- Home

- »

- Medical Devices

- »

-

Surgical Sutures Market Size & Share, Industry Report, 2030GVR Report cover

![Surgical Sutures Market Size, Share & Trends Report]()

Surgical Sutures Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Absorbable, Nonabsorbable), By Filament (Monofilament, Multifilament), By Application (General Surgery, Cardiovascular Surgery), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-683-7

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Sutures Market Summary

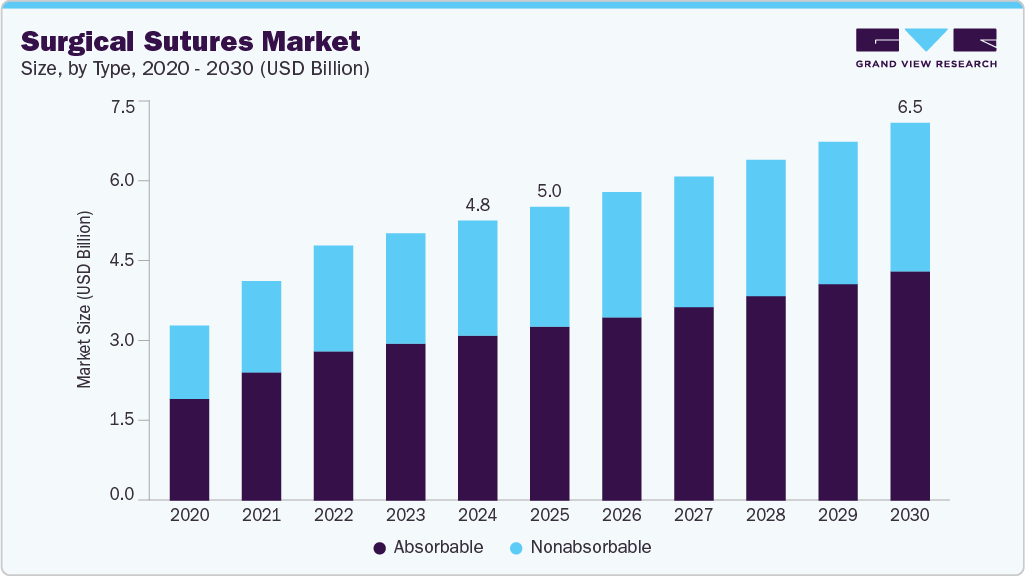

The global surgical sutures market size was estimated at USD 4,787.0 million in 2024 and is projected to reach USD 6,459.4 million by 2030, growing at a CAGR of 5.2% from 2025 to 2030. The market's growth is anticipated to be driven by increased surgical procedures and advancements in materials and technologies, including smart and antibacterial sutures.

Key Market Trends & Insights

- North America surgical sutures industry held the largest share of 44.8% of the global market in 2024.

- The surgical sutures industry in U.S. is expected to register the significant CAGR from 2025 to 2030.

- By type, the absorbable segment held the largest market share of 59.0% in 2024.

- By filament, the multifilament segment held the largest market share in 2024.

