- Home

- »

- Medical Devices

- »

-

Surgical Helmet Market Size & Share, Industry Report, 2030GVR Report cover

![Surgical Helmet Market Size, Share & Trends Report]()

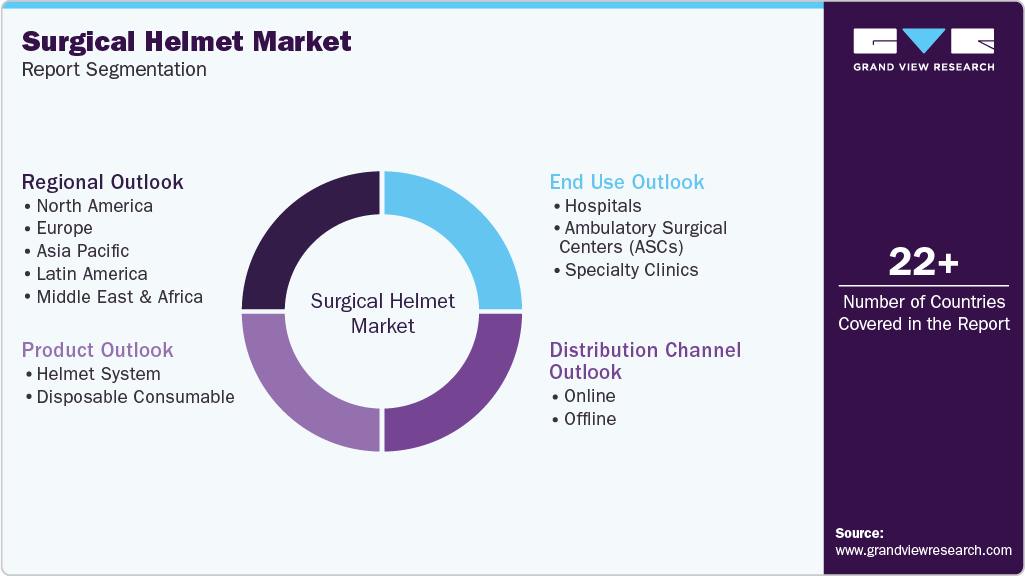

Surgical Helmet Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Helmet System, Disposable Consumables), By End Use (Hospitals, Specialty Clinics, Ambulatory Surgical Centers), By Distribution Channel, By Region, And Forecasts

- Report ID: GVR-4-68040-488-6

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Helmet Market Summary

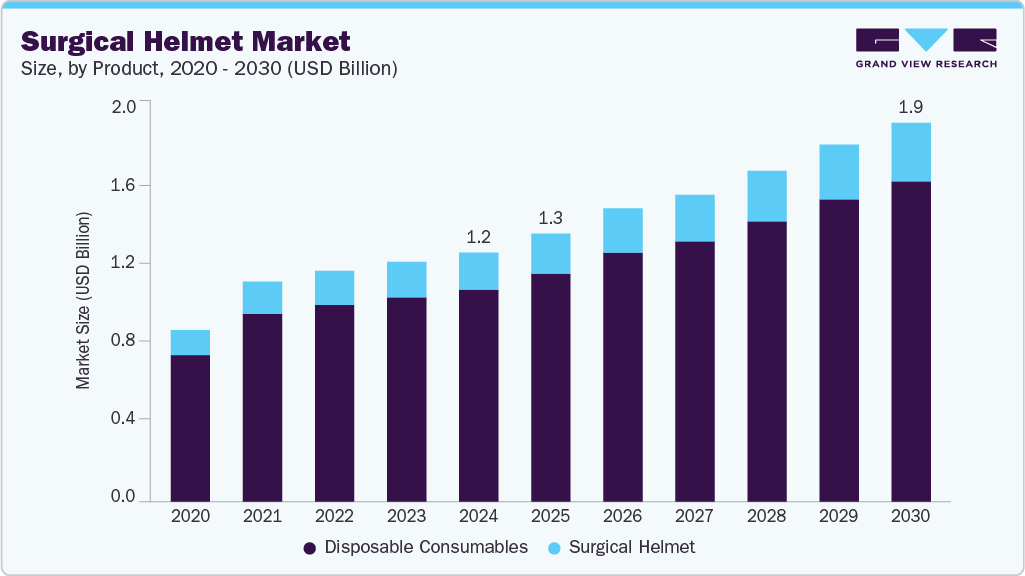

The global surgical helmet market size was estimated at USD 1.23 billion in 2024 and is projected to reach USD 1.87 billion by 2030, growing at a CAGR of 7.16% from 2025 to 2030. The growth can be attributed to increasing awareness of surgical site infections, rising demand for personal protective equipment in operating rooms, and the growing number of complex surgical procedures globally.

