- Home

- »

- Advanced Interior Materials

- »

-

Synthetic Gypsum Market Size, Share, Industry Report, 2030GVR Report cover

![Synthetic Gypsum Market Size, Share & Trends Report]()

Synthetic Gypsum Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Flue Gas Desulfurization (FGD) Gypsum, Fluorogypsum), By Application (Drywall, Cement, Soil Amendments), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-258-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Synthetic Gypsum Market Summary

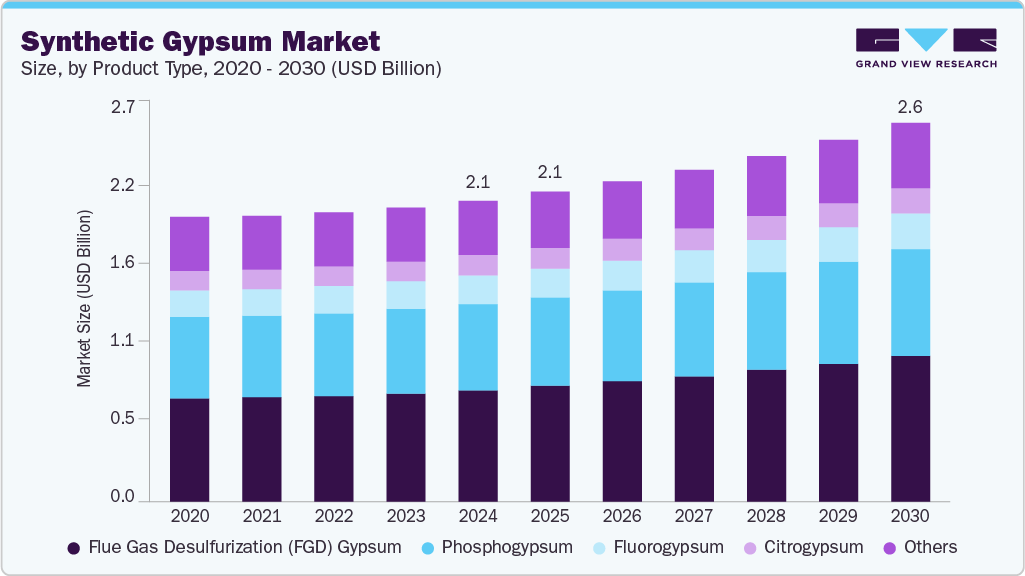

The global synthetic gypsum market size was estimated at USD 2.06 billion in 2024, and is projected to reach USD 2.59 billion by 2030, growing at a CAGR of 4.1% from 2025 to 2030, driven by the exponential growth in construction activities across the globe, owing to improving financial conditions and rapid industrialization. In addition, the governments of both developing and developed countries are emphasizing infrastructure development, which is further driving product demand.

