- Home

- »

- Green Building Materials

- »

-

Structural Insulated Panels Market Size Report, 2021-2028GVR Report cover

![Structural Insulated Panels Market Size, Share & Trends Report]()

Structural Insulated Panels Market Size, Share & Trends Analysis Report By Product (Polystyrene, Polyurethane), By Application (Walls & Floors, Roofs), By Region (APAC, North America), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-3-68038-773-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Advanced Materials

Report Overview

The global structural insulated panels market size was valued at USD 11.17 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 5.5% from 2021 to 2028. Favorable green building standards and regulations for the adoption of building insulation materials for lowering the overall energy consumption coupled with the growing investments in the development of cold chain infrastructure across the world are the key factors that are expected to drive the market. Structural insulated panels (SIPs) are expected to gain wide acceptance globally as they are lightweight, have a better external appearance, and can improve the thermal performance of buildings. In the U.S., as per the Federal Energy Policy Act 2005, a tax credit of up to USD 2,000 is provided for builders of new energy-efficient homes that are constructed as per the standards of Federal Manufactured Homes Construction and Safety Standards.

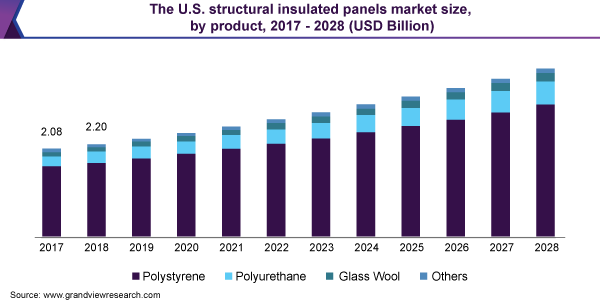

In 2020, the polystyrene product segment led the U.S. structural insulated panels market owing to robust insulation property and cost-effectiveness of polystyrene. Growing investments in the renovation of old building structures are expected to drive future product demand within the U.S. market.

Structural insulated panels are widely used in the construction of warehouses owing to their ability to reduce the overall construction time. The growth of the e-commerce industry is generating a huge demand for warehouses and last-mile delivery hubs. In addition, the establishment of local data centers by major technology companies, such as Amazon, Alibaba, Google, and Microsoft, is projected to have a positive impact on the market growth.

Structural insulated panels are fabricated at manufacturing facilities and shipped to the job site in a ready-to-install state. Metal sheets are emerging as a preferred facing material owing to their durability, fireproof property, and superior surface finish. Moreover, insulated metal panels are available in a variety of colors, thus making them suitable for direct application on building exteriors.

Raw materials used for manufacturing structural insulated panels include Polyisocyanurate (PIR), Polyurethane (PU), Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), and others. All these products are downstream derivatives of crude oil. Thus, the volatile pricing of crude oil in the international market is a serious restraint to the growth of this industry.

Product Insights

Polystyrene led the market and accounted for more than 72.0% share of the global revenue in 2020 and will retain the leading position throughout the forecast period. This growth can be credited to high demand for these products due to their cost-effectiveness and dust & moisture resistance. In addition, the tough and resilient surface of polystyrene offers a higher degree of puncture resistance and quakeproof property. However, the polyurethane segment is estimated to register the fastest CAGR from 2021 to 2028.

Polyurethane structural insulated panels are relatively more expensive than other product types, such as polystyrene and glass wool. These panels are widely preferred in the insulation of cold chain storages owing to their superior thermal insulation and vapor diffusion resistance properties. Thus, the growing emphasis on the development of cold chain infrastructures is expected to drive the product demand over the forecast period. The glass wool segment is expected to grow at a CAGR of 5.8% over the forecast period owing to superior thermal insulation, fire resistance, and noise insulation properties of glass wool.

Application Insights

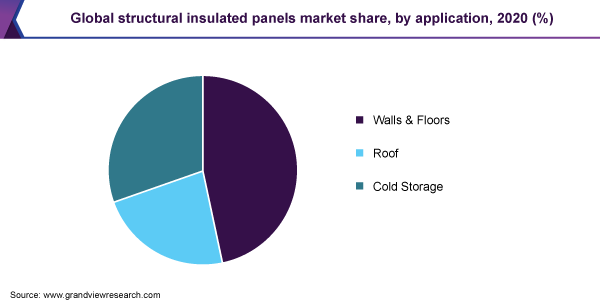

Walls & floors led the market and accounted for more than 46.0% share of the global revenue in 2020. Growing awareness about the economic advantages of installing effective building insulation is driving the segment growth. Insulation of walls is one of the essential elements to enhance the energy efficiency of buildings. Insulated walls along with insulated floors create a protective envelope, which eliminates heat transfer from the external environment through conduction and convection radiation and thereby reduce the energy expenditure on heating or cooling of a building structure.

