- Home

- »

- Next Generation Technologies

- »

-

Subscription Billing Management Market Size Report, 2030GVR Report cover

![Subscription Billing Management Market Size, Share & Trends Report]()

Subscription Billing Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Software, By Service (Professional, Managed), By Deployment (Cloud, On-premise), By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-976-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Subscription Billing Management Market Summary

The global subscription billing management market size was estimated at USD 7.15 billion in 2024 and is projected to reach USD 17.95 billion by 2030, growing at a CAGR of 16.9% from 2025 to 2030. The rising adoption of subscription-driven business models in various industries, ranging from the manufacturing sector to financial institutions, is expected to boost the adoption of the market.

Key Market Trends & Insights

- The North America's subscription billing management market held the largest share in 2024 and accounted for 30.82%.

- The U.S. subscription billing management market held a dominant position in 2024.

- By software, the subscription order management segment accounted for the largest revenue share of 31.80% in 2024.

- By service, the professional services segment accounted for the largest revenue share in 2024.

- By deployment, the cloud segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.15 Billion

- 2030 Projected Market Size: USD 17.95 Billion

- CAGR (2025-2030): 16.9%

- North America: Largest market in 2024

Moreover, the rising adoption of subscription-based models by numerous businesses is leading to improved customer retention rates. Such factors bode well for market growth in the coming years.

Several market players are focusing on expanding their presence and releasing new products focused on specific markets. For instance, in February 2022, Recurly, Inc., a subscription management and billing solution provider, announced the expansion of its European footprint to introduce new capabilities focused on the European market. Moreover, various subscription billing providers are also focusing on incorporating machine learning capabilities into their platforms to improve their revenues. For instance, Stripe’s billing software combines advanced machine learning capabilities with automatic card update features. This use of machine learning technology has helped Stripe in increasing its recurring bill revenue by 10% on average.

The companies offering subscription billing software are focused on integrating enhanced technologies such as artificial intelligence, the Internet of Things, and blockchain into their platforms to improve their offerings. At the same time, numerous digital infrastructure companies are also implementing cloud billing platforms into their existing products to meet the data connectivity demand from their customers. For instance, in March 2022, Aria Systems, Inc., a subscription billing company, announced that EXA Infrastructure, a digital infrastructure company, has implemented its cloud billing platform using Aria to bill for the existing products to meet the data connectivity demand from its customers.

Prominent digital payment solution providers have started using the subscription business model to meet the changing customer demands. The subscription-based model allows digital payment companies to efficiently improve their revenues and sell their products. Furthermore, digital payment companies are also collaborating with subscription billing management companies for merchants operating on the subscription model. For instance, in October 2021, Worldline, a digital payment company, announced its collaboration with Chargebee, a subscription billing management company, to provide subscription and revenue operations and end-to-end payment solutions for merchants.

Businesses use subscription billing management systems to generate and send invoices to their partners or customers to receive payments. A subscription billing management system helps companies improve performance and reduce errors by automating document preparation and other tasks. On the other hand, machine learning technology is also being used to analyze fraudulent attempts in online transactions. Machine learning technology is also used in recurring payment software to increase sales, enhance customer experience, and reduce payment failures.

Software Insights

The subscription order management segment accounted for the largest revenue share of 31.80% in 2024. Subscription order management involves finding the right mix of products and projects, recurring and one-time services, and usage charges for customers as part of the efforts to lower the customer churn rate. The ability of the subscription order management software to work closely with accounting tools to cater to the changing needs of the subscription services bodes well for the growth of the segment. Subscription order management software collects and stores the information of the customers’ billing details and subscription plans, and also integrates with the payment gateway systems to meet the requirements of the subscription business.

The receivables management segment is expected to witness moderate growth during the forecast period. In recent years, companies have continued to shift to the subscription business model, and the need to track customer details efficiently has also increased, which is one of the major factors driving the growth of the receivables management segment. Several market players are also focusing on acquiring collection management companies to introduce and expand their receivables management solutions. For instance, in February 2022, Chargebee, a subscription management solution provider, announced that it had acquired “numbers,” a collection management company, and launched Chargebee Receivables, a receivable management platform that allows automating the receivables process from purchase to payment efficiently.

Service Insights

The professional services segment accounted for the largest revenue share in 2024. It covers integration & deployment, support & maintenance, and training & consulting services. Integration & deployment services are necessary to help businesses in installing the software, aligning the software with the existing systems, and operating the software efficiently. Many professional service firms are now providing their services through a subscription model to enhance customer flexibility. For instance, according to Exact, a software company, 37% of professional service companies choose to provide their services through a subscription model to enhance customer loyalty.

Managed services are expected to grow at the fastest CAGR during the forecast period. These services help improve operations without incurring any additional expenses on employing new, dedicated staff for management purposes. Managed Services in a recurring billing system offer benefits such as improved customer billing, custom pricing discount plans, multiple renewable options, and better customer loyalty. Such factors are expected to create lucrative growth opportunities for the market in the coming years.

