- Home

- »

- HVAC & Construction

- »

-

Submarine Cables Market Size, Share, Industry Report, 2033GVR Report cover

![Submarine Cables Market Size, Share & Trends Report]()

Submarine Cables Market (2026 - 2033) Size, Share & Trends Analysis Report By Voltage (Medium Voltage, High Voltage, Extra-high Voltage), By Component (Dry, Wet), By Application, By End-use, By Offerings, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-880-0

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Submarine Cables Market Summary

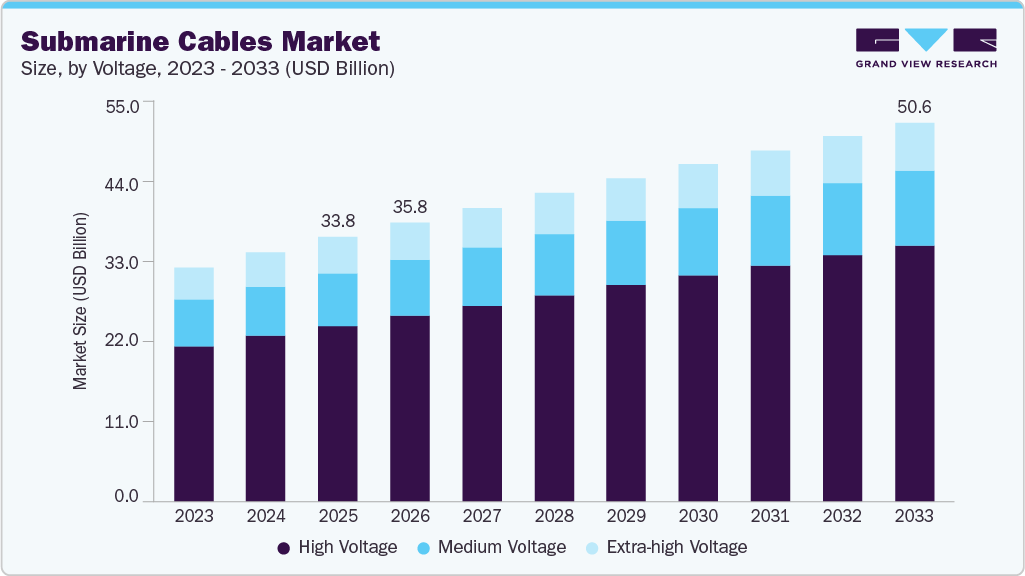

The global submarine cables market size was estimated at USD 33,761.6 million in 2025 and is projected to reach USD 50,566.4 million by 2033, growing at a CAGR of 5.0% from 2026 to 2033. The major factors driving the market are increasing investments in offshore wind farms, increasing data traffic, and investments by OTT providers to satisfy the requirements.

