- Home

- »

- Petrochemicals

- »

-

Specialty Chemical Distribution Market Size Report, 2030GVR Report cover

![Specialty Chemical Distribution Market Size, Share & Trends Report]()

Specialty Chemical Distribution Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (CASE, Agrochemicals), By End-use (Automotive & Transportation, Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-261-2

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

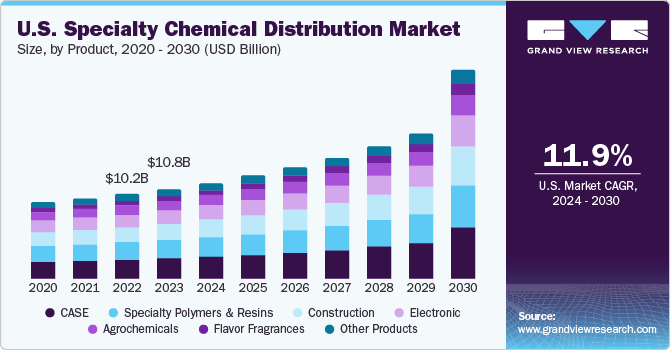

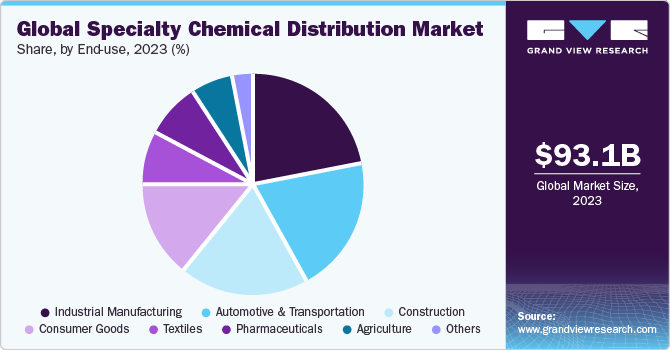

The global specialty chemical distribution market size was estimated at USD 93.10 billion in 2023 and is projected to grow at a CAGR of 7.4% from 2024 to 2030. The market is driven by several factors that contribute to its market growth. The demand for specialty distribution is projected to be driven by rising chemical consumption in a variety of end-use industries, including construction, pharmaceuticals, polymers & resins, and plastics.

The U.S. market is driven by several key factors that contribute to its growth and are significant to the overall industry. Economic growth, consumer spending power, and technological advancements play a crucial role in driving the demand for specialty chemicals. For example, as the economy grows, there is an increased need for specialty chemicals in construction, automotive, and consumer goods sectors. In addition, advancements in technology and changing consumer preferences for eco-friendly and sustainable products can also influence the market demand.

The regulatory scenario also plays a significant role in shaping the demand for specialty chemicals. Regulatory bodies such as the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHO) impose regulations and guidelines that govern the production, handling, and use of specialty chemicals.

Market Concentration & Characteristics

The market is fragmented and is growing at a steady pace owing to the increasing consumption of pharmaceuticals and personal care products. The demand for personal care products is witnessing growth due to an increase in disposable income, product innovation, and high market penetration.

A variety of chemicals such as formaldehyde, lanolin, ammonium lauryl sulfate, diethylene glycol, salicylic acid, malic acid, and lactic acid are used in manufacturing personal care products like soaps, toothpaste, fragrances, shampoos, hair dyes, lipsticks, and moisturizing lotions. The demand for these products is increasing as companies in personal care industry are focusing on maximizing product visibility through online promotional activities, sweepstakes, and other initiatives in developed regions.

The regulatory framework surrounding specialty chemical distribution is still evolving. Vegan products are not certified by a governing body, which means there are no specific certification stamps to look out for. However, most product descriptions will highlight if an item is vegan, and consumers can refer to vegan beauty guides for more information. It is important for consumers to carefully review product labels and descriptions to ensure that the collagen product they are purchasing aligns with their vegan lifestyle.

In addition to the competitive landscape and regulatory framework, other factors contribute to the market growth and its development. The increasing awareness and adoption of vegan and plant-based lifestyles, as well as ethical concerns regarding animal-derived collagen, are driving the demand for products. The beauty industry also plays a significant role in fueling the market's growth, as consumers are increasingly seeking organic, safer, and healthier alternatives to animal-based products in their beauty and personal care routines.

