- Home

- »

- Medical Devices

- »

-

Sterilization Wrap Market Size, Share & Growth Report, 2030GVR Report cover

![Sterilization Wrap Market Size, Share & Trends Report]()

Sterilization Wrap Market (2024 - 2030) Size, Share & Trends Analysis Report By Material Type (Plastic & Polymer, Paper & Paperboard, Others,), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-196-7

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sterilization Wrap Market Summary

The global sterilization wrap market size was valued at USD 374.93 million in 2023 and is projected to reach USD 471.74 million by 2030, growing at a compound annual growth rate (CAGR) of 3.34% from 2024 to 2030. The market is driven by numerous factors such as the increasing number of clinical trials for novel product launch, growing geriatric population across the globe coupled with rising cases of chronic diseases, and increasing prevalence of Hospital Acquired Infections (HAIs).

Key Market Trends & Insights

- North America accounted for 34.81% of the global market in 2023.

- Asia Pacific region is anticipated to grow at the fastest CAGR over the forecast period.

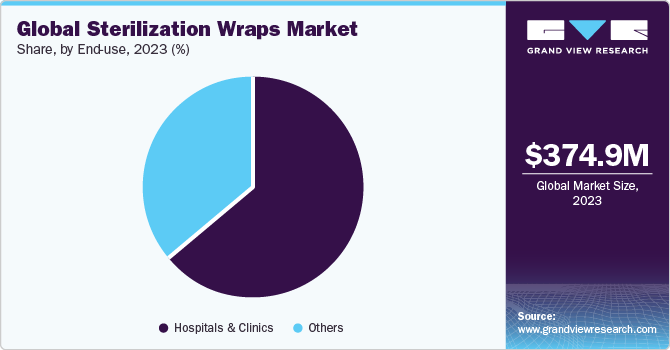

- Based on end-use, hospitals and clinics segment led the market in 2023.

- In terms of material type, plastic & polymer segment held the largest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 374.93 Million

- 2030 Projected Market Size: USD 471.74 Million

- CAGR (2024-2030): 3.34%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

For instance, according to the United Nations Population Fund's statistics for 2023, in South Korea, 69% of the population was between the ages of 15 and 64 years. In addition, according to the same source, 12% of the population in 2022 will be aged 65 or older.The escalating prevalence of elderly individuals has led to an augmented requirement for healthcare services and medical interventions, consequently intensifying the necessity for sterilization wraps. These wraps play a crucial role in preserving the sterility of medical equipment and instruments during their transit and storage. The ongoing surge in demand for healthcare services and medical procedures, driven by the expanding geriatric demographic, is anticipated to further propel the demand for sterilization wraps.

The escalating incidence of Hospital Acquired Infections (HAIs) constitutes a pivotal catalyst propelling the expansion of the sterilization wraps market. HAIs, denoting infections contracted by patients during their hospital or healthcare facility, are frequently attributed to the presence of harmful microorganisms on medical apparatus, instruments, and surfaces. Sterilization wraps play a crucial role in averting the dissemination of these microorganisms by upholding the sterility of medical equipment and instruments during their conveyance and storage. For instance, according to ECDC estimates in May 2023, every year, around 3.1 million to 4.6 million people acquire HAIs in Europe. Additionally, according to the 2022 reports recently published by the WHO, the prevalence of Healthcare-Associated Infections (HAIs) in acute-care hospitals is a growing concern. The reports indicate that in high-income nations, approximately 7 out of every 100 patients are susceptible to acquiring at least one HAI during their hospital stay, while in low- and middle-income nations, the number is higher at around 15 out of every 100 patients.

These numbers highlight the urgent need to take preventive measures to reduce the risk of HAIs in healthcare facilities. Sterilization wraps are one such preventive measure that can help maintain the sterility of medical equipment and instruments, thereby reducing the transmission of harmful microorganisms and improving patient safety. As awareness regarding the prevalence of HAIs increases and the imperative to curb their proliferation intensifies, the surge in demand for sterilization wraps is anticipated, reflecting healthcare facilities' commitment to fortify patient safety measures.

