- Home

- »

- Communication Services

- »

-

Supply Chain Management Market Size & Share Report, 2030GVR Report cover

![Supply Chain Management Market Size, Share & Trends Report]()

Supply Chain Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment, By Organization, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-928-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Supply Chain Management Market Summary

The global supply chain management market size was estimated at USD 25.67 billion in 2024, and is projected to reach USD 48.59 billion by 2030, growing at a CAGR of 11.4% from 2025 to 2030. The growth of the supply chain management (SCM) market can be attributed to the rising demand and increased awareness of the benefits of SCM solutions, such as transportation management systems, planning & analytics, forecasting accuracy, warehouse & inventory management, supply chain optimization, procurement & sourcing, waste minimization, manufacturing execution and relevant synthesis of business data.

Key Market Trends & Insights

- North America supply chain management market accounted for a 38.5% share of the overall market in 2024.

- The supply chain management industry in the U.S. held a dominant position in 2024.

- By component, the solution segment accounted for the largest share of 60.6% in 2024.

- By organization, the large enterprise segment held the largest market share in 2024.

- By deployment, the on-premise segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.67 Billion

- 2030 Projected Market Size: USD 48.59 Billion

- CAGR (2025-2030): 11.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

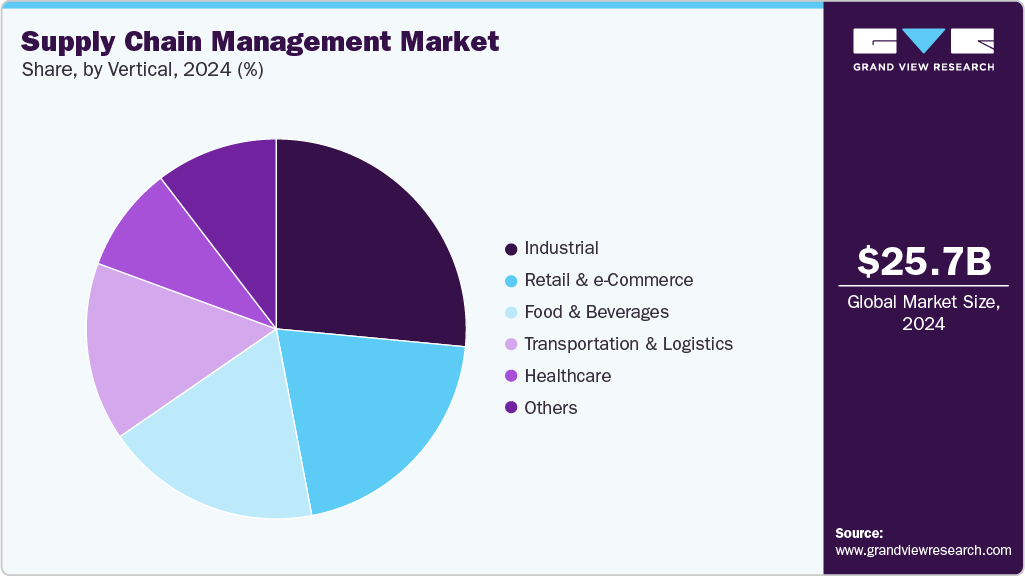

Organizations have been heavily investing in establishing information connections with their suppliers and buyers to decrease costs, lead times, and quality issues and enhance prompt customized delivery. In recent years, there has been a significant increase in investments in supply chain management across various industries. This trend is driven by the recognition that a well-managed supply chain can provide significant competitive advantages to businesses. Investing in supply chain management helps organizations improve operational efficiency, reduce costs, and enhance customer satisfaction. Organizations can optimize the supply chain to ensure that the right products are delivered to customers at the right time and cost. Moreover, effective supply chain management can also help businesses mitigate risks associated with supply chain disruptions, such as geopolitical issues, natural disasters, and supplier bankruptcies. By implementing risk management strategies and building resilience in the supply chain, businesses can minimize the impact of such disruptions on their operations and the bottom line.There has been a significant increase in the demand for supply chain management solutions among various end-use verticals, such as retail & e-commerce, transportation & logistics, healthcare, and food & beverages in recent years. The increasing demand for supply chain management solutions can be attributed to factors such as the increasing complexity of supply chains; the need for greater efficiency, better visibility, and risk mitigation; and the growing need for sustainability. Supply chains have become more complex with globalization and the growth of e-commerce. This complexity has made it difficult for companies to manage their supply chains effectively, leading to inefficiencies, delays, and increased costs. As a result, companies are preferring supply chain management solutions to streamline their operations and reduce costs.

