- Home

- »

- Medical Devices

- »

-

Sports Medicine Market Size & Share, Industry Report, 2033GVR Report cover

![Sports Medicine Market Size, Share & Trends Report]()

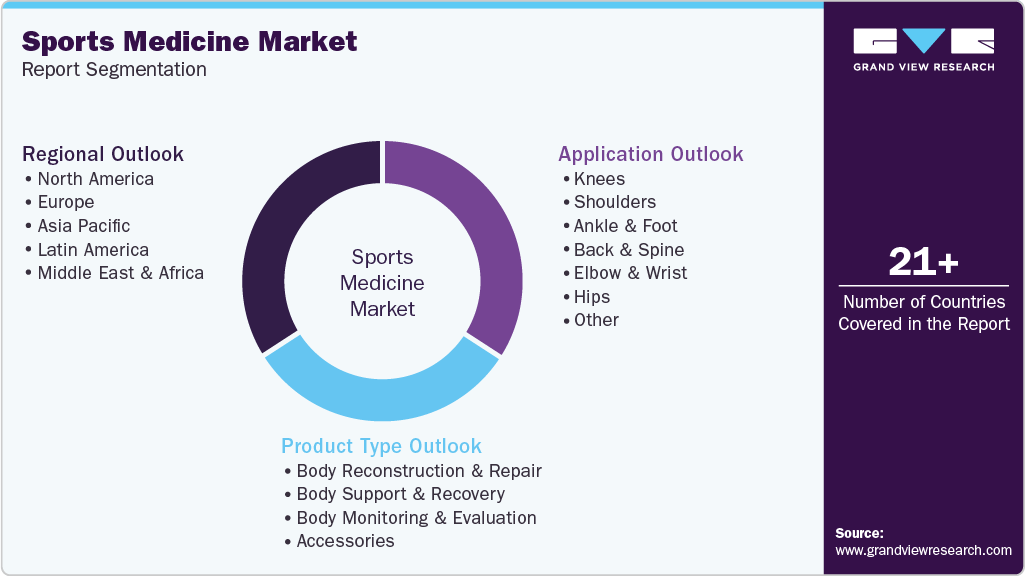

Sports Medicine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Body Reconstruction & Repair, Body Support & Recovery, Body Monitoring & Evaluation, Accessories), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-050-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sports Medicine Market Summary

