revenue share of 63.3% in 2024. This market is mainly influenced by the inclusion and significance of tahini in Mediterranean and Middle Eastern food servings. Tahini is considered a staple ingredient in Middle Eastern kitchens and commercial food service settings. It is widely used as a side dish, salad dressing, taste enhancer, and flavor additive.

Israel held a significant revenue share of the regional tahini market in 2024. Extensive utilization of tahini in multiple local dishes such as hummus, sabich, falafel, etc., and growing demand for commercial use and home cooking has primarily driven the growth of this market. The availability of locally sourced sesame seeds and the preference of local users to include tahini in preparations associated with breakfasts, traditional servings, and other dishes are expected to drive the growth of this market.

Key Tahini Company Insights

Some of the key companies in the global tahini industry are Al Wadi Al Akhdar, Carwari International Pty Ltd, Haitoglou Family Foods, Dipasa USA Inc. and others. To address increasing demand from the food service industry and growing competition, the market participants have embraced strategies such as packaging innovation, collaboration with other organizations, efficient distribution strategies, new product launches and more.

-

Al Wadi Al Akhdar, a company specializing in a wide range of food products, offers a portfolio comprising Lebanese specialties, canned vegetables, halva & tahini, specialty pickles, organic frozen vegetables, and more. It also provides jams and condiments. Its tahini products include regular tahini developed from hulled and crushed sesame seeds and organic tahini paste.

-

Dipasa USA Inc., part of Dipasa Group, is an importer and manufacturer of a variety of food ingredients and a service provider. Its product portfolio features sesame seeds, tahini, oils, and sweeteners. The tahini products offered by the company include Black Sesame Tahini

Key Tahini Companies:

The following are the leading companies in the tahini market. These companies collectively hold the largest market share and dictate industry trends.

- Al Wadi Al Akhdar

- Mighty Sesame Co.

- Prince Tahina Ltd.

- Haitoglou Family Foods

- Halwani Bros

- Carwari International Pty Ltd

- Dipasa USA Inc.

- Kevala

- MounirBissat

- SESAJAL

Tahini Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.77 billion

Revenue forecast in 2030

USD 2.29 billion

Growth rate

CAGR of 5.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, Turkey, France, Italy, China, Japan, India, Australia, South Korea, Brazil, Israel, Saudi Arabia

Key companies profiled

Al Wadi Al Akhdar; Mighty Sesame Co.; Prince Tahina Ltd.; Haitoglou Family Foods; Halwani Bros; Carwari International Pty Ltd; Dipasa USA Inc.; Kevala; MounirBissat; SESAJAL

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tahini Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tahini industry report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Paste & Spreads

-

Halva & Other Sweets

-

Sauces & Dips

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

Turkey

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East

-

Israel

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.