Sweden Nicotine Pouches Market Size, Share & Trends Analysis Report By Product (Tobacco Derived, Synthetic), By Flavor (Original/Unflavored, Flavored), By Distribution Channel (Online, Offline), By Strength, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-538-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Sweden Nicotine Pouches Market Trends

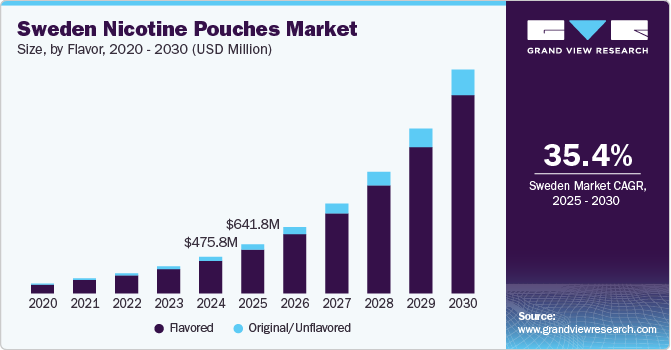

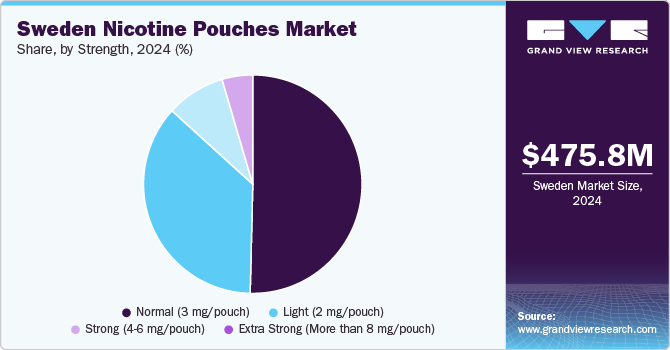

The Sweden nicotine pouches market size was estimated at USD 475.8 million in 2024 and is expected to grow at a CAGR of 35.4% from 2025 to 2030. The market is expected to grow rapidly due to the increasing popularity of alternative nicotine products, as consumers seek less harmful options compared to traditional smoking. The growing trend of health-consciousness and smoking cessation is driving demand for nicotine pouches. Additionally, Sweden’s progressive regulatory environment, which supports these products, combined with a well-established consumer base for smokeless alternatives like snus, further contributes to the market's strong growth outlook.

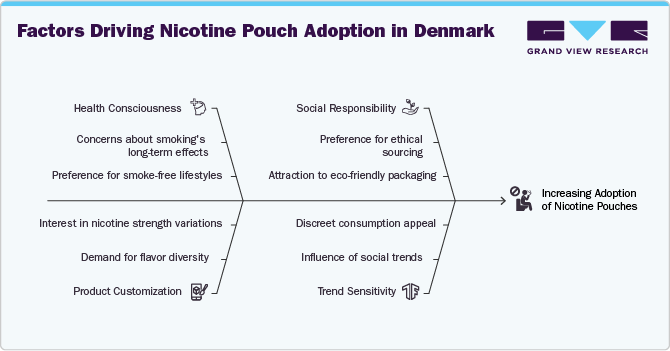

The nicotine pouches industry in Sweden is experiencing robust growth, driven by a growing consumer preference for smokeless alternatives to traditional tobacco products. As health-conscious consumers increasingly turn away from smoking, nicotine pouches have become a popular choice due to their convenience, variety of flavors, and perceived lower health risks. The Swedish market has been particularly receptive to these products, largely because of the cultural acceptance of smokeless alternatives like snus, a product with a long history in the country. This cultural shift, combined with increased awareness about the potential harms of smoking, has positioned nicotine pouches as an appealing option for both smokers looking to quit and those seeking a less harmful nicotine experience.

Additionally, the Swedish regulatory environment has fostered the growth of nicotine pouches, with policies that support innovation and the availability of these products in the industry. The government has maintained a relatively flexible approach toward nicotine alternatives, creating favorable conditions for manufacturers to expand their offerings. As a result, the market has seen rapid product innovation, with a broad range of strengths and flavors available to cater to diverse consumer preferences. With the increasing adoption of nicotine pouches and the rising demand for alternative nicotine products.

