- Home

- »

- Clinical Diagnostics

- »

-

Spectrometry Market Size & Share, Industry Report, 2030GVR Report cover

![Spectrometry Market Size, Share & Trends Report]()

Spectrometry Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Pharmaceutical Analysis, Forensic Analysis, Proteomics, Metabolomics), By Type, By Product, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-422-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Spectrometry Market Summary

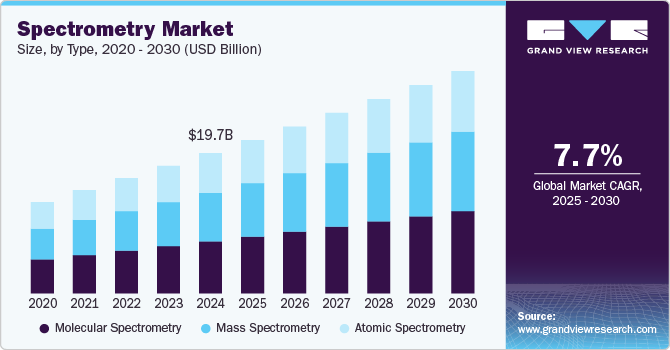

The global spectrometry market size was estimated at USD 19.71 billion in 2024 and is projected to reach USD 31.23 billion by 2030, growing at a CAGR of 7.7% from 2025 to 2030. The development of advanced spectroscopy instruments and consumables is expected to drive market growth.

Key Market Trends & Insights

- North America spectrometry market dominated the global market and accounted for 41.6% of revenue share in 2024.

- The spectrometry market in the U.S. held a significant share of the North American market in 2024.

- By type, the molecular spectrometry segment led the market, securing the largest revenue share of 37.1% in 2024.

- By product, the instrument segment dominated the market and accounted for the largest revenue share of 61.8% in 2024.

- By application, the pharmaceutical analysis segment dominated the market and accounted for the largest revenue share of 34.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.71 Billion

- 2030 Projected Market Size: USD 31.23 Billion

- CAGR (2025-2030): 7.7%

- North America: Largest market in 2024

Ongoing innovations in techniques have expanded the use of these instruments across various applications. Key players are focusing on products that deliver better performance, enabling researchers to achieve more accurate results. This progress is set to drive market growth and encourage greater adoption over the forecast period.Spectrometry serves various applications in physics, chemistry, medicine, and biology. Different spectrometry techniques are increasingly utilized in clinical laboratories and research settings. The growing adoption in clinical research, forensics, and precision medicine, alongside rising applications in pharmaceutical, food, and feed industries, is expected to create significant growth opportunities. In addition, increased R&D investments in the pharmaceutical and biotech sectors will support market expansion. Spectroscopy is gaining traction in diagnostics through biomedical research, including the analysis of peptides, proteins, nucleic acids, and amino acids. This technique enables the study of macromolecule dynamics and interactions, leading to greater use of NMR spectroscopy. A report from WHO in January 2022 noted increased funding for biomedical research, exemplified by a USD 19.11 million donation to the Chinese University of Hong Kong in June 2022 to enhance research in biomedical technology.

The spectrometry industry has expanded due to technological advancements. Ongoing developments in miniaturization have led to the creation of portable, compact devices for various industries. The integration of automation technologies, such as robotics and machine learning, has further propelled the growth of spectrometer instruments by increasing processing speed and improving sample analysis accuracy. Automation reduces human error and enhances the efficiency of spectrometer operations.

Type Insights

Molecular spectrometry led the market, securing the largest revenue share of 37.1% in 2024 due to its widespread applications in analytical chemistry, pharmaceuticals, and environmental monitoring. Its ability to provide detailed molecular information facilitates qualitative and quantitative analysis, making it essential for researchers and industries. The growing demand for accurate and sensitive analytical techniques in various sectors, including food safety, clinical diagnostics, and materials science, has further propelled its adoption. Innovations in molecular spectrometry, such as enhanced sensitivity and automation, contribute to its market dominance and support its role in advancing scientific research and technological development across multiple fields.

The mass spectrometry segment is projected to grow at a CAGR of 8.3% over the forecast period due to its increasing application across various industries, including pharmaceuticals, biotechnology, and environmental analysis. This growth is driven by the demand for precise and rapid analysis of complex samples and advancements in technologies that enhance sensitivity and accuracy. The rising focus on drug development, personalized medicine, and proteomics research further fuels this segment's expansion, positioning the segment as a vital tool in scientific research and quality control processes across diverse sectors.