Product Insights

The specialty polymers & resins segment led the market with the largest revenue share of 32.60% in 2023. The high share of specialty polymers & resins is attributed to specialty chemicals used in manufacturing of polymer additives and are added to plastic resins to form process ready polymer compounds or to modify or impart specific changes to their property. They also improve characteristics of polymers such as luster, strength, heat sensitivity or durability. Various types of polymer additives are plasticizers, heat stabilizers, antioxidants, and others.

High demand for specialty adhesives, coatings, and other materials in high-performance applications such as construction, automotive, and paints is projected to boost the demand for CASE in the market and subsequently boost the demand for specialty chemicals. In addition, the development of high-quality industrial coatings for custom-built and prefabricated structures will also act as a market driver.

Specialty chemicals introduce new levels of structural strength, protection, and energy efficiency to the infrastructure. They are used at various construction stages to provide high longevity, durability, and environmental sustainability to the structure. Various specialty chemicals and materials are used in the construction sector to manufacture a variety of products including liquid pigments (for colored concrete), cement additives, roofing under laments, self-adhered windows, deck and door flashings, structural waterproofing systems, and roof, floor, and waterproofing coatings.

End-use Insights

Based on end-use, the industrial manufacturing distribution segment led the market with the largest revenue share of 21.70% in 2023. This high share of this segment can be attributed to the growth in this segment can be attributed to the industrial manufacturing application segment includes pulp & paper chemicals, water management chemicals, oilfield, metalworking fluids, and rubber processing. The favorable physicochemical properties of specialty chemicals have triggered their demand in lubricants and oil additives, which are witnessing significant demand across various industries including rubber processing, metalworking, oil fields, and pulp & paper.

Specialty chemicals are used in automobiles to enhance their look & feel and for the smooth functioning of vehicle components. For instance, motor oil helps draw heat from the engine and allows the engine to function smoothly. Various types of specially designed adhesives and sealants, such as epoxy adhesives, polyimide adhesives, polyurethane adhesives, water-based latex, acrylic, butyl, silicone, and polysulfide, are used in the automotive industry as a substitute for welded joints, mechanical fasteners, and gaskets. Moreover, increasing demand for lightweight electric vehicles is expected to boost the demand for market in automotive and transportation applications.

In the construction sector, market such as fluorinated compounds, phthalates, polybrominated diphenyl ether, and short chain chlorinated paraffin are used in the manufacturing of precast concrete, concrete admixtures, and cement processing additives, among numerous other products and help impart unique properties to the building materials. Chemicals in the construction industry are used to enhance durability and appearance, improve structural strength, and perform other functions like protection from water leakage and fire. Chemicals are also used to enrich the aesthetic appeal of buildings. The demand for market in construction applications is directly related to the growth of construction activities across the globe.

Regional Insights

The specialty chemical distribution market in North America is expected to grow at the fastest CAGR over the forecast period, owing to their increasing use in various end-user industries such as pharmaceuticals, consumer goods, textiles, and automotive & transportation. In the pharmaceutical industry, specialty chemicals are used in the manufacturing of Active Pharmaceutical Ingredient (API), packaging of pharmaceutical products, and sterilizing medical equipment before and after use.

U.S. Specialty Chemical Distribution Market Trends

The specialty chemical distribution market in U.S. is expected to grow at the fastest CAGR during the forecast period, due to increasing use of specialty chemical in construction and downstream activities. Growing construction spending combined with highly skilled workforce and growing R&D initiatives to encourage innovative products coupled with rising the expansion of floor spaces in various industries has led to the growth of new construction and renovation projects in the country.

The Canada specialty chemical distribution market is driven by various factors, including the evolving chemicals industry, increased demand for market, and the shift towards third-party distribution.

Asia Pacific Specialty Chemical Distribution Market Trends

Asia Pacific dominated the specialty chemical distribution market with a revenue share of 59.10% in 2023. This is attributed to the rising demand for various chemicals from the end-use industries such as automotive, pharmaceuticals, mining, cosmetics, and plastic additives. In the past, the major economies of Asia-Pacific, including China, Japan, India, South Korea, and Australia, have had fast industrial growth, which has had a considerable impact on the market for chemical distribution. Furthermore, the region's quick industrialization is providing market participants with profitable chances. In the past, globalization was a major factor in the expansion of the specialty chemical distribution sector.

