- Home

- »

- Advanced Interior Materials

- »

-

Steam Trap Market Size, Share And Growth Report, 2030GVR Report cover

![Steam Trap Market Size, Share & Trends Report]()

Steam Trap Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Mechanical, Thermodynamics, Thermostatic), By End-use, By Region And By Segment Forecasts

- Report ID: GVR-4-68040-378-3

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Steam Trap Market Summary

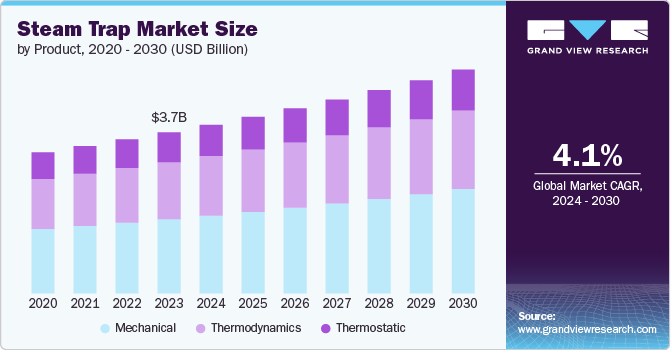

The global steam trap market was estimated at USD 3.66 billion in 2023 and is projected to reach USD 5.08 billion by 2030, growing at a CAGR of 4.1% from 2024 to 2030. The market growth is attributed to the increasing global focus on energy efficiency and sustainability which is driving demand for steam traps that optimize energy usage by preventing steam loss.

Key Market Trends & Insights

- North America dominated the steam trap market in 2023 with the revenue share of over 36%.

- Asia Pacific accounted for a revenue share of over 27% in 2023.

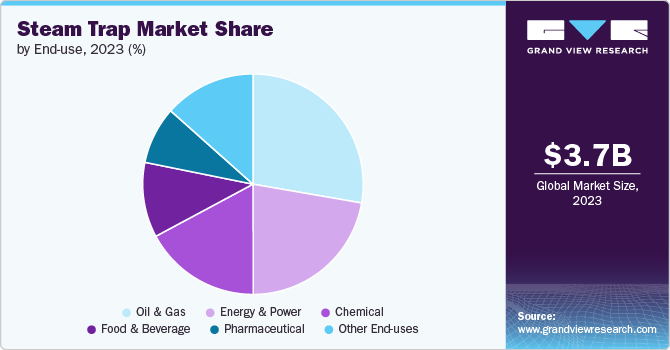

- Based on end use, oil & gas end use accounted for largest revenue share of around 28% in 2023.

- In terms of product, mechanical segment dominated the market with a revenue share of 46% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.66 Billion

- 2030 Projected Market Size: USD 5.08 Billion

- CAGR (2024-2030): 4.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Furthermore, growth in industries such as oil & gas, chemicals, food & beverages, and pharmaceuticals, where steam traps are crucial for process efficiency, further boosts market demand. Additionally, this market is witnessing innovations in steam trap technology, including smart steam traps with sensors for predictive maintenance. This is expected to enhance product adoption. Use of effective product into operations reduces operational costs by conserving energy and minimizing maintenance downtime, making them attractive for industries striving to improve profitability. Furthermore, supportive government policies promoting energy-efficient technologies and reducing carbon footprints create a positive environment for this market.

The initial cost of high-quality this product, especially advanced types like smart steam traps, can be a barrier to adoption, particularly in cost-sensitive industries. Improper maintenance or lack of regular servicing can lead to product inefficiency. Furthermore, advanced products may require specialized knowledge for installation and maintenance, which can prevent some end-users from adopting newer technologies. Emerging alternative technologies for steam management, such as heat exchangers or direct injection systems, provide alternatives to traditional steam traps, posing a competitive challenge.

Increasing adoption of industrial automation and IoT-enabled devices presents opportunities for this product that offer real-time monitoring and predictive maintenance capabilities. Furthermore, continuous advancements in materials, designs, and functionalities of steam traps offer opportunities for manufacturers to differentiate their products and cater to specific industry needs. Expansion of industrial activities in emerging markets, coupled with infrastructure development, provide a ground for this market growth.

Product Insights

Mechanical segment dominated the market with a revenue share of 46% in 2023 and is further expected to grow at a fastest rate over forecast period. Mechanical product type is known for their robust construction and ability to handle varying pressures and steam loads. They are suitable for a wide range of industrial applications, including process heating, HVAC systems, and steam distribution networks. Furthermore, they have fewer moving parts compared to other types, contributing to lower maintenance requirements.

Thermodynamic product type can handle high-pressure steam applications effectively. They are typically compact and lightweight, suitable for applications with limited space. Thermostatic traps offer precise control over condensate discharge, making them suitable for applications with varying steam loads. They efficiently remove condensate across a wide range of operating pressures and temperatures and find use in applications requiring rapid condensate removal, such as process equipment, sterilizers, and CIP systems.

End-use Insights

On the basis of end use, steam trap market is segmented into chemical, oil & gas, food & beverage, energy & power, and pharmaceutical. Among these, oil & gas end use accounted for largest revenue share of around 28% in 2023 and is further expected to grow at a fastest rate over forecast period. The need for continuous operation in oil and gas sector, necessitates steam traps that offer high reliability and minimal maintenance requirements. Furthermore, this product must adhere to stringent safety standards to prevent accidents and ensure worker safety in hazardous environments. In oil & gas end use, steam is used in enhanced oil recovery techniques and refining processes.

