- Home

- »

- Clinical Diagnostics

- »

-

Mass Spectrometry Market Size And Share Report, 2030GVR Report cover

![Mass Spectrometry Market Size, Share & Trends Report]()

Mass Spectrometry Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Consumables & Services), By Application (Proteomics, Metabolomics), By Technology, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-998-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mass Spectrometry Market Summary

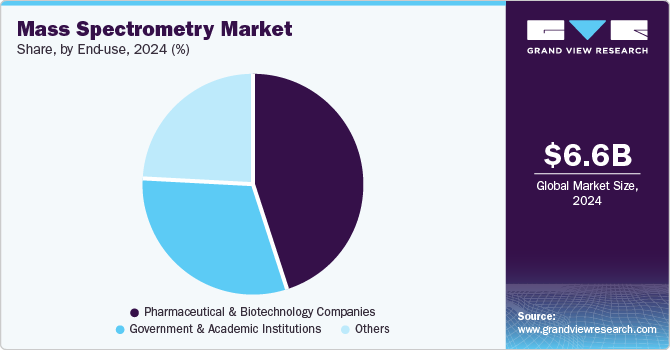

The global mass spectrometry market size was estimated at USD 6.6 billion in 2024 and is projected to reach USD 10.65 billion by 2030, growing at a CAGR of 7.97% from 2025 to 2030. Increasing R&D in the pharmaceutical and biotechnology industries is expected to drive the adoption of mass spectrometers.

Key Market Trends & Insights

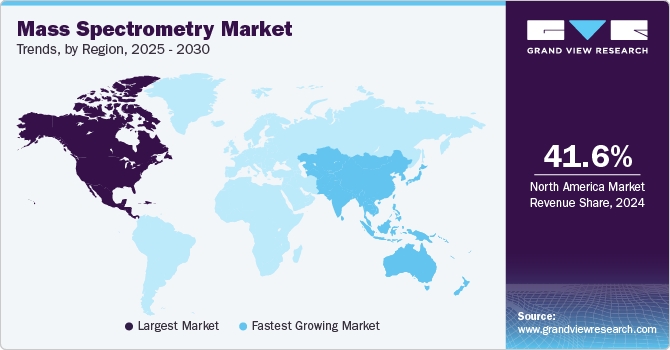

- The North America mass spectrometry market dominated globally in 2024 with a revenue share of 41.63%.

- The U.S. mass spectrometry market held a significant share of the North America market in 2024.

- By product, the instruments segment dominated the market with the largest revenue share and is expected to grow at a significant CAGR of 7.28%.

- By technology, quadrupole liquid chromatography-mass spectrometry segment dominated the market with the largest share of 37.3% in 2024.

- By application, the proteomics segment held the largest market share of 46.21% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.6 Billion

- 2030 Projected Market Size: USD 10.65 Billion

- CAGR (2025-2030): 7.97%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, advancements in proteomics research and the rapid growth of biomedical research are other factors contributing to market growth. Recent technology trends in the market include the integration of artificial intelligence (AI) for data analysis to enhance the speed and accuracy of results. In addition, developing high-resolution mass spectrometers, such as Orbitrap and Q-TOF systems, allows for improved sensitivity and the ability to analyze complex samples.

The increasing investment in R&D in the pharmaceutical and biotechnology industries is significantly driving the adoption of mass spectrometers (MS). These advanced analytical tools are essential for drug discovery, molecular analysis, and quality control. For example, Merck & Co.'s extensive R&D spending, especially in drug development, has increased the use of MS for protein characterization and biomarker discovery.

The rise in funding from government organizations to advance the pharmaceutical and healthcare sectors is significantly propelling the growth of the market. This financial support facilitates advanced R&D to encourage innovations in drug discovery, diagnostics, and personalized medicine, thereby boosting the demand for mass spectrometry technologies.

Advancements in spectrometry workflows have accelerated the scope of protein research, including protein function, structure, modification, and overall dynamics. The technology's sensitivity has also allowed single-cell analysis and clinical applications, enabling the discovery of intercellular dynamics and receptor-ligand interactions. As a result, various academic institutions and companies have developed product strategies to support the growing demand for spectrometry in the proteomics market.

