Speech Analytics Market Size, Share & Trends Analysis Report By Component (Solution, Service), By Deployment (On-Premises, Cloud), By Enterprise Size (SMEs), By Vertical (BFSI), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-209-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Speech Analytics Market Size & Trends

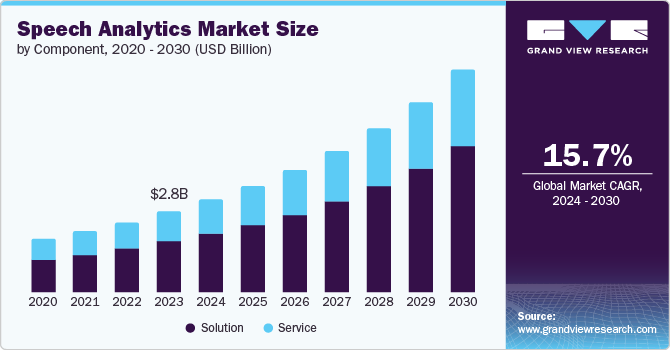

The global speech analytics market was valued at USD 2.82 billion in 2023 and is projected to grow at a CAGR of 15.7% from 2024 to 2030. Advancements in omnichannel integration capabilities fuel the market's growth. As customer demand for multi-touchpoint engagement intensifies, businesses require improved client-business interactions. Speech analytics with enhanced omnichannel integration fulfills this need. Providing a platform for individualized and coordinated customer interactions fosters deeper customer understanding through data analysis of trends, patterns, and opportunities. This translates into increased customer satisfaction, loyalty, and business growth, significantly propelling the speech analytics market forward.

Another driving force that has grown this market significantly is the crucial technological advancement that has positively shaped it. Natural Language Processing (NLP) algorithms have enabled the effective interpretation of human language through speech. In contrast, integrating Artificial Intelligence (AI) and Machine Learning (ML) algorithms empowers these systems to comprehend complex data and generate valuable business insights. Additionally, innovative voice recognition technology allows for the efficient transcription of speech into text, facilitating the analysis of large audio datasets by businesses.

The COVID-19 pandemic necessitated a rapid shift towards remote work environments, fundamentally altering how businesses interact with customers, employees, and stakeholders. This digital transformation fueled the rise of communication platforms, creating a prime opportunity for speech analytics to shine. By analyzing not just spoken interactions but also emails, chats, social media exchanges, and consumer behavior patterns, speech analytics emerged as a critical tool for businesses navigating the pandemic landscape.

Components Insights

The solutions components segment accounted for a revenue share of 62.8% in 2023. This dominance can be attributed to its advanced automation capabilities. The segment's solutions excel at comprehending customer data and translating it into actionable insights, including competitor analysis, customer preferences, and in-depth analytics. This empowers businesses to make data-driven decisions, glean valuable customer understanding, and optimize operational efficiency. These factors have been instrumental in significantly driving the segment's growth.

The service component segment is anticipated to grow at a CAGR of 14.4% from 2024 to 2030. This growth is primarily driven by the critical role that services play in ensuring the successful adoption, implementation, and utilization of speech analytics solutions. Service offerings encompass essential aspects such as technical support, user training, ongoing customization to meet evolving business needs, system integration, security management, and the flexibility and scalability required to accommodate future growth.

Deployment Insights

The on-premises deployment segment accounted for 60.6% of market revenue in 2023. This leading position is fueled by the long-term cost efficiency of on-premises solutions for organizations, especially those with substantial workloads or strict data privacy rules. Furthermore, on-premises deployment provides enhanced data security control, which is a critical factor for companies dealing with sensitive customer data. The adaptability of on-premises solutions for a wide range of applications and intricate language processing tasks also contributes to their popularity.

The cloud deployment segment is anticipated to witness the fastest growth at a CAGR of 18.0% from 2024 to 2030. This surge can be attributed to advancements in cloud technology and the increasing demand for cloud-based IT infrastructure. The adoption of cloud solutions is driven by their inherent benefits, including cost efficiency, improved data collection, streamlined file sharing, and the integration of diverse solutions. This growing demand for cloud deployment services is a key factor fueling the segment's significant expansion.

Enterprise Size Insights

The large enterprises segment held a 59.8% market revenue share in 2023. This leadership is driven by the significant role speech analytics plays in enhancing customer satisfaction for large organizations. These tools enable data-driven approaches to sales and market strategy development. Additionally, speech analytics empowers large enterprises to maintain regulatory compliance and safeguard sensitive data, further amplifying market demand and driving significant growth.

The SME segment is projected to grow at a CAGR of 16.7% from 2024 to 2030. This surge is attributed to the widespread adoption of speech analytics tools by SMEs. These tools empower SMEs to gather customer feedback and optimize customer interactions, leading to a range of benefits. Speech analytics equips SMEs to improve product offerings, enhance customer service experiences, cultivate stronger customer loyalty, and ultimately expand their market share.