The product is widely used in the cold storage industry owing to its superior structural strength and insulation properties. SIPs find application in walls, ceilings, and roofs for cold storage, freezers, and food processing buildings and can also be retrofitted to the existing controlled environment structures, such as dry warehouse, where maintaining temperature and insulation values is of immense importance. The recent global pandemic has generated a significant product demand for the establishment of cold chain infrastructure to ensure the safety of the Covid-19 vaccines and ensure seamless last-mile delivery.

Regional Insights

North America dominated the market and accounted for over 38.0% share of global revenue in 2019. Increased demand from the residential sector, extensively developed cold chain and logistics industry, and the government initiatives to develop social infrastructure are some of the major factors responsible for the market growth in North America. Rising awareness regarding the benefits of insulation of building structures is expected to drive the market in the coming years.

The Asia Pacific is expected to be the fastest-growing regional market due to the rapid growth of the residential and commercial construction sectors and the adoption of various green building standards. The Middle East and Africa is expected to register a significant CAGR over the forecast period. The region imports majority of its food products from overseas owing to the dry climate and lack of rainfall. The UAE has emerged as the import and trading hub for food products in the region. As a result, it is witnessing growing investments in the establishment of cold storage and cold chain logistics, which drives the demand for structural insulated panels.

Key Companies & Market Share Insights

Major companies in the market are focusing on expanding their product portfolio by developing cost-effective insulation products with enhanced properties. The manufacturers are also engaged in the product installation through their network of certified contractors and installers. Installation of these systems needs expert services, which can affect the overall price. Companies invest significantly in R&D activities related to product manufacturing, supply, and installation, which results in dynamic market conditions. Some prominent players in the global structural insulated panels market include:

-

Metl-Span

-

Kingspan Group

-

PFB Corporation

-

Isopan

-

KPS Global

-

American Insulated Panel

-

Structural Panels Inc.

-

All Weather Insulated Panels

-

Ingreen Systems Corp.

-

Owens Corning

Structural Insulated Panels Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 11.85 billion

Revenue forecast in 2028

USD 17.19 billion

Growth Rate

CAGR of 5.5% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in million square feet, revenue in USD million/billion, and CAGR from 2021 to 2028

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; Italy; China; Japan; India; Brazil; Argentina; UAE

Key companies profiled

Metl-Span; Kingspan Group; PFB Corp.; Isopan; KPS Global; American Insulated Panel; Structural Panels Inc.; All Weather Insulated Panels; Ingreen Systems Corp.; Owens Corning

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global structural insulated panels market report on the basis of product, application, and region:

-

Product Outlook (Volume, Million Square Feet; Revenue, USD Million, 2017 - 2028)

-

Polystyrene

-

Polyurethane

-

Glass Wool

-

Others

-

-

Application Outlook (Volume, Million Square Feet; Revenue, USD Million, 2017 - 2028)

-

Walls & Floors

-

Roof

-

Cold Storage

-

-

Regional Outlook (Volume, Million Square Feet; Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global structural insulated panels market size was estimated at USD 11.17 billion in 2020 and is expected to reach USD 11.85 billion in 2021.

b. The global structural insulated panels market is expected to grow at a compounded annual growth rate of 5.5% from 2021 to 2028 to reach USD 17.19 billion in 2028.

b. Asia Pacific dominated the structural insulated panels market with a share of 38.6% in 2019. Increasing production and consumption of packaged and processed food in the region have created scope for the construction of cold storage facilities, thus are supporting the market for structural insulated panels.

b. Some key players operating in the structural insulated panels market include Kingspan Group, Rautaruukki Corporation, Premier Building Systems, Alubel SpA, and Dana Group Plc.

b. Key factors driving the structural insulated panels market growth include increasing demand for affordable and cost-effective residential housing solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."