Regulatory Insights

|

Guide to Nicotine Pouch Regulations in Sweden: Key Compliance Requirements |

|

|

Regulation Aspect |

Requirements |

|

Regulatory Body |

|

|

Product Classification |

|

|

Taxation & Pricing |

|

|

Age Restrictions & Sales |

|

|

Marketing & Advertising |

|

|

Packaging & Labelling |

|

|

Potential Future Regulations |

|

Consumer Insights

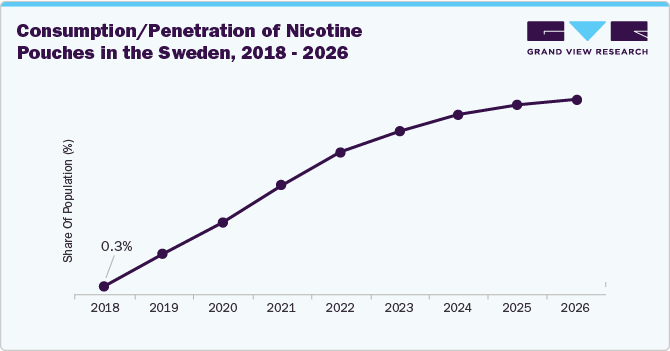

The consumption of nicotine pouches in Sweden has been steadily growing in recent years. These tobacco-free products offer a discreet and clean way to consume nicotine, leading to a rise in adoption among consumers.

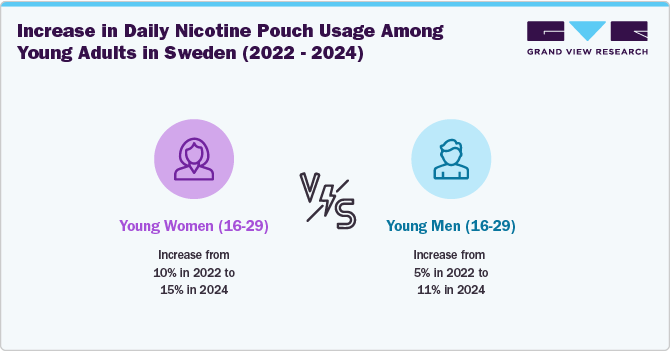

In Sweden, the data from the Public Health Agency of Sweden reveals a significant rise in the daily use of nicotine pouches, particularly among young adults aged 16-29 years. Women in this age group have seen a notable increase, from 10% in 2022 to 15% in 2024, indicating that the product has gained popularity among younger female users. Similarly, the usage among men in the same age group has doubled, rising from 5% to 11%. This suggests that nicotine pouches are becoming an attractive alternative to traditional smoking for younger generations, likely due to their convenience, discreetness, and perceived lower harm compared to cigarettes.

In addition to the surge among young adults, there is also an upward trend in usage among individuals in the 33-44 years and 45-64 years’ age groups, though from lower initial levels. This broader demographic shift indicates that nicotine pouches are slowly being embraced by a wider audience, including older age groups. This suggests that nicotine pouches are increasingly seen as a viable alternative to smoking for a broader segment of the population, with potential appeal driven by health-conscious decisions, ease of use, and a variety of flavors that appeal to diverse consumer preferences.

The nicotine pouches industry in Sweden is expected to experience significant growth, driven by increasing adoption and penetration among consumers. By 2025, it is projected that the penetration of nicotine pouches in Sweden will range between 5-7%, resulting in the market reaching a value of USD 641.8 Million.

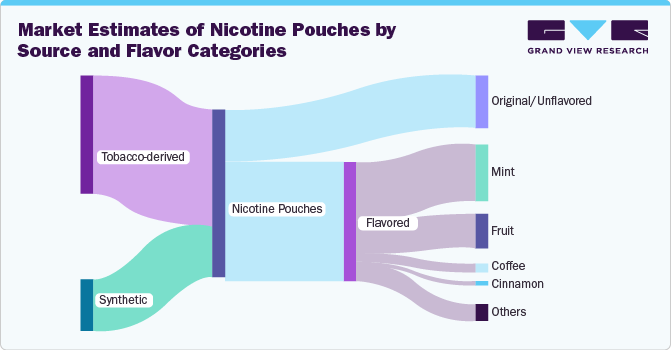

Product Insights

Tobacco-derived nicotine pouches accounted for 98.36% of the revenue share in Sweden in 2024 due to the country's strong preference for traditional tobacco-based products, coupled with the historical success of Swedish snus. Swedish consumers are highly accustomed to tobacco-derived nicotine products, which have been widely accepted as part of the culture. As nicotine pouches are marketed as a cleaner alternative to smoking, they naturally appeal to existing users of tobacco products, leading to a dominant share of tobacco-derived pouches in the market. The regulatory environment also supports the availability of these products, further solidifying their market position.

