- Home

- »

- Homecare & Decor

- »

-

Surfing Tourism Market Size & Share, Industry Report, 2030GVR Report cover

![Surfing Tourism Market Size, Share & Trends Report]()

Surfing Tourism Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Surf Tours & Expeditions, Surf Resorts & Accommodations, Surf Camps & Retreats), By Traveler Type (Domestic, International), By Travel Style, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-420-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surfing Tourism Market Summary

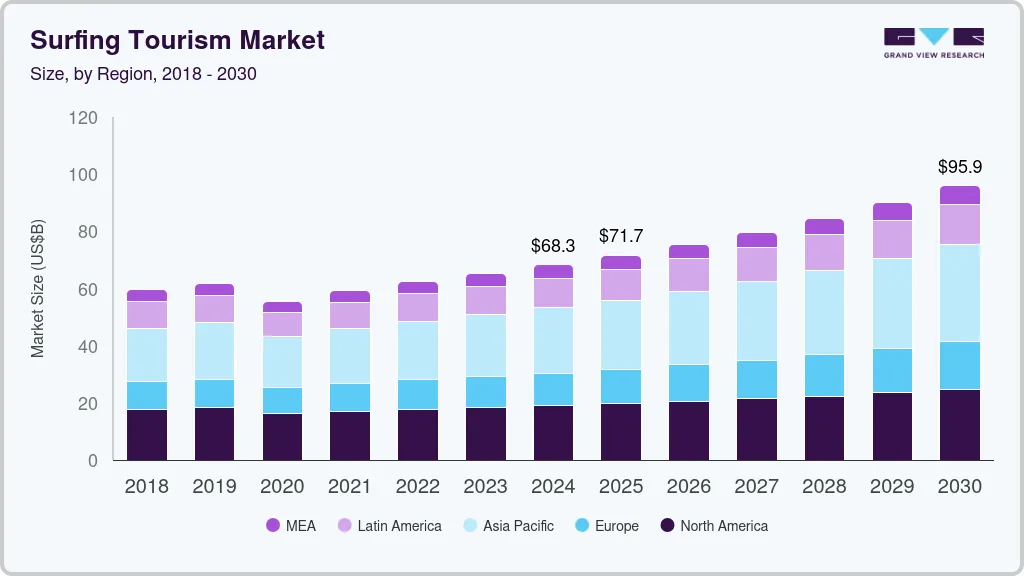

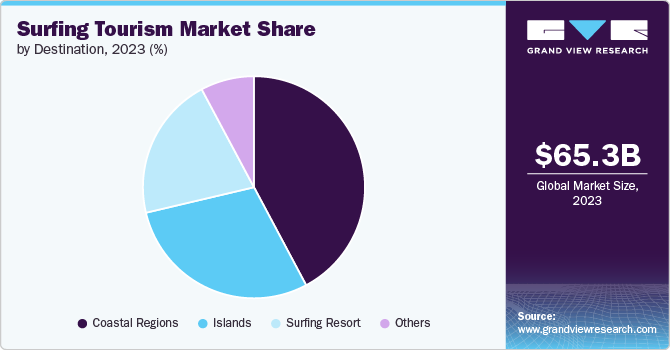

The global surfing tourism market size was estimated at USD 68.30 billion in 2024 and is expected to reach USD 95.93 billion by 2030, growing at a CAGR of 6.0% from 2025 to 2030. The market growth is primarily attributed to the rising popularity of adventure and experiential travel and the growing influence of surfing culture through social media and surf-centric content.

Key Market Trends & Insights

- The surfing tourism market in North America accounted for a share of over 27% of the global market revenue in 2024.

- Surfing tourism market in the U.S. is expected to grow at a CAGR of 4.4% from 2025 to 2030.

- By type, the surf tours and expeditions segment accounted for a revenue share of 35.46% in 2024.

- By traveler type, the domestic travelers segment contributed to a revenue share of over 61% in 2024.

- By travel style, the solo travelers segment contributed to a revenue share of 40.50% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 68.30 Billion

- 2030 Projected Market Size: USD 95.93 Billion

- CAGR (2025-2030): 6.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additionally, infrastructure development in coastal destinations, government initiatives to promote tourism, and the expansion of surf schools, camps, and eco-resorts are further encouraging both novice and experienced surfers to explore international surfing destinations, driving consistent market growth across regions.Surfing tourism is increasingly being shaped by the intersection of lifestyle, sustainability, and digital influence. A notable trend is the rise of eco-conscious surf travel, with travelers actively seeking destinations that emphasize environmental responsibility. For instance, countries like Costa Rica and Indonesia have begun promoting surf tourism while integrating marine conservation efforts. Surf resorts such as Nihiwatu in Sumba, Indonesia, and Olas Verdes in Nosara, Costa Rica, highlight their sustainable practices, ranging from solar power use to water conservation and reef protection.

