- Home

- »

- Animal Health

- »

-

Swine Lameness Diagnostic Market Size, Share Report 2030GVR Report cover

![Swine Lameness Diagnostic Market Size, Share & Trends Report]()

Swine Lameness Diagnostic Market (2024 - 2030) Size, Share & Trends Analysis Report By Sector (Public, Private), By Service Provider (Veterinary Hospital/Clinic Laboratories), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-316-7

- Number of Report Pages: 89

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Swine Lameness Diagnostic Market Trends

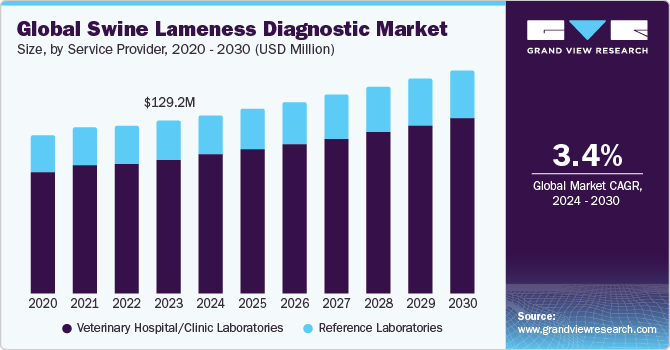

The global swine lameness diagnostic market size was estimated at USD 129.15 million in 2023 and is anticipated to grow at a CAGR of 3.8% from 2024 to 2030. Key factors expected to drive the market include the growing prevalence of lameness in pigs, rising pork meat production & consumption, and supportive initiatives undertaken by animal welfare organizations. For instance, according to Pig333 data from April 2024, worldwide pork meat production reached 124.5 million tonnes in 2023, with China accounting for more than 47% of total production. The substantial volume of production reflects an increase in the consumption of pig meat and, hence, the necessity to maintain a healthy pig. Moreover, increasing awareness among farmers and veterinarians about the impact of lameness on productivity & animal welfare drives the adoption of diagnostic kits. Improved veterinary healthcare infrastructure and access to veterinary services support the market growth.

The COVID-19 pandemic impacted the market both positively and negatively. During the first half of 2020, government measures included stay-at-home guidelines and social distancing protocols, causing market participants to adjust, reduce, or suspend activities. Vet clinics and hospitals across key geographies registered low patient volume, while some directed resources to focus only on emergency cases. On the positive side, the pandemic heightened awareness about zoonotic diseases, and the One Health approach increased attention on animal health & welfare. This supported the rise in interest in veterinary diagnostics, including test kits, as part of broader disease surveillance efforts.

The increasing prevalence of lameness in swine further propels the market growth. Lameness is a recurring problem in pigs. Although lameness in production animals like pigs may occur due to congenital or developmental issues, the majority of cases can be attributed to pain from infections, trauma-related injuries, or underlying metabolic illnesses. In recent years, the global prevalence of lameness has risen in production animals like swine. For instance, according to a June 2023 research study in Animals Journal, 40% of the target population of pregnant pigs were lame. The study concluded that this high prevalence of lameness may lead to a decrease in the efficiency of the placenta in protecting the fetus from the pregnant pig’s stress, thereby increasing the chances of stillborn offspring due to decreased gestation length.

Market Concentration & Characteristics

The market has a low concentration. The industry is witnessing a rise in number of supportive initiatives by various animal welfare organizations, industry participants, and researchers, which is expected to create lucrative growth opportunities in the market. For instance, according to a January 2023 article by Pig Progress, researchers from the U.S. recommend a 2-dimensional model to detect lameness in pigs. According to the researchers, the traditional visual lameness scoring method requires training and is prone to huge margins of error. These researchers have created a gait analysis method that can assist veterinarians in quantifying lameness and assigning further diagnostic tests & treatments.

The market demonstrates a moderate degree of innovation, characterized by technological advancements in diagnostic products. For instance, Infrared Thermography (IRT) is an effective and noninvasive method of measuring pigs' body temperature and has the advantages of being non-destructive, long-range, and highly sensitive. In contrast to conventional techniques, IRT provides a rapid and labor-saving way to collect physiological data, essential for comprehending the physiology and metabolism of pigs influenced by ambient temperature. IRT assists in respiratory health monitoring, early disease identification, differentiating lame from non-lame sows, and assessing the efficacy of vaccinations.