Key Market Trends & Insights

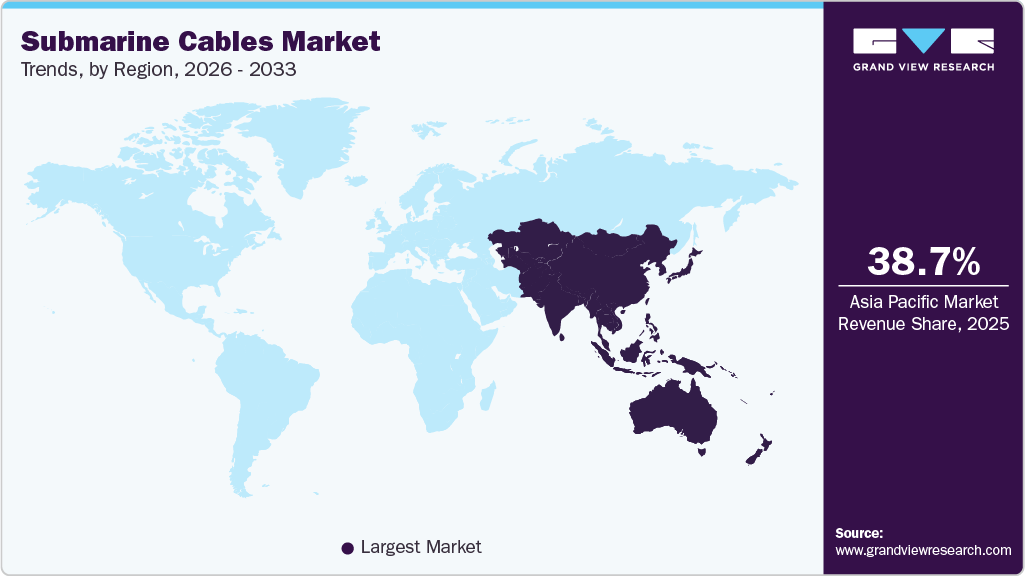

- Asia Pacific dominated the global submarine cables market with the largest revenue share of 38.7% in 2025.

- The submarine cables market in China led the Asia Pacific market and held the largest revenue share in 2025.

- By application, the submarine power cablessegment led the market and held the largest revenue share of 61.5% in 2025.

- By voltage, the high voltage segment held the dominant position in the market and accounted for the leading revenue share of 66.6% in 2025.

- By component, the wet plant productssegment led the component type of submarine communication market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 33,761.6 Million

- 2033 Projected Market Size: USD 50,566.4 Million

- CAGR (2026-2033): 5.0%

- Asia Pacific: Largest Market in 2025

Submarine cables are widely used for power and communication applications. The submarine power cables are used for power transmission to the oil rigs, power generated from offshore wind farms to the power station, and inter-country and island connections. Increasing demand for interconnecting countries' power grids is a factor influencing the demand for low-power cables. Submarine communication cables are used for inter-region/country communications. The worldwide internet traffic is entirely dependent on submarine cables, and with the rise in internet usage, the demand for submarine cables is increasing drastically.The rising focus on joining offshore renewable energy generation and increased energy security has driven the expansion of the market across the globe. These communication cables help in faster communication and carry a large amount of data traffic worldwide. The submarine communication cables carry around 90% of the data traffic across the world. In addition, their total carrying capacity is in terabits per second. As a result, they are the most valued cables for OTT and communication providers such as Google, Amazon, Facebook, and Microsoft.

Furthermore, the rapid advancements in fiber-optic technology enable higher data transmission speeds and capacities, supporting the surge in cloud computing and 5G/6G network deployments worldwide. The expansion of edge computing and IoT applications demands ultra-low latency connections, making submarine cables essential for real-time data processing across continents. Geopolitical shifts toward digital sovereignty and supply chain resilience are prompting investments in new cable routes to diversify infrastructure and reduce reliance on terrestrial alternatives.

Application Insights

The submarine power cable segment accounted for the largest revenue share of around 61.5% in 2025. Increased demand for inter-country and island connections and new capacity expansions in the offshore wind industry are driving the market. Furthermore, the increasing number of offshore wind farms and the increasing electrification of offshore oil and gas networks have increased research and development activities, further increasing the requirement for submarine power cables.

The submarine communication cables segment is predicted to experience significant growth in the forecast period. There has been a rapid increase in urbanization and economic activities, which will drive the growth in infrastructure and construction segments in both developing and developed countries. The demand from various sectors such as commercial, telecom, energy, and power industries is leading to expansion and up-gradation of infrastructure, which is anticipated to drive market demand.

Voltage Insights

The high voltage segment accounted for the largest market revenue share of 66.6% in 2025. The increasing demand for HVDC submarine power cables and rising investments in offshore wind power generation are the primary factors driving the high voltage cables segment in the market. The HVDC power system is evolving at high speed and permitting the transfer of electricity from the high-capacityhigh-power sources to the mainland.

The medium voltage segment is predicted to foresee significant growth in the forecast period. The growth is attributable to the utilization of medium voltage cables in the offshore oil & gas infrastructure for power transmission. The demand from overseas oil & gas operations has been increasing, thus driving the medium voltage market. The growth is driven by the expansion of offshore renewable energy projects, particularly wind farms and tidal energy systems.

