Sulphonamides Market Size & Trends

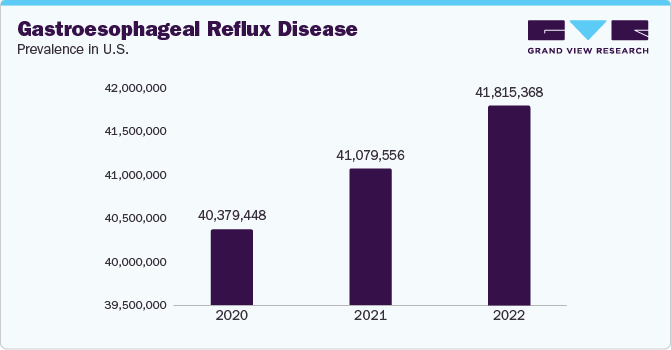

The global sulphonamides market size was valued at USD 123.39 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.19% from 2023 to 2030. This class of drug antibiotics acts by inhibiting folic acid synthesis, which is the precursor of DNA or RNA synthesis of bacteria and is used for the treatment of UTIs and ulcerative colitis. Hence, this market may witness growth due to the increasing prevalence of diseases, coupled with the presence of key manufacturers such as F. Hoffmann-La Roche AG, Teva Pharmaceutical Industries Ltd., and Pfizer, Inc.

With 247 million instances and 619,000 fatalities from malaria recorded in 2021 alone as per WHO, the illness is catastrophic. When a person contracts the mosquito-transmitted parasite Plasmodium falciparum, which causes malaria, they will have fever and flu-like symptoms. Insecticides that kill mosquitoes that transmit malaria are becoming more effective, and Sulfadoxine is often used to treat the symptoms of malaria around the world. However, both the parasite and insects are mutating such that they are no longer susceptible to these treatments. Therefore, there is an urgent need for new sulphonamide drugs with the ability to fight against resistance-causing mosquitoes. For instance, in January 2023, the Baum laboratory and associates at Imperial College London, UK, discovered a novel class of powerful antimalarial substances that belonged to the sulphonamide family. These substances only destroy the parasite during a particular sexual stage of its life cycle, preventing it from infecting a mosquito and, thus, preventing any subsequent human infection.

For improved sulphonamide drug candidate identification, there has been an increase in the use of cutting-edge technologies, including high throughput, combinatorial chemistry, and bioinformatics for the development of new drugs. Additionally, with the development of new technology, drug discovery has substantially improved, becoming more precise, quick, and time-efficient. However, the availability of alternative medications, sulphonamides, and the growing number of side effects related to the usage of sulphonamide drugs might impede the market's expansion throughout the projection period.

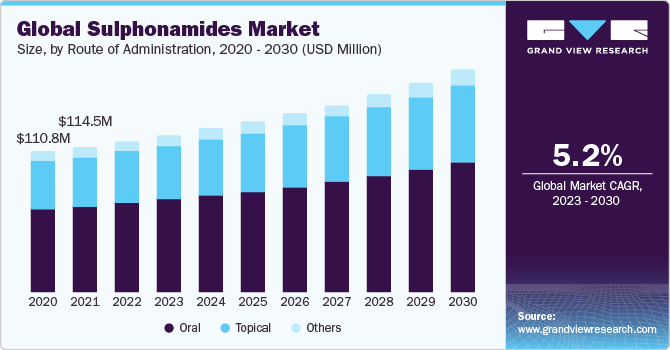

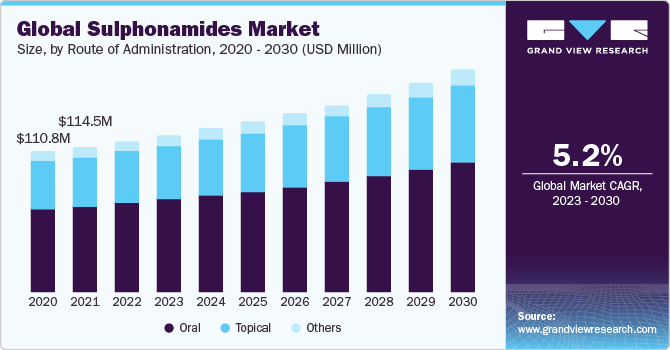

Route Of Administration Insights

Based on the route of administration, the sulphonamides market is segmented into oral, topical, and others. The oral segment held the largest market share in 2023. This can be attributed to the high advantages associated with the oral route of administration over another route of administration. Furthermore, it is considered the most practical, economical, and popular method for the delivery of sulphonamides to patients. Therefore, research and development of new oral sulphonamides is anticipated to drive market growth.