Product Insights

The instrument segment dominated the market and accounted for the largest revenue share of 61.8% in 2024 due to its essential role in various applications, including pharmaceuticals, environmental testing, and food safety. The demand for advanced instruments that provide accurate and reliable results has driven significant investments in this segment. Key factors contributing to its dominance include technological advancements, the need for precise analytical capabilities, and the increasing focus on quality control and regulatory compliance in multiple industries. As research and development activities expand, the instrument segment is expected to maintain its leading position in the market.

The consumables segment is projected to grow at a CAGR of 8.6% over the forecast period, driven by the increasing demand for various analytical applications. As research activities expand in fields such as pharmaceuticals, biotechnology, and environmental analysis, the need for high-quality consumables, including reagents, columns, and sample preparation materials, is rising. The ongoing development of innovative consumables that enhance instrument performance and reduce analysis time is further fueling this growth. Moreover, the trend toward outsourcing laboratory services and the increasing focus on maintaining quality standards will contribute to the expansion of the consumables segment in the coming years.

Application Insights

Pharmaceutical analysis dominated the market and accounted for the largest revenue share of 34.9% in 2024, due to the growing focus on drug development and quality assurance. As the pharmaceutical industry expands, the demand for precise and reliable analytical techniques increases, positioning spectrometry as an essential tool for evaluating drug formulations, impurities, and pharmacokinetics. Regulatory compliance requirements further drive the need for robust analytical methods to ensure safety and efficacy. The segment's growth is supported by advancements in mass spectrometry and other spectrometric techniques that enable comprehensive analysis of complex pharmaceutical compounds, fostering innovation in drug discovery and development processes.

Metabolomics is projected to grow at a CAGR of 8.9% over the forecast period due to its increasing applications in personalized medicine, disease diagnosis, and biomarker discovery. As researchers focus on understanding metabolic processes and their relationship to health and disease, the demand for advanced analytical techniques rises. Spectrometry offers precise identification and quantification of metabolites, facilitating insights into metabolic pathways and physiological responses. The growing emphasis on precision medicine and integrating metabolomics into clinical research will drive investment and innovation, contributing to the segment's rapid expansion in the coming years.

End Use Insights

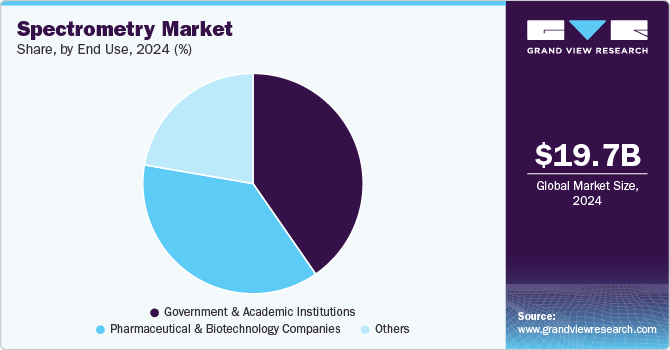

The government and academic institutions segment dominated the market and accounted for the largest revenue share of 40.4% in 2024 due to extensive investments in research and development activities. These institutions play a pivotal role in advancing scientific knowledge and driving demand for instruments and techniques. Their focus on fundamental research, innovation, and educational initiatives has led to increased adoption in various fields, including chemistry, biology, and environmental science. Furthermore, government funding for research projects and collaborations with private sectors bolsters the growth of this segment, ensuring continuous advancements in technology and methodologies that enhance research capabilities and outcomes.

Pharmaceutical & biotechnology companies is projected to grow at a CAGR of 8.3% over the forecast period due to the increasing focus on drug discovery, development, and personalized medicine. As these companies prioritize innovation, the demand for advanced techniques rises to support complex analyses and ensure regulatory compliance. The ability to provide precise data on molecular structures, dynamics, and interactions enhances the efficiency of R&D processes, leading to faster drug development timelines. In addition, the growing emphasis on biomarker discovery and the rising prevalence of chronic diseases drive investment in solutions, further fueling market expansion in this segment.

