- Home

- »

- Medical Devices

- »

-

Surgical Display Market Size, Share & Growth Report, 2030GVR Report cover

![Surgical Display Market Size, Share & Trends Report]()

Surgical Display Market (2024 - 2030) Size, Share & Trends Analysis Report By Resolution Type (High Definition (HD), Full HD, 4K Ultra HD, 8K Ultra HD), By Display Type, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-911-1

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Display Market Size & Trends

The global surgical display market size was estimated at USD 773.86 million in 2023 and is projected to grow at a CAGR of 3.12% from 2024 to 2030. Market growth can be attributed to the increasing demand for advanced surgical displays for minimally invasive surgeries, increase in digital operating rooms, growing number of strategic initiatives undertaken by key players, and rise in robotic-assisted surgeries. In January 2024, Activ Surgical announced the completion of the first international surgery at Abdali Hospital in Amman, Jordan, using its ActivSight Intelligent Light technology. Activ Surgical aims to deliver superior visualization and instantaneous surgical insights directly in the operating room. ActivSight integrates with modern laparoscopic and robotic systems, seamlessly connecting to standard monitors for enhanced surgical precision & efficiency.

Hence, such advancements can increase the adoption of surgical displays, contributing to market growth. The increasing demand for Minimally Invasive Surgery (MIS) is likely to remain a significant driver for market growth. Minimally invasive procedures offer benefits, such as smaller incisions, reduced pain & scarring, shorter recovery times, and lower risk of complications than traditional open surgeries. According to North Kansas City Hospital & Meritas Health, approximately 15 million laparoscopic procedures are performed in the U.S. annually. To perform these procedures effectively, surgeons rely heavily on high-quality displays to visualize intricate details in real time, guiding their actions accurately.

The demand for MIS continues to rise due to patient-centric advantages and advancements in surgical techniques. Key MIS experiencing demand growth include laparoscopic surgery, colectomy surgery, transluminal coronary angioplasty, and cesarean section. Therefore, the need for advanced surgical displays capable of providing clear, high-resolution images will likely increase as well. This trend highlighted the importance of innovation and development within the surgical display industry to meet the evolving needs of healthcare providers and patients. Furthermore, advancements in healthcare, particularly surgical techniques, are increasingly reliant on technological progress.

MIS, such as arthroscopic procedures, have grown substantially due to innovations in surgical display monitors leveraging the latest technological insights. Analogous to the upgrade from standard to high-definition television sets, the medical field is embracing enhanced resolution displays for various benefits across surgical practices. Whether facilitating keyhole surgeries or guiding robotic procedures, medical-grade surgical displays offer multifaceted advantages to surgeons & medical professionals. The COVID-19 pandemic hampered the overall market. With hospitals and medical facilities contending with a rise in COVID-19 cases, elective surgeries were either delayed or called off to allocate resources towards pandemic management.

However, the pandemic highlighted the importance of advanced medical technologies, including surgical displays, in facilitating efficient and safe surgical procedures. Healthcare systems experienced a growing recognition of the need for enhanced infection control measures, minimally invasive techniques, and remote collaboration tools in the operating room. This shift in healthcare priorities fueled renewed interest in innovative surgical display solutions that enable seamless communication, visualization, and workflow efficiency while prioritizing infection prevention protocols.

Market Concentration & Characteristics

The market growth is high, and the pace of its growth is accelerating. The market is characterized by a rise in demand for digital operating room technologies, an increase in demand for advanced surgical display for minimally invasive surgery, and an increase in strategic initiatives.

The degree of innovation is high. Technological advancements in surgical displays, such as high-resolution displays, multimodality displays, and wireless technology, have revolutionized the field of surgery. Key players are launching technologically advanced displays to improve precision in procedures and patient outcomes. For instance, in October 2023, Sony Europe B.V. launched a novel surgical monitor LMD-XH550MD with 4K HDR. The monitor, integrated with Sony’s advanced A.I.M.E. technology, can display highly enhanced images.

Key players are implementing strategic initiatives, such as geographical expansion, innovations, collaborations, and partnerships to strengthen their market presence. For instance, in September 2022, Olympus Corporation, Sony Corporation, and Sony Olympus Medical Solutions Inc. collaborated to create an advanced surgical endoscopy system. This system integrates high-definition surgical visualization technologies, such as 4K and 3D capabilities, infrared (IR) imaging, and narrow-band imaging (NBI). Marketed under the name “VISERA ELITE III,” Olympus has distributed this system across Europe, the EMEA, select Asian territories, Oceania, and Japan since September 2022.