Growing number of clinical trials linked to the introduction of new products serves as a crucial driver fueling the growth of the sterilization wraps market. Within the product development process, clinical trials require the use of sterile medical equipment and instruments to ensure the integrity and efficacy of the tested product. As a result, there is a significant increase in demand for sterilization wraps, owing to their essential role in maintaining the sterility of medical devices during the transportation and storage stages of these trials. For instance, in January 2024, Ahlstrom successfully obtained FDA 510(k) clearance from the U.S. FDA for its innovative product, Reliance Fusion. This advanced sterilization wrap is designed to enhance the efficiency of sterilizing surgical equipment trays within hospital settings. It is imperative to note that the acquisition of FDA 510(k) clearance is a prerequisite for the marketing and sale of medical devices in the U.S. As the number of clinical trials continues to rise for novel product launches, the demand for sterilization wraps is also expected to increase propelling the market growth.

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The sterilization wraps market is characterized by a moderate degree of growth owing to the increasing prevalence of chronic diseases, the growing geriatric population coupled with increasing demand for minimally invasive surgeries.

Key strategies implemented by players in the market for sterilization wrap are new product launches, expansion, acquisitions, partnerships, and other strategies. In November 2023, STERIS announced that its Applied Sterilization Technologies (AST) business was approved to participate in the U.S. FDA Radiation Sterilization Master File Pilot Program. Initially introduced by the FDA in April 2023, this program aimed to address global supply chain challenges and enhance supply chain resilience. STERIS's involvement in the Radiation Pilot Program followed its earlier acceptance into the Ethylene Oxide (EO) Master File Pilot Program in 2021. The voluntary nature of the Pilot Program enabled companies involved in the sterilization of single-use PMA-approved medical devices using gamma radiation.

The degree of innovation is notable in the development of wraps with advanced materials, improved barrier properties, and user-friendly features. Innovations also address environmental concerns, with a shift towards sustainable and eco-friendly materials, aligning with the broader trend of promoting green practices in healthcare.

Regulatory approvals play a vital role in shaping the competitive landscape of the sterilization wraps market. Compliance with regulatory standards is imperative to ensure the safety and efficacy of these medical devices. Manufacturers need to adhere to guidelines set by regulatory bodies such as the FDA in the U.S., EMA in Europe, and other relevant authorities globally. Obtaining regulatory approvals validates the quality and safety of sterilization wraps, enhancing confidence among healthcare professionals and end-users.

Compliance with the regulations is paramount for manufacturers to ensure the safety and efficacy of their products. Additionally, evolving standards related to infection prevention and control in healthcare facilities worldwide contribute to the adoption of high-quality sterilization wraps. Moreover, regulations create opportunities for companies that can provide innovative, compliant solutions, as healthcare facilities prioritize products that adhere to the latest guidelines.

North America holds the largest market share. This demand for sterilization wraps in this region is fueled by stringent regulatory standards, particularly in the healthcare sector, emphasizing the need for effective infection control measures. The increasing awareness among healthcare professionals about the importance of maintaining aseptic conditions further contributes to the market's growth.

Sterilization wraps find applications in various industries, including healthcare, pharmaceuticals, and food processing. Different sectors may have specific requirements and standards for sterilization wraps, leading to the emergence of niche players catering to specialized needs.

The sterilization wraps market has a global reach due to the universal need for sterile medical equipment. Market players often expand their operations internationally to cater to the demands of healthcare facilities worldwide. The heightened emphasis on emerging markets in Asia-Pacific, Latin America, and Africa is propelled by the expanding healthcare infrastructure within these locales. This strategic pivot underscores a deliberate move towards harnessing opportunities arising from the evolving medical landscape in these regions.

