- Home

- »

- Distribution & Utilities

- »

-

Synchronous Condenser Market Size, Industry Report, 2030GVR Report cover

![Synchronous Condenser Market Size, Share & Trends Report]()

Synchronous Condenser Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (New Synchronous Condenser, Refurbished Synchronous Condenser), By End-use (Electrical Utilities, Industrial), By Region (North America, Europe), And By Segment Forecasts

- Report ID: GVR-4-68040-386-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Synchronous Condenser Market Summary

The global synchronous condenser market size was estimated at USD 696.0 million in 2024 and is anticipated to reach USD 818.3 million by 2030, growing at a CAGR of 2.8% from 2025 to 2030. This growth is attributed to the growing complexity and variability in power generation across the globe.

Key Market Trends & Insights

- North America synchronous condenser market dominated the global market in 2024 with a revenue share of 34.33%.

- Synchronous condensers market in the U.S. is growing at a CAGR of 3.0% over the forecast period.

- By product, refurbished synchronous condenser segment dominated this market, accounting for a revenue share of 57.8% in 2024.

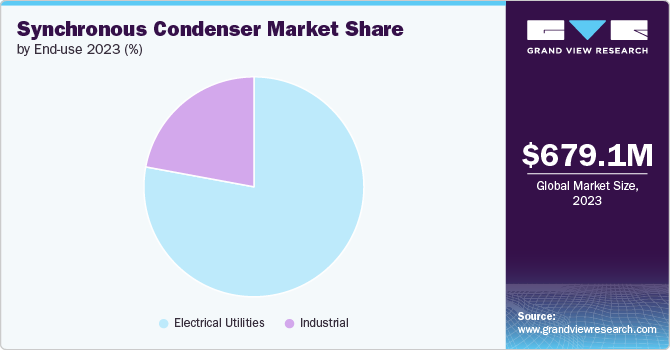

- By end-use, the electrical utilities segment accounted for the largest revenue share of 77.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 696.0 Million

- 2030 Projected Market Size: USD 818.3 Million

- CAGR (2025-2030): 2.8%

- North America: Largest market in 2024

Synchronous condensers help maintain grid stability by providing inertia and voltage support. Moreover, many power grids globally are aging, necessitating upgrades to ensure reliability and stability, where synchronous condensers play a crucial role.

As renewable energy sources such as wind and solar become more prevalent, the need for synchronous condensers to provide grid stability and inertia support increases. Furthermore, supportive policies and incentives aimed at enhancing grid reliability and integrating renewable energy sources often drive investments in synchronous condenser technology. Thereby, boosting market growth. Moreover, advances in control systems, materials, and design have improved the efficiency and performance of synchronous condensers, making them more suitable for grid operators.

Synchronous condensers require significant capital investment compared to other grid stabilization technologies, which can restrict their adoption in some applications. Integrating synchronous condensers into existing grid infrastructures can be challenging due to compatibility issues and the need for retrofitting. Furthermore, this product has high operational costs depending on its maintenance, fuel, and periodic refurbishment, which further increases its overall expenditure.

However, increasing penetration of renewable energy sources creates a growing market for synchronous condensers to manage grid stability. Initiatives of infrastructure projects that are aimed at expanding and interconnecting power grids present opportunities for product growth. Furthermore, increasing government initiatives aimed at accelerating the energy transition towards cleaner sources can drive demand for synchronous condensers. In addition to this, continued innovation in synchronous condenser technology in terms of materials, controls, and maintenance practices can reduce costs and improve performance.

Drivers, Opportunities & Restraints

The global shift toward renewable energy has significantly increased the demand for grid stabilization technologies. As more intermittent energy sources like solar and wind are integrated into the grid, the need for voltage regulation and reactive power support has grown. Synchronous condensers offer these capabilities, offering inertia and dynamic reactive power, which are essential for grid reliability in renewable-heavy energy systems.

Decommissioning conventional thermal power plants has left a void in ancillary services such as voltage control and short-circuit power. In many cases, instead of dismantling these plants entirely, utilities are repurposing old synchronous generators as condensers, allowing for a cost-effective way to maintain grid stability. This trend of retrofitting is further driving the market, especially in developed regions with aging infrastructure.