Key Market Trends & Insights

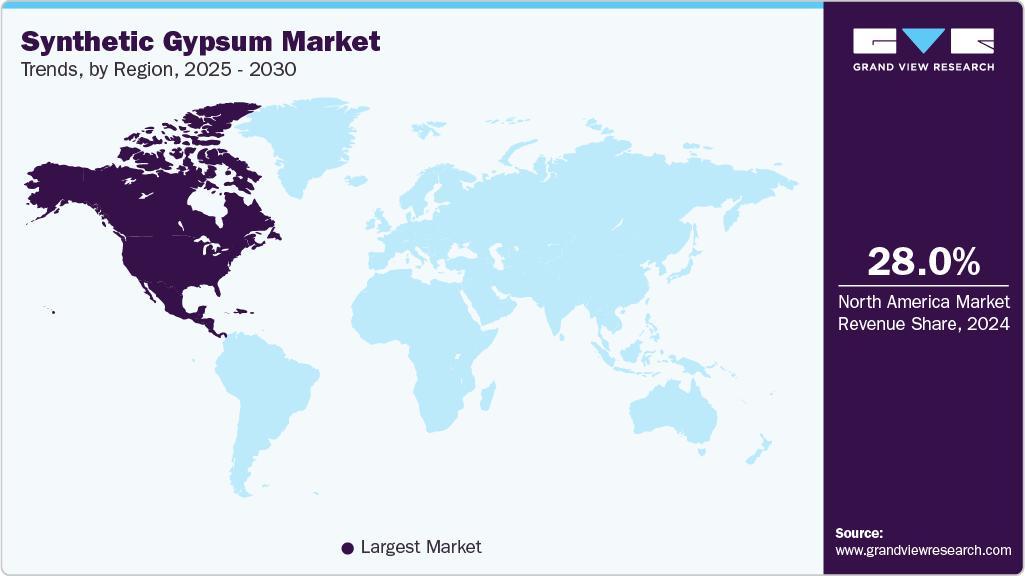

- The North America synthetic gypsum market dominated the market with the largest revenue share of 28.0% in 2024.

- The U.S. synthetic gypsum market held the largest share in the region in 2024.

- By product type, the flue gas desulfurization (FGD) gypsum segment held the largest revenue share of 37.0% in 2024.

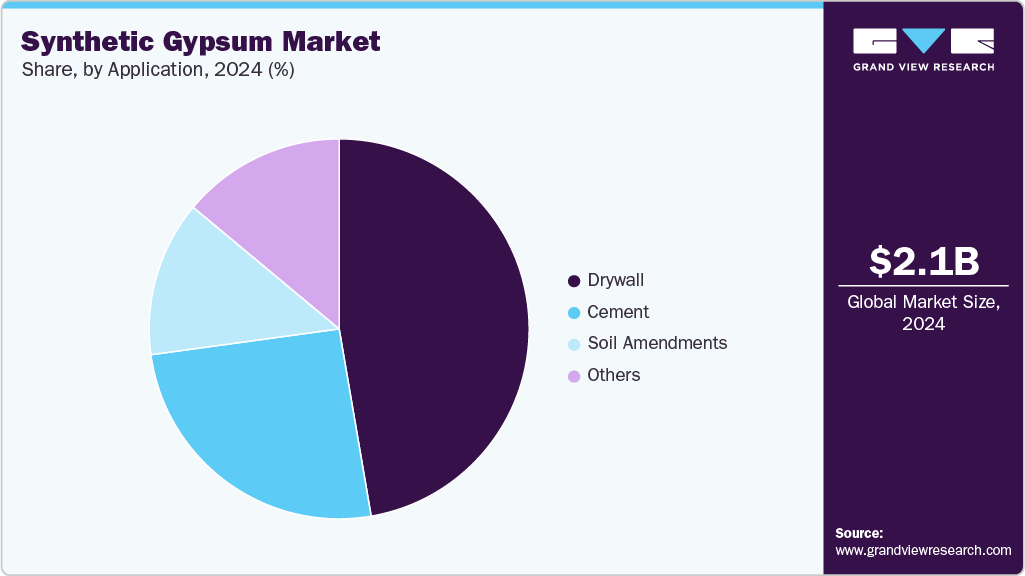

- By application, the drywall segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.06 Billion

- 2030 Projected Market Size: USD 2.59 Billion

- CAGR (2025-2030): 4.1%

- North America: Largest market in 2024

Expansion of urban infrastructure is further encouraging the use of eco-friendly and advanced construction materials. All such factors are promoting the growth of synthetic gypsum industry. Synthetic gypsum, also known as artificial gypsum, is derived from various industrial by-products. It is composed of calcium sulfate dihydrate and possesses the same characteristics as natural gypsum. Synthetic gypsum is used in the construction sector for various applications, including plasters, cement, and drywall. The limited resources and depleting reserves of natural gypsum across countries are propelling the production of synthetic gypsum to meet growing demand. In addition, synthetic gypsum is an energy-efficient product used to insulate buildings and reduce the overall energy consumption of structures. Synthetic gypsum also offers better insulation properties by absorbing noise and sound. The growing emphasis on the construction of green and energy-efficient buildings is boosting the growth of the synthetic gypsum industry.