For instance, in August 2024, researchers at the Technical University of Munich (TUM) developed a mass spectrometry-based workflow called decryptE to analyze the interactions of medical agents with cellular components for the detection of previously unknown therapeutic potentials. The approach profiles 8,000 proteins and assesses 144 drugs from 16 classes using Jurkat acute T cell leukemia cells. This innovative method incorporates micro-LC and high-field asymmetric ion mobility spectrometry to provide thousands of molecular readouts that will enable a more comprehensive understanding of drug effects beyond traditional cell viability or morphological changes.

Technological advancements in MS are driving significant growth and creating lucrative opportunities in the market. These innovations enhance sensitivity, accuracy, and throughput, making spectrometry an increasingly vital tool across various industries, including pharmaceuticals, clinical diagnostics, environmental monitoring, and food safety. For instance, in June 2024, Waters Corporation introduced the Xevo MRT Mass Spectrometer, a groundbreaking device that utilizes next-generation multi-reflecting time-of-flight technology to achieve high resolution and speed. This spectrometer offers up to 100,000 full-width half maximum resolution at 100 Hz, significantly enhancing sample throughput for large-scale biomedical research.

Product Insights

The instruments segment dominated the market with the largest revenue share and is expected to grow at a significant CAGR of 7.28% over the forecast period due to the presence of a large number of companies offering different types of mass spectrometry instruments. Major market players offer a wide range of instruments that can be used for various applications. For instance, in May 2024, Roche Diagnostics announced the upcoming launch of its fully automated mass spectrometry platform, the Cobas i601, at an investor presentation. This product is set for release by the end of 2024 in CE-marking markets, and in the U.S. next year, the platform integrates seamlessly with Roche's Cobas Pro solution.

The consumables & services segment is projected to record a rapid CAGR over the forecast period due to the increasing demand for such products from various academic institutions and research centers. For instance, Shimadzu Corporation exhibits a comprehensive offering of consumables designed to suit most mass spectrometry processes. Similarly, AB Sciex Pte. Ltd. offers an extensive range of custom-designed reagents and consumables through its iChemistry Solutions brand to enhance the performance of spectrometers and improve productivity, sensitivity, & data precision.

Technology Insights

Quadrupole Liquid Chromatography-Mass Spectrometry dominated the market with the largest share of 37.3% in 2024. Demand for this technology has grown significantly in the past few years due to the advantages offered by the technique. Manufacturers are developing advanced instruments to ensure compliance with these regulations, which require more accurate and reliable data for drug testing and safety assessments. For instance, in June 2024, Shimadzu launched its new LCMS-TQ RX Series of triple quadrupole high-performance LC-MS featuring three models: LCMS-8060RX, LCMS-8050RX, and LCMS-8045RX.

The Fourier Transform - Mass Spectrometry (FT-MS) is the fastest-growing segment and is expected to grow at a CAGR of 8.78% over the forecast period. The growth in the pharmaceutical and biotechnology industries is a major driver for FT-MS. Researchers require advanced mass spectrometry techniques to analyze large biomolecules like proteins and nucleic acids, leading to a rising demand for FT-MS in drug development and biomarker discovery. The ability of FT-MS to handle large, complex molecules with high accuracy fuels its market growth.

Application Insights

The proteomics segment held the largest market share of 46.21% in 2024. Mass spectrometry-based proteomics research is a comprehensive technique for quantitative profiling of proteins and studying protein-protein interactions. Mass spectrometry enables detailed studies of protein expression, modifications, and interactions, essential for unraveling complex biological processes. For instance, in March 2024, Utrecht University’s Biomolecular Mass Spectrometry & Proteomics group announced substantial investments in mass spectrometry and proteomics infrastructure, strengthening its leading position in these scientific domains. The new infrastructure is designed to tackle complex biological questions by exploring protein organization at the molecular level.

Metabolomics is projected to be the fastest-growing segment over the forecast period due to the wide range of applications of mass spectrometry in cancer screening and diagnosis. MS is the primary analytical technique utilized for metabolomics, as it enables the identification of numerous metabolites. Various research institutions employ mass spectrometry for metabolomics studies. For instance, in April 2023, the Columbia University Mailman School of Public Health and the Norwegian Institute of Public Health collaborated on a study to identify chemical compounds associated with Autism Spectrum Disorder (ASD).