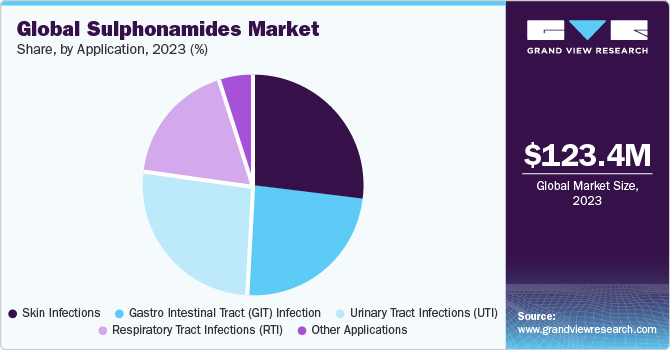

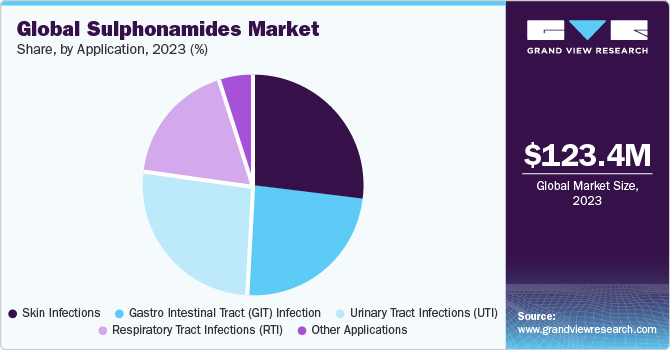

Application Insights

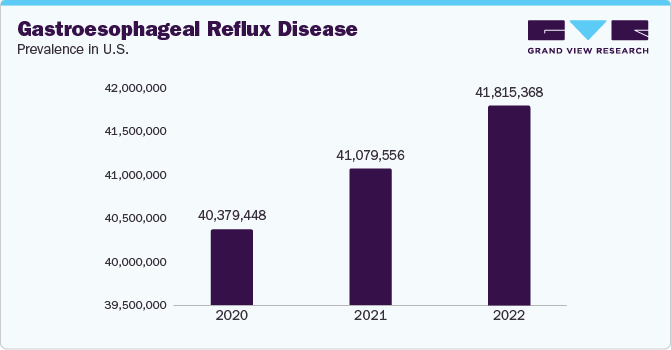

On the basis of application, the market is segmented into skin infections, gastro intestinal tract (GIT) Infection, urinary tract infections (UTI), respiratory tract infections (RTI), and other applications. The skin infections segment held the largest market share in 2023. This can be attributed to the growing number of skin infections worldwide. According to NCBI, over 14 million cases of cellulitis are reported each year in the U.S., making it one of the most frequent bacterial skin infections. It is responsible for 650,000 hospital admissions per year and ambulatory care expenses of about USD 3.7 billion. Thus, the increasing prevalence of skin infections is anticipated to drive segment growth over the forecast period.

Regional Insights

North America dominated the market in 2023. This can be attributed to expanding R&D in the medical sciences, the availability of cutting-edge technologies, the increased usage of antibiotics, and the rise in the prevalence of infections. Thus, developing and commercializing new drugs in the U.S. and Canada is anticipated to propel regional growth. Asia-Pacific is expected to witness the fastest CAGR over the forecast period. Developing countries such as South Korea, Brazil, India, and Mexico are expected to offer potential growth opportunities for key players in the market. This can be attributed to the increasing incidence and prevalence of infectious diseases, improved healthcare infrastructure, and large patient pool. For instance, in 2023, the Ministry of Health and Family Welfare allocated USD 891.5 billion for healthcare purposes in India.

Key Companies & Market Share Insights

The market is diversified and comprises several key pharmaceutical companies Such as AA Pharma Inc., Abbott, GSK plc., Akorn Operating Company LLC, Amneal Pharmaceuticals LLC, Viatris Inc., Lexine Technochem Pvt. Ltd, Pfizer Inc., Hoffmann-La Roche Ltd, and Teva Pharmaceutical Industries Ltd that hold a substantial share in the market. However, with product innovations and technological advancements, mid-size to smaller companies is increasing their market presence by introducing new, safe products at low prices, which may create tough competition for existing players in the market.

-

In August 2022, Valeo Pharma Inc. and Novartis Pharmaceuticals Canada Inc., a subsidiary of Novartis AG, signed a supply and distribution agreement for SIMBRINZA (brimonidine tartrate/brinzolamide) in Canada. Brinzolamide is a carbonic anhydrase inhibitor and sulfonamide with a specific affinity for carbonic anhydrase II. This move ensured a broader reach of its products in the global market.

-

In July 2022, the U.S. FDA granted approval to the drug ZONISADE (zonisamide oral suspension) developed by Azurity Pharmaceuticals Inc. to treat adult patients aged 16 years and above. Zonisamide is a sulfonamide antiepileptic drug,