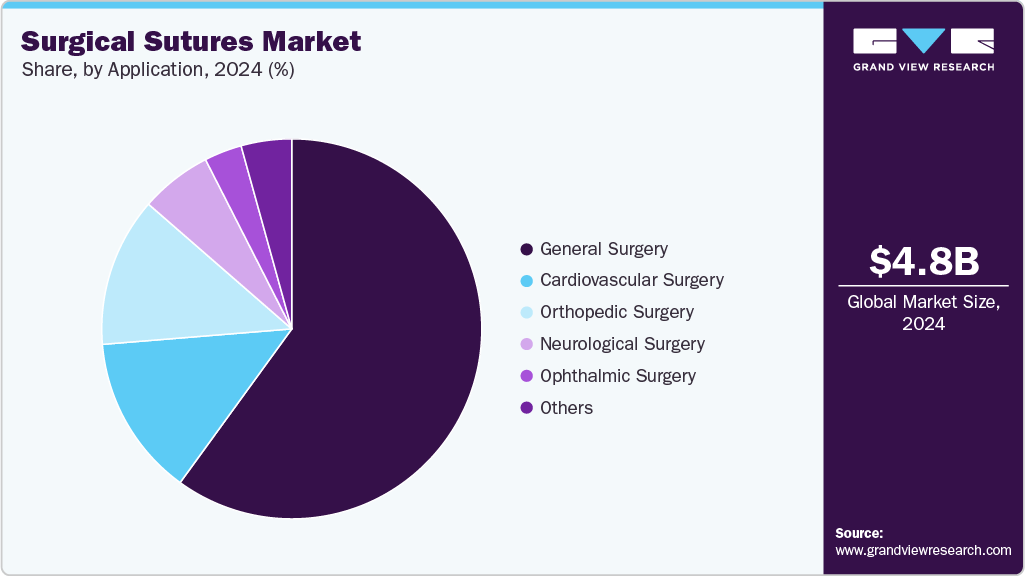

- By application, the general surgery segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4,787.0 Million

- 2030 Projected Market Size: USD 6,459.4 Million

- CAGR (2025-2030): 5.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, the development of healthcare infrastructure worldwide is boosting the demand for surgical sutures. The demand for wound closure products is rising owing to the growing number of surgical cases and the increasing prevalence of chronic wounds across the globe. According to the data published by Onenessbio in May 2025, approximately 6.3% of adults with diabetes worldwide suffer from diabetic foot ulcer (DFU). Such a burden of chronic wounds is anticipated to propel the demand for wound closure devices in the coming years. In addition, the rising incidence of road and traffic accidents worldwide is expected to drive the growth of the wound closure devices market significantly.Traffic-related injuries often result in severe wounds and trauma that require surgical intervention and effective wound management. According to the Global Road Safety Facility (GRSF) Annual Report 2024, road crashes claim approximately 1.19 million lives each year and lead to countless severe injuries and long-term disabilities globally. This alarming rate of injuries creates a substantial demand for advanced wound closure solutions. As the burden of traumatic injuries increases, healthcare providers and surgical centers are increasingly seeking reliable and efficient wound closure products to improve patient outcomes and reduce recovery times. Therefore, the growing prevalence of traffic-related injuries is expected to be a key driver supporting the expansion of the wound closure devices market in the coming years.

The growing number of surgical procedures worldwide is a significant factor driving the expansion of the surgical sutures industry. According to data published by Wellcome Leap Inc. in June 2024, approximately 313 million surgeries are performed annually across the globe. An estimated 143 million more procedures are also needed yearly to meet essential healthcare needs, particularly in low-resource regions. Most traumatic or surgical wounds require skin closure of some kind. Generally, this closure is done by suturing. Therefore, the rising demand for surgical interventions is expected to fuel the growth of surgical sutures in the coming years.

Common surgeries, including cataract operations, corneal transplantation (keratoplasty), and orthopedic procedures like total knee replacements, require surgical sutures. According to data published by the Cleveland Clinic, in October 2025, approximately 185,000 cornea transplant (keratoplasty) surgeries were conducted annually worldwide. As surgical activity continues to rise worldwide, the need for reliable surgical suture solutions is expected to grow accordingly.