Regional Insights

The North America spectrometry market dominated the global market and accounted for 41.6% of revenue share in 2024 due to advancements in technology, strong healthcare infrastructure, and increased investments in research and development. The region accounted for a significant market share driven by the presence of key players, such as Thermo Fisher Scientific and Agilent Technologies. The growing demand for spectrometry applications in biotechnology, pharmaceuticals, and environmental testing also contributed to its leadership position. Favorable government initiatives supporting life sciences research and technological innovations further fueled North America's market growth, positioning it as a global leader in technologies.

U.S. Spectrometry Market Trends

The spectrometry market in the U.S. held a significant share of the North American market in 2024, driven by its advanced healthcare infrastructure, robust research and development activities, and strong presence of leading spectrometry manufacturers. Increased applications in pharmaceuticals, biotechnology, and environmental testing, along with favorable government funding for scientific research, further boosted the U.S.'s market dominance in the region.

Europe Spectrometry Market Trends

The spectrometry market in Europe is experiencing significant growth due to rising demand for pharmaceuticals, biotechnology, and environmental testing. Increased regulatory requirements for food safety and pharmaceutical quality and advancements in molecular and mass spectrometry technologies are driving market expansion. Investments in R&D, particularly in proteomics and metabolomics, are further boosting demand. Furthermore, the growing uses in academic institutions and government research, alongside a focus on precision medicine, support continued growth across various applications and End Use sectors in Europe.

The UK spectrometry market is expected to show significant growth owing to rising research investments, increasing demand for advanced analytical techniques in biotechnology, and strong government support for scientific innovation. Expanding applications in environmental monitoring and forensic analysis are further fueling market expansion in the UK.

The spectrometry market in Germany is experiencing significant growth due to strong advancements in the pharmaceutical and biotechnology sectors, driven by increased R&D activities and demand for precision diagnostics. The country’s robust industrial base and stringent regulatory requirements in environmental testing and food safety further boost the adoption of spectrometry technologies. Moreover, advancements in mass spectrometry and molecular spectrometry are enhancing analytical capabilities.

Asia Pacific Spectrometry Market Trends

The spectrometry market in Asia Pacific is experiencing rapid growth due to increasing investments in pharmaceutical R&D, expanding biotechnology industries, and rising demand for environmental testing and food safety analysis. Technological advancements in mass spectrometry and molecular spectrometry, along with growing applications in proteomics and metabolomics, are boosting market adoption. Furthermore, government initiatives to strengthen healthcare infrastructure and scientific research in countries such as China, India, and Japan are further driving market expansion.

China spectrometry market is growing at a lucrative rate, driven by substantial investments in pharmaceutical and biotechnology sectors and increasing demand for advanced analytical techniques. The rise in environmental monitoring and food safety regulations is further fueling market expansion. Moreover, government initiatives promoting scientific research and innovation, along with advancements in mass spectrometry and molecular spectrometry technologies, are contributing to the market's rapid growth and adoption across various industries in China.

Latin America Spectrometry Market Trends

The spectrometry market in Latin America is experiencing significant progress, driven by increasing investments in pharmaceuticals and biotechnology and growing demand for environmental testing and quality control. Technological advancements in analytical techniques and expanding applications in food safety and forensic analysis are also contributing to market growth. In addition, supportive government initiatives and research funding foster innovation and enhance market development in the region.

Middle East And Africa Spectrometry Market Trends

The spectrometry market in MEA is experiencing growth driven by rising demand for advanced analytical techniques in pharmaceuticals, food safety, and environmental monitoring. Increasing investments in healthcare infrastructure and research initiatives are further supporting market expansion. Moreover, the growing emphasis on quality control and regulatory compliance in various industries is boosting the adoption of spectrometry technologies across the region.

Saudi Arabia spectrometry market growth is driven by increasing investments in the healthcare and biotechnology sectors and rising demand for advanced analytical techniques in environmental monitoring and food safety. Furthermore, government initiatives to enhance research capabilities and regulatory compliance are further supporting the adoption of spectrometry technologies in the country.

Key Spectrometry Company Insights

Several key global players, including Agilent Technologies, Thermo Fisher Scientific, PerkinElmer, and Bruker, characterize the spectrometry industry's competitive landscape. These companies compete on factors such as technological advancements, product portfolios, and strategic partnerships. The market is also witnessing increased investment in research and development to enhance spectrometry applications in proteomics, pharmaceutical analysis, and environmental testing. Mergers, acquisitions, and collaborations further intensify competition, while regional players in emerging markets add competitive pressure with cost-effective solutions.