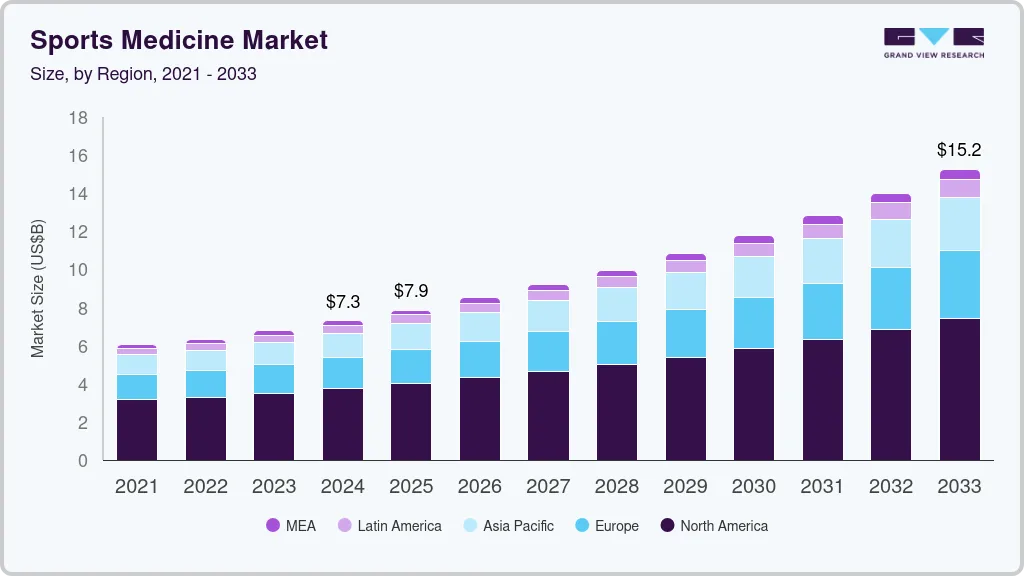

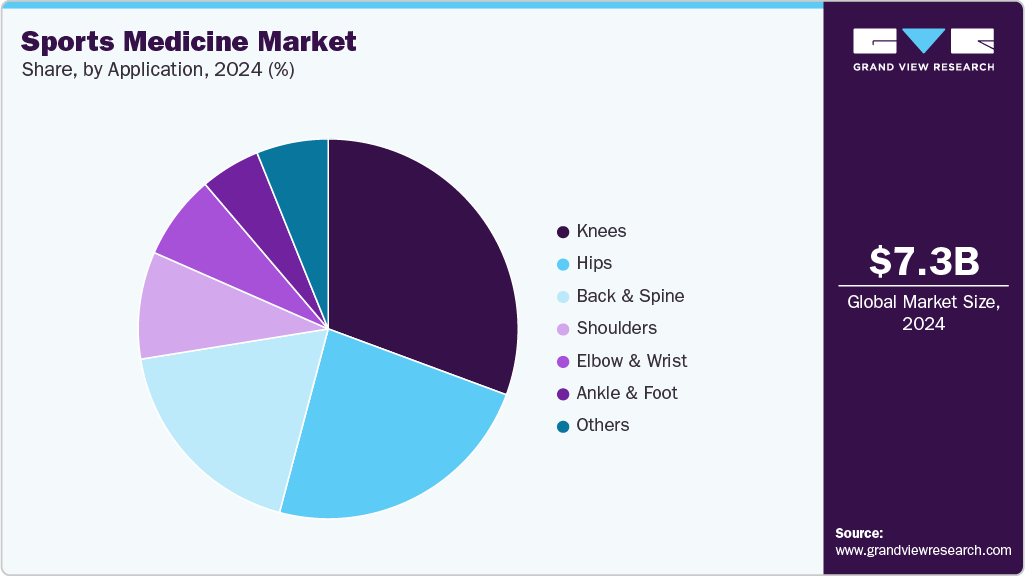

The global sports medicine market size was valued at USD 7.30 billion in 2024 and is projected to reach USD 15.25 billion by 2033, growing at a CAGR of 8.6% from 2025 to 2033. Demand for sports medicine has gained traction in recent years, owing to the rising incidence of athletic injuries and growing participation in sports and fitness-related activities by people. In addition, a gradual shift from proactive care to preventive care concerning injuries is further projected to drive the market.

Key Market Trends & Insights

- North America dominated the sports medicine market with a revenue share of 51.36% in 2024

- The U.S. dominated the sports medicine market in the North America region in 2024.

- By platform, the body reconstruction and repair segment dominated the market with the largest revenue share in 2024.

- By application, the knee segment dominated the market with a revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.30 Billion

