- Home

- »

- Automotive & Transportation

- »

-

Surface Mining Equipment Market Size & Share Report, 2030GVR Report cover

![Surface Mining Equipment Market Size, Share & Trends Report]()

Surface Mining Equipment Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Loader, Excavators, Dumper, Motor Graders), by Application, By Region and Segment Forecasts

- Report ID: GVR-4-68040-123-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

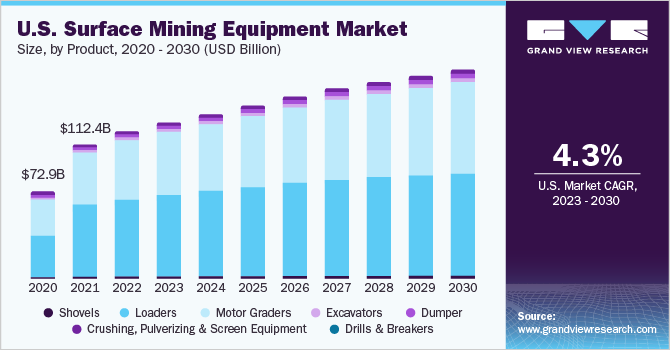

The global surface mining equipment market size was valued at USD 633.15 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.0% from 2023 to 2030. Factors such as the strong emphasis of automakers on vehicle electrification, growing demand for metals in industries such as consumer electronics, energy, and automotive, coupled with increasing urbanization in developing countries inducing the demand for coal, are driving the demand for surface equipment in the market. Favorable government regulations promoting mining in countries such as Canada, India, and the U.S. further drive the growth of surface mining equipment.

Mining businesses increasingly incorporate advanced technologies such as machine learning (ML) and artificial intelligence (AI) into their operations. Additionally, the market is being driven by the rising penetration of the Internet of Things (IoT) as well as the mining sector's increasing acceptance of digitization and automation. Smart and efficient mining equipment is being adopted by mining companies at an increasing rate worldwide owing to their capability to ensure the safety of the workforce at remote sites. All these factors are expected to contribute to the global growth of the market over the forecast period.

The adoption of automation and autonomous systems has led to significant developments in the global mining industry. With the declining mineral deposits and the deteriorating life of mines, autonomous systems are acting as adjuncts to manned vehicles for providing required location information to miners, issuing collision warnings to drivers, etc. At a highly complex level, automated equipment for hauling, loading, and drilling are used to carry out both, surface and underground exploration and mining activities. The usage of autonomous machines such as drillers, Load Haul and Dump Loaders (LHDs), and carrying trucks at mining locations is rapidly increasing worldwide. For instance, in February 2022, major mining enterprises in Australia, Brazil, Canada, and the U.S. have already received more than 239 autonomous trucks from Caterpillar, the largest equipment manufacturer.

A number of manufacturers of mining equipment are concentrating on enhancing the safety features of their equipment to avoid and reduce health risks and accidents caused by mining activities. The most recent mining equipment use cutting-edge technologies to ensure the safety of workers at mining sites. This factor accelerates the growth of the mining equipment market globally. For instance, in November 2022, Hitachi Construction Machinery Co., Ltd unveiled a brand-new model from its line of Stage V-compliant wheel loaders in Bauma, By providing safety features and unmatched comfort, the ZW160-7 is designed to provide operators total control over their workstation.

The high purchasing and maintenance cost associated with mining equipment is expected to pose a challenge to the market growth to a certain extent. The shortage of trained personnel required to operate the mining equipment and the improper training for automotive engineers may significantly impact the demand. The high operating cost of these machines is also estimated to hinder industry growth. Another factor expected to challenge the growth includes the higher prices of these machines attributed to the new Environment Protection Agency (EPA) emission regulations. Moreover, the unpredictable prices of raw materials, uncertainty in economic conditions, and the enforcement of emission-control norms are further estimated to impede the global market growth over the forecast period.

Product Type Insights

Among all the product segments excavators have accumulated the highest market share of over 42% in 2022. The segmental growth is attributed to the demand for excavatorsin mining operations for a variety of tasks such as moving bulk material, loading dump trucks and lorries, and breaking material into smaller, more manageable parts The increasing use of electric excavators on surface mining sites owing to increasing use of sustainable mining practices is also driving the excavator market. Another major factor driving the segmental growth is the development of compact excavators, the demand for this equipment has also increased. These excavators offer a viable remedy for performing excavation work in constrained areas within the mining sites.

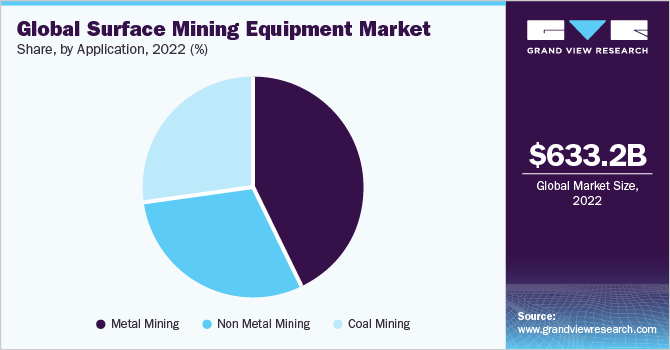

Application Insights

Based on application, the metal mining segment accounted for the largest market share of over 40% in 2022 and is expected to maintain dominance over the forecast period. The metal mining segment is anticipated to expand as a prominent application category due to increased resource exploration and strong demand for precious metals like silver, gold, copper, and iron. Owing to constantly improving technology, mining for rare earth metals has recently gained traction. The current high levels of investment in new technology recommend that for large metal mining operations, there is a focus on long-term value. Increased investment and government support for digital mining innovation are anticipated to generate demand for mining equipment. Increasing government support for digital mining innovation and increased investment are expected to drive the demand for mining equipment by driving segmental growth.