The synthetic nicotine pouches market in Sweden is expected to grow at a CAGR of 47.3% from 2025 to 2030, due to increasing consumer interest in alternatives to traditional tobacco-derived products. Synthetic nicotine offers an appealing option as it avoids certain regulatory constraints that apply to tobacco-based products. As awareness grows about synthetic nicotine's potential benefits, such as being free from tobacco, it is gaining traction among health-conscious users looking for a cleaner nicotine experience

Flavor Insights

Flavored nicotine pouches accounted for a revenue share of 89.53% in 2024. Flavored pouches, such as mint, berry, and citrus, appeal to a broader audience, particularly younger users and those new to nicotine pouches. The availability of diverse flavors makes the product more enjoyable and approachable compared to traditional nicotine products, encouraging greater adoption. Additionally, flavored pouches are often marketed as less harsh and more palatable, which further drives their popularity in the Swedish market, where consumer preferences are shifting toward more customized and pleasant nicotine experiences.

In Sweden, the original/unflavored nicotine pouches market is expected to grow at a CAGR of 37.2% from 2025 to 2030 due to the strong preference among Swedish consumers for more traditional, subtle nicotine options. The country has a long history of using smokeless tobacco products, such as snus, and many consumers are seeking a similar experience with nicotine pouches but without the added flavors. The unflavored variant provides a familiar, straightforward option that aligns with Swedish consumer preferences for simplicity and authenticity.

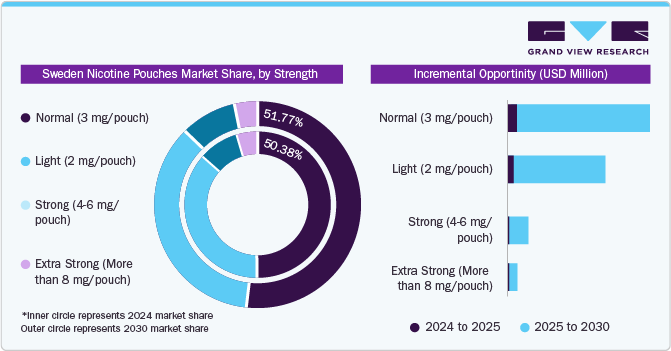

Strength Insights

In Sweden, normal strength (3 mg/pouch) nicotine pouches accounted for a revenue share of 50.38% in 2024 due to their balanced nicotine content, which appeals to a broad range of consumers. This strength offers a moderate and satisfying dose of nicotine, making it ideal for both occasional users and those transitioning from traditional tobacco products. Given Sweden's established market for smokeless tobacco and the preference for milder options, the 3 mg strength provides an optimal experience for most users, driving its widespread adoption in the nicotine pouch market.

The light (2 mg/pouch) strength nicotine pouches are anticipated to grow with a CAGR of 35.3% from 2025 to 2030. In Sweden, the light (2 mg/pouch) strength nicotine pouches are anticipated to grow at a CAGR of 35.3% from 2025 to 2030 due to the increasing preference for lower nicotine doses among users who are more health-conscious or seeking a less intense nicotine experience. With a strong tradition of tobacco harm reduction in Sweden, many users are choosing lighter options as a gradual step away from smoking or stronger nicotine products. Additionally, younger generations, who are more inclined toward moderate nicotine use, are driving the demand for these milder products. The regulatory landscape in Sweden, which promotes smoking alternatives, also encourages the adoption of these lighter strengths.

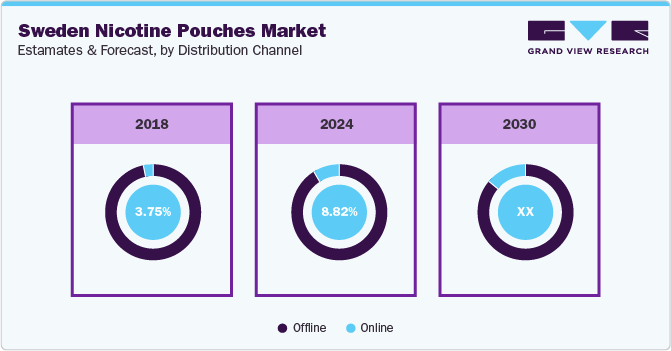

Distribution Channel Insights

Sales of nicotine pouches through offline channels accounted for a revenue share of 91.18% in 2024. due to the well-established retail infrastructure that supports easy access to these products. Sweden has a strong network of convenience stores, gas stations, and specialized tobacco shops, where nicotine pouches are widely available. The country's regulatory framework also ensures that nicotine pouches are sold predominantly through licensed retailers, making offline channels the most convenient and reliable purchasing option for Swedish consumers. Additionally, Swedes have a preference for purchasing products in person, where they can receive immediate access to their purchases and explore various brands and nicotine strengths.