The impact of regulations on the market is high. The market has witnessed a notable shift in regulatory trends, reflecting an increased focus on patient safety, technological advancements, and industry standardization. Regulatory bodies worldwide, such as the U.S. FDA and the EU EMA, have intensified their scrutiny over the development & deployment of surgical display systems. These agencies emphasize ensuring that such systems meet stringent quality & safety standards, particularly concerning image clarity, resolution, latency, and compatibility with other medical devices.

The threat of substitutes in the market is expected to be relatively low. Surgical displays are specialized equipment designed to meet the unique needs of medical professionals during procedures. While alternative display technologies such as standard monitors may be available, they often lack the specific features and certifications required for use in surgical environments.

The emphasis on patient-centric care and regulatory compliance fuels the demand for high-quality surgical displays in healthcare settings. Furthermore, companies are undertaking several strategic initiatives, such as the launch of new products, partnerships, acquisitions, and geographic expansion, to expand the reach of their products in hospitals & other healthcare facilities and ultimately promote market growth. For instance, in April 2021, Barco and Sigma-Jones | AV LLP partnered to enhance healthcare digital experiences through its advanced operating room video integration solution, Nexxis.

Resolution Type Insights

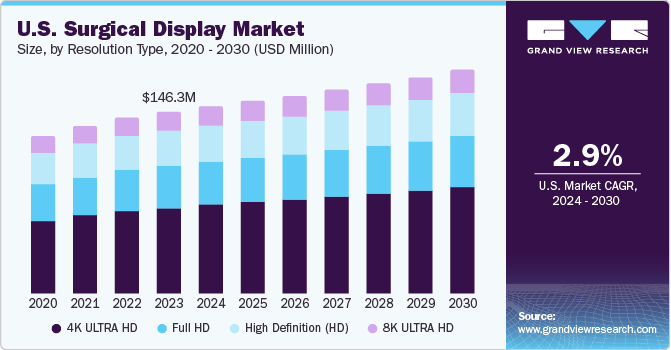

Based on the resolution type, the 4K ultra HD segment held the largest market share of 41.9% in 2023 and is expected to grow at the fastest CAGR during the forecast period. Its growth can be attributed to the increasing demand for high-quality imaging solutions in the healthcare sector. 4K surgical displays offer healthcare professionals precise visual detail, enabling them to clearly determine fine anatomical structures.

The 8K Ultra HD resolution type segment is expected to grow at a significant CAGR over the forecast period. 8K surgical displays have various applications in medical specialties, revolutionizing surgical procedures. In neurosurgery, cardiovascular surgery, and orthopedics fields, using 8K displays enables surgeons to visualize complex anatomical structures with unparalleled clarity, facilitating intricate procedures with enhanced precision. Moreover, incorporating 8K displays in minimally invasive surgeries allows for improved visualization of delicate tissues and organs, ultimately leading to better patient outcomes & reduced surgical complications

Display Type Insights

Based on the display type, the LCD segment held the largest share in 2023. The growing adoption of business initiatives by key market players and increasing advancements in LCD technology are expected to contribute to segment growth. For instance, in October 2023, Sony Corporation introduced the LMD-XH550MD, a surgical monitor with an LCD panel and signal processing technology that supports a wide color spectrum.

The OLED segment is expected to grow at the fastest CAGR over the forecast period. Organic Light-emitting Diode (OLED) displays are gaining popularity due to their unmatched image quality, which is characterized by deep blacks, vibrant colors, and high contrast ratios. Such factors are expected to drive its adoption over the coming years.

Application Insights

Based on application, the endoscopy segment dominated the market with the largest revenue share in 2023. Its growth can be attributed to the increasing prevalence of medical conditions, such as cancer, where surgical-display-enabled endoscopy helps screen & diagnose diseases. According to the American Cancer Society, in 2024, around 46,220 new rectal cancer cases and 106,590 new colon cancer cases are estimated in the U.S. Hence, the rising prevalence of colon and rectal cancers is boosting the demand for colonoscopies, consequently leading to market growth

End-use Insights

Based on end-use, the hospital segment dominated the market with the largest share in 2023. Hospitals are adopting advanced surgical techniques, such as minimally invasive surgery, which require high-resolution displays for precise visualization during procedures. These displays improve surgical outcomes, reduce complications, and enhance patient satisfaction. Hospitals also use surgical displays for educational purposes, training surgeons, and staying updated with new techniques.

