- Home

- »

- Medical Devices

- »

-

Surgical Lights Market Size, Share & Trends Report, 2030GVR Report cover

![Surgical Lights Market Size, Share & Trends Report]()

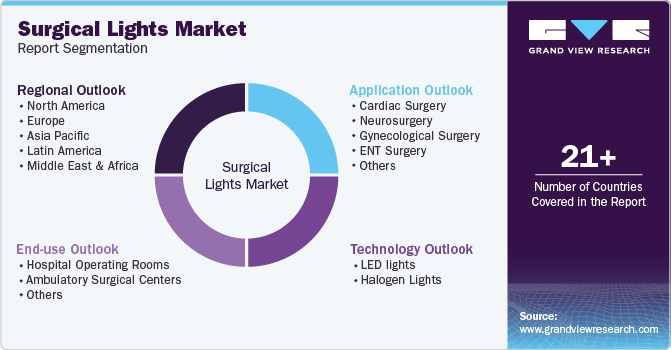

Surgical Lights Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (LED lights, Halogen Lights), By Application (Cardiac Surgery, Neurosurgery, Gynecological Surgery, ENT Surgery), By End-use, By Region And Segment Forecasts

- Report ID: GVR-3-68038-799-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Lights Market Summary

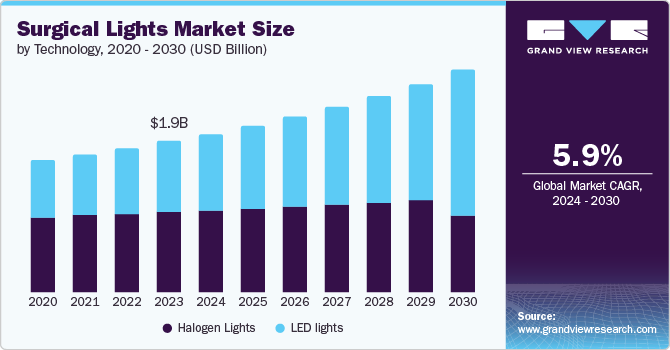

The global surgical lights market size was valued at USD 1.85 billion in 2023 and is projected to reach USD 2.74 billion by 2030, growing at a CAGR of 5.9% from 2024 to 2030. The surge in the number of hospitals, aging population, and prevalence of lifestyle diseases are some of the factors driving the growth. Developing healthcare infrastructure is expected to further fuel the market.

Key Market Trends & Insights

- North America surgical lights market dominated the market in 2023.

- The U.S. surgical lights market dominated the North America market in 2023.

- By technology, the halogen lights segment accounted for the largest market share of 53.5% in 2023

- By application, the cardiac surgery segment accounted for significant market share in 2023.

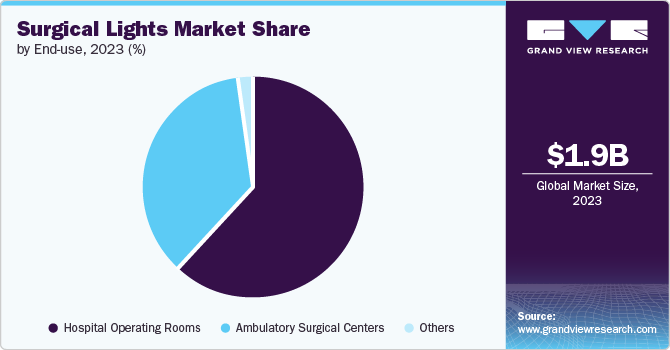

- By end use, the hospital operating rooms segment dominated the market and accounted for the largest share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.85 Billion

- 2030 Projected Market Size: USD 2.74 Billion

- CAGR (2024-2030): 5.9%

- North America: Largest market in 2023

The development of new hospitals and clinics are propelling the demand for surgical lights and other medical equipment. A rise in regulatory approvals for operating room equipment coupled with a rising focus on offering better patient care across different healthcare facilities is expected to drive the demand for surgical lights.

Factors, such as rising product availability, high demand for well-equipped operating rooms by healthcare professionals and surgeons, and accessibility of healthcare facilities, especially in emerging economies are projected to further propel the growth of the market for surgical lights. The rising number of hospitals in developing countries along with an increasing acceptance of advanced LED surgical lights are the major factors driving the growth of the surgical lights market. Besides, the initiatives are taken by the Indian and Chinese governments to offer improved healthcare, subsidies to organizations for investments in medical facilities, and increasing investments in various healthcare institutions are among the major factors driving the market growth.

Technology Insights

The halogen lights segment accounted for the largest market share of 53.5% in 2023 due to easy and widespread availability. The reduction in cost due to the use of halogen lights is one of the key drivers contributing to the market growth. The consistent light output offered by halogen lights along with great color accuracy, which is important for precise tissue visualization in surgical procedures is driving the demand in the market.

The LED lights segment is expected to register the fastest CAGR of 11.6% during the forecast period. LED lights consume less power as compare to other lights, resulting in notable cost reductions for healthcare facilities. These lights possess an extended operational lifespan, resulting in less downtime and decreased maintenance expenses. The superior color rendering index offered by LED lights that allows precise color representation of tissues, encourages its market growth in the market.