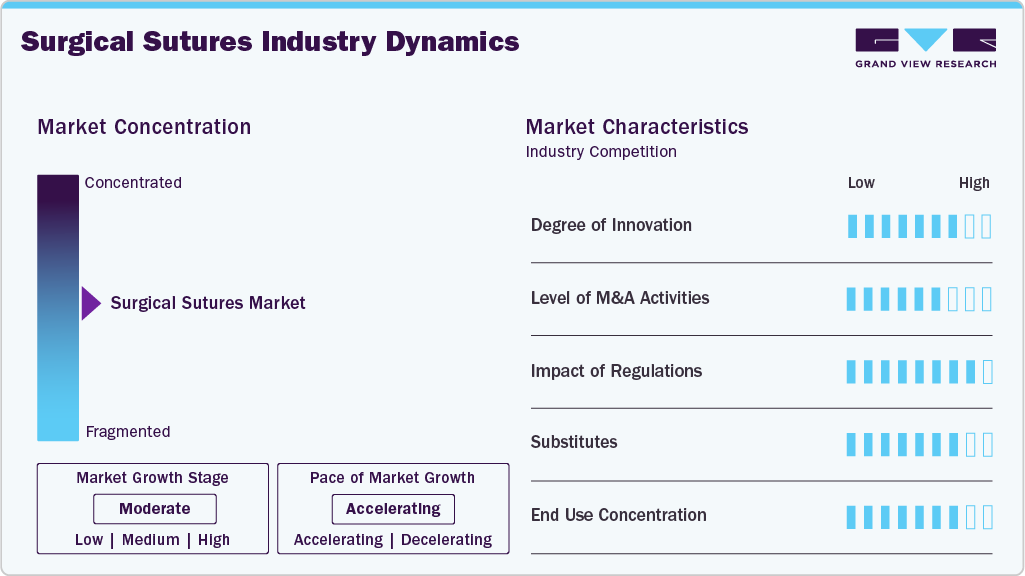

Market Concentration & Characteristics

The market growth stage is moderate and the pace of the market growth is accelerating due to advancements in medical technology and materials used in sutures, which have led to enhanced product efficacy, driving product adoption and demand. Furthermore, the rising prevalence of chronic diseases and age-related ailments necessitating surgical interventions, coupled with a growing global population, contributes significantly to the expanding market.

The level of merger and acquisition (M&A) activity in the market is increasing as companies merge and acquire each other to increase their market share, offer a wider range of products, and gain access to innovative technologies and specialty materials for sutures. These mergers and acquisitions also allow companies to work together more effectively, run their businesses more efficiently, and improve their distribution networks, ultimately making them stronger competitors.

Regulations governing the surgical sutures industry are overseen by health authorities and regulatory bodies within respective countries or regions. Agencies like the FDA in the U.S., the European Medicines Agency (EMA) in the European Union, and other analogous regulatory bodies globally play a crucial role in setting standards, monitoring, and approving surgical sutures. These regulatory entities ensure that sutures meet stringent safety, quality, and efficacy standards before being marketed and used in medical procedures.

Alternative methods for closing wounds are becoming more popular in the medical field. These methods serve the same purpose as traditional sutures, including adhesive tissue sealants, staples, tapes, and hemostats. Adhesive tissue sealants create a bond between tissue surfaces, reducing the need for traditional sutures in certain procedures. Staples are used instead of sutures for closing larger incisions or wounds, providing rapid closure, but may cause more tissue trauma. These alternatives offer numerous benefits, such as being cost-effective, time-efficient, and producing optimal cosmetic results.

Companies in the market are looking to grow in new areas by teaming up with local distributors or manufacturers, forming strategic alliances, or establishing subsidiaries or offices in target regions. This expansion strategy allows them to reach untapped markets and exploit the increasing demand for surgical sutures. These partnerships and local connections can significantly facilitate international expansion by providing valuable insights into the target market, distribution channels, and customer preferences. Researchers from the National Autonomous University of Mexico (UNAM) in 2024 developed a highly stable, positively charged nanosilver coating for silk sutures to combat surgical-site infections, which account for over 20% of healthcare-related infections.