Within the market, a low level of merger and acquisition activity exists, indicative of ongoing consolidation, strategic acquisitions, and partnerships among industry players. For instance, in January 2023, Merck acquired Imago BioSciences, Inc. After the completion of this merger, Imago was expected to become a fully-owned subsidiary of Merck.

The market experiences a moderate level of product substitutes. The increasing penetration of substitutes is also a consequence of the high-profit margins gained by manufacturers. Moreover, there are a significant number of players offering diagnostic products at lower costs. Furthermore, veterinary diagnostics is witnessing a shift toward biological tests and procedures due to their accurate results and sensitivity to minute changes, which help diagnose a disease better. Most of the diagnostic tests for animals are technologically advanced and biological.

Moderate levels of regional growth operations in the market are caused by initiatives by major competitors. For instance, in November 2023, Antech, part of Mars Petcare’s Science & Diagnostics division, inaugurated a new veterinary diagnostics laboratory in Warwick, UK, bolstering its existing network.

Service Provider Insights

The veterinary hospital/clinic laboratories segment dominates the market due to its specialized expertise, advanced equipment, and comprehensive veterinary care services. These facilities offer various diagnostic tests & services focused on identifying and treating lameness issues in swine, making them the preferred choice for veterinarians and swine producers. Moreover, diagnosing swine lameness requires specialized anatomy, physiology, and pathology knowledge. Veterinary hospitals/clinics equipped with advanced diagnostic tools and staffed by experienced veterinarians are essential for accurate & timely diagnosis. Thus, demand for veterinary hospital/clinic laboratories is increasing for swine lameness diagnosis.

The reference laboratories segment is expected to grow significantly during the forecast period. Reference laboratories often offer comprehensive testing panels that cover a wide range of potential causes of lameness in swine, including bacterial & viral infections, nutritional deficiencies, genetic predispositions, and environmental factors. This comprehensive approach safeguards thorough evaluation and accurate diagnosis. Similarly, reference laboratories frequently engage in R&D activities to advance understanding and improve diagnostic techniques for swine lameness. This commitment to innovation ensures they lead in the field, offering cutting-edge solutions to their clients.

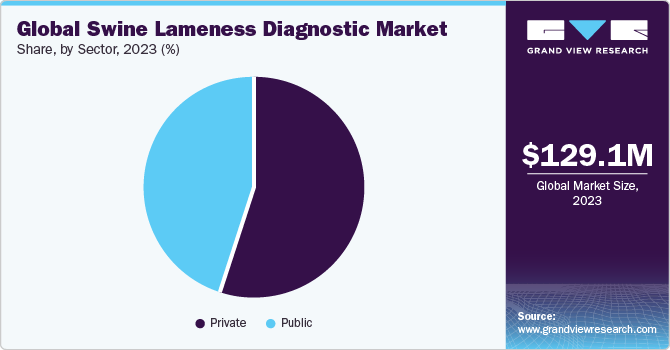

Sector Insights

Based on sector, the private segment held the largest share of 53.07% in 2023. Privately owned clinic laboratories often have advanced diagnostic technologies and methodologies. They invest in innovative equipment and advanced research, enabling more accurate & faster diagnoses compared to public or on-farm facilities. For instance, Langford Vets offers veterinary diagnostic services for molecular diagnostics, genetics, and microbiology, among other services. This helps in the early detection and management of swine lameness, which is crucial for maintaining swine health and productivity.

Private laboratories often charge higher fees for diagnostic services compared to public sector facilities. Swine producers and veterinarians opt for public sector services to minimize costs, especially those operating on tight budgets. However, private laboratories increasingly integrate technology into their diagnostic processes to improve efficiency and accuracy. This involves adopting automated diagnostic platforms, digital imaging systems, or data analytics tools to enhance the speed and reliability of swine lameness diagnosis. Thus, demand for the private sector will grow rapidly during the forecast period. Swine lameness diagnosis in the public sector involves utilizing veterinary expertise and government resources to identify & manage lameness issues in swine population. Veterinary inspectors and animal health officials often play a crucial role in conducting on-farm assessments, implementing disease surveillance programs, and providing diagnostic support to farmers. Furthermore, public health agencies and veterinary authorities establish surveillance programs to monitor the prevalence & distribution of lameness-causing pathogens in swine populations. This involves collecting samples for laboratory testing, analyzing epidemiological data, and implementing control measures to prevent disease spread.