End-use Insights

The pharmaceutical and biotechnology companies segment dominated the market in 2024 due to the extensive adoption of protein sequencing using mass spectrometry in the pharmaceutical industry for drug discovery and development processes. Furthermore, an increase in partnerships between key players in proteomics to advance biopharma and precision medicine research is driving segment growth. For instance, in April 2024, Biognosys and Alamar Biosciences entered into a strategic partnership to enhance biofluid proteomics research and biomarker discovery. This collaboration integrates Biognosys' data-independent acquisition mass spectrometry (DIA-MS) with Alamar's ultra-sensitive NULISA immunoassays, enabling detailed analysis of low-abundance proteins in plasma.

Government & academic institutions segment is expected to grow at a rapid CAGR over the forecast period due to the rise in healthcare expenditure, global increase in government funding for research activities, and increasing role of mass spectrometry techniques for disease surveillance and epidemiological research. For instance, in April 2024, Sheffield Hallam University is a part of a consortium that has received nearly USD 66.94 million in government funding to enhance the UK's mass spectrometry capabilities through the Critical Mass UK (C-MASS) project.

Regional Insights

The North America mass spectrometry market dominated globally in 2024 with a revenue share of 41.63%. This large share is due to presence of key market players, established academic institutions, pharmaceutical companies, and research centers, coupled with robust funding opportunities for R&D in biotechnology and drug discovery & development. In addition, increasing government support also fuels market growth. For instance, UniProt, a free resource for protein sequencing and functional information, is supported by multiple government institutions, such as the National Eye Institute (NEI), National Heart, Lung, and Blood Institute, National Human Genome Research Institute (NHGRI), etc.

U.S. Mass Spectrometry Market Trends

The U.S. mass spectrometry market held a significant share of the North America market in 2024, driven by technological advancements, growing demand from the pharmaceutical & biotechnology industry, increasing expenditure on drug discovery & development, and rising adoption in disease diagnostics. Moreover, robust funding in the field of proteomics and related fields is expected to create multiple growth opportunities in the market. For instance, in August 2020, the National Institutes of Health (NIH) granted USD 10.6 million to the University of Arkansas for Medical Sciences (UAMS) to expand its proteomics resource.

Europe Mass Spectrometry Market Trends

The Europe mass spectrometry market is experiencing significant growth due to rising demand in pharmaceuticals, biotechnology, and environmental testing. This growth can be attributed to the strong presence of pharmaceutical, biopharmaceutical, and biotechnology companies, coupled with the robust healthcare infrastructure and increased R&D spending in drug discovery & development. In addition, companies are launching new devices and consumables, thereby leveraging their market presence. For instance, in August 2023, Thermo Fisher Scientific, Inc. launched the EXENT solution, an IVDR-certified mass spectrometry solution, in Belgium, France, Germany, Italy, the Netherlands, Spain, and the UK.

The UK mass spectrometry market is expected to show significant growth owing to the presence of established R&D infrastructure and increasing government investments. Furthermore, companies are organizing workshops and conferences to encourage professionals working in scientific fields to update their understanding of spectrometric techniques and applications and enhance their knowledge & skills necessary for advancements in research and industry practices.

The Germany mass spectrometry market is experiencing significant growth due to favorable government regulations, advanced biotechnology R&D infrastructure, and a rising number of drug approvals. Innovations in spectrometry technology, increasing partnerships between academics & organizations, and increasing government funding to develop innovative spectrometry products are further contributing to market growth.

Asia Pacific Mass Spectrometry Market Trends

The Asia Pacific mass spectrometry market is expected to grow at the fastest CAGR over the forecast period. The market witnesses substantial product launches, merger and acquisition activities, collaborations, and partnerships. In addition, several research grants are offered by the governments. For instance, in developing countries like India, the government focuses on developing healthcare and biotechnology infrastructure by launching initiatives such as Make in India or BIRAC.

The China mass spectrometry market is growing at a lucrative rate, driven by an increase in biotechnology, precision medicine, and translational research in the country. Although the country is comparatively new in the development of translational medicine, the market is expected to grow rapidly.

Latin America Mass Spectrometry Market Trends

The Latin America mass spectrometry market exhibits high growth potential for the market owing to favorable government policies for improved funding for research activities. In addition, the stability of national governments across the region has considerably improved during the past few years, and governments have entered into agreements that foster liberal trade. With growing support for healthcare and a growing proportion of the middle-class population in the region, consumer demand for advanced diagnostics & research is expected to increase in the region.