The Ambulatory Surgical Centers (ASC) segment is expected to grow at the fastest CAGR from 2024 to 2030. ASCs specialize in providing minimally invasive procedures, focusing on efficient, high-quality same-day surgical care for patients. These centers heavily invest in advanced surgical technologies, including surgical displays, to support various minimally invasive procedures, such as laparoscopic surgeries, endoscopic interventions, and orthopedic surgeries.

Regional Insights

The surgical display market in North America is anticipated to witness significant growth over the forecast years due to growing investment in advancing healthcare infrastructure, the rise in robotic-assisted surgeries, and the high demand for minimally invasive surgeries.

U.S. Surgical Display Market Trends

The U.S. surgical display market is expected to grow at a significant rate owing to advancements in display technology, such as higher resolutions and enhanced image quality, which contribute to the adoption of surgical displays across healthcare facilities. These technological improvements, including features, such as HDR and 3D visualization, are crucial for improving visual clarity and precision during surgical procedures, ultimately leading to better patient outcomes.

Asia Pacific Surgical Display Market Trends

The surgical display market in Asia Pacific dominated the global market and accounted for a share of 33.8% in 2023. The regional market growth is propelled by advancements in medical technology, notably the adoption of high-definition and 4K resolution displays in surgical settings. These displays significantly improve surgeons' visualization, thereby enhancing patient outcomes. The surge in demand for minimally invasive surgeries, which rely heavily on precise imaging and visualization, has further accelerated the adoption of advanced surgical display solutions. Moreover, increasing healthcare spending and investments in infrastructure across the region have facilitated the seamless integration of these advanced display systems in healthcare facilities. The rapidly aging population has also increased the demand for more sophisticated surgical procedures, highlighting the need for advanced display technologies in the healthcare sector.

The Japan surgical display market is expected to grow at the fastest CAGR over a forecast period. This can be attributed to the increasing adoption of minimally invasive surgeries fueling the adoption of advanced surgical displays in the country. According to a study published by NCBI in March 2023, minimally invasive surgeries for the management of endometrial cancer increased to 34% in Japan. The increasing demand for surgical displays is encouraging key players in the market to invest in developing technologically advanced and cost-effective surgical displays.

The surgical display market in China is anticipated to grow at a significant rate owing to increasing government support in the form of initiatives aimed at healthcare infrastructure advancements coupled with the growing adoption of digital operating rooms is anticipated to fuel market growth over the forecast period.

Latin America Surgical Display Market Trends

The Latin America surgical display market is expected to grow due to factors such as the increasing adoption of advanced medical technologies in Brazil and Mexico necessitates high-quality display systems for precise visualization during surgical procedures. This demand is especially significant in countries witnessing growth in healthcare infrastructure and investment in modern medical equipment, driving the market.

MEA Surgical Display Market Trends

The surgical display market in MEA is expected to grow significantly over the coming years, driven by the rapid expansion & modernization of healthcare infrastructure and the increasing demand for advanced medical technologies.

Key Surgical Display Company Insights

Key players are adopting various strategies, such as product development, partnerships, funding, and investments, driving the surgical display market. For instance, in December 2023, LG Electronics launched the 24HR513C medical monitor, marking a notable advancement in functionality and user experience relative to current medical imaging devices. This monitor's 600 cd/m2 luminance makes it ideal for multiple types of clinical and diagnostic applications. With this addition, LG Electronics expanded its portfolio to 11 models, covering a range of applications from clinical and diagnostic to surgical settings.

Key Surgical Display Companies:

The following are the leading companies in the surgical display market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus Corporation

- Barco

- STERIS

- Sony Europe B.V.

- LG Electronics

- Shenzhen JLD Display Technology Co., Ltd. (Reshin)

- EIZO GmbH

- BenQ Materials Corporation

- ADLINK Technology Inc.

