- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Sports Nutrition Market Size, Share, Industry Report, 2033GVR Report cover

![Sports Nutrition Market Size, Share & Trends Report]()

Sports Nutrition Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Sports Drinks, Sports Foods), By Form (Tablets, Capsules, Powder), By Age Group (Children, Adults), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-721-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Sports Nutrition Market Summary

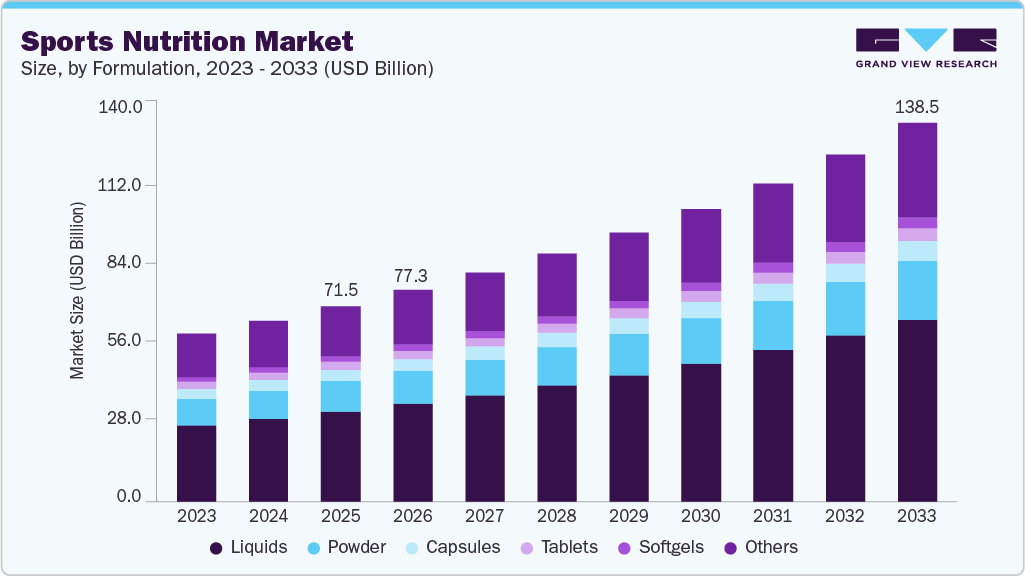

The global sports nutrition market size was estimated at USD 66.27 billion in 2024 and is projected to reach USD 138.48 billion in 2033, growing at a CAGR of 8.6% from 2025 to 2033. The global market has experienced significant growth over the past decade, driven by the rising adoption of fitness regimes and the increasing awareness of the importance of nutrition in maintaining an active lifestyle.

Key Market Trends & Insights

- North America dominated the global sports nutrition market in 2024 with a revenue share of 48.2%

- Asia Pacific is growing at the fastest CAGR of 10.7% in the forecast period.

- Based on product, the sports drinks segment in the global sports nutrition market accounted for a share of 38.4% in 2024.

- Based on Form, the liquids segment held a share of 45.9% in 2024.

- Based on age group, the adult segment held a share of 88.9% in 2024.