Key Market Trends & Insights

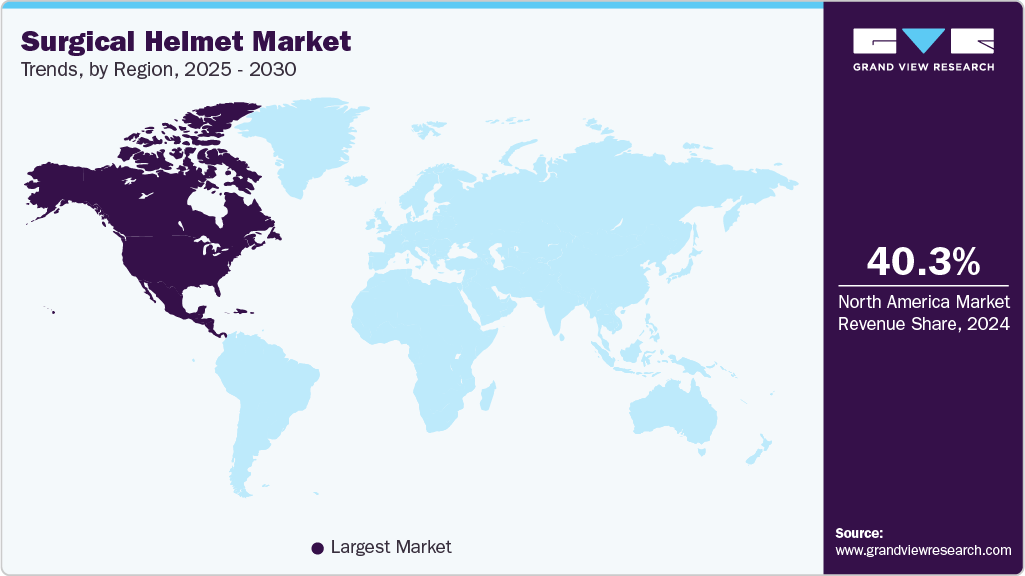

- North America held the largest revenue share of 40.31% in the market in 2024.

- By product, the disposable consumables segment dominated the market and accounted for the largest revenue share of 85.10% in 2024.

- By distribution channel, the offline segment dominated the market and accounted for the largest revenue share in 2024.