The rising demand for e-commerce can be attributed to factors such as convenience, safety, product variety, ease of payment and delivery, and improved user experiences. The increase in e-commerce has significantly impacted the supply chain management market. With the growth of e-commerce, the demand for supply chain management solutions has also increased. This is because e-commerce companies have more complex supply chains compared to traditional retailers, and they must manage multiple distribution channels, including warehouses, fulfillment centers, and shipping carriers. As e-commerce continues to evolve and become more convenient and personalized, its popularity among consumers is likely to increase, thus driving the market growth.

The increasing demand for supply chain visibility, resiliency, and transparency is a response to several factors that have emerged in recent years. One of the primary drivers of this trend is globalization, which has led to extended and more complex supply chains. As companies expand their operations across different regions, they face new challenges such as managing diverse suppliers, navigating complex regulations, and dealing with unforeseen disruptions (including natural disasters, geopolitical conflicts, and pandemic outbreaks). To mitigate these risks, businesses need greater visibility into their supply chains, which enables them to track the flow of goods and services from source to destination, identify potential bottlenecks, and respond quickly to disruptions.

The implementation cost of supply chain management solutions can be high, which is a significant challenge for many organizations. The cost of implementing supply chain management solutions can vary widely depending on the solution's scope and complexity, the organization's size, and the level of customization required. One of the main factors contributing to the high cost of supply chain management solutions is the need for technology infrastructure. Supply chain management solutions require a range of components, including hardware, software, and network infrastructure. This can be expensive, particularly for smaller organizations, which may not have the resources to invest in the necessary infrastructure. Networking equipment, such as routers and switches, may also be required to connect various systems and devices. These devices can be costly and the installation process can be time-consuming, which can further add to the overall implementation cost.

Component Insights

The solution segment accounted for the largest share of 60.6% in 2024. SCM solutions are used for quality assurance, inventory management, vendor management, supplier management, and logistics management. SCM solutions provide benefits such as higher visibility, increased efficiency, analytics, lower costs, greater agility, and increased compliance over the complex supply chain. It assists in automating major procedures such as processing orders, billing, and order tracking resulting in reducing time and administration expenses. SCM systems also identify excess materials and costs connected with shipping, warehousing, and manufacturing, which helps reduce excess inventory.

The service segment is expected to grow at the fastest CAGR from 2025 to 2030. SCM services provide data-driven insights to companies and improve their supply chain operations. The services offer real-time predictive production cost assessment services to identify process inefficiencies and opportunities. It effectively executes data-driven sales and operations planning and inventory management to assist in cost reduction. SCM services enable the monitoring of manufacturing activities to optimize performance and reduce risk.

Deployment Insights

The on-premise segment accounted for the largest share in 2024. On-premise supply chain management solutions provide businesses with full control over their supply chain data and operations by installing and managing the software on servers located within the company's premises, handled by the in-house IT staff. Although cloud-based solutions are gaining traction due to their scalability and cost efficiency, the on-premise model remains the preferred choice in industries such as manufacturing, defense, and energy, where data sensitivity and operational continuity are paramount.

The cloud-based segment is expected to grow at a significant CAGR during the forecast period. Cloud-based supply chain management solutions offer numerous advantages for businesses. One of the most significant benefits is cost savings. Companies can avoid the significant capital expenditures associated with implementing and maintaining an on-premises solution by opting for cloud-based solutions, since the software is hosted on remote servers and businesses have to pay only for the necessary service rather than investing in dedicated hardware or infrastructure. In addition, providers of cloud-based solutions offer automatic software updates, which means businesses can always access the latest features and functionalities without incurring any additional costs. Cloud-based solutions also facilitate greater accessibility and collaboration.