Deployment Insights

The cloud segment held the largest market share in 2024. The segment is estimated to expand further at the fastest CAGR, retaining the leading position throughout the forecast period. Cloud-based billing solutions can accommodate changes and capably manage the organization's shifting needs, which is a major factor driving the growth of this segment in the coming years. Cloud-based billing offers benefits such as automated processes, flexibility, scalability, business operations support, and end-to-end customer life cycle management.

On-premise deployment is expected to register a moderate CAGR during the forecast period. On-premise for billing software has the advantage that it is stored on the customer’s local server, which in turn provides better flexibility. In on-premise subscription billing software, everything runs on the systems installed in the organization without any involvement of third parties. Moreover, on-premise businesses can effectively cater to changing business needs. Such factors mentioned above bode well for the growth of the segment during the forecast period.

Enterprise Size Insights

The large enterprises segment dominated the market in 2024. Large enterprises have a huge customer base that is spread widely across the globe. Hence, to improve the customer retention rate, they are aggressively investing in subscription billing management solutions. These solutions assist large enterprises in managing the customer’s portfolio by providing them with a better customer experience. Moreover, payment companies are striking partnerships with cloud-based subscription billing solution providers to expand their reach. Such partnerships are expected to drive the growth of the large enterprise segment during the forecast period.

The small & medium enterprises segment is expected to grow at the fastest CAGR during the forecast period. The growing preference to automate manual accounting and financial processes and provide efficient services to customers is expected to drive the adoption of subscription billing management software among small and medium enterprises. Cloud-based billing solutions help small & medium enterprises enhance the overall customer experience and maximize customer retention rates.

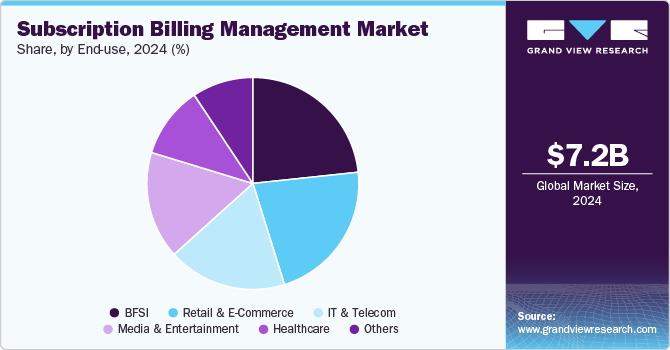

End-use Insights

The BFSI segment dominated the market in 2024. The increasing adoption of the latest technologies by the incumbents of the BFSI industry is playing a vital role in driving the growth of the market. Several payment service providers across the globe are striking partnerships with subscription management platform providers to provide seamless payment solutions. For instance, in January 2022, a payment service provider in Europe announced its partnership with Chargebee to simplify the subscription billing for merchants.

The retail & e-commerce segment is expected to register a notable growth rate during the forecast period. The changing preference in consumer demands and buying behavior is reshaping the retail & e-commerce segment. The increasing use of online channels for buying consumer goods is prompting retailers to opt for automated subscription billing platforms that can potentially help in automating bills and settling customer disputes. Such factors bode well for the growth of the segment during the projection period.

Regional Insights

The North America's subscription billing management market held the largest share in 2024 and accounted for 30.82% of the revenue. North America is home to several market players, such as SAP SE, Oracle, Aria System Inc., and Blusynergy, featuring a competitive marketplace with promising growth opportunities. These companies are focusing on developing subscription billing management solutions aimed at providing better customer service.

U.S. Subscription Billing Management Market Trends

The U.S. subscription billing management market held a dominant position in 2024. The proliferation of subscription-based business models across various sectors, including media, software, and e-commerce, drives market growth. The increasing adoption of cloud-based solutions is enabling businesses to streamline their billing processes and enhance customer experience. In addition, several players in the market are also investing in innovative technologies such as AI and machine learning to optimize billing operations and reduce churn rates, thereby driving the growth of the market.

Europe Subscription Billing Management Market Trends

The Europe subscription billing management market was identified as a lucrative region in 2024. Numerous global market players are expanding their business in the Europe region. These business expansion initiatives are expected to increase the adoption of subscription-based billing in the region. For instance, in September 2024, Chargebee Inc., a provider of subscription billing and revenue growth management solutions, opened a new office in Dublin, representing a key milestone in its expansion across Europe. Such initiatives are expected to contribute to the market’s growth in the region.

The Germany subscription billing management market is expected to grow rapidly in the coming years. The rise of e-commerce and digital services in the country is driving demand for advanced billing solutions that can handle complex pricing structures and multi-currency transactions. German businesses are increasingly adopting subscription models in sectors such as software, media, and SaaS, leading to a surge in the need for streamlined billing processes.