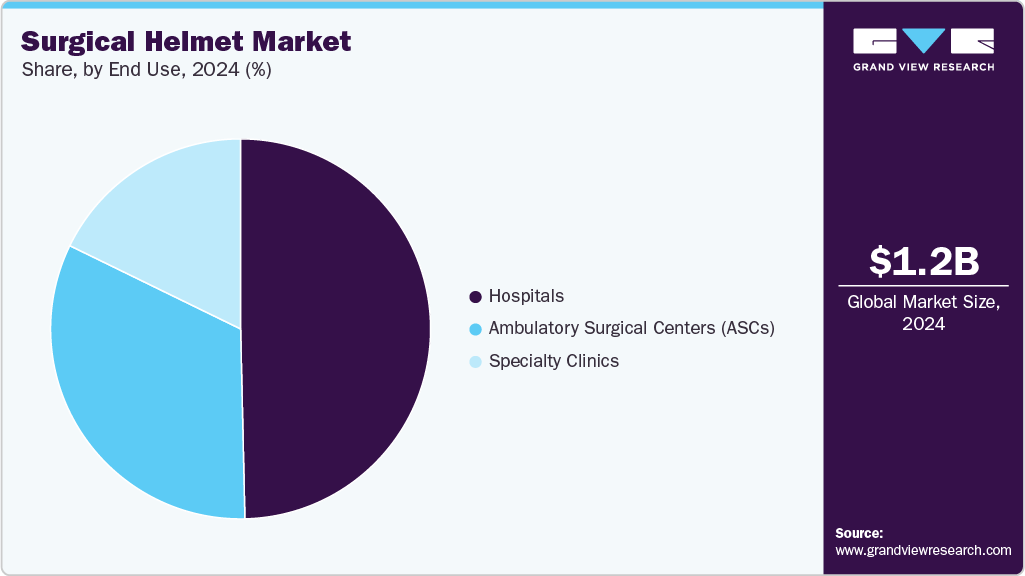

- By end use, the hospital segment is expected to dominate the market, accounting for the largest revenue share of 49.64% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.23 Billion

- 2030 Projected Market Size: USD 1.87 Billion

- CAGR (2025-2030): 7.16%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additional drivers include advancements in helmet technology, such as integrated ventilation and communication systems, stricter infection control regulations, and an expanding aging population requiring more orthopedic and joint replacement surgeries. Furthermore, the increasing incidence of road accidents leading to trauma cases that require surgical intervention is also contributing to the rising demand for surgical helmets. According to the International Transport Forum, in 2023, Mexico recorded a provisional total of 16,662 road fatalities, a 4.2% increase from the 15,986 deaths reported in 2022.In addition, data released by Transport Canada in May 2024 reveals that in 2022, there were 1,931 motor vehicle fatalities, marking a 6.0% increase from 2021 (1,821) and the second-highest number recorded in the past decade. The total number of injuries also rose to 118,853 in 2022, a 9.5% increase compared to 108,552 in 2021. The rise in road accidents is expected to result in a higher incidence of orthopedic injuries, which is anticipated to drive the demand for surgical helmets in the forecast years.

Several government authorities are working to prevent infection due to the increasing burden of healthcare-associated infections and increasing investments in PPEs, including surgical helmets. For instance, in November 2024, a new report on infection prevention and control by the WHO highlighted the need for sustained investment in infection prevention and control programs. IPC guidelines emphasize standard precautions to prevent the transmission of diseases in healthcare settings. Thus, such guidelines and a rising focus on infection control and prevention are anticipated to drive the demand for surgical helmets.

“WHO is committed to supporting countries to ensure that by 2030, everyone accessing and providing health care is safe from HAIs. Fulfilling all IPC minimum requirements at the national and healthcare-facility levels should be a priority for all countries, to protect patients and health-care workers, and prevent unnecessary suffering”. said Dr Bruce Aylward, WHO Assistant Director-General, Universal Health Coverage, Life Course.

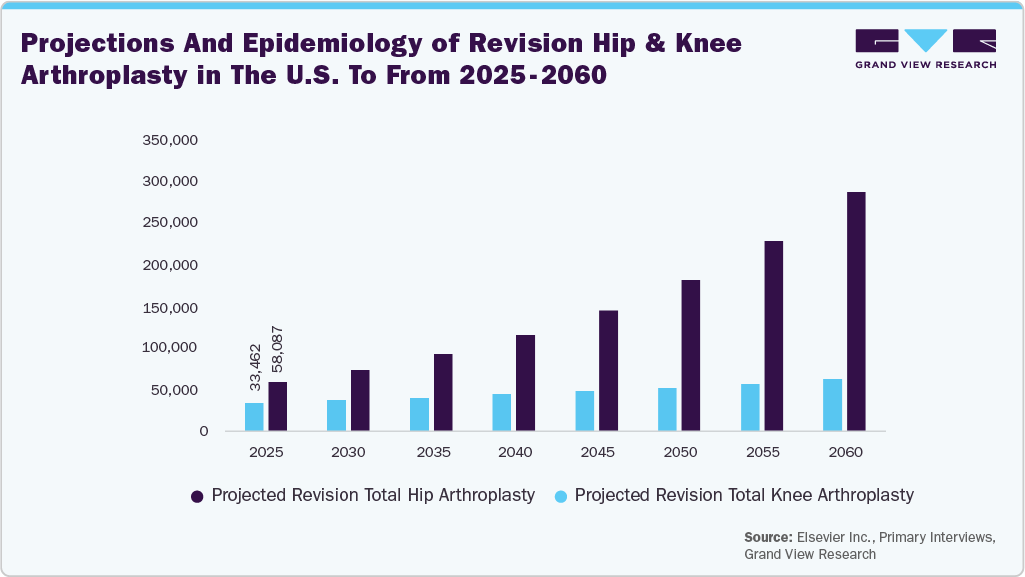

Furthermore, the growing number of orthopedic procedures are anticipated to drive the demand for surgical helmets over the forecast period. An article published by the American College of Rheumatology in February 2024 reports that approximately 790,000 total knee replacements and 544,000 hip replacements are performed annually in the U.S., with these figures continuing to rise as the population ages.