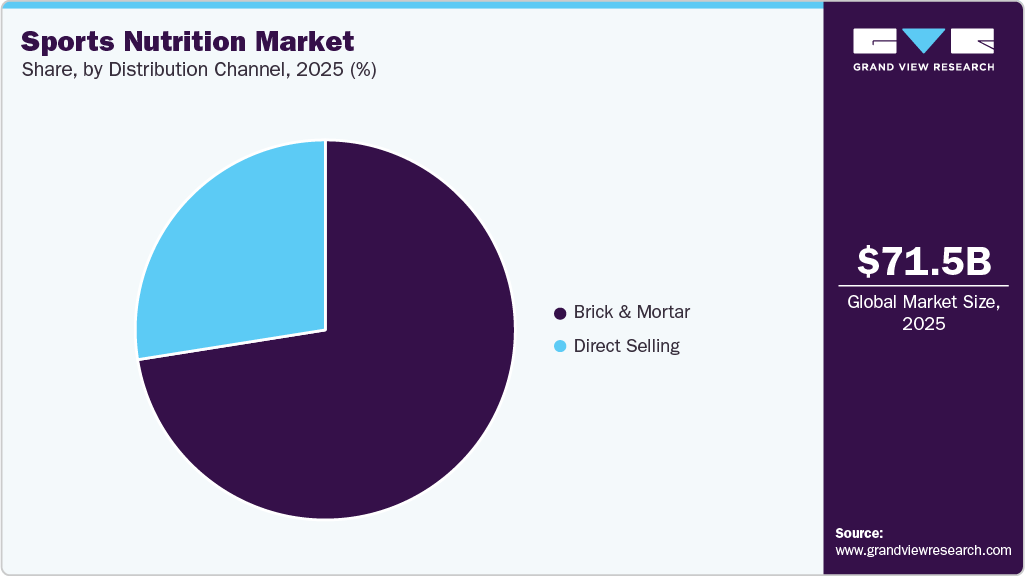

- By distribution channel, the brick & mortar segment dominated the market with a revenue share of 72.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 66.27 Billion

- 2033 Projected Market Size: USD 138.48 Billion

- CAGR (2025-2033): 8.6%

- Asia Pacific: Significantly growing market in 2024

This market encompasses a broad range of products, including protein powders, energy bars, dietary supplements, and ready-to-drink (RTD) beverages, designed to enhance athletic performance, support recovery, and improve overall health, driving the overall market during the forecast period. Moreover, athletes and fitness enthusiasts constantly seek products to enhance their performance, improve endurance, and support recovery. This has driven the demand for a wide range of sports nutrition products, including protein powders, energy bars, and recovery drinks. The increasing focus on performance optimization has led to the development of products tailored to specific needs, such as pre-workout supplements for energy, intra-workout products for endurance, and post-workout supplements for recovery.

Technological advancements and innovations in food science have led to developing new and improved sports nutrition products. Companies invest heavily in research and development (R&D) to create effective and appealing products. For instance, introducing plant-based protein powders and bars has opened up new market segments, catering to the growing number of consumers adopting vegetarian and vegan diets, which is further expected to augment market growth during the forecast period.

The rise of e-commerce has significantly impacted the global market by making these products more accessible to a broader audience. Online platforms offer consumers the convenience of purchasing products from the comfort of their homes, often with detailed product descriptions, reviews, and recommendations.

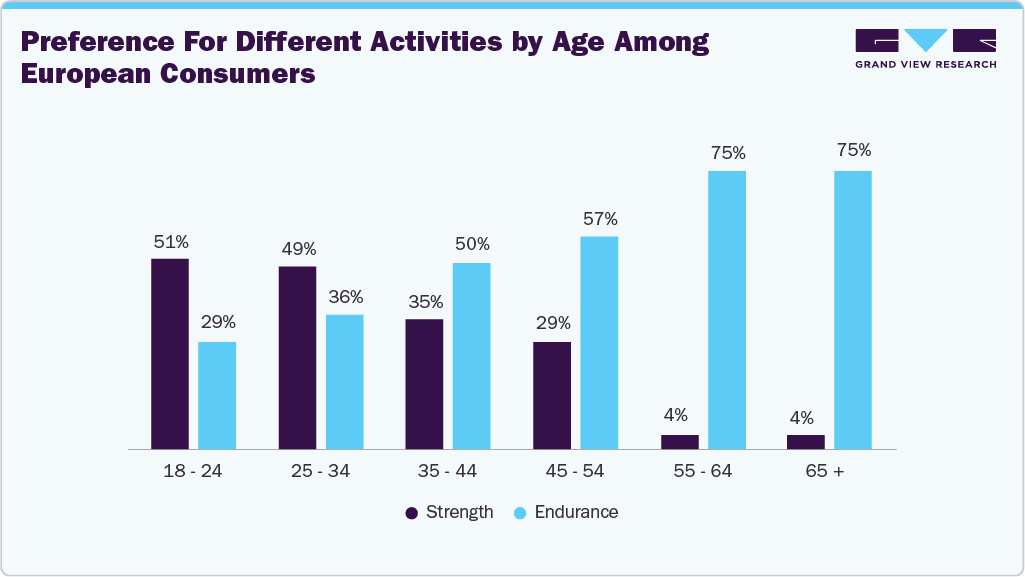

Consumer Insights for the Sports Nutrition Market

Consumers increasingly prioritize overall health, fitness, and well-being, driving demand for products supporting immunity, energy, and mental focus. Products that offer functional benefits, such as immunity-boosting and gut health support, are gaining traction. Prinova Europe Ltd. surveyed 1,277 consumers across five of Europe’s largest markets: France, Germany, Italy, Spain, and the UK, and published the results dated September 2023. The results revealed significant age-related differences in the popularity of strength training versus endurance activities. Over half of the respondents aged 18-24 indicated that strength or gym training was their most frequent exercise. In contrast, consumers aged 55 and older strongly preferred endurance activities.