Material Type Insights

Plastic & polymer segment held the largest market share in 2023. Plastic and polymer materials demonstrate exceptional barrier characteristics against microorganisms, thereby ensuring a robust level of protection for sterilized medical devices. This attribute is pivotal in mitigating the risk of contamination throughout the storage and transportation phases. Plastics offer unparalleled design flexibility across a broad spectrum of operating temperatures. They exhibit exceptional attributes such as bio-inertness, high stiffness and toughness, superior strength-to-weight ratio, ductility, corrosion resistance, effective thermal and electrical insulation, non-toxicity, and remarkable durability. Moreover, when considering the low material cost in comparison to alternative materials, plastics emerge as highly resource efficient. The increasing need for sterilization wraps, particularly those fabricated from plastic and polymer compositions, is driven by the heightened acknowledgment of infection control imperatives in healthcare settings. In the pursuit of adherence to stringent sterilization protocols within medical institutions, the paramount priority lies in the adoption of sterilization wraps characterized by both efficacy and reliability.

Plastic & polymer segment is further anticipated to grow at the fastest CAGR of 3.65% during the forecast period. Plastic & polymer are available in different sizes and shapes, which allows healthcare professionals to select the most appropriate wrap for the instrument or equipment being sterilized. Additionally, these materials are lightweight and easy to handle, which makes them convenient for healthcare workers to use, contributing to the growth of this segment. Thus, as the industry continues to evolve, it is likely that these materials will continue to play a key role in ensuring safe and effective healthcare practices.

End-use Insights

Hospitals and clinics segment led the market in 2023. Hospitals and clinics prioritize stringent infection control measures to ensure patient safety. Sterilization wraps play a vital role in maintaining the sterility of surgical instruments and medical devices, reducing the risk of infections during medical procedures. High number of surgical procedures performed in hospitals and clinics necessitates a constant supply of sterile instruments. For instance, according to the Organization for Economic Co-operation and Development (OECD), around 30,055 cataract surgeries were performed in Ireland in 2022. As the number of surgeries increases, there is a higher demand for effective infection prevention measures. Sterilization wraps are used to package surgical tools and equipment, safeguarding them from contamination until they are ready for use in the operating room. Advancements in medical technology have led to an increase in specialized surgical procedures across various medical disciplines. Different surgeries may require specific sterilization protocols and wraps tailored to the instruments and equipment used. The diversity of surgical specializations contributes to the demand for a variety of sterilization wraps in hospitals and clinics.

Hospitals and clinics segment is further anticipated to grow at the fastest CAGR of 3.62% during the forecast period. Hospitals and clinics prioritize the adoption of efficient and cost-effective sterilization methods, driving the market for innovative and technologically advanced sterilization wraps. The ability of these wraps to facilitate easy and effective sterilization processes while ensuring the integrity of medical instruments aligns with the evolving needs of healthcare providers thus propelling the industry growth.

Regional Insights

North America Sterilization Wraps Market Trends

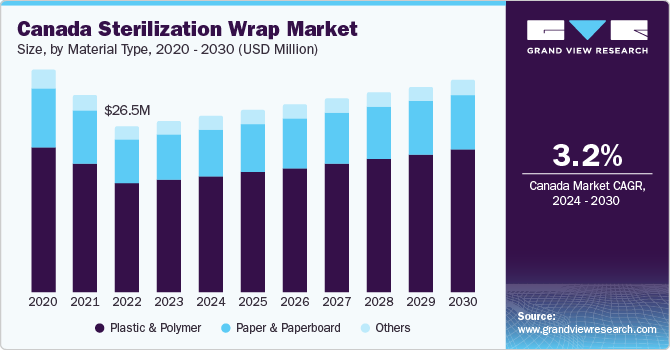

North America accounted for 34.81% of the global market in 2023 and is expected to continue its dominance over the forecast period. The market is anticipated to experience trends influenced by advancements in material technology for sterilization wraps. Manufacturers are projected to focus on developing materials that offer improved microbial barrier properties while being economically viable and environmentally sustainable. Moreover, growing incidence of HAIs boosts the demand for sterilization wraps in Canada.

The escalating prevalence of Healthcare-Associated Infections (HAIs) is prompting a growing adoption of infection prevention and control protocols within healthcare facilities. For instance, as per a report by the Public Health Agency of Canada (modified in August 2022), Canadian hospitals estimated that 7.9% of patients had at least one HAI. These factors are expected to positively impact the market over the forecast period. Notably, the utilization of sterilization wraps has become integral in mitigating the risk of infections. Consequently, there is a heightened demand for sterilization wraps within the healthcare industry.