The rising incidence of orthopedic surgeries, particularly joint replacement procedures such as hip and knee arthroplasties, is expected to drive significant demand for surgical helmets in the coming years. As joint replacement surgeries become more common due to an aging population and the increasing prevalence of conditions such as osteoarthritis, the need for effective personal protective equipment, including surgical helmets, grows. Surgical helmets play a vital role in ensuring both patient and surgeon safety by maintaining a sterile environment and protecting the surgical team from potential hazards. The joint replacements often involve complex and precision-driven surgeries, surgical helmets are essential for providing clear visibility, reducing fatigue, and enhancing overall performance in the operating room. As a result, the steady rise in joint replacement procedures is anticipated to contribute to sustained growth in the surgical helmet market as hospitals and surgical centers demand high-quality protective surgical helmets to meet both safety and operational needs.

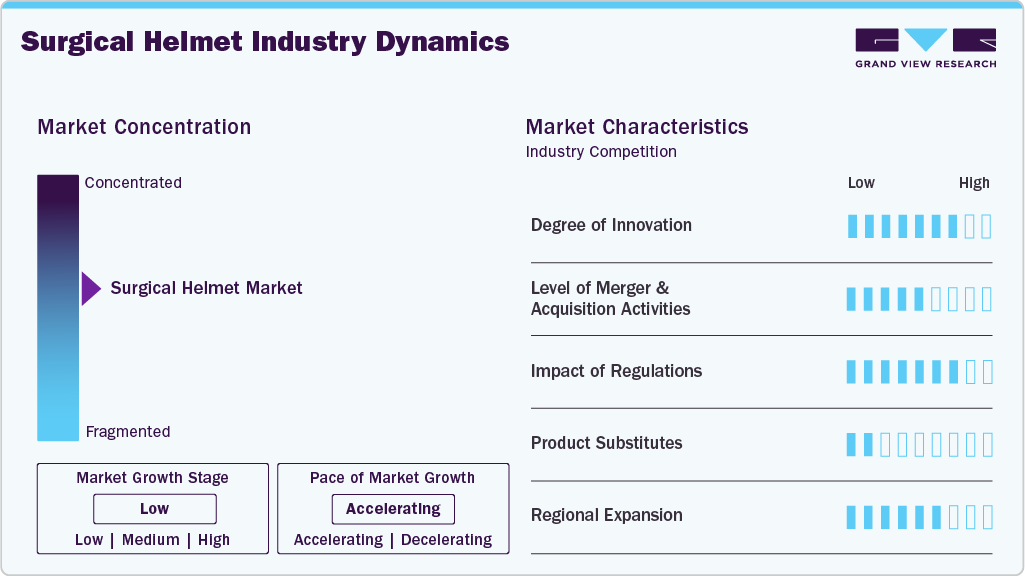

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The surgical helmet market is characterized by a high degree of growth owing to the rising number of surgical procedures, the growing number of road accidents, and the advancements in surgical helmets.

Degree of Innovation: Companies are increasingly integrating advanced features and designs into surgical helmets, with several industry leaders launching innovative products. For instance, in January 2021, Stryker introduced the T7 Surgical Helmet, a next-generation personal protection system for surgeons. This helmet is designed to keep surgeons cool and comfortable while ensuring effective protection during procedures. It is the lightest and quietest model from Stryker, offering a 40% reduction in noise compared to its predecessor. The helmet’s foam conforms to the user's head, providing a more comfortable fit, while its improved balance and ergonomic design enhance comfort and stability. In addition, the dual adjust knobs allow users to customize the helmet's height and width, and the optimized center of gravity helps reduce neck strain. A pause button enables users to control the fan and conserve battery life, making the helmet easier to put on and remove. These innovations are expected to drive significant market growth in the coming years.