Steam traps used in pharmaceutical applications must have hygienic designs that prevent contamination and meet strict cleanliness standards. Furthermore, thermostatic product type is often preferred for pharmaceutical applications due to their precise condensate removal and control capabilities. On other hand, chemical processes often operate under high temperatures and pressures, requiring a product that can withstand harsh conditions and offer reliable performance.

Regional Insights

North America dominated the steam trap market in 2023 with the revenue share of over 36% and is further expected to grow at a significant rate over forecast period. North America has well-established industrial sectors including manufacturing, oil & gas, pharmaceuticals, and food processing, which require reliable steam trap solutions. Furthermore, replacement and upgrade cycles in aging industrial infrastructure contribute to ongoing demand for this product.

U.S. Steam Trap Market Trends

The steam trap market in the U.S. is growing at a significant rate over the forecast period. Shale gas revolution in country has led to increased demand for steam in oil & gas operations, particularly in steam-assisted gravity drainage (SAGD) and hydraulic fracturing processes. This has spurred demand for this product type which is capable of handling high-pressure and high-temperature steam conditions.

Asia Pacific Steam Trap Market Trends

Asia Pacific accounted for a revenue share of over 27% in 2023 and is further expected to grow at a fastest rate of 4.3% over forecast period. Governments in the region are implementing stringent regulations and initiatives aimed at improving energy efficiency and reducing carbon emissions. This product plays a crucial role in optimizing energy use by preventing steam loss and improving overall system efficiency, aligning with these initiatives. Thereby, boosting market growth.

Europe Steam Trap Market Trends

European industries are undergoing modernization and automation to improve productivity and competitiveness, increasing the demand for efficient steam trap solutions. Furthermore, sectors such as chemicals, pharmaceuticals, food & beverages, and automotive rely heavily on steam for various processes, driving the market this product in region.

Key Steam Trap Company Insights

Some of the key players operating in the market Flowserve Corporation and Emerson Electric Co.:

-

Flowserve Corporation, founded in 1997 and headquartered in Irving, Texas, USA, is a manufacturers of fluid motion and control products and services. The company specializes in designing, manufacturing, and servicing of pumps, valves, seals, and related equipment for various industrial applications.

-

Emerson Electric Co. is a Missouri based company that was established in 1890. It is involved in engineering and automation technology services. Company serves many industries such as oil and gas, power generation, water and wastewater management, and manufacturing. Its extensive portfolio includes a broad spectrum of automation products.

Velan Inc. and Spirax-Sarco Engineering are some of the emerging participants in the market.

-

Velan Inc. is involved in manufacturing of gate, globe, check valves, cryogenic valves, HF acid valves, steam traps, and bellows seal valves. With its products it serves various industries including nuclear power, power, oil & gas, refining, chemical, pulp & paper, marine, mining, LNG & cryogenics, and water & wastewater. Furthermore, company operates manufacturing plants in Asia, Europe, and North America.

-

Spirax-Sarco Engineering is involved in manufacturing and supplying of boiler controls and systems, condensate and heat recovery systems, control systems, flowmetering, heat transfer solutions, humidification, steam traps, compressed air, pipeline ancillaries, and isolation valves. It serves around 62 countries and various industries such as brewing and distilling, food and beverage, hospitals, OEM, oil and gas, pharmaceutical, pulp and paper, and sugar refining with its products.

Key Steam Trap Companies:

The following are the leading companies in the steam trap market. These companies collectively hold the largest market share and dictate industry trends.

- Circor International Inc.

- Emerson Electric Co.

- Flowserve Corporation

- Pentair Inc.

- Schlumberger Limited

- Spirax-Sarco Engineering

- Thermax Ltd.

- Velan Inc.

- Watts Water Technologies Inc.

- Armstrong International

Recent Developments

- In October 2023, IMI Critical Engineering launched its new steam trap monitoring solution. This solution will help in reducing losses and downtime in various industrial applications. Furthermore, it comes with compact design which helps in its installation easier on any side of a product.

Steam Trap Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.83 billion

Revenue forecast in 2030

USD 5.08 billion

Growth rate

CAGR of 4.1% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Circor International Inc.; Emerson Electric Co.; Flowserve Corporation; Pentair Inc.; Schlumberger Limited; Spirax-Sarco Engineering; Thermax Ltd.; Velan Inc.; Watts Water Technologies Inc.; Armstrong International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Steam Trap Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the steam trap market based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical

-

Thermodynamics

-

Thermostatic

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical

-

Oil & Gas

-

Food & Beverage

-

Energy & Power

-

Pharmaceutical

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global steam trap market size was estimated at USD 3.66 billion in 2023 and is expected to reach USD 3.83 billion in 2024.

b. The global steam trap market is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2024 to 2030 to reach USD 5.08 billion by 2030.

b. Oil & gas end use accounted for largest revenue share of 28% in 2023 and is further expected to grow at a fastest rate over forecast period. The need for continuous operation in oil and gas sector, necessitates steam traps that offer high reliability and minimal maintenance requirements.

b. Some key players operating in the steam trap market include Circor International Inc., Emerson Electric Co., Flowserve Corporation, Pentair Inc., Schlumberger Limited, Spirax-Sarco Engineering, Thermax Ltd., Velan Inc., Watts Water Technologies Inc., and Armstrong International.

b. The key factors that are driving the steam trap market growth is the increasing global focus on energy efficiency and sustainability which is driving demand for steam traps that optimize energy usage by preventing steam loss.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.