Technological advancements in synthetic gypsum production have improved its quality and efficiency, making it more viable for various applications. Synthetic gypsum’s ability to enhance agricultural productivity is boosting its adoption in sustainable farming practices. Rich in sulfur, synthetic gypsum is an ideal source of plant nutrition and is also used to improve soil structure and aggregation and reduce dispersion in the soil. Innovations, such as enhanced purification and processing methods, are expanding synthetic gypsum’s use in construction and agriculture. The rising demand for soil amendments, due to the need for improved soil structure and nutrient availability, is further driving market growth.

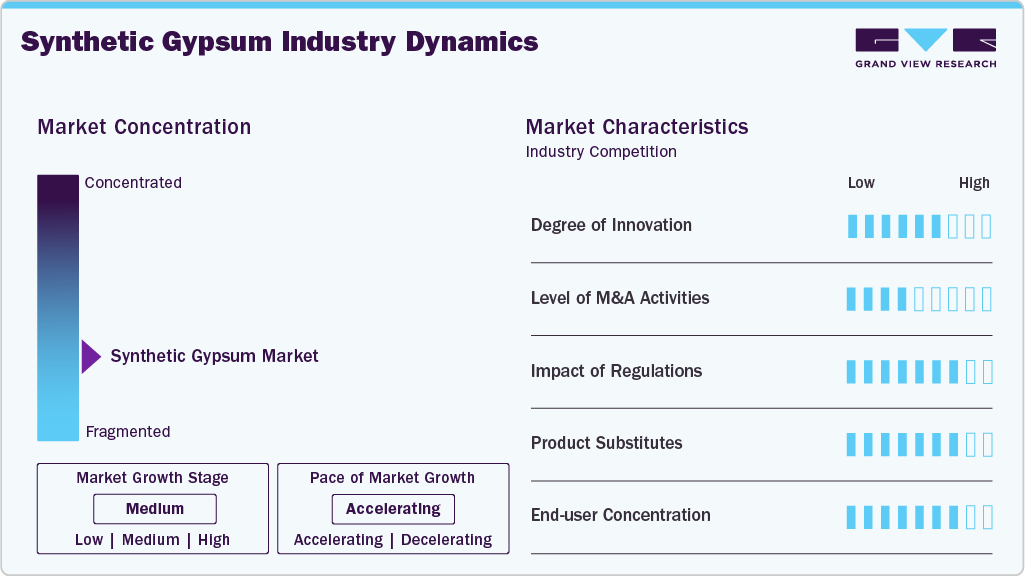

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. Ongoing efforts by key industry participants have resulted in fragmented market scenarios by driving innovation, strategic partnerships, and sustainability initiatives. Major players are investing in advanced technologies to improve product quality, efficiency, and cost-effectiveness, while also exploring new applications in construction, agriculture, and other sectors. In addition, industry leaders are expanding their regional presence by strengthening distribution networks and addressing growing environmental concerns. These efforts enhance competitiveness support the overall growth of the synthetic gypsum market, ensuring long-term sustainability and market expansion.

The global synthetic gypsum industry is characterized by a moderate degree of innovation in terms of technology, production process, and use of raw materials. Manufacturers are exploring advanced technologies and alternative raw materials to enhance the production process, reducing energy consumption and minimizing waste. Innovations such as improved purification techniques and the use of industrial by-products are making synthetic gypsum an eco-friendlier alternative. Such advancements contribute in achieving environmental goals and open up new growth opportunities for industry players by catering to the increasing demand for sustainable construction and agricultural solutions.

There are several product substitutes for synthetic gypsum, including natural gypsum, recycled gypsum, limestone, silica fume, and other industrial byproducts. These alternatives can be used in place of synthetic gypsum in various applications inclusing construction, soil amendments, and waste management. For instance, limestone is often used as a substitute in soil treatment and waste management. However, due to the increasing focus on sustainability and the environmental advantages of synthetic gypsum-such as reducing waste and conserving natural resources-the synthetic gypsum industry is expected to grow consistently.

Product Type Insights

The flue gas desulfurization (FGD) gypsum segment held the largest revenue share of 37.0% in 2024, fueled by its versatile applications and cost advantages. FGD gypsum is widely used in the production of construction materials such as cement and plaster, offering consistent quality and performance. Moreover, its adoption in the agriculture sector as a fertilizer is growing, as it helps improve soil quality and boost crop yields. Low production costs, efficient manufacturing processes, and diverse applications continue to drive the dominance of FGD gypsum in the market.