Level of M & A Activities: Mergers and acquisitions in the surgical helmet market have been relatively modest but are gaining traction as companies seek to consolidate capabilities and expand global footprints. Large PPE and surgical equipment manufacturers are increasingly acquiring niche helmet producers to enhance their infection control portfolios and gain access to specialized technologies, such as integrated ventilation or communication systems. Strategic collaborations and acquisitions have also been used to navigate regulatory complexities in new regions, improve distribution channels, and foster innovation.

Impact of Regulations: Several national and international regulatory authorities regulate surgical helmets. For instance, the U.S. Food and Drug Administration (FDA) regulates surgical helmets under the following guidelines:

-

Premarket review: Surgical helmets are reviewed by the Office of Surgical and Infection Control Devices (OHT4) and Infection Control Devices (DHT4C).

-

Submission type: Surgical helmets are 510(K) exempt.

-

Regulation number: Surgical helmets are regulated by 878.4040.

-

Device class: Surgical helmets are Class 1 devices.

Product Substitutes: Several products can serve as alternatives to surgical helmets. These substitutes include face shields and surgical masks with attached face shields, which offer basic protection against splashes and particles during surgical procedures.

Regional Expansion: The surgical helmet market is experiencing significant regional expansion, with strong growth driven by increasing awareness of surgical site infection prevention, regulatory mandates, and the rising volume of orthopedic and other high-risk surgeries. In North America and Europe, mature healthcare systems and stringent occupational safety standards have led to the widespread adoption of surgical helmets, especially in orthopedic and trauma surgeries. For instance, in June 2024, RevelAi Health and Zimmer Biomet Holdings, Inc. announced a multi-year co-marketing agreement. This partnership aims to combine RevelAi Health’s innovative solutions with Zimmer Biomet’s extensive global reach to enhance the delivery and adoption of advanced medical technologies, improving patient outcomes across multiple therapeutic areas.

Product Insights

The disposable consumables segment dominated the market and accounted for the largest revenue share of 85.10% in 2024. Due to their critical importance in maintaining sterility and infection control within operating theatres. These consumables include disposable helmet covers, hoods, togas, face shields, and among others, all designed for single use to prevent cross-contamination between surgical procedures. Their dominance is due to the increasing global focus on hospital-acquired infection prevention, which has become a top priority for healthcare institutions. Hospitals and surgical centers adopt disposable components as part of stringent PPE protocols to ensure maximum patient and staff safety. In addition, disposable consumables eliminate the need for time-consuming and costly decontamination processes associated with reusable components, offering greater operational efficiency. Regulatory bodies in markets such as the UK and EU also favor disposable items in surgical settings due to their consistent quality assurance and ease of compliance with infection control standards..

Helmet systems are expected to grow at a significant CAGR over the forecast period, driven by the rising demand for comprehensive infection control solutions in operating rooms. These systems include an integrated helmet, a powered air-purifying respirator or ventilation unit, and a full-body gown or hood offering head-to-toe protection for surgical staff. The growth is primarily fueled by increasing awareness of occupational hazards in high-risk surgeries such as orthopedic, trauma, and joint replacement procedures, where blood splatter and aerosolized particles are common. Hospitals and surgical centers prioritize helmet systems as they offer enhanced safety, comfort, and regulatory compliance compared to individually sourced components.

Distribution Channel Insights

The offline segment dominated the market and accounted for the largest revenue share in 2024. This is primarily due to the established relationships between manufacturers and healthcare facilities, such as hospitals, clinics, and surgical centers, which prefer to purchase directly from suppliers or distributors. Offline channels also allow for direct interaction, where medical professionals can assess the quality, comfort, and functionality of surgical helmets before purchase. In addition, healthcare institutions value the ability to receive product demonstrations, training, and customer support in person, further bolstering the offline channel's segment growth over the forecast period.

The online segment is expected to experience the significant growth, with a CAGR of 6.45% over the forecast period. Online distribution channels are gaining increasing popularity, particularly among smaller clinics, individual practitioners, and healthcare facilities looking for greater convenience and a wider selection of products. E-commerce platforms provide easy access to a variety of surgical helmet options, often with the benefit of competitive pricing, detailed product information, and customer reviews. The ability to place orders remotely, along with fast shipping options, is appealing to practitioners who does not have easy access to local suppliers or who prefer a more streamlined purchasing process.