As highlighted in Booking.com’s 2023 Sustainable Travel Report, 76% of global travelers indicated a preference for more sustainable travel options-signaling a growing trend that many surf destinations are now starting to embrace and integrate into their offerings.

The market has seen increased diversification of surf experiences-with a surge in surf retreats, wellness camps, and female-focused surf travel brands. Companies such as Surf With Amigas (Central America) and Witch’s Rock Surf Camp (Costa Rica) offer programs tailored to women, solo travelers, and beginners, contributing to the inclusivity and mainstreaming of the sport.

As a result, the customer base for surf tourism is broadening beyond just professional surfers, attracting wellness seekers, families, and millennial travelers looking for immersive, healthy lifestyle experiences. This is supported by the growing volume of surf camps and experiences listed on Airbnb and similar platforms, indicating strong demand for flexible, authentic travel experiences tied to surf culture.

Consumer Insights

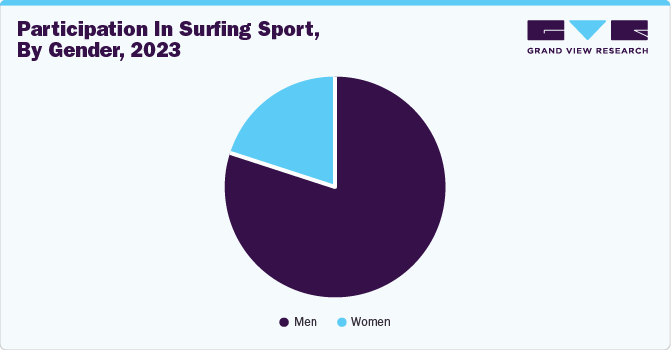

According to the International Surfing Association (ISA) in 2023, male surfers outnumber female surfers by a ratio of 4:1 globally. This gender disparity in participation is attributed to cultural, social, and logistical factors. In many surf-rich regions, especially in developing countries, societal norms and safety concerns have historically limited female involvement in water sports.

Additionally, the lack of female-centric surf programs, limited representation in media, and fewer female instructors or mentors is discouraging women from pursuing the sport. However, this trend is slowly shifting as more surf schools, brands, and tourism operators actively promote gender inclusivity, female-only surf retreats, and empowerment-focused campaigns, creating new opportunities to expand the market among women.

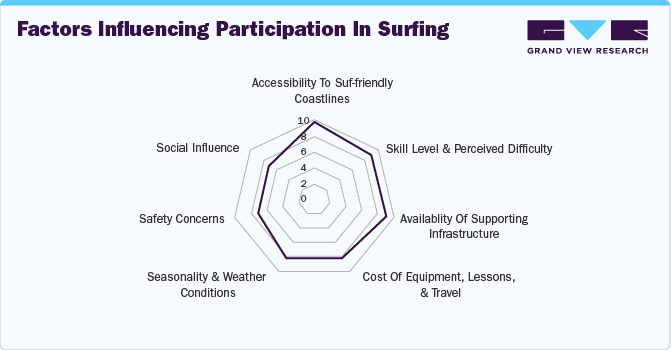

Consumer participation in surfing is influenced by a mix of personal, social, and environmental factors. Key drivers include accessibility to surf-friendly coastlines, as proximity greatly affects frequency and ease of participation. Skill level and perceived difficulty of the sport also play a crucial role-beginners often look for gentle waves and structured learning environments, while experienced surfers seek challenging breaks.

Cost of equipment, lessons, and travel can act as a barrier, especially in less developed regions. Additionally, safety concerns, including wave conditions, currents, and marine life, impact decision-making, particularly among women and families. Social influence-through peers, surf culture, and media portrayal - shapes aspirational interest, while seasonality and weather conditions determine the ideal travel window. The availability of supporting infrastructure, such as surf schools, camps, and accommodations enhances destination appeal, making participation more accessible and enjoyable to consumers

Type Insights

Surf tours and expeditions accounted for a revenue share of 35.46% in 2024, largely fueled by the rising interest in experiential travel and the pursuit of unique, off-the-beaten-path surfing destinations. Travelers, especially millennials and Gen Z, increasingly seek curated surf experiences that combine adventure, skill-building, and cultural immersion. This trend is visible in the growing popularity of guided surf trips in countries like Indonesia, Costa Rica, and Morocco, where tour operators offer multi-day packages covering remote surf breaks, transportation, and local engagement.