Type Insights

The absorbable segment dominated the market with the largest revenue share of 59.0% in 2024 and is expected to record the fastest CAGR over the forecast period. The demand for absorbable sutures is continuously rising due to their ability to temporarily support wounds until they heal and can withstand normal stress. In addition, absorbable sutures can degrade naturally, making them a preferred choice. The composition of absorbable sutures plays a significant role in their market dominance. These sutures are made from natural material, such as catgut, or synthetic polymers, including polyglycolic acid, polylactic acid, and polydioxanone. The body enzymatically breaks down natural sutures, while synthetic variants undergo hydrolytic degradation. This gradual absorption ensures that the sutures provide adequate tissue support during the critical healing period and are fully absorbed without requiring removal, thereby reducing patient discomfort and the risk of infection. In July 2025, Corza Medical expanded its Onatec Ophthalmic Suture Portfolio, offering nearly 130 products designed exclusively for delicate ophthalmic and oculoplastic surgeries. The portfolio includes absorbable and non-absorbable sutures made from highly tempered stainless steel.

The nonabsorbable segment is projected to grow at a significant CAGR of 4.4% over the forecast period, due to its long-lasting nature and sustained demand for various surgical procedures. Their durability and effectiveness drive this rise in popularity, which helps contribute to their lucrative expansion within the market.

Filament Insights

The multifilament segment held the largest market revenue share in 2024. This can be attributed to the advantages associated with multifilament, such as better compliance, high tensile strength, and flexibility.

The monofilament segment is projected to grow at the fastest CAGR over the forecast period. Its single-strand design offers reduced tissue trauma and better handling characteristics during surgeries. The increasing preference for monofilament sutures is attributed to their decreased risk of infection and tissue reaction, contributing significantly to their expanding market share.

Application Insights

The general surgery segment held the largest share in the market in 2024, driven by the widespread use of surgical sutures as a therapeutic agent to prevent and treat thromboembolic disorders. This segment includes plasma-derived and recombinant surgical sutures products, essential in managing hereditary surgical sutures deficiency, deep vein thrombosis, and complications during major surgeries.

The cardiovascular segment is anticipated to register the fastest growth over the forecast period, due to the high incidence of cardiac diseases, sufficient experts in the field, supportive reimbursement scenarios, and advanced diagnostics. According to the report, “Global Cardiac Surgical Volume and Gaps: Trends, Targets, and Way Forward”, published in Annals of Thoracic Surgery Short Reports in 2024, high-income countries performed an average of 123.2 cardiac surgical procedures per 100,000 people annually. When adjusted for cardiovascular disease burden, recommended annual volumes are 86.1 per 100,000 for upper-middle-income countries, 55.1 for lower-middle-income countries, and 40.2 for low-income countries. These targets are intended to guide the planning and scaling up of cardiac surgical capacity in alignment with population needs and universal health coverage goals.

Regional Insights

North America surgical sutures market dominated the global market for surgical sutures and accounted for 44.8% share in 2024, owing to the strong presence of major local and international companies, which led to the development of innovative products and extensive distribution networks. In addition, the relatively higher cost of sutures compared to other regions, supportive reimbursement policies, and government healthcare programs created a favorable environment for sustained market growth.

U.S. Surgical Sutures Market Trends

The U.S. surgical sutures industry accounted for the largest share in North America in 2024. This is due to strong healthcare infrastructure, extensive research and development activities, and the presence of major healthcare players and manufacturers within its borders. In addition, the U.S. healthcare system's emphasis on innovation, high healthcare expenditures, and favorable reimbursement policies further help its prominent share in the market. The U.S. has an increasing geriatric population, which is more prone to chronic conditions requiring surgical intervention. Older adults often require procedures for cardiovascular, orthopedic, and ophthalmic issues, which drives consistent demand for high-quality sutures. As the elderly population rises, the market sees a sustained need for surgical sutures capable of delivering reliable performance in delicate or complex surgeries, fueling overall market growth.