The fluorogypsum segment is anticipated to grow significantly with a CAGR of 4.3% over the forecast period. The growth of the segment is attributed to its diverse applications across construction and agriculture. Derived from the production of phosphate fertilizers, fluorogypsum offers similar chemical properties to natural gypsum, making it a viable alternative for cement and drywall production. Technological advancements in processing methods are improving their quality and reducing impurities. The increasing demand for sustainable materials and eco-friendly solutions is also driving the rise of fluorogypsum in various industries.

Application Insights

The drywall segment held the largest revenue share in 2024, propelled by its widespread use in both residential and commercial construction. Its cost-effectiveness compared to traditional building materials has made it the preferred choice for interior wall and ceiling applications. The growing construction activities driven by rapid urbanization, particularly in developing economies, are further fueling the demand for drywall. In addition, its fire-resistant properties make drywall an ideal option for institutional and commercial structures, contributing significantly to its dominant position in the synthetic gypsum industry.

The soil amendments segment is projected to be the fastest-growing segment in the synthetic gypsum industry from 2025 to 2030, propelled by the agriculture sector’s focus on sustainability and innovative practices. Synthetic gypsum provides a sustainable, cost-effective solution for improving soil structure, enhancing water retention, and boosting nutrient availability. These benefits help promote plant growth and increase soil fertility, aligning with the growing demand for eco-friendly agricultural inputs. The rising need for efficient farming practices and the utilization of industrial by-products are further fueling the demand for synthetic gypsum in soil amendment applications.

Regional Insights

The North America synthetic gypsum market dominated the market with the largest revenue share of 28.0% in 2024, attributed to the growth in construction and infrastructure projects. The increasing demand for sustainable building materials is fueling the adoption of eco-friendly synthetic gypsum for applications such as drywall, cement, and plaster. This shift is fueled by the need for energy-efficient and environmentally responsible solutions in the construction sector. Stricter environmental regulations further support the use of synthetic gypsum, making it an attractive option for green buildings and contributing to the expanding market in North America. Major players operating in the synthetic gypsum industry are continuously striving to introduce new products with better features and offerings. For instance, in October 2024, Saint-Gobain Canada, through its subsidiary CertainTeed Canada Inc., introduced CarbonLow, a new low-carbon gypsum wallboard line set to launch in Canada in 2025. CarbonLow features up to 60% less embodied carbon compared to traditional alternatives, offering contractors and homeowners a sustainable option without compromising on quality. This product enables users to reduce their environmental impact while continuing to rely on the trusted CertainTeed brand.

U.S. Synthetic Gypsum Market Trends

TheU.S. synthetic gypsum market held the largest share in the region in 2024, owing torising demand for sustainable agricultural practices and consistent operation of construction projects. Farmers are increasingly adopting synthetic gypsum for soil amendment to improve soil structure, enhance water retention, and boost nutrient availability. In addition, regulatory support encouraging the use of industrial byproducts, such as flue gas desulfurization gypsum, as an eco-friendly alternative to natural gypsum is further fueling market growth. Environmental policies and incentives are pushing industries to adopt more sustainable practices, increasing the adoption of synthetic gypsum in agriculture and contributing to market expansion.

Europe Synthetic Gypsum Market Trends

Europe synthetic gypsum market is anticipated to experience significant expansion during the forecast period. Increased focus on recycling industrial byproducts is a significant driver of the Europe synthetic gypsum industry, as industries aim to reduce waste and adopt sustainable practices. The use of byproducts, including flue gas desulfurization (FGD) gypsum, in construction and agriculture helps reduce environmental impact. Moreover, innovations in production processes are enhancing the efficiency and quality of synthetic gypsum, expanding its application range. These advancements improve product performance and make synthetic gypsum a more affordable and sustainable choice, further propelling its market growth in Europe. Companies are also consistently introducing regulatory-compliant and affordable offerings in the regional market. In March 2025,British Gypsum launched the Gyproc SoundBloc Infinaé 100, a plasterboard made entirely from recycled gypsum. Designed for acoustic insulation and fire resistance, it offers a sustainable construction solution. This is the first UK-manufactured plasterboard to use 100% recycled gypsum.