U.S. Sterilization Wraps Market Trends

The sterilization wraps market in the U.S. is expected to grow over the forecast period due to heightened focus on infection prevention and control, healthcare institutions in the U.S. have strategically allocated resources to implement advanced sterilization methods and products, with a particular emphasis on wraps. This ongoing trend is expected to endure, highlighting the increasing importance placed on maintaining a sterile environment within healthcare facilities.

UK Sterilization Wraps Market Trends

The sterilization wraps market in the UK is expected to grow over the forecast period due to expansion of healthcare infrastructure, fueled by demographic trends and a progressively aging population, has generated an elevated demand for sterilization wraps. Moreover, rising number of healthcare facilities addressing the growing requirements of an expanding and aging population propels industry growth.

France Sterilization Wraps Market Trends

The sterilization wraps market in France is expected to grow over the forecast period. The increasing number of hospitals and surgeries in France contributes to market growth. As sterilization wraps is an essential requirement in healthcare facilities such as hospitals, clinics, and others, a rise in the number of hospitals in France is anticipated to impact market growth positively.

Germany Sterilization Wraps Market Trends

The sterilization wraps market in Germany is expected to grow over the forecast period. The industry key players are involved in mergers and acquisitions to expand the product portfolio propelling the industry growth in this region.

Asia Pacific Sterilization Wraps Market Trends

Asia Pacific region is anticipated to grow at the fastest CAGR over the forecast period. The region serves as a pivotal market for sterilization wraps, propelled by heightened demand for healthcare facilities and heightened awareness regarding infection control practices. The escalating frequency of surgeries and medical procedures conducted in hospitals and clinics necessitates the efficient sterilization of medical equipment and devices. Consequently, there has been a notable surge in the adoption of sterilization wraps within the region, given their indispensable role in the sterilization process. Anticipated to sustain its growth trajectory, the market is poised for continuous expansion in the forthcoming years. This growth is anticipated to be driven by the introduction of novel and advanced products, coupled with an augmented emphasis on both patient safety and infection control measures.

China Sterilization Wraps Market Trends

The sterilization wraps market in China is expected to grow over the forecast period. The considerable demographic scale of the nation has led to a significant rise in surgical interventions and medical procedures in healthcare facilities. As a result, there is a growing need for the effective sterilization of medical instruments and equipment. This increased demand is propelling the market for sterilization wraps in the country.

Japan Sterilization Wraps Market Trends

The sterilization wraps market in Japan is expected to grow over the forecast period owing to the escalating incidence of chronic ailments, including cancer, cardiovascular diseases, and diabetes, has emerged as a pivotal factor propelling the expansion of the sterilization wraps market in Japan.

Saudi Arabia Sterilization Wraps Market Trends

The sterilization wraps market in Saudi Arabia is expected to grow over the forecast period due to the rising number of healthcare facilities addressing the growing requirements of an expanding and aging population propel the industry growth.

Kuwait Sterilization Wraps Market Trends

The sterilization wraps market in Kuwait is expected to grow over the forecast period due to the confluence of early disease diagnosis and the escalating prevalence of chronic conditions and rising healthcare expenditure.

Key Sterilization Wrap Company Insights

Cygnus Medical, Surgeine Healthcare (India) Pvt. Ltd., Halyard health, are some of the emerging players in the sterilization wraps market. The sterilization wraps market is experiencing several notable trends that are significantly impacting the activities of emerging players in the industry. One key trend is the growing emphasis on sustainability and eco-friendly practices. As environmental consciousness rises across industries, there is an increasing demand for sterilization wraps that are not only effective in maintaining sterility but also environmentally responsible. Emerging players are focusing on developing biodegradable and recyclable materials for sterilization wraps, aligning with global efforts towards greener healthcare solutions.