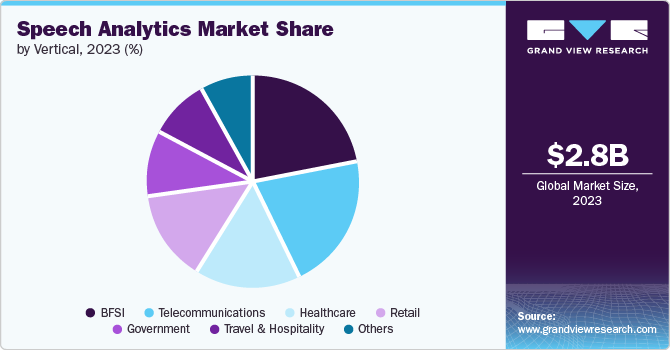

Vertical Insights

Banking, Financial Services, and Insurance (BFSI) sector held a commanding position in the market in 2023. This dominance can be attributed to the pivotal role of speech analytics tools in ensuring compliance with rigorous governmental rules and regulations imposed on BFSI entities. These tools aid in customer engagement, trend identification in customer satisfaction, and enhancement of BFSI operations. The broad-ranging applications of speech analytics in this sector significantly contribute to its growth.

The retail segment is anticipated to grow at a CAGR of 17.8% from 2024 to 2030. Speech analytics have been instrumental in elevating the customer experience in this sector by providing invaluable insights derived from various communication channels such as voicemails, live chats, and phone calls. This has resulted in operational improvements for businesses and conferred a competitive edge in the marketplace. These elements significantly contribute to the substantial growth of this sector.

Regional Insights

The North American speech analytics market emerged as the global leader in 2023. This dominance can be attributed to the region's well-developed infrastructure, characterized by high-speed internet connectivity and robust telecommunications networks. These factors significantly contribute to the growth of the speech analytics market by facilitating the seamless integration, adoption, and performance of these analytical tools.

U.S. Speech Analytics Market Trends

The U.S. dominated the North America speech analytics market with a share of 60.9% in 2023. This dominance can be attributed to the intense competition among regional players and numerous service providers, coupled with remarkable technological advancements in recent years that have significantly bolstered the market within the country.

Europe Speech Analytics Market Trends

The European speech analytics market emerged as a significant growth area in 2023. This expansion can be attributed to the confluence of two key trends: the burgeoning demand for contact centers and the rise of e-commerce. These factors have fueled the need for improved customer interactions and operational efficiency, driving the adoption of speech analytics solutions across the region.

The UK Speech Analytics market is expected to grow rapidly in the coming years, driven by demonstrably improved operational efficiency, regulatory compliance, and customer engagement. These factors have fueled a surge in demand for speech analytics solutions, propelling market expansion within the region.

Asia Pacific Speech Analytics Market Trends

The Asia Pacific speech analytics market is expected to grow at a CAGR of 17.6% from 2024 to 2030. This surge is primarily driven by the burgeoning outsourcing industry in developing Asia Pacific nations such as China, India, and Australia. To remain competitive, businesses in these regions are increasingly prioritizing enhanced customer experience, fueling the demand for speech analytics solutions that provide valuable insights into customer interactions.

The speech analytics market in China held a substantial market share in 2023. This can be attributed to the expansion of contact center operations, adherence to regulatory standards, enhancement of customer experience, and improvement in operational efficiency. These factors have escalated the product demand and substantially contributed to market growth in the country.

Key Speech Analytics Company Insights

Some of the key companies in the speech analytics market include Microsoft Corporation, IBM Corporation, Amazon.com, Inc.; Clarifai, Inc., Ayasdi AI LLC, H2O.ai, HyperVerge, Inc., and Google LLC (Alphabet Inc.). Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Avaya LLC's portfolio includes a wide range of products and services that help the organization enhance business performance and customer interactions. Its speech analytics tools use AI, NLP, and ML

-

Genesys provides cloud deployments with an AI-powered experience, enabling organizations to provide personalized experiences. It also provides a 360-degree view of the interaction, covering key issues and agent performances.

Key Speech Analytics Companies:

The following are the leading companies in the speech analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Avaya LLC

- Calabrio, Inc.

- CallMiner

- Qualtrics

- Genesys

- Hewlett Packard Enterprise Development LP

- inContact, Inc.

- NICE

- Verint Systems Inc.

Recent Developments

-

In June 2024, Amazon announced the nationwide rollout in the U.S. of its AI-powered shopping assistant, Rufus. Leveraging generative AI (GenAI) technology, Rufus is designed to enhance the customer experience by answering product-related inquiries, facilitating comparisons, and providing guidance throughout the shopping journey. This strategic move aims to empower customers with the information necessary to make informed decisions and expedite the shopping process.

-

In March 2024, Linus Health acquired Aural Analytics to strengthen its cognitive assessment platform with speech analysis technology. This expands their reach into the early detection of cognitive decline and the life sciences market.

Speech Analytics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.22 billion |

|

Revenue forecast in 2030 |

USD 7.73 billion |

|

Growth Rate |

CAGR of 15.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, vertical, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, South Africa |

|

Key companies profiled |

Avaya LLC; Calabrio, Inc.; CallMiner; Qualtrics; Genesys; Hewlett Packard Enterprise Development LP; inContact, Inc.; NICE; Verint Systems Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Speech Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global speech analytics market report based on component, deployment, enterprise size, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Service

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Telecommunications

-

Healthcare

-

Retail

-

Government

-

Travel and Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."