- 2033 Projected Market Size: USD 15.25 Billion

- CAGR (2025-2033): 8.6%

- North America: Largest market in 2024

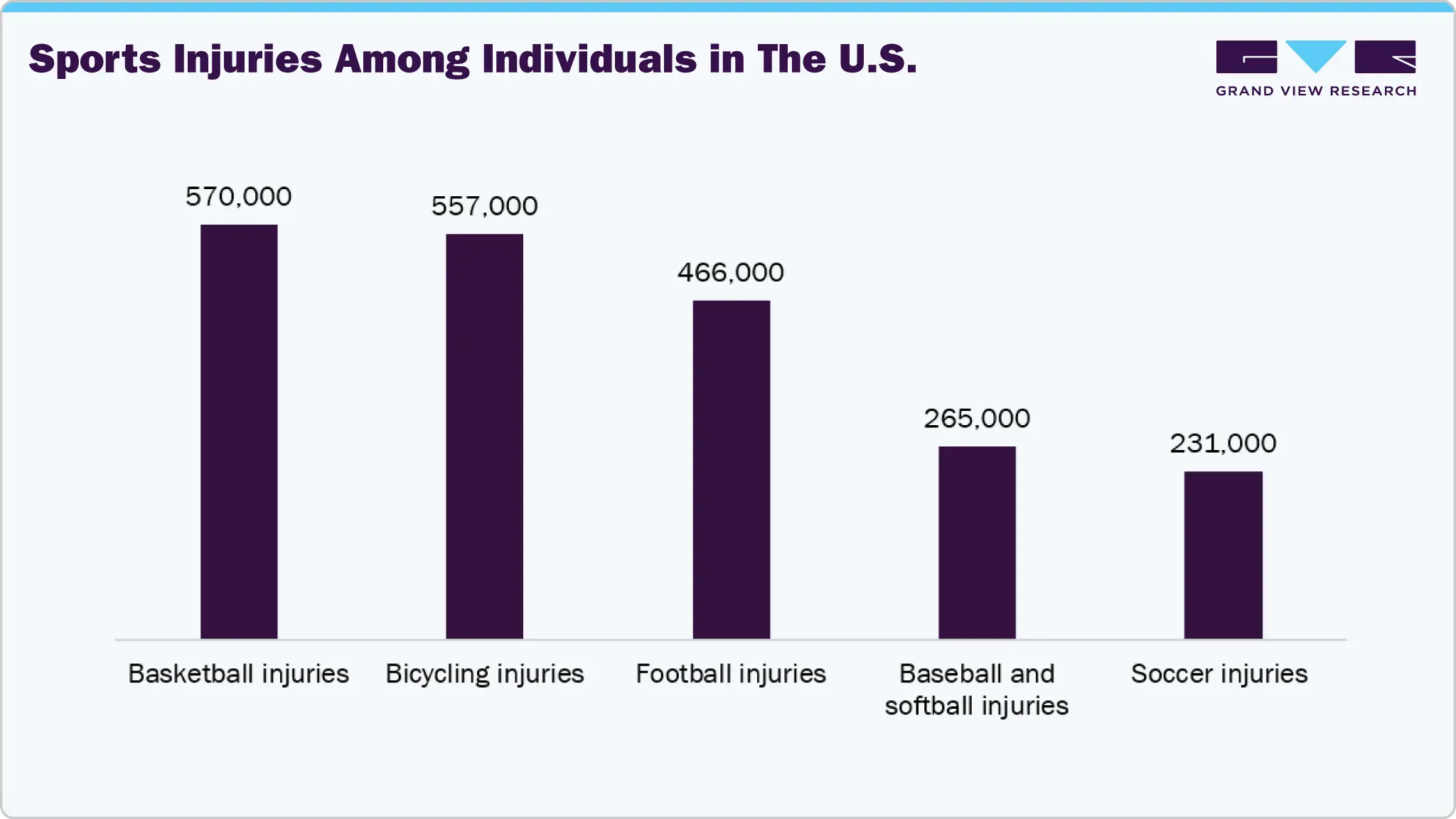

According to The Johns Hopkins University, 30 million people participate in some kind of sports, and over 3.5 million injuries are reported annually in the U.S. Similarly, according to latest estimates provided by the CDC, in 2020, about 54.1% of children in the age group of 6-17 years participated in sporting activities in the U.S. Furthermore, according to statistics provided by Stanford Medicine Children’s Health, around 3.5 million injuries in the age group of 14 years or less are reported in the U.S. every year. High participation rate of children in sports, coupled with increased injuries, is creating significant demand for the industry.Increasing utilization of technologically advanced wearable devices such as fitness bands supports market growth. For instance, a performance-based company in Nova Scotia named Athletigen Technology, Inc. works with various athletes to use the information collected or gathered on their respective DNA to improve their health and performance, thus reducing the incidence of sports-related injuries. Such initiatives are anticipated to support market growth over the forecast period.

Increasing career opportunities and a growing inclination toward fitness, owing to rising health awareness, have increased the number of people choosing sport as a hobby or a career. For instance, according to a survey conducted by Safe Kids World on emergency room visits, young athletes globally are admitted to emergency departments over a million times annually for athletic-related injuries. Of these, 15% of injuries were related to ankles and 9% to the knees. This, in turn, is expected to rise in market growth.