Key Spectrometry Companies:

The following are the leading companies in the spectrometry market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- Perkin Elmer, Inc.

- WATERS CORPORATION

- Shimadzu Corporation

- Bruker Corporation

- JEOL Ltd.

- Flir Systems Inc.

- Endress+Hauser Group Services AG

- MKS Instruments, Inc.

Recent Developments

-

In January 2024, Shimadzu introduced the ICPMS-2040/2050 Series, advanced Inductively Coupled Plasma Mass Spectrometers designed for high-performance elemental analysis in industries such as environmental, pharmaceutical, and food. Featuring an eco-friendly mini-torch system, low argon gas consumption, and a high-resolution quadrupole mass filter, the series improves sensitivity and efficiency. It enables rapid, accurate analysis with reduced supervision and enhanced interference removal for reliable, long-term operation.

-

In June 2023, Seer, Inc. expanded its collaboration with Thermo Fisher Scientific, integrating Seer's Proteograph XT Assay Kit with Thermo Fisher's Orbitrap Astral Mass Spectrometer. This partnership will enhance access to deep, unbiased proteomics, supporting large-scale studies in cancer and neurodegenerative diseases. The new Seer Technology Access Center will provide mass spectrometry services to researchers, enabling high-throughput sample processing with minimal hands-on time, improving biological insights and advancing clinical outcomes.

-

In June 2023, Bruker introduced the EVOQ DART-TQ+, a triple-quadrupole mass spectrometer designed for chromatography-free workflows, improving efficiency in applied markets such as food, forensic, and environmental analysis. The system offers simplified tuning, method development, and cost-effective, eco-friendly operation. In addition, Bruker launched the impact II VIP ESI-TOF for high-sensitivity screening and the TargetScreener 4D, enhancing analyte identification with TIMS technology.

-

In June 2023, Thermo Fisher Scientific introduced the Orbitrap Astral mass spectrometer, a major advancement in mass spectrometry, offering high resolution, speed, and sensitivity for proteomics research. It accelerates protein discovery and enhances precision medicine by providing deeper proteome coverage and faster throughput. This breakthrough enables researchers to uncover new biomarkers and develop targeted therapies for diseases such as cancer and cardiovascular conditions.

Spectrometry Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.55 billion

Revenue forecast in 2030

USD 31.23 billion

Growth rate

CAGR of 7.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Agilent Technologies, Inc.; Perkin Elmer, Inc.; WATERS CORPORATION; Shimadzu Corporation; Bruker Corporation; JEOL Ltd.; Flir Systems Inc.; Endress+Hauser Group Services AG; MKS Instruments, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Spectrometry Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the spectrometry market based on type, product, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Molecular Spectrometry

-

Visible and Ultraviolet Spectroscopy

-

Infrared Spectroscopy

-

Nuclear Magnetic Resonance (NMR) Spectroscopy

-

Others

-

-

Mass Spectrometry, by Type

-

MALDI-TOF

-

Triple Quadrupole

-

Quadrupole-Trap

-

Hybrid Linear Ion Trap Orbitrap

-

Quadrupole-Orbitrap

-

-

Mass Spectrometry, by Component

-

Vacuum Systems

-

Inlet Systems

-

Ion Sources

-

Mass Analyzers

-

Ion Detectors

-

-

Atomic Spectrometry

-

Atomic Absorption Spectroscopy (AAS)

-

Atomic Emission Spectroscopy (AES)

-

Atomic Fluorescence Spectroscopy (AFS)

-

X-ray Fluorescence (XRF)

-

Inorganic Mass Spectroscopy

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instrument

-

Consumables

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Proteomics

-

Metabolomics

-

Pharmaceutical Analysis

-

Forensic Analysis

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government & Academic Institutions

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Reginal Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The instrument segment dominated the spectrometry market and accounted for the largest revenue share of 61.76% in 2024.

b. The pharmaceutical analysis application segment dominated the spectrometry market and accounted for the largest revenue share of 34.85% in 2024, and is expected to witness the fastest CAGR over the forecast period.

b. The government and academic institutions segment dominated the spectrometry market and accounted for the largest revenue share of 40.37% in 2024.

b. North America dominated the spectrometry market and accounted for the largest revenue share of 40.6% in 2024.

b. The global spectrometry market size was estimated at USD 19.71 billion in 2024 and is expected to reach USD 21.55 billion in 2025.

b. The global spectrometry market is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2030 to reach USD 31.23 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.