End Use Insights

The hospital segment is expected to dominate the market, accounting for the largest revenue share of 49.64% in 2024. It is also anticipated to grow fastest over the forecast period. This is driven by the high volume of surgeries, including complex and high-risk procedures, where infection control and staff protection are critical. With their established infrastructure and budgets, hospitals are major consumers of surgical helmets, prioritizing safety and sterilization. The growing emphasis on staff protection continues to fuel demand for surgical helmets in hospital settings.

The Ambulatory Surgery Center (ASC) segment is expected to witness significant growth in the coming years due to several factors. The increasing preference for outpatient surgeries, driven by advancements in surgical techniques and shorter recovery times, is contributing to the rise in ASC procedures. Moreover, cost-effectiveness and the growing demand for specialized, non-emergency surgeries in a more convenient, efficient setting are further boosting the adoption of surgical helmets in ASCs.

Regional Insights

North America held the largest revenue share of 40.31% in the market in 2024 due to the increasing number of surgical procedures and favorable government initiatives. In addition, the growing healthcare expenditures in the U.S. and Canada are anticipated to propel the market growth.

U.S. Surgical Helmet Market Trends

The increasing number of surgeries performed annually in the U.S. significantly boosts demand for surgical helmet systems, particularly orthopedic surgeries. These helmets offer protection against bloodborne pathogens, aerosols, and particulate contamination, making them essential in high-risk environments. Orthopedic surgeries such as joint replacements are major contributors due to their higher infection control needs. The aging population also contributes to the rise in surgeries such as hip and knee replacements, which are more prevalent in elderly patients.

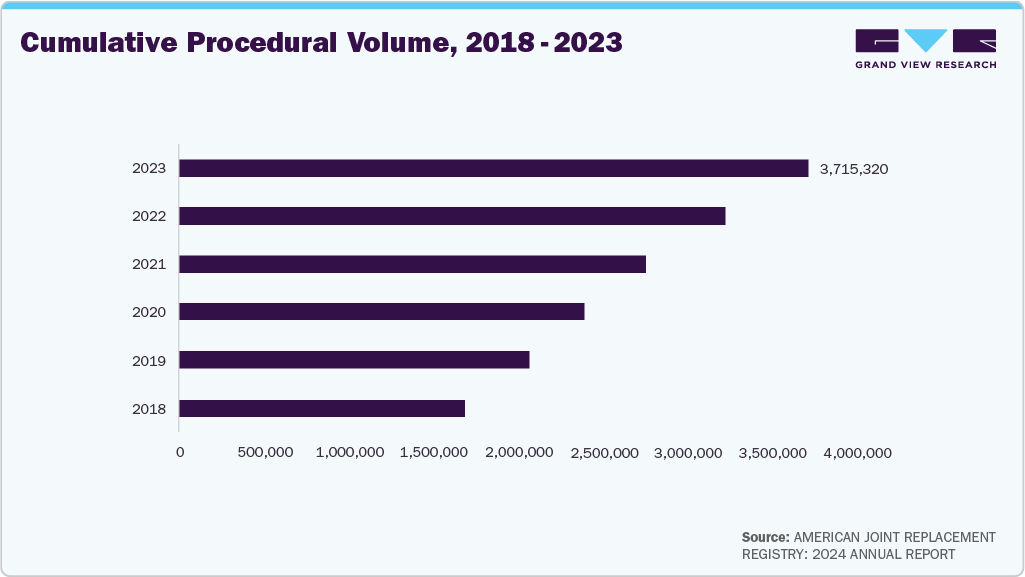

The American Joint Replacement Registry (AJRR) continues to play a pivotal role in tracking orthopedic surgical trends in the U.S., with over 4 million procedures captured as of 2023. The 2023 report analyzed 3,715,320 valid cases, reflecting a notable increase of procedures from 2022. The data highlights:

-

A strong focus on joint replacements, with 1.9 million total knee arthroplasties and 1.2 million total hip arthroplasties performed.