Sales of nicotine pouches through online channels are expected to grow with a CAGR of 45.6% from 2025 to 2030. Swedish consumers are increasingly embracing e-commerce for convenience, especially for purchasing nicotine products. Online platforms offer greater access to a wider range of brands, flavors, and nicotine strengths that may not be available in physical stores. Additionally, the ease of online shopping, coupled with Sweden’s high digital penetration, makes it a preferred choice for many consumers. As regulations around online sales become clearer and more streamlined, this growth is further supported by the desire for discreet and hassle-free purchases.

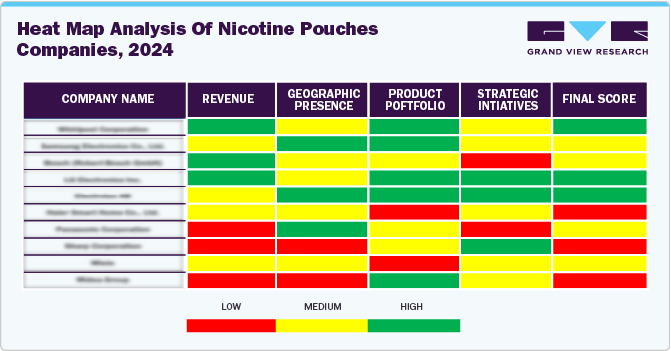

Key Brands & Market Share Insights

The nicotine pouch industry in Sweden is driven by a mix of established tobacco giants and specialized brands focused on smokeless nicotine alternatives. These companies lead the market by utilizing strong brand recognition, innovative product offerings, and extensive distribution networks.

As consumer demand for discreet, tobacco free nicotine products grows, the industry has become increasingly competitive, with major players continually enhancing product strength, flavor variety, and overall user experience.

With continued market growth, both global and emerging local brands are expected to compete for market share, targeting health-conscious individuals and those looking to reduce or quit traditional smoking.

Key Sweden Nicotine Pouches Companies:

- Swedish Match

- Fiedler & Lundgren

- British American Tobacco

- Imperial Brands

- Japan Tobacco International (JTI)

- Altria Group

- Skruf Snus

- Nicotine River

- Scandinavian Tobacco Group (STG)

Recent Developments

- In May 2024, Scandinavian Tobacco Group (STG) announced its entry into the next-generation nicotine category with the launch of XQS pouches. Created in Sweden, the birthplace of nicotine pouches, this new product line will be available to retailers starting this month at a competitive price of USD 7.11 (£5.50). XQS will be offered in four flavors-Tropical, Blueberry Mint, Cool Ice, and Arctic Freeze-with a range of strengths. All variants come in fully recyclable packaging and feature uniquely smaller pouches designed for a perfect fit under the lip.

Sweden Nicotine Pouches Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 641.8 million |

|

Revenue forecast in 2030 |

USD 2.93 billion |

|

Growth rate |

CAGR of 35.4% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, favor, strength, distribution, channel |

|

Key companies profiled |

Swedish Match; Fiedler & Lundgren; British American Tobacco; Imperial Brands; Japan Tobacco International (JTI); Altria Group; Skruf Snus; Nicotine River; and Scandinavian Tobacco Group (STG) |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Sweden Nicotine Pouches Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Sweden nicotine pouches market report based on the product, flavor, strength, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tobacco derived

-

Synthetic

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Original/Unflavored

-

Flavored

-

Mint

-

Fruit

-

Coffee

-

Cinnamon

-

Other Flavors

-

-

-

Strength Outlook (Revenue, USD Million, 2018 - 2030)

-

Light (2 mg/pouch)

-

Normal (3 mg/pouch)

-

Strong (46 mg/pouch)

-

Extra Strong (More than 8 mg/pouch)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The Sweden nicotine pouches market size was estimated at USD 475.8 million in 2024 and is expected to reach USD 641.8 billion in 2025.

b. The Sweden nicotine pouches market is expected to grow at a compounded growth rate of 35.4% from 2024 to 2030 to reach USD 2.93 billion by 2030.

b. Tobacco-derived nicotine pouches accounted for a revenue share of 98.36% in 2024, due to the country's strong preference for traditional tobacco-based products, coupled with the historical success of Swedish snus.

b. Some key players operating in the market include Swedish Match ; Fiedler & Lundgren; British American Tobacco; Imperial Brands; Japan Tobacco International (JTI); Altria Group; Skruf Snus; Nicotine River; and Scandinavian Tobacco Group (STG)

b. The market is expected to grow rapidly due to the increasing popularity of alternative nicotine products, as consumers seek less harmful options compared to traditional smoking. The growing trend of health-consciousness and smoking cessation is driving demand for nicotine pouches.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."