Regional Insights

U.S. Swine Lameness Diagnostic Market Trends

The swine lameness diagnostic market in the U.S. is rising due to the rise in pork meat consumption in the U.S. According to data published by USDA's World Agricultural Outlook Board in May 2024, commercial pork production is projected to observe a moderate increase in 2025, reaching 28.4 billion pounds. This represents an approximate 1.2% rise compared to the forecasted production for 2024. Higher demand for pork drives producers to ensure optimal herd health and productivity, making early & accurate detection of lameness critical. This increased focus on diagnostics helps reduce economic losses associated with lameness, improve animal welfare, and meet consumer expectations for high-quality pork products. Thus, the surge in pork import, export, and production in the U.S. is directly influencing the U.S. swine lameness diagnostic market.

Europe Swine Lameness Diagnostic Market Trends

The swine lameness diagnostic market in Europe is expected to grow significantly during the forecast period. Lameness is a significant health concern in intensive swine production systems, with studies across Europe reporting a prevalence ranging from 9% to 29%. This painful condition has various infectious or noninfectious causes, including foot & leg injuries. Foot and leg pain are identified as major welfare risks for gestating sows. Moreover, lameness poses economic challenges as it reduces sow productivity and leads to earlier culling compared to non-lame sows. In addition, lameness contributes to on-farm deaths or euthanasia.

The UK swine lameness diagnostic market is expected to register significant growth during the forecast period. Increasing focus on research on lameness in pigs is propelling the market growth in the country. Ongoing studies, such as those led by Newcastle University, are identifying biological and behavioral markers for genetic predisposition to degenerative joint disease in pigs. Researchers at Newcastle University are leading a project to identify early indicators of genetic predisposition to lameness in pigs.

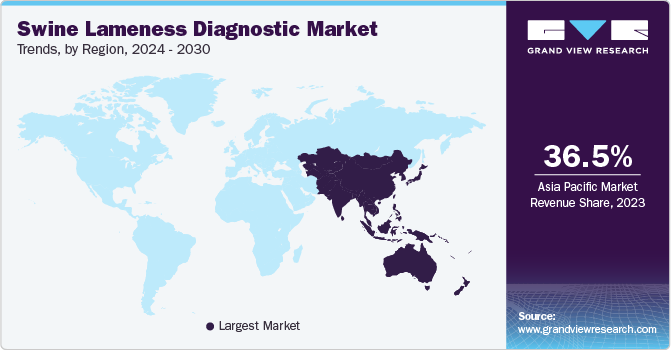

Asia Pacific Swine Lameness Diagnostic Market Trends

The swine lameness diagnostic market in Asia Pacific is dominating, with a revenue market share of 36.52% in 2023. The pig production landscape in Asia, especially in China, holds significant global importance due to its dual role as the largest producer and consumer of pork. Despite several challenges, such as resource scarcity, low efficiency, environmental concerns, and disease outbreaks, the region's pig production continues to expand, driven by growing populations and economies. China dominates Asian pig production, accounting for a substantial portion of the global market.

China swine lameness diagnostic market dominated the Asia Pacific region and accounted for the largest revenue market share in 2023. According to the Agriculture and Horticulture Development Board, in 2024, about 60% of all meat consumed in China is pork, and pork consumption has witnessed steady growth, driven by the expanding middle-class population. China's pork production reached 57.94 million tons in 2023, a 5% increase year-on-year, due to higher slaughter rates and increased culling. Lameness is responsible for the culling of up to 50% of the sow herd, especially affecting gilts and first parity sows, more than any other factor.

Latin America Swine Lameness Diagnostic Market Trends

The swine lameness diagnostic market in Latin America is expected to grow at the fastest CAGR during the forecast period. According to the OECD/FAO Outlook 2031, pork production is projected to increase by 16% in Latin America over the next decade due to rising demand fueled by population growth, higher incomes, and dietary shifts. According to a study published in the National Library of Medicine in April 2024, Brazil is the largest pork exporter in the region. However, the industry faces challenges such as disease outbreaks and the need for sustainable production methods.