The rapid expansion of renewable energy capacity in developing countries presents a major growth opportunity for the synchronous condenser market. As these regions invest in new grid infrastructure, many are opting to include synchronous condensers as part of the initial design to future-proof their systems against voltage instability and low inertia caused by high renewable penetration.

Technological advancements are opening new avenues for hybrid systems that combine synchronous condensers with power electronics like STATCOMs or battery energy storage. These hybrid solutions offer improved dynamic response, better fault recovery, and enhanced grid resilience. This convergence creates opportunities for OEMs and integrators to deliver customized, high-performance solutions to grid operators.

High capital and installation costs remain a significant barrier to the widespread adoption of synchronous condensers, especially in cost-sensitive regions. Unlike some modern solid-state solutions, synchronous condensers are mechanical machines that require substantial physical infrastructure, such as cooling systems, foundations, and maintenance facilities. This can deter smaller utilities or private developers.

Operational complexity and maintenance requirements are another constraint. Synchronous condensers, being rotating machines, require regular inspection, lubrication, and component replacements. The need for skilled personnel and periodic outages adds to operational costs, which may drive some utilities to consider alternatives like STATCOMs or battery-based systems with lower maintenance overhead.

Product Type Insights

Refurbished synchronous condenser segment dominated this market, accounting for a revenue share of 57.8% in 2024. This product type is an older unit that has been overhauled, repaired, or upgraded to extend its operational life. They offer a cost-effective alternative to purchasing new equipment. Refurbishment can improve the performance and reliability of older synchronous condensers, bringing them closer to the efficiency levels of newer units. This includes enhancing control systems for better grid integration. However, refurbished units may have limitations in terms of customization compared to new synchronous condensers.

New synchronous condenser segment is expected to grow at the fastest CAGR of 3.0% during the forecast period. New synchronous condensers incorporate the latest technological advancements in terms of materials, design, and control systems. This includes improvements in rotor design, insulation materials, and advanced monitoring and control capabilities. Furthermore, they are designed to be more efficient in converting electrical energy into mechanical energy and vice versa. This efficiency contributes to better grid stability and management of reactive power, thereby, increasing their adoption in the market.

End-use Insights

The electrical utilities segment accounted for the largest revenue share of 77.7% in 2024. Synchronous condensers are crucial for maintaining grid stability by providing inertia and reactive power support in electrical utility end use. They help stabilize voltage fluctuations and improve the overall reliability of electrical grids. Furthermore, as renewable energy sources like wind and solar power increase, this creates demand for synchronous condensers. This product plays a vital role in managing grid dynamics. They provide necessary inertia and help manage reactive power fluctuations, which are common with variable renewable sources.

Industrial end use of synchronous condenser market is expected to grow at the fastest CAGR of 3.5% over forecast period. In industrial sector, this product is used in steel industry, chemical plants, mining operations, pulp and paper mills, and oil & gas sector. The product helps in improve power factor and stabilize voltage in these industries, which is critical for maintaining operational efficiency and protecting equipment. Furthermore, it also helps in preventing fluctuations in power demand and supply, optimizing energy use, and reducing operational costs.

Regional Insights

North America synchronous condenser market dominated the global market in 2024 with a revenue share of 34.33%. North America is witnessing significant growth in renewable energy generation. Synchronous condensers help manage the variability of wind and solar power, ensuring grid stability and reliability. In addition to this, countries in North America have aging power infrastructures that require upgrades to meet current and future energy demands. This is further expected to increase product demand in region.

U.S. Synchronous Condenser Market Trends

Synchronous condensers market in the U.S. is growing at a CAGR of 3.0% over the forecast period. Rising investments in grid reliability enhancements to mitigate power outages and improve overall system reliability is increasing product demand as this product helps in maintaining grid stability and supporting reliable electricity supply.

Europe Synchronous Condenser Market Trends

Demand for synchronous condenser in Europe is expected to grow at a significant rate over forecast period. Region is aggressively transitioning towards renewable energy sources like wind and solar. This product is essential here to stabilize grid frequency and voltage, manage intermittency, and support grid stability, thereby, boosting its adoption. Furthermore, demand is also driven by investments in modernizing grid infrastructure to enhance reliability and accommodate increasing renewable energy capacities.