Middle East And Africa Mass Spectrometry Market Trends

The MEA mass spectrometry market growth can be attributed to technological advancements and the increasing application of mass spectrometric techniques across various sectors. The rising demand for MS in pharmaceuticals, environmental testing, and food safety drives market growth. Countries such as South Africa, the United Arab Emirates, and Saudi Arabia are witnessing significant investments in R&D.

The Saudi Arabia mass spectrometry market growth is driven by growing government initiatives, rising healthcare expenditure, and technological advancements. In addition, the Saudi government is actively working to develop its biotechnology R&D infrastructure to address various challenges and leverage opportunities in health, agriculture, & industrial biotechnology.

Key Mass Spectrometry Company Insights

The market is highly competitive due to several strategic initiatives, such as new product launches, mergers and acquisitions, and regional expansion, undertaken by key market players to increase their global footprints. Companies are diversifying their product portfolios to address a broader range of applications. This includes developing specialized MS systems tailored for specific industries.

Key Mass Spectrometry Companies:

The following are the leading companies in the mass spectrometry market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- Danaher Corporation (SCIEX)

- Waters Corporation

- Bruker Corporation

- Shimadzu Corporation

- PerkinElmer, Inc.

- Rigaku Corporation

- LECO Corporation

- JEOL Ltd.

Recent Developments

-

In September 2024, PerkinElmer entered into a partnership with Emphor DLAS to offer analytical laboratory solutions across the UAE and Qatar. The services will cover mass spectrometry, atomic spectroscopy, chromatography, thermal analysis, and more

-

In June 2024, SCIEX (Danaher Corporation) announced a collaboration announced artificial intelligence quantitation (AI quant) software to process data from the ZenoTOF 7600 system and SCIEX 7500+ mass spectrometers.

-

In June 2024, Thermo Fisher Scientific Inc. launched the Thermo Scientific Stellar Mass Spectrometer (MS) as a new solution designed to enhance translational omics research. This advanced instrument offers rapid throughput, high sensitivity, and user-friendly operation, enabling researchers to make groundbreaking discoveries more efficiently.

-

In May 2024, Waters Corporation announced the launch of the ACQUITY QDa II Mass Detector, an evolution of its successful compact mass detection instrument. This upgraded detector provides high-quality mass spectral data for chromatographic separations, enabling scientists to analyze a broader range of chemical entities. It offers a robust, cost-effective solution with low energy consumption.

Mass Spectrometry Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.26 billion

Revenue forecast for 2030

USD 10.65 billion

Growth rate

CAGR of 7.97% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark, Sweden, Norway, Japan; China; India; Australia; South Korea; Thailand, Brazil; Argentina; South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Agilent Technologies, Inc.; Danaher Corporation; Waters Corporation; Bruker Corporation; Shimadzu Corporation; PerkinElmer, Inc.; Rigaku Corporation; LECO Corporation; JEOL Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mass Spectrometry Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global mass spectrometry market report based on product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Consumables & Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Quadrupole Liquid Chromatography-Mass Spectrometry

-

Gas Chromatography-Mass Spectrometry (GC-MS)

-

Fourier Transform-Mass Spectrometry (FT-MS)

-

Time-of-Flight Mass Spectrometry (TOFMS)

-

Matrix-Assisted Laser Desorption/Ionization-Time-of-Flight Mass Spectrometry (MALDI-TOF)

-

Magnetic Sector Mass Spectrometry

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Proteomics

-

Metabolomics

-

Glycomics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government & Academic Institutions

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mass spectrometry market size was estimated at USD 6.62 billion in 2024 and is expected to reach USD 7.26 billion in 2025.

b. The global mass spectrometry market is expected to grow at a compound annual growth rate of 7.97% from 2025 to 2030 to reach USD 10.65 billion by 2030.

b. North America dominated the mass spectrometry market with a share of 41.63% in 2024. This is attributable to the presence of well-established research institutes and R&D plants of various pharmaceutical companies.

b. Some key players operating in the mass spectrometry market include Thermo Fisher Scientific, Inc.; Agilent Technologies, Inc.; Danaher Corporation; Waters Corporation; Bruker Corporation; Shimadzu Corporation; PerkinElmer, Inc.; Rigaku Corporation; LECO Corporation; JEOL Ltd.

b. Key factors that are driving the mass spectrometry market growth include increasing spending on drug discovery and development, along with the increase in the prevalence of chronic diseases and the need for the development of new diagnostic techniques

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.