Weight loss is a prominent goal, with nearly one in four active lifestyle consumers and one in six performance consumers citing it as their primary reason for exercising. Protein is a vital ingredient because it promotes satiety, while innovative options like Prolibra bioactive whey protein and CapsiAtra dihydrocapsiate, marketed for weight loss, are gaining appeal. Overall, 78% of consumers considered supplements important for achieving their goals.

Strength and recovery remained key, particularly for performance consumers who engaged in intense activities like CrossFit and weightlifting. Protein shakes were popular choices in powder (39%) and ready-to-drink (RTD, 35%) formats. Millennials and Gen Z were the largest regular users of these products. Post-workout preferences lean toward dairy-based protein products, with RTDs, powders, and bars being the most favored. The trend towards holistic health is gaining traction, with consumers looking for products that enhance physical performance and support mental and emotional well-being. This has led to the growth of sports product categories that include adaptogens, nootropics, and other supplements aimed at stress management and cognitive enhancement.

Form Insights

Based on forms, liquids held a 45.9% share in 2024. The rising demand for sports nutrition in liquid form is fueled by its convenience, rapid absorption, and suitability for on-the-go consumption, making it highly appealing to athletes and fitness enthusiasts. Liquid sports nutrition products, such as protein shakes, energy drinks, and recovery solutions, offer immediate nutritional benefits, particularly post-workout when quick nutrient delivery is crucial. For instance, Muscle Milk Ready-to-Drink Protein Shake provides 25 grams of protein in a portable format, ideal for supporting muscle recovery and growth after exercise.

Powdered sports nutrition products are anticipated to grow at a CAGR of 8.5% in the forecast period. They can be easily mixed with water, juice, or smoothies without measuring or weighing. Powders can be manufactured to provide a high concentration of active ingredients, making them a more potent option than other supplements. Overall, the customization, convenience, fast absorption, potency, cost-effectiveness, and innovation of dietary supplement powders are all driving their growth in popularity among consumers. The presence of a large number of brands, including Optimum Nutrition, MET-Rx, Quest Nutrition, Bio-Engineered Supplements and Nutrition, Inc., MusclePharm, NOW Foods, Body Fortress, and Pure Protein, is also expected to contribute to the segment growth.

Product Insights

Based on product, sports drinks held the largest share, accounting for 38.4% of the global revenues in 2024. The growth of the sports drinks industry is driven by a combination of factors that align with the evolving needs of athletes, fitness enthusiasts, and health-conscious consumers. One of the key drivers is the increasing focus on hydration and electrolyte replenishment during physical activity. Sports drinks are formulated to restore fluids and essential minerals lost through sweat, making them indispensable for endurance athletes. For instance, Gatorade Thirst Quencher, a market leader, offers a balanced mix of electrolytes and carbohydrates to help maintain hydration and energy levels during prolonged exercise, catering to professional and amateur athletes alike. Products like BODYARMOR Lyte Sports Drink have gained popularity for their blend of coconut water, electrolytes, and natural sweeteners, appealing to health-conscious individuals seeking clean-label options.

Sports foods is anticipated to grow at a CAGR of 8.7% from 2025 to 2033. One of the primary drivers is the rising awareness of protein's role in muscle recovery and overall health, leading to a surge in protein-rich sports bars. Products like Clif Builder’s Protein Bar and RXBAR cater to athletes and fitness enthusiasts by offering high protein content alongside clean, simple ingredients, making them a popular choice for post-workout snacks. In addition, advancements in flavor profiles and ingredient innovation support the industry's growth, which enhances consumer appeal. Companies are incorporating superfoods like chia seeds, quinoa, and nuts to boost the nutritional profile of their products, as seen in bars like Larabar. These ingredients resonate with consumers seeking health benefits alongside taste.