Europe Surgical Sutures Market Trends

The Europe surgical sutures industry is expected to witness steady growth in the coming years, driven by the increasing number of surgical procedures due to the rising prevalence of chronic diseases, an aging population, and the expansion of healthcare infrastructure across the region. Technological advancements, such as antimicrobial-coated, biodegradable, and precision sutures for robotic-assisted surgeries, enhance patient outcomes and reduce post-operative complications. Additionally, the growing adoption of minimally invasive and robotic-assisted surgeries is boosting the demand for advanced suturing solutions that offer greater efficiency and accuracy.

Asia Pacific Surgical Sutures Market Trends

Asia Pacific surgical sutures industry is projected to grow at the fastest CAGR of 8.3% over the forecast period due to the rising prevalence of chronic diseases, increasing surgical procedures, and expanding healthcare infrastructure across the region. Countries such as China, India, Japan, and South Korea are experiencing a surge in surgeries related to cardiovascular disorders, orthopedic interventions, ophthalmic procedures, and general surgery, driving demand for reliable wound closure solutions. The growing awareness about minimally invasive and advanced surgical techniques and rising patient awareness further contribute to market expansion.

The surgical sutures industry in India is expected to witness significant growth in the coming years. India’s market for surgical sutures is witnessing strong growth due to the rising number of surgical procedures and the increasing prevalence of chronic diseases. Conditions such as diabetes, cardiovascular diseases, and cancer are leading to a higher demand for surgeries, including tumor resections, organ transplants, and cardiovascular interventions. Surgical sutures remain essential in these procedures for wound closure, tissue repair, and ensuring proper healing.

The Japanese surgical sutures industry is primarily driven by the country’s rapidly aging population. As of September 2024, 29.3% of Japan’s population is aged 65 and older, the highest proportion globally. The geriatric population is more susceptible to chronic wounds, complications from underlying diseases, and slower recovery post-surgery, leading to increased hospitalizations and surgical interventions. This demographic trend significantly boosts the demand for reliable and advanced surgical sutures to ensure effective wound closure and minimize post-operative complications.

China’s surgical sutures industry is experiencing significant growth, largely driven by demographic trends. The country’s rapidly aging population is contributing to a higher prevalence of chronic diseases such as cardiovascular conditions, diabetes, and other age-related health issues, which often require surgical interventions. This increase in surgery demand directly fuels the need for absorbable and non-absorbable surgical sutures across hospitals and specialty clinics.

Latin America Surgical Sutures Market Trends

The Latin American surgical sutures industry is experiencing steady growth, primarily driven by increasing surgical procedures across the region. The rising prevalence of chronic diseases such as cardiovascular conditions, diabetes, and obesity has led to a higher demand for surgeries, thereby boosting the need for surgical sutures. Advancements in suture technology, including developing absorbable and specialized sutures, have improved surgical outcomes and safety, further supporting market expansion. Additionally, investments in healthcare infrastructure and improved access to surgical services have facilitated greater adoption of sutures across hospitals and clinics, collectively contributing to the market’s growth trajectory.

Key Surgical Sutures Company Insights

Some key companies in the market include Medtronic; Ethicon US, LLC.; B. Braun SE.; and others. Key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

B.Braun operates through three key divisions: Hospital Care, which focuses on infusion therapy, nutrition therapy, and pain management; Aesculap, specializing in surgical and interventional therapy solutions; and Avitum, which covers infection prevention, extracorporeal blood treatments, wound, stoma, and continence care. B. Braun offers a range of advanced wound care solutions, including Askina Calgitrol silver dressings, available in multiple forms to suit various wound care needs.

-

Stryker provides innovative products and services across MedSurg, Neurotechnology, Orthopaedics, and Spine that aim to enhance patient outcomes and overall healthcare quality. In 2023, Stryker witnessed an organic sales growth of over 11%.