Organization Insights

The large enterprise segment accounted for the largest share in 2024. Large enterprises have complex supply chains that involve multiple suppliers, distributors, and customers across different geographic locations. Efficient supply chain management is crucial for large enterprises to ensure that their products are delivered to clients on schedule and with the required quality. The segment growth can be attributed to growing complexity of supply chains, driven by e-commerce expansion and globalization, has led large enterprises to adopt supply chain management solutions to efficiently manage their extensive networks, optimize performance, and ensure timely delivery of goods to customers.

The small and medium-sized enterprise (SMEs) segment is expected to register a notable CAGR from 2025 to 2030. SMEs are rapidly adopting supply chain management to boost their operational effectiveness and gain a competitive edge. SCM solutions and services help SMEs optimize their supply chain processes, reduce costs, and increase profitability. SCM systems can be customized to an organization's unique needs, whether in a single location or across multiple regions. This customization enables organizations to optimize their supply chain processes and adapt to changing market conditions and customer demands.

Vertical Insights

The industrial segment accounted for the largest share in 2024. The segment is further categorized into automotive and heavy equipment & machinery. Effective supplier management is crucial to ensuring that industrial companies acquire high-quality materials and components from their complicated network of suppliers at reasonable costs. Industrial companies can improve supplier quality and reduce supply chain risks by implementing supplier performance metrics, conducting regular supplier audits, and developing long-term relationships with key suppliers.

The high market share can be attributed to the increased adoption of effective supply chain management solutions to acquire high-quality materials at reasonable costs, mitigate supply chain risks, improve production processes, and reduce waste through lean manufacturing principles and process improvement initiatives.

The retail & e-commerce segment is expected to register a notable CAGR from 2025 to 2030 In the retail industry, SCM has become essential to meet client demands and ensure that the appropriate products are available at the appropriate time and location. SCM also plays a vital role in reducing costs by optimizing inventory levels, streamlining transportation, and reducing lead times.

The growth of e-commerce has accelerated the adoption of SCM in the retail industry. The management of e-commerce supply chains is centered around procuring raw materials, production processes, and timely distribution of finished products. It encompasses coordinating supply and demand, inventory management, order processing, warehousing, and customer delivery. By implementing an effective supply chain management strategy, businesses can improve visibility across their networks and closely monitor the performance of all production, storage, and distribution activities.

Regional Insights

The North America supply chain management market accounted for 38.5% of the global share in 2024. The rapid growth of e-commerce in North America has increased the demand for efficient supply chain management solutions to meet customers' expectations for fast and reliable deliveries. Moreover, the rising demand for supply chain management solutions that offer real-time tracking, traceability, and data analytics is driven by the increasing desire for visibility and transparency, leading to improved decision-making and increased customer satisfaction.

U.S. Supply Chain Management Industry Trends

The U.S. supply chain management industry held a dominant position in 2024. Supply chain management is a critical aspect of the U.S. economy, enabling the efficient movement of goods and services from manufacturers to consumers. The U.S. has a complex and extensive supply chain network that spans various industries, including manufacturing, agriculture, retail, and logistics. In recent years, the U.S. has faced several challenges related to supply chain management, including disruptions caused by trade disputes and the COVID-19 pandemic. These challenges have highlighted the need for robust SCM practices to ensure the resilience and flexibility of the supply chain.

Supply chain management market in Mexico is witnessing growth due to its strategic location as a bridge between North and South America. Mexico has become a significant manufacturing hub for the consumer goods, automotive, aerospace, and electronics sectors. Many multinational companies have established production facilities in Mexico to take advantage of its skilled labor force and favorable trade agreements

Europe Supply Chain Management Market Trends

The Europe supply chain management industry was identified as a lucrative region in 2024. The growth of e-commerce and high demand for seamless shopping experiences have transformed the supply chain landscape in Europe. Retailers are adopting omni channel strategies, integrating online and offline channels, and offering faster delivery options to meet customer expectations. This trend has increased the demand for warehousing, last-mile delivery solutions, and order fulfillment services.

In addition, European organizations are prioritizing sustainability and environmental responsibility in their supply chain operations. Energy intensity reduction is a critical aspect of sustainable supply chain management. Companies are implementing measures to minimize greenhouse gas emissions, reduce waste generation, and enhance resource efficiency. This includes optimizing transportation routes to minimize fuel consumption, promoting circular economy principles to minimize waste, and collaborating with suppliers to prioritize eco-friendly practices.