Surf resorts and accommodation demand is projected to grow at a CAGR of 7.0% from 2025 to 2030, driven by the expansion of upscale surf-centric properties and the growing demand for integrated surf and leisure experiences. This segment benefits from the rising number of surf travelers seeking comfort, amenities, and proximity to quality surf breaks without compromising convenience. Destinations like the Maldives, Nicaragua, and Sri Lanka have seen notable increases in boutique surf resort development, often featuring all-inclusive packages, yoga retreats, and wellness offerings. Notably, properties like Niyama Private Islands in the Maldives and Kalon Surf in Costa Rica have become case studies in combining luxury hospitality with tailored surf experiences.

Traveler Type Insights

Domestic travelers contributed to a revenue share of over 61% in 2024 in the surfing tourism industry, reflecting the strong local engagement in surf culture, particularly in countries with long coastlines and established beach communities such as the U.S., Australia, Brazil, and Japan. Many domestic travelers opt for weekend surf getaways or short-haul road trips to nearby surf breaks, making local tourism a major driver of consistent, year-round revenue. For instance, the U.S. West Coast alone-from California to Oregon-hosts over 3 million active surfers, most of whom participate in multiple surf trips annually within their home states.

Surfing tourism among international travelers is projected to grow at a CAGR of 6.5% from 2025 to 2030, driven by the increasing popularity of destination surfing, improving global air connectivity, and the rising influence of surf culture in travel marketing. Emerging surf hotspots such as El Salvador, Portugal, and the Philippines have seen surges in foreign tourist arrivals due to government-backed surf tourism initiatives, international surf competitions, and influencer-led travel content. For example, El Salvador, which hosted the ISA World Surfing Games in 2021 and 2023, reported a 30% increase in surf-related international visitors over the past two years.

Travel Style Insights

Solo travelers contributed to a revenue share of 40.50% in 2024 in the surfing tourism industry, underscoring the sport's strong appeal to independent adventurers seeking personal growth, freedom, and immersive local experiences. Many solo surfers-especially from Gen Z and millennial cohorts-are drawn to surf camps, retreats, and guided expeditions that offer both structured training and opportunities for community-building with like-minded enthusiasts. Popular destinations such as Bali, Costa Rica, and Morocco have responded by offering surf-hostels and budget-friendly packages tailored for solo guests, including skill-based programs, yoga, and cultural experiences.

The couples segment in the surfing tourism industry is projected to grow at a CAGR of 6.1% from 2025 to 2030, driven by the increasing popularity of surf-centric vacations as romantic or wellness-focused getaways. Surf resorts and boutique beachfront accommodations are increasingly offering dual-person experiences-like couple’s surf lessons, spa treatments, and beachfront dining-that cater to the leisure preferences of romantic travelers. Destinations such as the Maldives, Nicaragua, and the Gold Coast in Australia have reported a rise in honeymooners and couples choosing surfing as a shared activity.

Regional Insights

The surfing tourism market in North America accounted for a share of over 27% of the global market revenue in 2024, largely driven by its expansive coastline, strong domestic tourism infrastructure, and well-established surf culture across California, Hawaii, and the East Coast. The region’s long history with surfing-popularized through global icons and major competitions like the Vans US Open of Surfing-has helped strengthen its position.

U.S. Surfing Tourism Market Trends

Surfing tourism market in the U.S. is expected to grow at a CAGR of 4.4% from 2025 to 2030. Urban centers are seeing a rise in indoor surf parks-like Goodsurf’s upcoming Citywave installations-making the sport accessible even in non-coastal areas. Additionally, high participation rates, a robust adventure sports ecosystem, and investments in surf parks (e.g., Surf Lakes in Texas and California's Kelly Slater Surf Ranch) have made the U.S. a key region in the surfing tourism market.

Europe Surfing Tourism Market Trends

Surfing tourism market in Europe accounted for a share of over 16% of the global market revenue in 2024, supported by its diverse surfing destinations across Portugal, France, and Spain, which offer world-class breaks, accessible pricing, and strong cultural appeal. Surf hubs such as Biarritz, Peniche, and San Sebastián have built robust ecosystems with surf camps, hostels, and seasonal surf festivals that draw thousands of enthusiasts each year.

Asia Pacific Surfing Tourism Market Trends

The surfing tourism industry in Asia Pacific is expected to grow at a CAGR of 7.0% from 2025 to 2030, led by rising disposable incomes, international promotional campaigns, and emerging surf hotspots in Southeast Asia and South Asia. Countries like Indonesia, Sri Lanka, the Philippines, and India offer consistent year-round waves and lower-cost travel, appealing to both budget and premium segments. Bali and the Mentawai Islands are already established meccas, while newer destinations such as Varkala in India and Siargao in the Philippines are rapidly gaining traction due to government-backed tourism campaigns and investments in surf schools and infrastructure.