Asia Pacific Synchronous Condenser Market Trends

Rapid industrialization and urbanization in countries like China and India are driving increased demand for electricity, which is increasing product use to support grid stability amidst this growing energy demand. Furthermore, governments across Asia Pacific are focusing on integrating renewable energy sources into their energy mix. This is further expected to drive product demand in region.

Key Synchronous Condenser Market Company Insights

Some of the key players operating in the market ABB and Siemens Energy:

-

ABB is Switzerland based leader in automation and electrification technology. The company provides a wide range of products under metallurgy products, electric drivetrains, motors & generators, industrial software, robotics, PLC automation, power converters and inverters, drives, control tool solutions, and low voltage products & systems. It offers these products for numerous industries, including oil & gas, automotive, cement, chemicals, mining, power generation, and pulp & paper products.

-

Siemens Energy is a leading energy technology provider for a wide range of industries, including oil & gas, power & heat generation, power transmission, marine, data centers, pulp & paper. Its product portfolio includes hybrid power plants operated with hydrogen, conventional and renewable energy technology, such as gas and steam turbines, and power generators and transformers. The company has approximately 99,000 employees who are working in more than 90 countries across the world.

IDEAL ELECTRIC POWER CO. and Ansaldo Energia S.p.A. are some of the emerging participants in the market.

-

IDEAL ELECTRIC POWER CO. was established in 1903 and headquartered in the U.S. It is a leading manufacturer of specialty electric motors and condensers, including synchronous generators, power systems and controls, and switchgear. The company is also one of the only U.S. producers to offer space-saving generator-mounted epicyclic gears.

-

Ansaldo Energia S.p.A. is an Italy-based manufacturer and service provider in the power generation industry. The company has expertise in conventional and next-generation technologies, from gas to nuclear energy and renewable energy. It offers its products and services under various segments, including power plants, equipment, and solutions for the energy transition, digital systems, nuclear, and services. The company employs approximately 3,300 people.

Key Synchronous Condenser Companies:

The following are the leading companies in the synchronous condenser market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Siemens Energy

- IDEAL ELECTRIC POWER CO.

- Ansaldo Energia S.p.A.

- GE Vernova Inc.

- Andritz AG

- Voith

- Fuji Electric

- WEG

- BRUSH

Recent Developments

-

In June 2024, GE Vernova Inc. announced the construction of two synchronous condenser facilities of 115 kV to improve grid stability in New York. This contract has been awarded by National Grid upstate New York business. With this, GE Vernova Inc. will able to support National Grid to meet the New York State’s goals to reduce carbon emissions by 85% by 2050.

Synchronous Condenser Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 713.8 million

Revenue forecast in 2030

USD 818.3 million

Growth rate

CAGR of 2.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

ABB; Siemens Energy; IDEAL ELECTRIC POWER CO.; Ansaldo Energia S.p.A.; GE Vernova Inc.; Andritz AG; Voith; Fuji Electric; WEG; BRUSH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Synchronous Condenser Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the synchronous condenser market based on product type, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

New Synchronous Condenser

-

Refurbished Synchronous Condenser

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Electrical Utilities

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global synchronous condenser market size was estimated at USD 695.98 million in 2024 and is expected to reach USD 713.8 million in 2025.

b. The global synchronous condenser market is expected to grow at a compound annual growth rate (CAGR) of 2.7% from 2025 to 2030 to reach USD 818.3 million by 2030.

b. Electrical utilities end use accounted for the largest revenue share of 77.71% in 2024 as they help stabilize voltage fluctuations and improve the overall reliability of electrical grids.

b. Some key players operating in the synchronous condenser market include ABB, Siemens Energy, IDEAL ELECTRIC POWER CO., Ansaldo Energia S.p.A., GE Vernova Inc., Andritz AG, Voith, Fuji Electric, WEG, and BRUSH.

b. The key factors that are driving the synchronous condenser market growth is the growing complexity and variability in power generation across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.