The need for minimally invasive procedures is increasing due to reduced trauma and faster recovery compared to invasive alternatives. During minimally invasive knee replacement surgeries, fewer muscles & tendons are affected, offering more natural results. Wound closure is easier, and recovery time is shorter than traditional procedures. Growing concern about surgical scars is a major driver of this segment. Lesser blood loss is also an added advantage of these surgeries. For instance, in May 2021, Stryker Corporation installed more than 1,000 Mako surgical robots worldwide and performed more than 500,000 procedures with these surgical robots.

In 2023, the FDA granted over 570 orthopedic 510(k) clearances, nearly 100 more than the previous year. Approximately 40% of these clearances were for spine implants and instruments. Please note that the company names in parentheses indicate the names used for the 510(k) submissions.

Appendix Lists Orthopedic Products Identified in FDA’s 510(K) Database 2023

Company

Product

3D LifePrints

EmbedMed

3D Systems

Vantage PSI

4WEB Medical

Cervical Spine Truss System (CSTS) Interbody Fusion Device

4WEB Medical

Cervical Spine Truss System - Stand Alone (CSTSSA) Interbody Fusion Device

4WEB Medical

Cervical Spine Truss System (CSTS)

A Plus Biotechnology

APS Metal Plate & Screw

aap Implantate

LOQTEQ VA Elbow Plates 27/35

Accelus (Fusion Robotics; acquired by ATEC)

Remi Robotic Navigation

Acro Composites

Acro Composites Interbody

Acuitive Technologies

Citregen Tendon Interference Screw (TIS), Citrelock Tendon Fixation Device, Citrespline, Citrelock ACL Implants

Acuitive Technologies

CITRELOCK DUO

Acuity Surgical Devices

Align Cervical Interbody Fusion

Acumed

Acutrak 3 Headless Compression Screw

Technologies used in orthopedic surgeries are continuously improving. New & improved versions of existing technologies have been developed to improve surgical outcomes and achieve longevity. Tools, parts, and instruments used in surgeries, such as fixation screws, are continuously advancing. Various titanium-based biocompatible or biomaterial-based screws & fixation systems have offered better results with lesser chances of rejection over a longer period than previously used metal screws. Novel technologies, such as tissue grafting and the use of scaffolds & other tissue matrices for the regeneration of native tissue, are being successfully used to impart improved mobility & flexibility to repaired limbs. Growth factor-infused matrices are being used for better & faster healing of tissue surrounding the injury.

Medicare Changes in 2023

-

No Cost-Sharing for Adult Vaccines: Effective January 1, 2023, Medicare beneficiaries pay nothing out-of-pocket for adult vaccines recommended by the Advisory Committee on Immunization Practices (ACIP), including shingles, whooping cough, tetanus, and more.

-

Insulin Cost Capped at USD 35/Month: As part of the Inflation Reduction Act, the out-of-pocket cost for insulin is capped at USD 35 per month for Medicare Part D enrollees starting January 1, 2023. This cap applies to insulin used with durable medical equipment (such as insulin pumps) starting July 1, 2023 for Medicare Part B enrollees.

-

Medicare Part B Premium Decreased to USD 164.90/Month: The standard monthly premium for Medicare Part B enrollees is USD 164.90 for 2023, a decrease from USD 170.10 in 2022. The annual deductible for all Medicare Part B beneficiaries is USD 226 in 2023, a decrease from USD 233 in 2022.

-

Medicare Advantage Updates: The expected average revenue change for Medicare Advantage (MA) plans in 2023 is 8.50%. This includes an effective growth rate of 4.88% and a rebasing/re-pricing adjustment of 0.39%.

-

Inflation Reduction Act Reforms: The Inflation Reduction Act, signed into law by President Joe Biden, aims to combat climate change, tax corporations more equitably, and lower health care spending, particularly benefiting Medicare beneficiaries age 65 and older. Key provisions include capping Medicare Part D out-of-pocket costs at USD 2,000 per year beginning in 2025, penalizing drug manufacturers for price hikes above inflation rates starting in October, and allowing the government to negotiate drug prices starting in 2023.

Impact of Medicare Changes on the Sports Medicine Market

-

Better Access to Preventive Care: Eliminating cost-sharing for adult vaccines supports overall health in active seniors, potentially reducing the incidence of vaccine-preventable diseases and related complications.