Component Insights

The dry plant products segment led the component type of submarine communication market in 2025. The growth is driven by the increasing adoption of dry plant products such as power feeding equipment, monitoring systems, and transmission terminals in submarine communication cables. These components enhance network reliability, simplify maintenance, and reduce overall operational costs by enabling better onshore cable management. As demand for high-speed, low-latency global data transmission grows, dry plant technologies are becoming essential for supporting advanced cable systems.

The wet plant products segment is expected to expand with the fastest CAGR over the forecast period. Wet plant products such as optical repeaters, branching units, and undersea fiber optic cables are crucial drivers of market growth. These components are directly deployed on the seabed and are vital for signal amplification, routing, and long-distance transmission. With increasing global demand for high-capacity, transoceanic connectivity, the need for strong and high-performance wet plant systems is rising.

Offering Insights

The voltage & commissioning segment dominated the market in 2024. Voltage & commissioning (I&C) offerings are driving the submarine communication market by enabling faster deployment, ensuring technical reliability, and supporting complex system upgrades. As global data demand grows, I&C services provide end-to-end solutions—from marine surveys to final system testing—crucial for timely and secure cable Voltages. Their role in large-scale connectivity projects and compliance assurance makes them vital to both new builds and modernization efforts.

The upgrade segment is expected to grow at a promising CAGR over the forecast period. In the market, upgrade offerings primarily revolve around enhancing existing cable systems with advanced technologies like coherent optical transmission and higher-capacity repeaters. These upgrades significantly extend the lifespan and data throughput of older systems without the need for full replacements, offering cost efficiency and faster deployment.

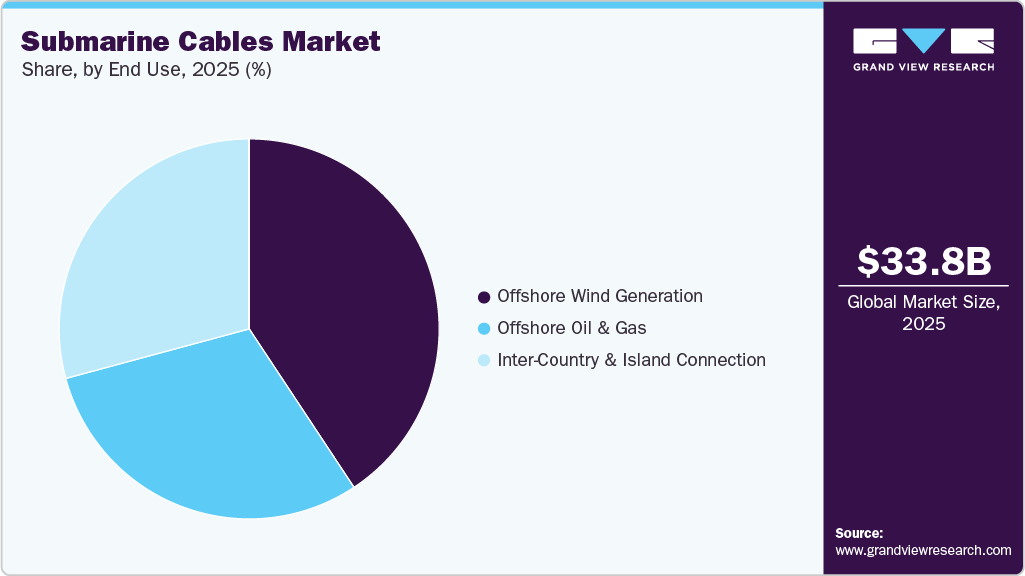

End-use Insights

The offshore wind power generation segment accounted for the largest market revenue share in 2025. Increasing investments in offshore wind power generation and the usage of submarine power cables for long-distance power transmissions from these plants are the primary factors in the market's flourishing. For instance, in June 2024, the Global Wind Energy Council reported 10.8 GW of new offshore wind capacity installed worldwide in 2023, increasing the global total to 75.2 GW with a 24% year-on-year rise.