Brazil swine lameness diagnostic market dominated the Latin America region with the highest revenue market share in 2023. Brazil is one of the world's largest producers and exporters of pork products. The Brazilian pork industry has witnessed significant growth due to modernization, technology adoption, and genetic improvements, making it the fourth-largest pork producer globally. Despite challenges such as production costs and diseases such as ASF, Brazil's pork exports continue to expand, especially to Asian markets.

Key Swine Lameness Diagnostic Company Insights

The market is fairly competitive due to the existence of small to major market participants. Due to the existence of multiple small and large companies, the market is slightly fragmented. Leading players are continually expanding their product lines with innovative technologies and expanding their geographic reach by acquiring small & local companies. These companies implement various strategies, such as joint ventures, mergers & acquisitions, partnerships & collaborations, research & development, geographic growth, and product launches, to increase their market position and share.

Key Swine Lameness Diagnostic Companies:

The following are the leading companies in the swine lameness diagnostic market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- IDEXX Laboratories, Inc.

- BioChek

- Neogen Corporation

- Bio-Rad Laboratories

- Gold Standard Diagnostics

- Thermo Fisher Scientific Inc.

- Ingenetix GmbH

- KYLT ( part of SAN Group)

- Ring Biotechnology Co Ltd.

- Primer Design (Novacyt)

Swine Lameness Diagnostic Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 133.64 million

Revenue forecast in 2030

USD 166.74 million

Growth rate

CAGR of 3.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sector, service provider, region

Regional scope

Europe; Asia Pacific; Latin America

Country scope

U.S.; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Vietnam; Brazil

Key companies profiled

Merck KGaA; IDEXX Laboratories, Inc.; BioChek; Neogen Corporation; Bio-Rad Laboratories; Gold Standard Diagnostics; Thermo Fisher Scientific Inc.; Ingenetix GmbH; KYLT ( part of SAN Group); Ring Biotechnology Co Ltd.; Primer Design (Novacyt )

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Swine Lameness Diagnostic Market Report Segmentation

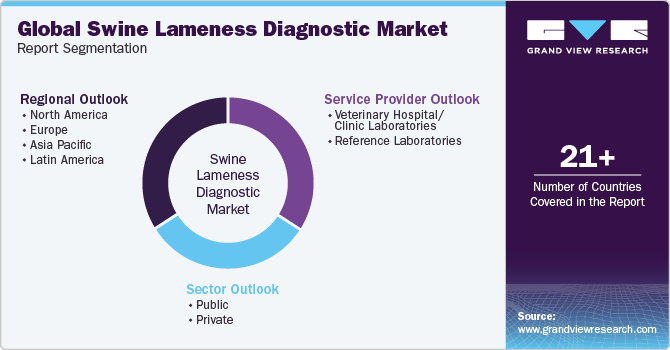

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global swine lameness diagnostic market report based on sector, service provider, and region:

-

Sector Outlook (Revenue, USD Million, 2018 - 2030)

-

Public

-

Private

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospital/Clinic Laboratories

-

Reference Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Vietnam

-

-

Latin America

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The global swine lameness diagnostic market size was estimated at USD 129.15 million in 2023 and is expected to reach USD 133.64 million in 2024.

b. The global swine lameness diagnostic market is expected to grow at a compound annual growth rate of 3.8% from 2024 to 2030 to reach USD 166.74 million by 2030.

b. Asia Pacific dominated the swine lameness diagnostic market with a share of 36.52% in 2023. The increasing demand for pork and pork products in Asia Pacific is driving the growth of the swine industry, which in turn is driving the demand for swine diagnostics. This demand is fueled by the growing population and rising income, leading to increased consumption of meat products.

b. Some key players operating in the swine lameness diagnostic market include Merck KGaA, IDEXX Laboratories, Inc., BioChek, Neogen Corporation, Bio-Rad Laboratories, Gold Standard Diagnostics, Thermo Fisher Scientific Inc., Ingenetix GmbH, KYLT ( part of SAN Group), Ring Biotechnology Co Ltd.,Primer Design (Novacyt )

b. Key factors that are driving the market growth include growing prevalence of lameness in pigs, rising pork meat production & consumption, and rising supportive initiatives undertaken by animal welfare organizations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.