-

Improved Chronic Disease Management: The insulin cost cap benefits diabetic patients needing sports medicine services, making diabetes management more affordable and encouraging adherence to treatment plans.

-

Medicare Advantage Changes: Updates to Medicare Advantage plans, including increased physician payment rates and prior authorization processes, may improve coverage for physical therapy and orthopedic treatments, enhancing access to sports medicine services.

-

Growing Demand: The aging, active population drives higher utilization of sports medicine services covered by Medicare, leading to increased demand for treatments related to knee, shoulder, ankle, and foot, back and spine, elbow and wrist, hips, and other areas.

These 2023 Medicare updates enhance affordability and access, indirectly boosting the sports medicine market by supporting preventive and rehabilitative care for Medicare beneficiaries.

Overview of the impact of 2023 Medicare changes on key sports medicine application areas such as knees, shoulders, ankle & foot, back & spine, elbow & wrist, hips, and others, highlighting the situation before and after the changes:

Application Area

Before the 2023 Medicare Changes

After the 2023 Medicare Changes

Impact Summary

Knees

Coverage for surgeries, physical therapy, and rehab was subject to standard Medicare Part B and Advantage plan rules with usual cost-sharing and prior authorization requirements.

Improved affordability due to lower Part B premiums and enhanced Medicare Advantage plan policies; better access to therapy services with updated prior authorization processes.

Reduced out-of-pocket costs and smoother access to knee-related treatments and rehab services.

Shoulders

Complete Analysis will be a part of the final deliverable

Ankle & Foot

Back & Spine

Elbow & Wrist

Hips

Others

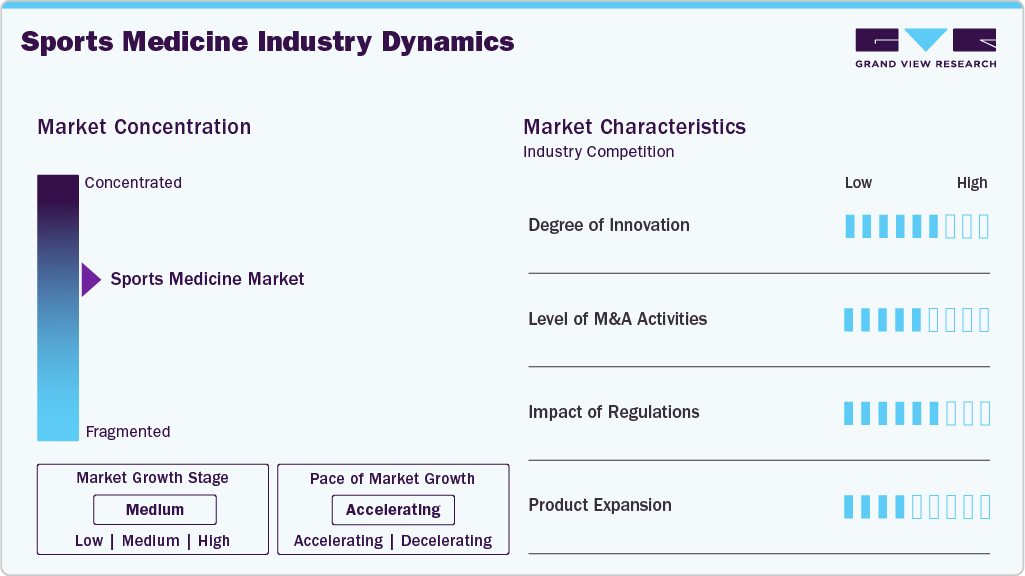

Market Concentration & Characteristics

The sports medicine industry is characterized by significant innovation, continuous development, and the introduction of new technologies. It has become a popular option as a minimally invasive procedure that provides lower pain and fatigue. As a result, key market players are investing in innovative technologies to strengthen their market position. For instance, in May 2025, OsteoCentric Technologies accepted the first investment from the University Hospitals (UH) Haslam Sports Innovation Center, to accelerate innovation in orthopedic sports medicine.