Recent Developments

-

In March 2024, Barco, a global leader in visualization technologies, collaborated with NVIDIA and SoftAcuity to incorporate NVIDIA Holoscan-powered AI into its Nexxis video-over-IP platform, designed for digital operating rooms and interventional suites. This partnership is expected to add two AI-enabled products to the Nexxis lineup. Specifically, Barco plans to incorporate NVIDIA Jetson Orin and IGX Orin system-on-modules into these new offerings within the Nexxis platform to enhance digital operations and interventional procedures

-

In November 2023, LG Business Solutions USA introduced the 55MH5K model, a 55-inch surgical monitor featuring 4K resolution. This model is designed with wide viewing angles, enhanced durability, and failover technology for operational continuity. It also supports multi-image display capabilities, allowing for a 2x2 grid configuration onscreen

-

In October 2023, Sony launched the LMD-XH550MD, a 55-inch surgical monitor that supports 4K HDR imaging. This medical-grade monitor features elevated peak brightness, a high contrast ratio, and an extensive color gamut, enabling the display of high-quality 4K HDR color video images in 2D. Its 4K resolution offers superior detail, making it suitable for applications in hospital operating theaters, surgical centers, and educational settings.

Surgical Display Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 797.07 million

Revenue forecast in 2030

USD 958.18 million

Growth Rate

CAGR of 3.12% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resolution type, display type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central Asia; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; Ukraine; Russia; China; Japan; India; South Korea; Australia; Thailand; Bangladesh; Cambodia; Hong Kong; Indonesia; Malaysia; Mongolia; Myanmar; Nepal; New Zealand; Philippines; Singapore; Sri Lanka; Taiwan; Vietnam; Uzbekistan; Kazakhstan; Brazil; Mexico; Argentina; UAE; South Africa; Saudi Arabia; Qatar; Bahrain; Lebanon; Kuwait

Key companies profiled

Olympus Corp.; Barco; STERIS; Sony Europe B.V.; LG Electronics; Shenzhen JLD Display Technology Co., Ltd. (Reshin); Stryker; EIZO GmbH; BenQ Materials Corp.; ADLINK Technology Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Display Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the surgical display market report based on resolution type, display type, application, end-use, and region:

-

Resolution Type Outlook (Revenue, USD Million, 2018 - 2030)

-

High Definition (HD)

-

Full HD

-

4K ULTRA HD

-

8K ULTRA HD

-

-

Display Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Light-emitting Diode (LED) Displays

-

Liquid Crystal Display (LCD)

-

Organic Light-Emitting Diode (OLED) Displays

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Endoscopy

-

Orthopedic Surgery

-

Neurosurgery

-

Cardiovascular Surgery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

Ukraine

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Australia

-

South Korea

-

Bangladesh

-

Cambodia

-

Hong Kong

-

Indonesia

-

Malaysia

-

Mongolia

-

Myanmar

-

Nepal

-

New Zealand

-

Philippines

-

Singapore

-

Sri Lanka

-

Taiwan

-

Vietnam

-

-

Central Asia

-

Uzbekistan

-

Kazakhstan

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

Qatar

-

Bahrain

-

Lebanon

-

-

Frequently Asked Questions About This Report

b. The global surgical display market is expected to grow at a compound annual growth rate of 3.12% from 2024 to 2030 to reach USD 958.18 million by 2030.

b. Some key players operating in the surgical display market include Olympus Corporation, Barco, STERIS, Sony Europe B.V., LG Electronics, Shenzhen JLD Display Technology Co., Ltd. (Reshin), Stryker, EIZO GmbH, BenQ Materials Corporation, ADLINK Technology Inc., among others.

b. Increase in Demand of Advanced Surgical Display For Minimally Invasive Surgery, Surge in Demand for digital Operating Room Technologies, Increase in Strategic Initiatives, Surge in Robotic Surgical Procedures Drives Demand for High-Resolution Surgical Displays are some of the key drivers of this market.

b. Asia Pacific held over 33.8% share of the surgical display market in 2023. The regional growth of the surgical display market is propelled by advancements in medical technology, notably the adoption of high-definition and 4K resolution displays in surgical settings. These displays significantly improve surgeons' visualization, thereby enhancing patient outcomes. The surge in demand for minimally invasive surgeries, which rely heavily on precise imaging and visualization, has further accelerated the adoption of advanced surgical display solutions.

b. The global surgical display market size was estimated at USD 773.86 million in 2023 and is expected to reach USD 797.07 million in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.