Age Group Insights

Based on age group, the adult segment held the largest share, accounting for 88.9% of the global revenues in 2024. The growth of adult sports nutrition products is driven by several specific factors, reflecting the increasing awareness of nutrition's role in athletic performance, recovery, and overall health. One key driver is the growing participation in fitness and recreational sports. Adults increasingly engage in activities like running, cycling, weightlifting, and CrossFit, which require proper fueling and recovery. Products such as Optimum Nutrition’s Whey Protein and Quest Bars are designed to meet active adults' protein and energy needs, offering convenience and efficacy. These products help enhance muscle growth, endurance, and post-workout recovery.

The geriatric segment is anticipated to grow at a CAGR of 7.6% from 2025 to 2033. The growing trend of "active aging" is a significant factor driving the demand for geriatric sports nutrition. Older adults live longer, healthier lives, and many participate in low-impact activities like walking, swimming, yoga, and light strength training. Products like Ensure Active and MuscleTech’s Clear Muscle are specifically designed to support muscle maintenance, joint health, and energy levels in seniors, helping them stay active and independent longer.

Distribution Channel Insights

The sale of sports nutrition products through the brick & mortar channel accounted for a share of over 72.5% of the global revenues in 2024. The rising sales of sports nutrition products through brick-and-mortar channels are driven by the consumer preference for in-store shopping, where they can physically examine products, seek expert advice, and make immediate purchases. Physical retail stores such as supermarkets, specialty health stores, and gyms provide a hands-on shopping experience that online platforms cannot replicate. For example, retail chains like GNC and Vitamin Shoppe are popular destinations for fitness enthusiasts to explore a wide range of protein powders, supplements, and energy bars while receiving tailored recommendations from knowledgeable staff.

The sale of sports nutrition products through e-commerce is anticipated to grow at a CAGR of 10.3% from 2025 to 2033. The surge in internet users, coupled with the accessibility of numerous brands and consumers' fast-paced lifestyles, is fueling the demand for sports nutrition products through online distribution channels. The convenience of online shopping, round-the-clock availability of products, and diverse offerings further contribute to the increasing sales of these supplements online.

The benefits to customers, including price comparison and the availability of several brands with customer reviews, are further driving sales of supplements through this channel. Moreover, different discussion portals, discounts and offers, easy payment options, and various promotion strategies are projected to fuel online sales of dietary supplements over the forecast period.

Regional Insights

The North America sports nutrition market is expected to grow at a CAGR of 7.5% from 2025 to 2033. A key factor fueling this growth is increasing health and fitness awareness. As individuals prioritize active lifestyles and physical well-being, demand for sports nutrition products like protein powders, energy bars, and hydration supplements has surged. For instance, Optimum Nutrition and MuscleTech have developed whey protein powders to enhance muscle recovery and performance, catering to a diverse audience of fitness enthusiasts. The market also benefits from increasing participation in sports and fitness activities, such as marathons, gym workouts, and cycling. Brands like GU Energy have developed energy gels tailored to endurance athletes, helping them maintain energy during prolonged physical activities. Furthermore, the trend toward personalized nutrition is gaining traction, with companies like Gainful offering bespoke protein blends tailored to individual goals, dietary restrictions, and activity levels.

U.S. Sports Nutrition Market Trends

The sports nutrition market in the U.S. held a market share of 92.1% of North America in 2024. The U.S. market is expanding rapidly, fueled by several key factors that reflect the country's unique consumer preferences, lifestyle trends, and market dynamics. A primary driver is the growing emphasis on health and fitness, as Americans increasingly adopt active lifestyles and seek performance-enhancing solutions to support their goals. For instance, the popularity of gym memberships, home workouts, and recreational sports has propelled demand for protein powders and recovery supplements from brands like Optimum Nutrition and Dymatize, which are tailored to meet the needs of both amateur fitness enthusiasts and professional athletes. In July 2024, MyProtein capitalized on the growing demand for specialized sports nutrition by expanding its collaboration with fitness competition Hyrox. This partnership led to six new products designed for hybrid athletes, including energy gels and re-fuel bars tailored to support different stages of intense workout routines. This strategic move highlights the increasing focus on catering to niche fitness segments, such as hybrid training. It underscores the importance of product innovation in driving growth within the U.S. market.