Several market players such as Enovis (DJO, LLC), Performance Health, Zimmer Biomet, and DePuy Synthes (Johnson & Johnson) are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories. For instance, in December 2023, Stryker Corporation announced its intent to acquire SERF SAS, a France-based joint replacement company known for its innovations in hip implants, including the original Dual Mobility Cup. This strategic move aims to enhance Stryker's global leadership in the joint replacement market and expand its product offerings across Europe.

Before being introduced to the market, sports medicine products must meet strict regulatory requirements to ensure high-quality, safety, and effectiveness standards. The major regulatory agencies for sports medical devices include the Australian Therapeutic Goods Administration, the Food and Drug Administration (FDA) in the U.S., the Ministry of Health, Labour and Welfare in Japan, the China Food and Drug Administration, and the Medicines and Healthcare Products Regulatory Agency (MHRA) in the UK. All the companies operating in the market are subject to regular inspections and audits by regulatory agencies and notified bodies.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. For instance, in April 2023, Smith+Nephew signed a distribution agreement with NAVBIT to market the NAVBIT SPRINT in Japan. It is used in primary hip arthroplasty.

Product Type Insights

The body reconstruction and repair segment accounted for the largest revenue share of 39.22% in 2024. The body reconstruction and repair segment includes soft tissue repair equipment, bone reconstruction devices, and surgical equipment. A significant market share is attributed to growing fracture and ligament repair device usage and increasing adoption of arthroscopy devices in minimally invasive surgeries. Moreover, the growing incidence of traumatic injury due to the rising number of accidents is expected to drive the growth of the body reconstruction & repair segment. According to the National Center for Health Statistics, around 31 million people in the U.S. require medical treatment due to injuries every year. Of these, around 2 million suffer from severe injuries and require hospitalization.

The accessories segment is anticipated to witness the fastest market growth over the forecast period. This segment includes bandages, tapes, wraps, disinfectants, and other products required for treating minor sports injuries. The growing usage of PRICE (Protection, Rest, Ice, Compression, Elevation) therapy as an immediate treatment for any sports injury is one of the major factors driving this segment's growth.

Survey of Beliefs and Clinical Applications of Kinesiology Tapes (KTs) in the U.S. Healthcare Professionals

A cross-sectional survey was conducted for the National Athletic Trainer Association members, the American Academy of Sports Physical Therapy, and the Academy of Orthopaedic Physical Therapy. Responses were gathered from around 1,535 people, while the survey was shared with 51,000 healthcare professionals.

The survey highlighted that professionals are using different brands and types of KT. The respondents conveyed that they purchased KT from three key brands: KT Tape, RockTape, and Kinesio Tex. In addition, different KT lengths and tensions were used to treat diverse conditions. The survey also indicated that KT provides numerous therapeutic effects. In addition, most respondents reported using KT for approximately 2 to 3 days, while 50% of tension KT dominated the tension category. Furthermore, survey respondents predominantly used standard uncut rolls.

Application Insights

The knee segment accounted for the largest revenue share of 30.64% in 2024, aided by rising incidences of knee injuries. They are commonly reported during sports or other physical activities, as excessive running and jumping lead to wear and tear of the knee joint. Various advanced treatments include dry needling, soft tissue massage, osteopathic manipulation, platelet-rich plasma therapy, and arthroscopic surgeries for knee repair. Availability of a wide number of treatments and growing incidence of knee injuries are some of the major factors driving the segment’s growth. As per the British Journal of Sports Medicine, knee injury is common and accounts for around 41% of the total sports injuries. Around one-fifth of the knee injuries are associated with the Anterior Cruciate Ligament (ACL). Other knee injuries include posterior cruciate ligament tears, meniscus tears, and avulsion of ligaments & tendons of the knee.

The ankle & foot segment is estimated to register the fastest CAGR over the forecast period. This is due to increased participation in physical activities, which increases the likelihood of ankle and foot injuries. Athletes and fitness enthusiasts who engage in high-impact sports and activities, such as basketball, football, and running, are particularly susceptible to ankle and foot injuries. Furthermore, the market expansion is supported by introducing new products with advanced technologies, such as 3D printing, to produce implants simulating anatomical structures. In addition, key players are contributing to extensive Research & Development (R&D) and seeking approval from regulatory bodies for manufacturing safe & effective devices. For instance, in February 2021, Additive Orthopaedics announced the approval of its Patient-Specific Talus Spacer by the U.S. FDA for treating avascular necrosis of the talus.