-

Broad institutional participation from 1,447 centers, including 312 Ambulatory Surgical Centers, emphasizes outpatient surgery's expanding role.

-

Contributions from 4,954 surgeons, demonstrating broad clinical engagement.

Europe Surgical Helmet Market Trends

Europe surgical helmet market held a substantial market share in 2024. The European surgical helmet market is primarily driven by a combination of regulatory, technological, and healthcare trends that collectively emphasize safety, infection control, and advanced surgical performance. Stringent regulations and guidelines imposed by European health authorities and institutions, such as the European Medicines Agency (EMA) and various national health ministry’s promote using personal protective equipment in surgical settings. These regulations aim to minimize surgical site infection risk, which remains a significant concern in operative procedures.

The surgical helmet market in the UK is expected to grow moderately over the forecast period. The growing number of road accidents and related orthopedic procedures is anticipated to support market growth in the coming years. According to the data published by the British Orthopedic Association in May 2022, in England, over 42,000 orthopedic operations were completed in March 2022, the highest number since June 2021.

In the UK, regulatory bodies such as the NHS, UK Health Security Agency (UKHSA), and Health and Safety Executive (HSE) have reinforced strict PPE guidelines, particularly in operating theatres. Surgical helmets, especially those with integrated air filtration systems, have become essential in reducing the risk of aerosol and droplet transmission during procedures.

The surgical helmet market in Germany is experiencing steady growth. Germany has a high rate of orthopedic surgeries, including hip and knee replacements, which are often associated with the use of surgical helmets and togas. In 2022, Germany recorded one of the highest rates of hip replacement surgeries in the European Union, with 326.2 procedures performed per 100,000 inhabitants. These surgeries, classified under ICD-9-CM codes 81.51 to 81.53, reflect the country’s high surgical volume, particularly in orthopedics. This substantial number highlights the advanced state of the German healthcare system and significantly drives the demand for surgical helmets and togas. Germany follows strict infection control and hygiene standards as outlined by institutions such as the Robert Koch Institute (RKI) and DIN (Deutsches Institut für Normung). Surgical helmets and togas are required during procedures involving a high risk of bloodborne pathogens, such as orthopedic, trauma, and joint replacement surgeries..

Asia Pacific Surgical Helmet Market Trends

Asia Pacific region is anticipated to grow significantly over the forecast period, driven by the rapid expansion of the healthcare infrastructure across emerging economies such as India, China, and Southeast Asian countries is fueling demand for advanced surgical protective equipment. Increasing investments in modern hospitals and surgical centers and rising healthcare expenditures create a conducive environment for adopting surgical helmets. The growing prevalence of orthopedic and cardiovascular surgeries due to aging populations and lifestyle-related diseases drives the need for enhanced infection control measures in operating rooms, making surgical helmets essential for protecting patients and healthcare professionals.

The surgical helmet market in China is anticipated to experience significant growth over the forecast period. China's rapidly aging population and increasing prevalence of chronic diseases are significantly contributing to the demand for surgical procedures, thereby boosting the need for surgical helmets. According to the National Bureau of Statistics, over 15.4% of China's population was aged 65 and above in 2023, and this demographic requires surgeries such as joint replacements and cardiac interventions. For example, the growing number of orthopedic surgeries involving high infection risk has spurred the adoption of surgical helmets that offer enhanced protection against bloodborne pathogens and airborne contaminants.

The market for surgical helmets in Japan is projected to expand during the forecast period due to several critical factors, including an increasing number of surgeries throughout the country and a growing elderly population. According to data from the BBC, it is expected that in Japan, individuals over 65 will make up 34.8% of the population by 2040. Furthermore, road accidents remain a concerning public health issue in Japan. Elderly pedestrians and drivers are more prone to severe injuries such as traumatic brain injuries and fractures, which require complex surgical procedures. In these scenarios, surgical helmets become essential for maintaining sterile environments during emergency and trauma surgeries and ensuring compliance with stringent hygiene protocols. In 2023, Japan reported that traffic accidents increased by 7,072 year-on-year to 307,911. The number of people injured in accidents also rose, reaching 365,027, an increase of 8,426.