Key Surgical Sutures Companies:

The following are the leading companies in the surgical sutures market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Stryker

- Smith+Nephew

- Ethicon (Johnson & Johnson)

- B. Braun SE

- Riverpoint Medical

- Dynarex Corporation

- Healthium Medtech Ltd

- Lotus Surgicals Pvt Ltd (TI Medical, a Murugappa Group company)

- DemeTECH Corporation

Recent Developments

-

In July 2025, Smith+Nephew announced the launch of its Q-FIX KNOTLESS All-Suture Anchor, designed for soft tissue-to-bone fixation across various joint areas, including shoulder, hip, and foot and ankle.

-

In July 2024, Corza Medical announced the successful acquisition of the TachoSil manufacturing operations in Linz, Austria, previously announced, integrating it into Takeda’s global production network. TachoSil is a world-renowned surgical patch trusted by healthcare professionals worldwide.

-

In August 2023, Riverpoint Medical invested USD 10 million in a new manufacturing facility in the Coyol Free Trade Zone in Alajuela, Costa Rica. This strategic expansion aligns with the company’s goal of leveraging Costa Rica’s growing prominence as a hub for medical device manufacturing. The facility initially covers 4,000 square meters, featuring two certified clean rooms dedicated to producing absorbable and non-absorbable orthopedic sutures.

Surgical Sutures Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,023.0 million

Revenue forecast in 2030

USD 6,459.4 million

Growth rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, filament, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Sweden; Denmark; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Medtronic; Stryker; Smith+Nephew; Ethicon (Johnson & Johnson); B. Braun SE; Riverpoint Medical; Dynarex Corporation; Healthium Medtech Ltd; Lotus Surgicals Pvt Ltd (TI Medical, a Murugappa Group company); DemeTECH Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Surgical Sutures Market Report Segmentation

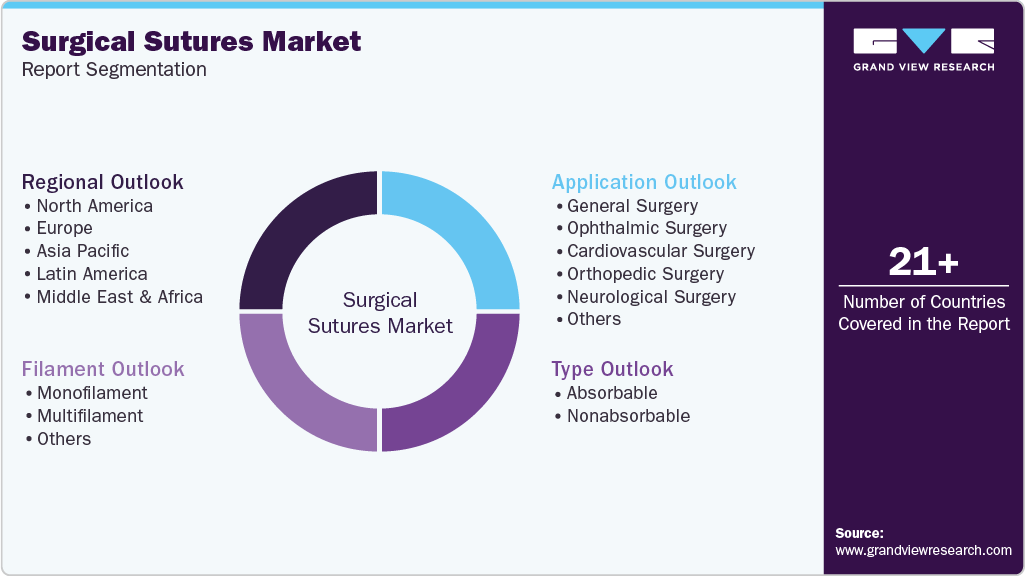

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surgical sutures market report based on type, filament, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Absorbable

-

Nonabsorbable

-

-

Filament Outlook (Revenue, USD Million, 2018 - 2030)

-

Monofilament

-

Multifilament

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Surgery

-

Ophthalmic Surgery

-

Cardiovascular Surgery

-

Orthopedic Surgery

-

Neurological Surgery

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.