The inter-country & island connection segment is predicted to foresee significant growth in the forecast period. The growing need for inter-country and island connectivity is a key market driver, as nations seek to improve communication infrastructure and ensure reliable power transmission. Remote islands and geographically dispersed countries rely on submarine cables to bridge gaps in internet and electricity access, supporting economic development and digital inclusion.

Regional Insights

Asia Pacific dominated the global submarine cables market with the largest revenue share of 38.7% in 2025. The submarine cable market in the Asia Pacific is driven by surging internet demand, fueled by rapid digitalization, mobile usage, and cloud adoption across emerging economies. Increasing investments from hyperscalers like Google, Meta, and AWS are also accelerating infrastructure expansion to support data-intensive applications. In addition, the region's strategic position as a global data transit hub between the U.S., Europe, and Africa enhances its importance. Government initiatives promoting digital connectivity and public-private partnerships further support new cable projects.

China Submarine Cables Market Trends

The submarine cable market in China led the Asia Pacific market and held the largest revenue share in 2025. The submarine cables market in China is driven by rapid digital economy expansion, strong demand for high-capacity international data transmission, and widespread deployment of 5G networks alongside cloud computing and IoT applications. Government initiatives drive large investments in cross-border digital infrastructure to enhance global connectivity and reduce dependence on foreign networks. Technological advancements in fiber-optic systems and strategic collaborations further boost capacity, reliability, and cost-efficiency, further growing the market.

North America Submarine Cables Market Trends

The North America submarine cable market accounted for a significant share of around 16.7% of the overall market in 2025. The region is experiencing rapid growth in submarine cable expansion due to rising demand for high-speed, low-latency data transmission directed by cloud services, streaming platforms, and AI workloads. Strategic routes now connect the U.S. to Latin America, Europe, and the Asia-Pacific with increased capacity and redundancy. Regulatory support and public-private partnerships are accelerating deployment. In addition, emerging cable landing stations along the U.S. coasts are boosting regional digital infrastructure and economic activity.

The submarine cables market in the U.S. is accelerating as demand for high-capacity data transmission surges, fueled by the expansion of AI, cloud services, and global internet usage in this region. Key tech players such as Google, Meta, Amazon, and Microsoft are heavily investing in new transoceanic cable systems to strengthen international data connectivity and reduce latency. These cables are critical infrastructure for supporting data centers, content delivery networks, and emerging digital services. The U.S. is also becoming a key hub for intercontinental data traffic, reinforcing its role in the global digital economy.

Europe Submarine Cables Market Trends

The submarine cable market in Europe is distinct, driven by its geopolitical focus on digital autonomy and reducing reliance on non-EU data routes. Unlike North America’s transpacific focus, Europe is expanding connectivity with Africa, the Middle East, and Asia via the Mediterranean. Initiatives like the EU’s Global Gateway are funding infrastructure to enhance international digital links. Coastal nations such as France, Spain, and Greece are emerging as key landing points due to their geographic and political stability. Europe is also emphasizing green data transmission, integrating cable projects with renewable energy goals.

Key Submarine Cables Company Insights

Key market companies include NEC Corporation, Microsoft, ZTT, and more.

-

NEC Corporation is a prominent global player in the submarine cable industry, having deployed over 400,000 kilometers of undersea cables worldwide. The company offers end-to-end solutions, from cable manufacturing to marine Voltage and long-term maintenance, making it a preferred partner for global connectivity projects. NEC has been instrumental in major international cable systems like the Asia Direct Cable (ADC) and the India-Lakshadweep project, enhancing digital infrastructure across Asia. Its cables are engineered to withstand extreme oceanic conditions, supporting robust data transmission across continents. As global demand for high-speed, high-capacity networks rises, NEC continues to expand its presence in key markets, facilitating digital transformation and economic growth.