Asia Pacific Synthetic Gypsum Market Trends

The Asia Pacific synthetic gypsum market is expected to witness a significant CAGR of 4.4% from 2025 to 2030. Government initiatives promoting affordable housing are boosting the demand for construction materials, including synthetic gypsum, in the Asia Pacific region. These initiatives are accelerating urban development, requiring large-scale use of building materials. Furthermore, the growing emphasis on sustainable construction practices is driving the shift toward eco-friendly materials. Synthetic gypsum, being a byproduct of industrial processes, aligns with these green building initiatives by reducing environmental impact, thus making it a preferred choice for construction projects and further propelling market growth.

China synthetic gypsum market is projected to grow at the fastest rate in the regional market over the forecast period. Recycling initiatives in China are significantly propelling the market by promoting the use of industrial byproducts, such as flue-gas desulfurization gypsum, which helps reduce waste and supports environmental sustainability. Furthermore, rapid urbanization and extensive infrastructure development are driving the demand for construction materials, including synthetic gypsum, for applications such as drywall and plaster. The expansion of China’s urban areas and the rise in large-scale infrastructure projects are driving the growing demand for sustainable, cost-effective building materials, including synthetic gypsum, which is expected to further boost the market size in the coming years.

Key Synthetic Gypsum Company Insights

Some of the key companies in the synthetic gypsum industry include USG Corporation; Knauf Digital GmbH; American Gypsum Company, LLC; BauMineral; and Georgia-Pacific Gypsum LLC.

-

American Gypsum Company, LLC is a U.S.-based company that produces and distributes gypsum wallboard products. The company's products are categorized in the pointers as regular/non-fire-rated, fire-rated, mold & moisture-resistant, and factory-built housing.

-

Georgia-Pacific Gypsum LLC manufactures sustainable and durable building materials for roofs, ceilings, walls, and exterior sheathing. The company operates through various brands, which are divided into gypsum and wood categories. Furthermore, its gypsum products find application in interior and exterior ceilings & walls and commercial roofs.

Key Synthetic Gypsum Companies:

The following are the leading companies in the synthetic gypsum market. These companies collectively hold the largest market share and dictate industry trends.

- USG Corporation

- Knauf Group

- American Gypsum Company, LLC

- BauMineral

- Dolina Nidy Sp.z.o.o

- Saint-Gobain

- National Gypsum Company

- BNBM Group

- Yoshino Gypsum Co., Ltd.

- Etex Group

Recent Developments

-

In May 2024, EuroChem launched the third phase of its chemical complex project in Kazakhstan, which will produce synthetic gypsum as a byproduct. The Switzerland-based company has partnered with China National Chemical Engineering to design, construct, and commission the facility in Janatas, Jambyl Region. This phase will generate synthetic gypsum and calcium chloride, which will be utilized in construction materials and as reagents for the road construction, coal, and hydrocarbon industries.

-

In February 2024, Knauf España introduced its new Maxiboard boards, expanding its range of oversize gypsum wallboard systems. These boards, with a 900mm thickness, reduce the need for studs, screws, and joint treatment by 30% during installation. Ideal for large spaces like shopping centers, cinemas, and data centers, Maxiboard boards offer EI 240 fire resistance in systems up to 6m high and EI 120 fire resistance in systems up to 11m high.

Synthetic Gypsum Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.12 billion

Revenue forecast in 2030

USD 2.59 billion

Growth Rate

CAGR of 4.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; Brazil; Saudi Arabia

Key companies profiled

USG Corporation; Knauf Group; American Gypsum Company, LLC; BauMineral; Dolina Nidy Sp.z.o.o; Saint-Gobain; National Gypsum Company; BNBM Group; Yoshino Gypsum Co., Ltd.; and Etex Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Synthetic Gypsum Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global synthetic gypsum market report based on product type, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Flue Gas Desulfurization (FGD) Gypsum

-

Fluorogypsum

-

Phosphogypsum

-

Citrogypsum

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drywall

-

Cement

-

Soil Amendments

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.