Middle East and Africa Surgical Helmet Market Trends

The Middle East and Africa surgical helmet market is expected to witness significant growth in the coming years due to the growing healthcare expenditure and rising demand for advanced medical equipment, particularly in the field of orthopedic surgeries. The increasing prevalence of musculoskeletal disorders, mainly due to lifestyle changes and an aging population, is contributing to a higher volume of orthopedic surgeries, such as joint replacements and spinal surgeries, which is further anticipated to boost the demand for surgical helmets.

Key Surgical Helmet Company Insights

Kaiser Technology Co., Ltd., Zimmer Biomet, Stryker, Beijing ZKSK Technology Co., Ltd., THI Total Healthcare Innovation GmbH., and MAXAIR Systems, are some of the major players in the surgical helmet market Companies operating in the industry are launching novel products and expanding their product portfolios to bolster their presence in the market. In addition, manufacturers showcase their products at various conferences and events and emphasize the global supply of their products.

Key Surgical Helmet Companies:

The following are the leading companies in the surgical helmet market. These companies collectively hold the largest market share and dictate industry trends.

- Zimmer Biomet

- Stryker

- Beijing ZKSK Technology Co., Ltd.

- Kaiser Technology Co., Ltd.

- THI Total Healthcare Innovation GmbH

- MAXAIR Systems

- AresAir

- Regal Healthcare

- Vizbl brand products (Prodancy Pvt. Ltd.)

- Apex Hygiene Products

- Cardinal Health

- Integra LifeSciences Corporation

Recent Developments

-

In March 2025, Stryker introduced its latest personal protective equipment (PPE), the Steri-Shield 8 personal protection system. This innovative system was developed through years of research, testing, and collaboration with actual users in the field.

-

In May 2024, MAXAIR Systems, a manufacturer of surgical helmets, presented the CAPR SHS Advanced Surgical Helmet System at the 2024 AORN Global Surgical Conference & Expo. It features unmatched Outward Particulate Reduction and NIOSH-authorized filtration to help staff and patients in infection control and prevention.

-

In February 2024, Zimmer Biomet Holdings, Inc. highlighted its latest product innovations at the annual meeting of the American Academy of Orthopedic Surgeons (AAOS) in San Francisco. Among the showcased products were implants, robotic solutions, and surgical tools, including the ViVi Surgical Helmet System. Designed to keep clinicians cool and comfortable while ensuring clear visibility for precise procedures, the ViVi system features a powerful 100,000 Lux LED light and is recognized as the quietest and lightest surgical helmet available.

Surgical Helmet Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.32 billion

Revenue forecast in 2030

USD 1.87 billion

Growth rate

CAGR of 7.16% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025- 2030

Report updated

June 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, end use, distribution channel and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Zimmer Biomet; Stryker; Beijing ZKSK Technology Co., Ltd.; Kaiser Technology Co., Ltd.; THI Total Healthcare Innovation GmbH; MAXAIR Systems; AresAir; Regal Healthcare; Vizbl brand products (Prodancy Pvt. Ltd.); Apex Hygiene Products; Cardinal Health; Integra LifeSciences Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Helmet Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the surgical helmet market report based on product, end use, distribution channel, and region.

-

Product Outlook (Volume in Units; Revenue, USD Million, 2018 - 2030)

-

Helmet System

-

Disposable Consumable

-

Hoods

-

Togas

-

Other Disposable Consumables

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Specialty Clinics

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical helmet market size was estimated at USD 1.23 billion in 2024 and is expected to reach USD 1.32 billion in 2025.

b. The global surgical helmet market is expected to grow at a compound annual growth rate of 7.16% from 2025 to 2030 to reach USD 1.87 billion by 2030.

b. The disposable consumables segment dominated the market and accounted for the largest revenue share, 85.10%, in 2024 due to their critical importance in maintaining sterility and infection control within operating theatres.

b. Some key players operating in the surgical helmets market include Kaiser Technology Co., Ltd., Zimmer Biomet, Stryker, Beijing ZKSK Technology Co., Ltd., THI Total Healthcare Innovation GmbH., MAXAIR Systems, AresAir, and Prodancy Pvt. Ltd. (Vizbl brand).

b. Key factors driving the market growth include the high volume of surgical procedures, the growing focus on infection control and prevention, and the increasing number of road and sports accidents.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.