-

Microsoft Corporation is a global technology provider specializing in software, cloud services, and digital infrastructure. To support its expansive cloud offerings, including Azure and Microsoft 365, Microsoft has heavily invested in submarine cable systems that enhance global data connectivity. Notably, Microsoft co-developed the MAREA cable with Meta and Telxius, a 6,600 km transatlantic system connecting Virginia, USA, to Bilbao, Spain, designed to deliver ultra-high capacity and low-latency connectivity across the Atlantic. In addition, Microsoft participates in the Amitié cable consortium, linking the U.S. to the UK and France, further strengthening its transatlantic infrastructure. These investments ensure faster, more reliable access to Microsoft's cloud services worldwide.

Key Submarine Cables Companies:

The following are the leading companies in the submarine cables market. These companies collectively hold the largest market share and dictate industry trends.

- ALE International, ALE USA Inc.

- SubCom, LLC

- NEC Corporation

- Prysmian S.p.A

- Nexans

- Google LLC

- Amazon.com, Inc.

- Microsoft

- NKT A/S

- ZTT

Recent Developments

-

In November 2025, Google revealed Dhivaru, a subsea cable system spanning the Trans-Indian Ocean and linking the Maldives, Christmas Island, and Oman under the Australia Connect program. The initiative incorporates connectivity hubs in the Maldives and Christmas Island that offer cable switching to enable automatic traffic rerouting, content caching to minimize latency, and colocation facilities for regional carriers.

-

In October 2025, China’s ZTT Group signed a land lease agreement with Saudi Ports Authority (Mawani) at Ras Al-Khair Port to establish a manufacturing facility for submarine power cables and terrestrial fiber optic cables. This development aligns with Saudi Vision 2030 objectives for industrial diversification and energy infrastructure.

-

In January 2025, Microsoft's Irish unit filed three applications with the Irish Maritime Area Regulatory Authority for marine surveys on proposed subsea cable routes connecting Ireland to the UK, including Tuskar from Kilmore Quay in County Wexford to Newgale in Wales, SOBR1 from Dublin Bay to Anglesey, and SOBR2 from Portmarnock or Malahide to Abergele.

Submarine Cable Market Report Scope

Report Attribute

Details

Market size in 2026

USD 35,825.8 million

Revenue forecast in 2033

USD 50,566.4 million

Growth rate

CAGR of 5.0% from 2026 to 2033

Base year for estimation

2025

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, voltage, end-use, component, offerings, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Europe; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

ALE International, ALE USA Inc.; SubCom, LLC; NEC Corporation; Prysmian S.p.A; Nexans; Google LLC; Amazon.com, Inc.; Microsoft; NKT A/S; ZTT

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Submarine Cable Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global wires and cables market report based on application, voltage, end-use, offerings, component, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Submarine Power Cables

-

Submarine Communication Cables

-

-

Voltage Outlook (Revenue, USD Million, 2021 - 2033)

-

Medium Voltage

-

High Voltage

-

Extra High Voltage

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Offshore Wind Power Generation

-

Inter-country & island connection

-

Offshore Oil & Gas

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Dry Plant Products

-

Wet Plant Products

-

-

Offerings Outlook (Revenue, USD Million, 2021 - 2033)

-

Installation & Commissioning

-

Upgrade

-

Maintenance

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global submarine cables market size was estimated at USD 33,761.6 million in 2025 and is expected to reach USD 35,825.8 million in 2026.

b. Some key players operating in the submarine cables market include ALE International, ALE USA Inc.; SubCom, LLC; NEC Corporation; Prysmian S.p.A; Nexans; Google LLC; Amazon.com, Inc.; Microsoft; NKT A/S; ZTT

b. The global submarine cables market is expected to grow at a compound annual growth rate of 5.0% from 2026 to 2033 to reach USD 50,566.4 million by 2033.

b. Asia Pacific dominated the submarine cables market with a share of 38.66% in 2025. This is driven by surging internet demand, fueled by rapid digitalization, mobile usage, and cloud adoption across emerging economies.

b. Key factors driving the submarine cables market growth are increasing investments in offshore wind farms, increasing data traffic, and investments by OTT providers to satisfy the requirements. Submarine cables are widely used for power and communication applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.