Application Insights

The cardiac surgery segment accounted for significant market share in 2023. These surgeries are complex in nature that involves intricate procedures, demanding high levels of visibility and precision. According to a study published on the National Library of Medicine, it is estimated that approximately 300,000 cardiac procedures are performed each year in India. There is a significantly greater demand. The adjustable color temperature offered by the surgical lights helps in procuring positive and feasible results. The rise in minimally invasive cardiac procedures requires specialized lighting systems for optimal illumination in small spaces is also fueling the market growth.

The neurosurgery segment is projected to grow at significant CAGR over the forecast period.

The increasing number of elderly people face a higher risk of developing neurological disorders such as brain tumors, Alzheimer’s, and Parkinson’s. According to Cancer Research UK, there are 12,700 new cases of brain, other CNS, and intracranial tumors are diagnosed annually, averaging 35 cases per day between 2017 and 2019. The surgical lights enhance results by reducing errors and minimizing post - surgery problems. These are some of the factors attributing to the segment growth.End-use Insights

The hospital operating rooms segment dominated the market and accounted for the largest share in 2023. The rising interest of the hospitals in upgrading the Operation Rooms (ORs) is expected to boost the market growth. Moreover, the increase in number of patients who require surgery interventions is leading to an increased demand for hospital operating rooms. The increasing demand for advanced and hybrid ORs and growing investments in infrastructure to improve treatment facilities is driving the growth of this segment.

The ambulatory surgical centers segment is expected to register the fastest CAGR during the forecast period. The outpatient surgery centers are in great demand due to their excellent healthcare services, prompt discharge and cost-effective treatment, when compared to hospitals. The rising expenditure on healthcare infrastructure and the increasing demand for healthcare services is fueling the market growth. It offers affordable services and a convenient environment which is better than the options available at most of the hospitals.

Regional Insights

North America surgical lights market dominated the market in 2023. The region has a strong network of hospitals, ambulatory surgical centers, and clinics that have advanced medical technology. According to the Definitive Healthcare, there are nearly 9,100 active ambulatory surgical centers in U.S. The significant investments in medical research and development is also attributing to the market growth in this region.

U.S. Surgical Lights Market Trends

The U.S. surgical lights market dominated the North America market in 2023 due the emergence of several medical research and development centers in the region facilitating the growth of surgical lighting market. The growing medical infrastructure is driving the demand for medical equipment such as surgical lights. According to American Hospital Association, there are 6,120 hospitals in the U.S.

Europe Surgical Lights Market Trends

The Europe surgical lights market was identified as a lucrative region in 2023 due to the rise in geriatric population and increasing prevalence of chronic diseases among them. The UK surgical lights market is expected to grow rapidly in the coming years due to the development of new hospitals and clinics, which require the need for medical equipments such as surgical lights. The growing technology in surgical lights is contributing to market growth.

Asia Pacific Surgical Lights Market Trends

Asia Pacific surgical lights market anticipated to witness significant growth in the coming years. The increased investment in healthcare infrastructure in Asia Pacific region is necessitating the demand for surgical lightings. Additionally, the growing awareness about the advanced surgical technologies is leading to rise in number of surgeries taking place in the region.

The China surgical lights market is expected to grow rapidly in the coming years. The rising surgical procedures are fueling the market growth. The accurate lighting in OR enhances the staff performance in surgery and results in lower chances of complications, driving the growth of surgical lighting in China.

Key Surgical Lights Company Insights

Some key companies in surgical lights market include STERIS, A-dec Inc., SKYTRON, LLC, Herbert Waldmann GmbH & Co. KG, and others. The key players focuses onimplementing different growth strategies like forming partnerships, expanding their product offerings, among other approaches, developing new and innovative products, and engaging in mergers and acquisitions.

-

BihlerMed is known for its lighted medical equipment and medical manufacturing. The organization has access to advanced assembly and manufacturing automation solutions for medical devices.

Key Surgical Lights Companies:

The following are the leading companies in the surgical lights market. These companies collectively hold the largest market share and dictate industry trends.

- STERIS

- A-dec Inc.

- CV Medica

- BihlerMed

- SKYTRON, LLC

- Herbert Waldmann GmbH & Co. KG

- Getinge

- INTEGRA LIFESCIENCES

- S.I.M.E.O.N. Medical GmbH & Co. KG

- Baxter

Recent Developments

-

In January 2024, Getinge launched easy-to-use and robust surgical light, Maquet Ezea. This surgical light is suitable for a variety of settings such as general operating rooms, outpatient treatment rooms, intensive care units, and emergency departments.

-

In Julu 2021, MezLight LLC announced the launch of surgical lighting system to provide sterile, reusable and bright solution for focused lights to the surgeons.

Surgical Lights Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.94 billion

Revenue forecast in 2030

USD 2.74 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; and South Africa

Key companies profiled

STERIS; A-dec Inc.; CV Medica; BihlerMed; SKYTRON, LLC; Herbert Waldmann GmbH & Co. KG; Getinge ; INTEGRA LIFESCIENCES; S.I.M.E.O.N. Medical GmbH & Co. KG; Baxter

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Lights Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surgical lights market report based on technology, application, end-use and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

LED lights

-

Halogen Lights

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac Surgery

-

Neurosurgery

-

Gynecological Surgery

-

ENT Surgery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Operating Rooms

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.