Regional Insights

North America dominated the overall sports medicine market with the largest share of 51.36% in 2024. The presence of a well-developed healthcare infrastructure, high spending, and availability of technologically advanced medical devices to treat various orthopedic injuries are some of the major factors driving the market. For instance, in December 2022, Stryker introduced Citrefix, a suture anchor system for foot & ankle surgeries that utilizes the company’s Citregen material, developed to mimic the structure and chemistry of native bone to support natural healing and bone regeneration.

U.S. Sports Medicine Market Trends

The U.S. accounted for the largest share of the market in North America in 2024. The increasing popularity of sports among youth is a major factor fueling the growth of the U.S. sports medicine market. Moreover, public health advocates and clinicians promote physical activity to maintain health and reduce the risk of obesity and other chronic disorders. As more people are engaged in sports and recreational activities, injuries resulting from these activities are a growing public health concern, further increasing market growth.

Europe Sports Medicine Market Trends

The sports medicine market in Europe is expected to grow significantly over the forecast period. Europe is the second-largest regional market in the global sports medicine market, owing to the high healthcare expenditure of European countries and the growing popularity of sports such as football, baseball, skiing, cricket, ice hockey, swimming, and rugby. In addition, the growing emphasis on preventive healthcare and wellness programs is boosting the adoption of sports medicine solutions. Key regional players are focusing on R&D to introduce advanced products, further propelling the market growth.

The Germany market for sports medicine is growing owing to the availability of more advanced treatment options for injuries than other European countries and the increasing number of orthopedic surgeries. The German market is a well-established center for addressing musculoskeletal disorders through medical exercise therapy. Numerous clinics across the region have employed the industry's leading solutions to cater to patients' diverse needs.

Asia Pacific Sports Medicine Market Trends

The Asia Pacific region is expected to grow at the fastest rate during the forecast period. Increasing awareness about the benefits of physical activity among the regional population has led to a rise in the number of people participating in sports. Owing to this, the usage rate of sports medicine in countries such as China, Japan, and South Korea is increasing continuously. The parge population base in the region, coupled with rising iincidenceof sports-related injuries, has led to a higher demand for sports medicine products and services. In addition, regional governments are investing in developing sports infrastructure and promoting sports activities, further contributing to the market growth for sports medicine.

The China sports medicine market is growing, owing to well-established sports infrastructure and increased awareness about sports and fitness. China has undergone a transformative shift in its public health and sports development approach. Furthermore, the government implemented impactful policies, including the "Healthy China 2030" and Medium-and Long-term Plan for Prevention and Treatment of Chronic Diseases (2017–2025).

Latin America Sports Medicine Market Trends

The Latin America region is expected to grow substantially during the forecast period, owing to the presence of developing economies such as Brazil & Mexico and the establishment of medical device companies in the region, allowing foreign manufacturers to carry out sustainable commercial operations in the region. For instance, medical device companies such as BSN Medical and Stryker Corporation have established their regional base to distribute their products easily.

The Brazil sports medicine market is developing owing to the popularity of football and other sports and growing investments in improving sports infrastructure in the country. In addition, an increase in medical tourism and the availability of advanced treatments at affordable costs are making the country a preferred destination for orthopedic treatment. Moreover, the presence of a well-defined regulatory framework established by health agencies, such as ANVISA, and the easy availability of experienced professionals are some of the major factors boosting the demand for orthopedic procedures in the country.

Middle East & Africa Sports Medicine Market Trends

The Middle East and Africa region is expected to grow at a lucrative rate during the forecast period. The government's emphasis on providing quality care in hospitals, the increasing number of orthopedic surgeons, and the high occurrence rate of sports injuries among the young and active population in the UAE and other countries are driving the market in the Middle East. Moreover, the increasing number of doping cases among Saudi players and the establishment of various medical institutes offering a specialized degree in sports medicine are driving the market growth in this region.