The Germany supply chain management market is being shaped by the growing use of cloud-based solutions. Germany is one of the leading economies in Europe. It has a well-developed supply chain management market that is highly competitive and rapidly evolving. Also, the German market is characterized by a large number of players offering various services and solutions to help businesses optimize their supply chain operations. This, coupled with the increasing demand for supply chain visibility, efficiency, and flexibility, has contributed to the growth of the SCM solutions market in Germany.

Supply chain management market in the UK has a well-established logistics and transportation industry with many of the world's largest logistics companies.Its logistics and transportation industry has been pivotal in fostering innovations and, in turn, driving the growth of the supply chain management market.

One key trend in the UK SCM market is the increasing adoption of technologies to improve efficiency and reduce costs. This includes the use of data analytics, automation, and artificial intelligence to optimize supply chain processes and improve visibility and control over inventory. Another factor is the growth of e-commerce. As more consumers shop online, retail and logistics companies are under increasing pressure to deliver products quickly and efficiently, leading to a greater focus on supply chain optimization and the need for specialized logistics services.

Asia Pacific Supply Chain Management Market Trends

The Asia Pacific supply chain management industry was identified as a lucrative region in 2024. The Asia Pacific region is home to various manufacturing industries, including textile, automotive, and electronics. To effectively manage the supply chains in these industries, the coordination of a sophisticated network of suppliers and logistics partners is required. Therefore, businesses in the region are adopting supply chain management solutions to optimize their operations. These solutions provide real-time data analysis, allowing businesses to make informed inventory management, production scheduling, and transportation routing decisions. This results in more efficient supply chain operations with reduced costs and increased profitability.

The China supply chain management industry held a substantial market share in 2024. China has a rapidly growing and dynamic supply chain management market. China plays a pivotal role in global supply chains with a thriving e-commerce industry led by giants such as Alibaba and JD.com. The increasing popularity of online shopping and the surge in demand for swift and efficient deliveries have created a necessity for advancements in supply chain management solutions. Companies are focusing on integrating their online and offline channels to create seamless omnichannel experiences, which require sophisticated supply chain management strategies.

Supply chain management market in Japan held a significant share in 2024. Japan's supply chain management market is experiencing significant growth and witnessing several trends. Japan's economic activities have been expanding at a significant pace, which is attributed to the growth of various sectors in Japan. One aspect of this growth is the increase in imports and exports. Japan has a strong presence in global trade, with its exports ranging from automobiles and electronics to machinery and chemicals.

Key Supply Chain Management Company Insights

Some of the key players operating in the market include SAP, Oracle Corporation, IBM Corporation, Blue Yonder Group, Inc., and Manhattan Associates.

-

Founded in 1972 and headquartered in Walldorf, Germany, SAP SE specializes in developing and delivering enterprise software solutions to businesses in various industries. SAP's extensive product and service portfolio allows businesses to streamline processes, increase productivity, and make data-driven choices. The company offers supply chain management, business intelligence, enterprise resource planning (ERP), customer relationship management (CRM), and analytics solutions. The software solutions of the company are intended to cater to the requirements of industries and sectors such as finance, manufacturing, retail, healthcare, and utilities.

-

Founded in 1977 and headquartered in Texas, U.S., Oracle offers a comprehensive range of products and services designed to meet the needs of businesses across various industries. Its primary focus is developing and marketing database management systems, cloud-based applications, and integrated software solutions. Oracle provides various enterprise applications, including customer experience management, human capital management, supply chain management, and enterprise resource planning (ERP).

Key Supply Chain Management Companies:

The following are the leading companies in the supply chain management market. These companies collectively hold the largest market share and dictate industry trends.

- SAP

- Oracle Corporation

- Blue Yonder Group, Inc.

- Infor

- Manhattan Associates, Inc

- Coupa Software

- IBM Corporation

- Logility, Inc

- Korber AG

- Epicor Software Corporation

- THE DESCARTES SYSTEMS GROUP INC

- Yusen Logistics (Nippon Yusen Kabushiki Kaisha)

- Kerry Logistics Network

- Anaplan, Inc.

- Tecsys Inc

Recent Developments

-

In May 2025, Manhattan Associates Inc. introduced comprehensive Agentic AI capabilities within its Manhattan Active solutions, featuring intelligent, autonomous digital agents designed to transform supply chain commerce execution, enhance optimization, and elevate user experiences.