The UK subscription billing management market held a substantial market share in 2024. The growth of the market can be attributed to the growing digital economy and an increasing number of startups offering subscription services. The need for efficient billing solutions that can accommodate various pricing models, such as tiered and usage-based billing, is driving market demand.

Asia Pacific Subscription Billing Management Market Trends

The Asia Pacific subscription billing management market is anticipated to grow at a significant CAGR during the forecast period. The increasing adoption of subscription-based B2B business models across various industries, including finance and manufacturing, is driving market growth in the Asia Pacific region.

Japan's subscription billing management market is expected to register a moderate growth rate during the forecast period owing to the rising adoption of digital services and an increasing preference for subscription-based consumption models. In addition, the rising adoption of subscription and billing management solutions across industries such as automotive, electronics, healthcare, and construction, where efficiency and innovation are top priorities, is driving the market growth. The market is also benefiting from a shift towards sustainable and eco-friendly solutions, as subscription and billing management is increasingly used to comply with stringent environmental regulations.

The China subscription billing management market held a substantial market share in 2024 owing to the rapid growth of digital services and e-commerce. The country's vast consumer base and increasing internet penetration are creating significant opportunities for subscription-based business models. Furthermore, advancements in mobile payment technologies are enabling smoother transactions, enhancing customer experience, and driving market growth.

Key Subscription Billing Management Company Insights

Some of the key companies in the market include cleverbridge, Oracle, Aria Systems, Inc., SAP SE; and Zuora Inc.; among others. Market players are pursuing various strategies aimed at long-term sustenance, thereby making it challenging for new players to make a market foray. These strategies include geographical expansion, product innovation, a strong focus on R&D activities, and strategic partnership agreements and joint ventures.

-

Oracle is a technology company based in the U.S. The company’s subscription billing management platform is based on a machine learning platform and is used by product- and service-based companies to simplify the management of billing, contract, and revenue.

-

Zuora Inc. is a provider of subscription billing management solutions based in the U.S. The products offered by the company include Zuora Billing, Zuora Revenue, Zuora Collect, Zuora Central Platform, and Zuora CPQ. The company’s clientele includes companies such as HBO, Siemens Healthineers, Micro Focus, and Mindbody, among others.

Key Subscription Billing Management Companies:

The following are the leading companies in the subscription billing management market. These companies collectively hold the largest market share and dictate industry trends.

- Aria Systems, Inc.

- Oracle

- BluSynergy

- SAP SE

- Conga

- Recurly, Inc.

- Gotransverse

- cleverbridge

- Zuora Inc.

- LogiSense Corporation

Recent Developments

-

In June 2024, Aria Systems Inc. introduced Aria Billing Studio for ServiceNow, a comprehensive integration suite designed to streamline the customer revenue lifecycle. Leveraging the ServiceNow platform, this solution empowers ServiceNow customers to manage order-to-cash-to-care processes across industries, such as communications, media, and technology, using Aria Billing Cloud.

-

In April 2024, Recurly Inc. introduced new dashboards featuring built-in benchmarking capabilities. Leveraging data from over 60 million subscribers, these dashboards provide merchants with actionable insights and benchmarking metrics to identify growth opportunities and make informed decisions in the competitive subscription market.

Subscription Billing Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.24 billion

Revenue forecast in 2030

USD 17.95 billion

Growth rate

CAGR of 16.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Software, service, deployment, enterprise size, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, South Africa

Key companies profiled

Aria Systems, Inc., Oracle, BluSynergy, SAP SE, Conga, Recurly, Inc., Gotransverse, cleverbridge, Zuora Inc., LogiSense Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Subscription Billing Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global subscription billing management market report based on software, service, deployment, enterprise size, end-use, and region.

-

Software Outlook (Revenue, USD Million, 2018 - 2030)

-

Credit and Collection Management

-

Receivables Management

-

Quote and Pricing Management

-

Subscription Order Management

-

Dispute Management

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Professional Services

-

Managed Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail & E-commerce

-

IT & Telecom

-

Media & Entertainment

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global subscription billing management market size was estimated at USD 7.15 billion in 2024 and is expected to reach USD 8.24 billion in 2025.

b. The global subscription billing management market is expected to grow at a compound annual growth rate of 16.9% from 2025 to 2030 and is expected to reach USD 17.95 billion by 2030.

b. North America dominated the subscription billing management market with a share of 30.82% in 2024. This is because a large number of players across this region are focusing on developing subscription billing management solutions aimed at providing better customer service.

b. Some key players operating in the subscription billing management market include Aria Systems, Inc., Oracle, Blusynergy, SAP SE, Conga, and Recurly, Inc.

b. Key factors that are driving the subscription billing management market growth include the rising adoption of subscription business models and the growing need to improve customer retention.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.