The South Africa sport medicine market are driven by economic development and high unmet healthcare needs. Moreover, the government is undertaking initiatives to promote sports in South Africa to maximize participation. For instance, Netball South Africa (NSA) serves as the governing body for netball in the country, overseeing the sport nationwide and managing the national netball team-SPAR Proteas. NSA's historic hosting of the Netball World Cup in Cape Town in 2023 marks a significant milestone for the African sport.

Key Sports Medicine Company Insights

Key participants in the global market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Sports Medicine Companies:

The following are the leading companies in the sport medicine market. These companies collectively hold the largest market share and dictate industry trends.

- Smith+Nephew

- Stryker

- Zimmer Biomet

- Arthrex, Inc.

- Enovis (DJO, LLC)

- DePuy Synthes (Johnson & Johnson)

- CONMED Corporation

- Mueller Sports Medicine, Inc.

- Breg, Inc.

- Performance Health

- Bauerfeind

- Karl Storz SE & Co. KG

Recent Developments

-

In November 2024, Auxein launched a range of innovative advanced orthopedic and arthroscopy products at MEDICA2024. The company showcased its latest innovations in orthopedic products, receiving an overwhelming response from thousands of industry professionals, healthcare providers, medical distributors, and experts worldwide.

-

In July 2024, Stryker completed the previously announced acquisition of Artelon, a privately held company specializing in innovative soft tissue fixation products. The acquisition focuses on developing products for foot and ankle and sports medicine procedures.

-

In October 2023, Smith+Nephew launched its REGENETEN Bioinductive Implant in Japan, providing a healing option for patients with rotator cuff tears.

-

In August 2023, Smith+Nephew introduced India's OR3O Dual Mobility System for primary and revision hip arthroplasty use.

-

In March 2023, Arthrex, Inc. received U.S. FDA 510(k) clearance for the TightRope Implant. This device is used to treat orthopedic injuries and is the only one cleared for pediatric ACL surgery.

-

In January 2023, Enovis (DJO, LLC) launched DynaClip Quattro and DynaClip Delta bone staples. These staples offer foot and ankle surgeons ease of use and procedural efficiency.

Sports Medicine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.87 billion

Revenue forecast in 2033

USD 15.25 billion

Growth rate

CAGR of 8.6% from 2023 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico, UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Smith+Nephew; Stryker; Zimmer Biomet; Arthrex, Inc.; Enovis (DJO, LLC); DePuy Synthes (Johnson & Johnson); CONMED Corporation; Mueller Sports; Medicine, Inc.; Breg, Inc.; Performance Health; Bauerfeind; Karl Storz SE & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sports Medicine Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global sports medicine market report on the basis of product, application, and region:

-

Product Type Outlook (Revenue in USD Million, 2021 - 2033)

-

Body Reconstruction & Repair

-

Surgical Equipment

-

Soft Tissue Repair

-

Bone Reconstruction Devices

-

-

Body support & recovery

-

Braces and Other Support Devices

-

Compression Clothing

-

Hot & Cold Therapy

-

-

Body Monitoring & Evaluation

-

Cardiac

-

Respiratory

-

Hemodynamic

-

Musculoskeletal

-

Others

-

-

Accessories

-

Bandages

-

Tapes

-

Disinfectants

-

Wraps

-

Others

-

-

-

Application Outlook (Revenue, USD Million; 2021 - 2033)

-

Knees

-

Shoulders

-

Ankle & Foot

-

Back & Spine

-

Elbow & Wrist

-

Hips

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the sports medicine market growth include increasing demand for sports medicine, owing to the shift towards a healthy lifestyle adopted by the young population, and rising incidences of injuries among athletes and fitness enthusiasts.

b. The global sports medicine market size was estimated at USD 7.30 billion in 2024 and is expected to reach USD 7.87 billion in 2025.

b. The global sports medicine market is expected to grow at a compound annual growth rate of 8.62% from 2025 to 2033 to reach USD 15.25 billion by 2033.

b. Body Reconstruction & Repair segment dominated the sports medicine market with a share in 2024. This is attributable to the growing usage of fracture and ligament repair devices, and the increasing adoption of arthroscopy devices in minimally invasive surgeries.

b. Some key players operating in the sports medicine market include Arthrex, Inc.; Smith and Nephew; Stryker; Zimmer Biomet; Wright Group N.V.; and DJO Global.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.