Owing to increased resource exploration and strong demand for precious metals such as silver, gold, copper, and iron, the metal mining market is expected to grow as a significant application segment. Metal mining is the extraction and processing of ores in order to refine them into valuable target metals. For instance, in the U.S., mining activities produce metals utilized in various sectors, such as automotive, electric, and industrial equipment. Large volumes of on-site land disposal are generated during the extraction and processing of these minerals, primarily metal-bearing rock and waste rock. For instance, the Government of India has allowed 100% FDI in this sector for the exploration of metal and non-metal ores. Moreover, the Ministry of Steel aims to increase the steel production capacity to 300 million tons from 2030–2031. Such initiatives and assistance are projected to push mining equipment manufacturers, such as Epiroc, Boart Longyear Ltd, Caterpillar, Inc, and others, to expand their businesses, consequently magnifying the mining equipment industry's growth over the forecast period. Therefore, the developing metal mining industries and growing investments are anticipated to propel the mining equipment market over the forecast period.

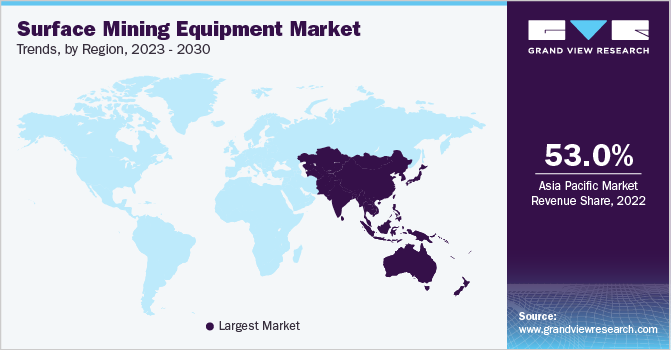

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 53% in 2022. The expansion of the construction equipment market is attributed to favorable government policies aimed at boosting infrastructure projects in developing nations such as India, China, Vietnam, and Taiwan.

Furthermore, China's recent Regional Comprehensive Economic Partnership (RCEP) free trade agreement with Asia Pacific countries such as Japan, South Korea, Australia, and other smaller Southeast Asian countries is expected to drive advanced transport infrastructure activities in the region, driving market demand.

Key Companies & Market Share Insights

The surface mining equipment market is highly competitive in nature with the presence of prominent market players. Surface Mining equipment manufacturers use a variety of strategies to increase market penetration and cater to changing technological demand for equipment from various applications such as metal mining, nonmetal mining, and coal mining. These strategies include mergers, acquisitions, joint ventures, new product development, and geographical expansion. For instance, in June 2023, Epiroc AB presented the MTVR, a hydraulic technology-based mobile wagon-mounted power pack for electric blast-hole drills. MTVR reduces the requirement for high-voltage cable management, increasing productivity and uptime while also providing agility and reliability in mining applications. Some prominent players in the global surface mining equipment market include:

-

AB Volvo.

-

Atlas Copco AB

-

Boart Longyear Ltd

-

Caterpillar Inc

-

Hitachi Construction Machinery Co. Ltd.

-

J.C. Bamford Excavators Limited

-

Komatsu Ltd.

-

Liebherr-International AG

-

Metso Corporation

-

Sandvik AB

Surface Mining Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 674.50 billion

Revenue forecast in 2030

USD 1,016.78 billion

Growth rate

CAGR of 6.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume units, revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Brazil; Mexico

Key companies profiled

Atlas Copco AB; Boart Longyear Ltd; Caterpillar Inc; Hitachi Construction Machinery Co. Ltd.; J.C. Bamford Excavators Limited; Komatsu Ltd.; Liebherr-International AG; Metso Corporation; Sandvik AB; AB Volvo.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surface Mining Equipment Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the surface mining equipment market report based on product, application, and region:

-

Product Outlook (Volume Units; Revenue, USD Million, 2018 - 2030)

-

Loaders

-

Excavators

-

Crushing, Pulverizing & Screen Equipment

-

Drills & Breakers

-

Dumper

-

Shovels

-

Motor Graders

-

Others

-

-

Application Outlook (Volume Units; Revenue, USD Million, 2018 - 2030)

-

Metal Mining

-

Non Metal Mining

-

Coal Mining

-

-

Regional Outlook (Volume Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global surface mining equipment market size was estimated at USD 633.15 billion in 2022 and is expected to reach USD 674.50 billion in 2023.

b. The global surface mining equipment market is expected to witness a compound annual growth rate of 6.0% from 2023 to 2030 to reach USD 1,016.78 billion by 2030.

b. The metal mining segment accounted for the largest market share of over 40% in 2022 and is expected to maintain dominance over the forecast period. The metal mining segment is anticipated to expand as a prominent application category due to increased resource exploration and strong demand for precious metals like silver, gold, copper, and iron. Owing to constantly improving technology, mining for rare earth metals has recently gained traction.

b. Key industry players operating in the surface mining equipment market include Atlas Copco AB, Boart Longyear Ltd, Caterpillar Inc, Hitachi Construction Machinery Co. Ltd. J.C. Bamford Excavators Limited, Komatsu Ltd. , Liebherr-International AG, Metso Corporation, Sandvik AB, and AB Volvo.

b. Factors such as the strong emphasis of automakers on vehicle electrification, growing demand for metals in industries such as consumer electronics, energy, and automotive, coupled with increasing urbanization in developing countries inducing the demand for coal, are driving the demand for surface equipment in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.