Key Surfing Tourism Company Insights

The global surfing tourism industry is fragmented and is characterized by the presence of a large number of international and domestic players. Companies are increasingly differentiating themselves through curated experiences, sustainability practices, and digital engagement. For instance, World Surfaris offers bespoke surf trips to remote destinations like the Maldives and Papua New Guinea, targeting high-spending adventure travelers.

Many players are also leveraging eco-certification and community-based tourism models to align with rising demand for sustainable travel; Soul & Surf in India and Sri Lanka integrates yoga, wellness, and local experiences alongside surfing.

Key Surfing Tourism Companies:

The following are the leading companies in the surfing tourism market. These companies collectively hold the largest market share and dictate industry trends.

- World Surfaris

- G Adventures

- Waterways Travel Surf Adventures

- Wavehunters Surf Travel

- Epic Surf Tours

- Stoked Surf Adventures

- Witch's Rock Surf Camp

- Soul & Surf

- Perfect Wave Travel

- LUEX Surf Travel

Recent Developments

-

Bahrain will open the Middle East’s first surf park-the Bahrain Surf Park - Club Hawaii Experience-in early 2026, powered by Wavegarden Cove technology. Located on the island’s southwest coast, the park will host over 140,000 surf sessions annually, accommodate 90 surfers simultaneously, and produce 1,000 waves per hour. It will be a centerpiece of the Bilaj Al Jazayer megaproject, expected to attract 300,000+ visitors per year, and aims to position Bahrain as a new surfing tourism hotspot in the region.

-

In May 2023, Urban Entertainment Concepts (UEC), through its subsidiary Goodsurf, has acquired Citywave North America, gaining exclusive rights to the Citywave stationary surf wave technology across the U.S., Canada, Mexico, and the Caribbean. Citywave, a global leader in artificial surf wave installations, has 15 active sites worldwide and is known for blending authenticity with accessibility in urban surfing. This acquisition marked a strategic expansion aimed at introducing surf experiences in resorts and entertainment venues across North America, making surfing more accessible to wider audiences.

-

In November 2022, Kerala launched its first government-sponsored surfing school, 'Aventura', at Gotheeswaram Beach in Beypore, aiming to boost adventure and sports tourism. Backed by the Kerala Responsible Tourism Mission, DTPC, and the Adventure Tourism Society, the school features internationally certified trainers, including locals from fishing communities trained under a three-month program. This initiative positions Beypore as a growing surfing destination in India, reflecting Kerala’s growing focus on sustainable and inclusive tourism development.

Surfing Tourism Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 71.72 billion

Revenue forecast in 2030

USD 95.93 billion

Growth rate (Revenue)

CAGR of 6.0% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, traveler type, travel style, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Portugal; France; Spain; China; Japan; Australia & New Zealand; Indonesia; Philippines; Brazil; Peru; Chile; South Africa

Key companies profiled

World Surfaris; G Adventures; Waterways Travel Surf Adventures; Wavehunters Surf Travel; Epic Surf Tours; Stoked Surf Adventures; Witch's Rock Surf Camp; Soul & Surf; Perfect Wave Travel; LUEX Surf Travel

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surfing Tourism Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surfing tourism market on the basis of type, traveler type, travel style, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Surf Tours and Expeditions

-

Surf Resorts and Accommodations

-

Surf Camps and Retreats

-

Others

-

-

Traveler Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Domestic

-

International

-

-

Travel Style Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solo/Individuals

-

Friends/Groups

-

Couples

-

Families

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Portugal

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

Australia & New Zealand

-

Indonesia

-

Philippines

-

-

Latin America

-

Brazil

-

Peru

-

Chile

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global surfing tourism market was estimated at USD 68.30 billion in 2024 and is expected to reach USD 71.72 billion in 2025.

b. The global surfing tourism market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2030 to reach USD 95.93 billion by 2030.

b. The surfing tourism market in North America accounted for a share of over 27% of the global market revenue in 2024, largely driven by its expansive coastline, strong domestic tourism infrastructure, and well-established surf culture across California, Hawaii, and the East Coast.

b. Some of the key players operating in the surfing tourism market include AGIT Global North America, Inc.; AJW Surfboard Boardriders, Inc.; Body Glove; BruSurf; CANNIBAL SURFBOARDS; Channel Islands Surfboards; Firewire Surfboards, LLC; Global Surf Industries; Globe International Limited; Gul Watersports Ltd.

b. Key factors that are driving the surfing tourism market growth include the allure of experiencing diverse cultures and exotic surf locations, and the improved travel infrastructure and increased flight connectivity to remote surf spots have made global surfing tourism more accessible.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.