Additionally, advancements in material technology are shaping the landscape of sterilization wraps. Emerging players are investing in research and development to introduce innovative materials that offer enhanced durability, breathability, and barrier properties. This trend is driven by the need for more robust and reliable sterilization solutions in healthcare settings, emphasizing the importance of effective infection control measures.

Furthermore, with the rise of digitalization in healthcare, emerging players are incorporating smart technologies into sterilization wraps. This includes features such as RFID tracking and monitoring systems, providing real-time information on the status and history of sterilization processes. Such innovations improve traceability, efficiency, and compliance with regulatory standards, addressing the evolving needs of the healthcare industry.

Key Sterilization Wrap Companies:

The following are the leading companies in the sterilization wrap market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these sterilization wrap companies are analyzed to map the supply network.

- Medline Industries, LP.

- STERIS

- Cardinal Health

- Crosstex International, Inc.

- Ahlstrom

- McKesson Medical-Surgical Inc.

- Propper Manufacturing Co., Inc.

- Berry Global Inc.

- Narang Medical Limited

- Dynarex Corporation

- A.R. Medicom Australia Pty, Ltd.

Recent Developments

-

In May 2023, Ahlstrom enhanced its product portfolio in the medical sector with the introduction of Reliance Fusion, an advanced simultaneous sterilization wrap. This innovative solution was designed to optimize the sterilization process for surgical equipment trays in hospital settings, thereby contributing to increased operational efficiency.

-

In April 2023, as per the reports published by the U.S. FDA, Center for Devices and Radiological Health projected to launch a Radiation Sterilization Master File Pilot Program, with the primary objective of facilitating companies in advancing alternative and innovative sterilization approaches for approved medical devices. The program was designed to explore various radiation sources within a regulatory framework that imposes the least burdens on participants. Participation in this pilot program was voluntary, affording companies involved in sterilizing single-use PMA-approved medical devices the flexibility to submit master files when implementing specific changes. These modifications may encompass alterations to sterilization sites, methods, or other processes, with a particular emphasis on encouraging and expediting actions that bolster sterilization safety, such as reducing gamma radiation doses.

-

In January 2023, Life Science Outsourcing, Inc. officially completed the acquisition of J-Pac Medical, a company specializing in manufacturing, packaging, and sterilization outsourcing services for medical device and diagnostic companies.

Sterilization Wrap Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 387.30 million

Revenue forecast in 2030

USD 471.74 million

Growth rate

CAGR of 3.34% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Material type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medline Industries, LP.; STERIS; Cardinal Health; Crosstex International, Inc.; Ahlstrom; McKesson Medical-Surgical Inc.; Propper Manufacturing Co., Inc.; Berry Global Inc.; Narang Medical Limited; Dynarex Corporation; A.R. Medicom Australia Pty, Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sterilization Wrap Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sterilization wrap market report based on material type, end-use, and region.

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic & Polymer

-

Paper & Paperboard

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sterilization wraps market size was estimated at USD 374.93 million in 2023 and is expected to reach USD 387.30 million in 2024.

b. The global sterilization wraps market is expected to grow at a compound annual growth rate of 3.34% from 2024 to 2030 to reach USD 471.74 million by 2030.

b. Hospitals and clinics segment dominated the global sterilization wraps market with a share of 64.19% in 2023. Sterilization wraps play a vital role in maintaining the sterility of surgical instruments and medical devices, reducing the risk of infections during medical procedures. High number of surgical procedures performed in hospitals and clinics necessitates a constant supply of sterile instruments.

b. Some of the key players operating in the global sterilization wraps market include Medline Industries, LP., STERIS, Cardinal Health, Crosstex International, Inc., Ahlstrom, McKesson Medical-Surgical Inc., Propper Manufacturing Co., Inc., Berry Global Inc., Narang Medical Limited, Dynarex Corporation, A.R. Medicom Australia Pty, Ltd.

b. The market is driven by numerous factors such as increasing number of clinical trials for novel product launch, growing geriatric population across the globe coupled with rising cases of chronic diseases, and increasing prevalence of Hospital Acquired Infections (HAIs).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.