-

In January 2025,Oracle Corporation introduced new AI-driven order and logistics management capabilities within Oracle Fusion SCM to enhance the sustainability and efficiency of global supply chains. The newest updates to Oracle Global Trade Management, Oracle Transportation Management, and Oracle Order Management are designed to improve customer satisfaction by increasing shipment visibility, reducing trade costs, optimizing transportation decisions, and minimizing shipment-related emissions.

-

In February 2024, Logility, Inc. introduced a generative AI capability as part of its AI-first approach to supply chain management. Built on its AI-native platform, Logility GenAI is designed to help enterprises navigate the complexity of supply chain data, enabling faster decision-making and driving competitive advantage.

-

In May 2023, Accenture and Blue Yonder, Inc. announced the expansion of their strategic partnership to enhance organizations' supply chains by leveraging Accenture's technology and industry expertise. Accenture's cloud-native platform engineers and industry experts likely to collaborate with Blue Yonder to develop new solutions on the Blue Yonder Luminate Platform, offering end-to-end supply chain synchronization. The partnership aimed to help clients achieve a more modular, digitized, and agile supply chain of the future through co-innovation and the vertical of emerging technologies such as generative artificial intelligence and robotics process automation.

-

In April 2023, Oracle introduced advanced artificial intelligence (AI) and automation capabilities designed to assist customers in optimizing their supply chain management processes. These new features leveraged AI and automation technologies to enhance efficiency, streamline operations, and enable better decision-making within supply chain management for its customers. The updates included improved quote-to-cash procedures in Oracle Fusion Vertical s and new planning, usage-based pricing, and rebate management features in Oracle Fusion Cloud Supply Chain & Manufacturing (SCM).

Supply Chain Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.37 billion

Revenue Forecast in 2030

USD 48.59 billion

Growth rate

CAGR of 11.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments Covered

Component, deployment, organization, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

SAP; Oracle Corporation; Blue Yonder Group, Inc.;

Infor; Manhattan Associates, Inc; Coupa Software;

IBM Corporation; Logility, Inc; Korber AG; Epicor Software Corporation; THE DESCARTES SYSTEMS GROUP INC; Yusen Logistics (Nippon Yusen Kabushiki Kaisha); Kerry Logistics Network; Anaplan, Inc.; Tecsys Inc;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Supply Chain Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global supply chain management market report based on component, deployment, organization, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Transportation Management System

-

Planning & Analytics

-

Warehouse & Inventory Management System

-

Procurement & Sourcing

-

Manufacturing Execution System

-

-

Services

-

Professional Services

-

Strategic Advisory

-

Administrative Services

-

Marketing Services

-

-

Managed Services

-

System Integration

-

Maintenance & Support

-

Data Analytics

-

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud-based

-

-

Organization Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Sized Enterprises

-

Large Enterprises

-

Waterways

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail & E-Commerce

-

Healthcare

-

Transportation & Logistics

-

Food & Beverages

-

Industrial

-

Automotive

-

Heavy Equipment & Machinery

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global supply chain management market size was estimated at USD 25.67 billion in 2024 and is expected to reach USD 48.59 billion in 2030.

b. The global supply chain management market is expected to grow at a compound annual growth rate of 11.4% from 2025 to 2030 to reach USD 48.59 billion by 2030.

b. North America dominated the supply chain management market with a share of 38.5% in 2024. The presence of a huge number of adopters for such software in the region along with the fact that the region is technologically advanced are contributing to the market growth. The presence of major key players operating in the region is another key factor contributing to market growth.

b. Some key players operating in the supply chain management market include SAP, Oracle Corporation, IBM Corporation, Blue Yonder Group, Inc., Manhattan Associates, Yusen Logistics, Inc., Logility, Inc., Coupa Software Inc.

b. Key factors that are driving the supply chain management market growth include rising demand and increased awareness of the benefits of SCM solutions, such as transportation management systems, planning & analytics, forecasting accuracy, warehouse & inventory management, supply chain optimization, procurement & sourcing, waste minimization, manufacturing execution and relevant synthesis of business data. Also, the rapidly growing adoption of information technology and technical breakthroughs improves and supports the overall supply chain are contributing to the market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.