Europe Sports Nutrition Market Trends

The sports nutrition market in Europe held a share of 24.5% of the global market in 2024. Growing technological innovation in the nutraceuticals sector offers new opportunities for the market in the European region. The Federation of European Nutrition Societies (FENS) funds and invests in various nutritional foods & nutria-cosmetics businesses. The federation operates and nurtures the growth of such businesses in 26 countries in the region. The European Society for Clinical Nutrition and Metabolism (ESPEN) governs and offers grants for businesses in the nutrition sector and recognizes the industry's best-performing organizations. Such initiatives have encouraged participants to develop highly beneficial and innovative products, thus boosting industry growth.

The UK sports nutrition market held a market share of 22.9% of the European market in 2024. The UK market is experiencing growth, partly driven by a steady increase in gym memberships. According to a study published by Pure Gym Limited, 16% of the population in the UK held a gym membership in 2023, with a 2% increase from the previous year, reflecting a clear trend of growing interest in fitness and wellness. This increase signifies a larger base of consumers likely to invest in sports nutrition products to enhance their workout results and improve recovery times. In addition, the segment of the population planning to join a gym next year remained significant at 16%, indicating a sustained demand for sports nutrition supplements, protein powders, and performance enhancers in the coming months.

Asia Pacific Sports Nutrition Market Trends

The sports nutrition market in the Asia Pacific held a share of 14.7% of the global market in 2024. China, Japan, and India are among the largest markets for sports nutrition products in Asia, owing to a large consumer base in these countries. Japan and Australia have experienced heightened awareness regarding the health benefits of sports supplements over the years, which is expected to strengthen the regional market growth over the forecast period. Rising expenditure on health-enhancing products, in light of physical fitness requirements and increasing sports activities in the region, is likely to fuel product demand over the forecast period. Various regulatory bodies govern and regulate the market; their approval is necessary before seeking claims. For instance, in Japan, the approval of Food for Specified Health Uses (FOSHU) along with the FOSHU logo is required to seek health claims. Food Standards Australia New Zealand (FSANZ) in Australia and New Zealand, and the Food Safety and Standards Act (FSSAI) in India, strictly control dietary supplements, and their pre-market approval is mandatory for health claims.

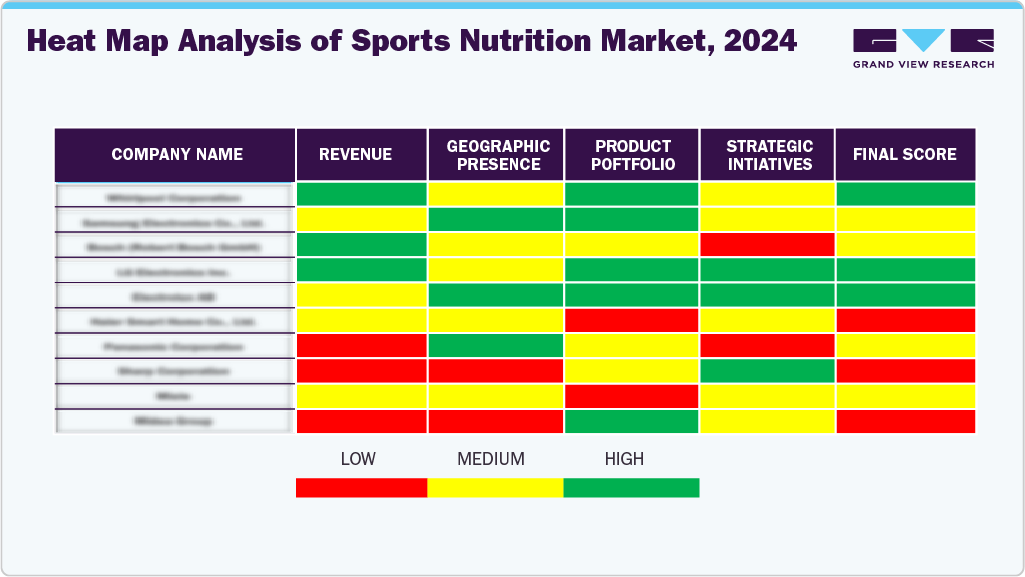

Key Sports Nutrition Company Insights

Key companies in the market primarily focus on innovation, Form diversity, and health-centric offerings. They invest in product development, strategic partnerships, and sustainable packaging to cater to evolving consumer preferences, expand their footprint, and strengthen regional competitiveness.

Key Sports Nutrition Companies:

The following are the leading companies in the sports nutrition market. These companies collectively hold the largest market share and dictate industry trends.

- BA Sports Nutrition, LLC

- Abbott

- Quest Nutrition

- PepsiCo

- Mondelez International, Inc.

- The Coca-Cola Company

- FitLife Brands

- GNC Holdings, Inc.

- Nutra Holdings

- Nutrivend

Recent Developments

-

In October 2024, Lionel Messi launched a new sports drink, Mas+. The sports drink is a low-sugar Form infused with electrolytes and vitamins and available in 4 variants: Miami Punch, Limón Lime League, Berry Copa Crush and Orange d'Or.

-

In September 2024, PepsiCo brand Gatorade announced the launch of Gatorade Hydration Booster, an electrolyte drink mix designed to support hydration throughout the day. Gatorade Sports Science Institute backs the new product, and the formula contains essential vitamins such as vitamin A, B3, B5, B6, and vitamin C with no artificial flavors, colors, or sweeteners.

-

In June 2024, PepsiCo introduced the GATORADE hydration brand in India, offering it in three refreshing flavors: Blue Bolt, Orange, and Lemon. As part of the launch, PepsiCo India is rolling out a campaign in Jammu and Kashmir with the slogan "Sweat Makes You Shine," aimed at inspiring consumers to boost their confidence and believe in their ability to achieve peak performance.

-

In May 2024, CSN Supplements was acquired by Nutrivend to merge the strengths of both companies, expand product offerings, and become a major player in the UK market.

Sports Nutrition Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 71.55 billion

Revenue forecast in 2033

USD 138.48 billion

Growth rate

CAGR of 8.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, age group, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Singapore; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia

Key companies profiled

BA Sports Nutrition, LLC; Abbott; Quest Nutrition; PepsiCo; Mondelēz International, Inc.; The Coca-Cola Company; FitLife Brands; GNC Holdings, Inc.; Nutra Holdings; Nutrivend

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sports Nutrition Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global sports nutrition market based on product, form, age group, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Sports Supplement

-

Protein Supplements

-

Egg Protein

-

Soy Protein

-

Pea Protein

-

Lentil Protein

-

Hemp Protein

-

Casein

-

Quinoa Protein

-

Whey Protein

-

Whey Protein Isolate

-

Whey Protein Concentrate

-

-

-

Vitamins

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

-

Amino Acid

-

BCAA

-

Arginine

-

Aspartate

-

Glutamine

-

Beta Alanine

-

Creatine

-

L-carnitine

-

-

Probiotics

-

Omega-3 Fatty Acids

-

Carbohydrates

-

Maltodextrin

-

Dextrose

-

Waxy Maize

-

Karbolyn

-

-

Detox Supplements

-

Electrolytes

-

Others

-

-

Sports Drinks

-

Isotonic

-

Hypotonic

-

Hypertonic

-

-

Sports Foods

-

Protein Bars

-

Energy Bars

-

Protein Gel

-

-

Meal Replacement Products

-

Weight Loss Products

-

-

Form Outlook (Revenue, USD Billion, 2021 - 2033)

-

Tablets

-

Capsules

-

Powder

-

Softgels

-

Liquids

-

Others

-

-

Age Group Outlook (Revenue, USD Billion, 2021 - 2033)

-

Children

-

Adult

-

Men

-

Women

-

-

Geriatric

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Brick & Mortar

-

Direct Selling

-

Chemist/Pharmacies

-

Health Food Shops

-

Hypermarkets

-

Supermarkets

-

Others

-

-

E-Commerce

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Spain

-

France

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Singapore

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global sports nutrition market size was estimated at USD 66.27 billion in 2024 and is expected to reach USD 71.55 billion in 2025.

b. The global sports nutrition market is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2033 to reach USD 138.48 billion in 2033.

b. The sports supplements segment dominated the sports nutrition market and held the largest revenue share of 33.39% in 2024.

b. Some key players operating in the sports nutrition market include Glanbia Plc.; Abbott; Quest Nutrition; PepsiCo; Cliff Bar; Coca Cola Company; The Bountiful Company; Post Holdings; Cardiff Sports Nutrition; and MusclePharm.

b. Key factors that are driving the sports nutrition market growth include an increase in demand for various types of protein bars, dietary supplements, and energy drinks among athletes and bodybuilders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.