The specialty chemical distribution market in India is expected to grow at the fastest CAGR during the forecast period. The growing demand for chemicals in various end-user industries such as textiles, downstream, and agriculture is expected to boost the market growth during the forecast period.

The China specialty chemical distribution market is expected to grow at the fastest CAGR over the forecast period. China is known as a leader in chemical manufacturing. In 2023, the chemical industry contributed around 40% of revenue to the global chemical industry due to the growing demand for chemicals in end-user industries including aerospace and electric & electronic equipment in electric cars.

Europe Specialty Chemical Distribution Market Trends

The specialty chemical distribution market in Europe is expected to grow at the fastest CAGR during the forecast period. The European chemical industry is involved in producing petrochemicals, basic inorganics, specialties, & consumer chemicals. According to the European Union about 56% of the specialty chemicals produced in Europe are downstream chemical manufacturers including coatings & inks, adhesives, cleaning agents, solvents, and chemical reagents like bleaching products, among others.

The Germany specialty chemical distribution market is expected to grow at the fastest CAGR over the forecast period. The, increasing demand for chemicals in the market, coupled with various government initiatives, is expected to benefit the market growth over the forecast period. Some of the major chemical distributors in the country are TER Chemicals Distribution Group, Nordmann, Rassmann GmbH, Bodo Möller Chemie GmbH, Bodo Möller Group, C H Erbslöh GmbH & Co. KG, HSH Chemie GmbH, Kreglinger Europe NV, Omya Hamburg GmbH, and S Goldmann GmbH & Co. KG.

The specialty chemical distribution market in UK has growing demand for pharmaceutical products in the market which helps increase chemical sales, thus providing lucrative opportunities for the growth of chemicals distributors in the country.

Central & South America Specialty Chemical Distribution Market Trends

The specialty chemical distribution market in Central & South America is expected to grow at the fastest CAGR during the forecast period. Increasing presence of middle- and high-income consumers and steady economic growth in countries such as Argentina, Brazil, Peru, and Chile, among others, are positively affecting the growth of the food & beverage industry in this region.

The Brazil specialty chemical distribution market is facing a series of challenges, which has resulted in production stagnation and a decrease in investments due to the high cost of raw materials, complexity in the tax system, and inefficient framework.

Middle East & Africa Specialty Chemical Distribution Market Trends

The specialty chemical distribution market in Middle East & Africa is expected to grow at the fastest CAGR during the forecast period. Middle East economies comprise the UAE, Bahrain, Qatar, Kuwait, Saudi Arabia, Oman, Jordan, Syria, Iran, Iraq, Yemen, and others. The region accounts for over half of the world’s crude oil reserve and the contribution of oil sector to the regional GDP is the largest among all sectors. The Gulf Cooperation Council countries such as the UEA, Kuwait, Qatar, Oman, Bahrain, and Saudi Arabia account for almost 65% of the regional GDP.

The Saudi Arabia specialty chemical distribution market is expected to grow at the fastest CAGR during the forecast period, owing to the availability of raw materials to produce chemicals coupled with government push to develop the non-oil-based economy. Therefore, the market can provide ample opportunities for specialty chemical distributors to expand their business in the country over the forecast period. Thereby it helps market growth.

Key Specialty Chemical Distribution Company Insights

Some of the key players operating in the market include Brenntag SE and Univar Solutions, Inc., Ashland, Azelis, IMCD, OMYA AG and others.

-

Brenntag AG is engaged in the manufacturing and distribution of chemicals. The company has its operational activities in more than 640 locations in 77 countries across the globe. It has a portfolio of more than 10,000 products for its customers. The company has 225 distribution centers in EMEA followed by 198 in North America. It markets its products under the brand name “ConnectingChemistry”. The company’s wide product range has potential applications in many industries such as automotive, coating, mining, cosmetics, plastics, agriculture, and pharmaceuticals

-

Univar Solutions Inc. is a chemical distribution company society. The company has four business segments including Univar Solutions U.S. (“U.S.”), Univar Solutions Canada (“Canada”), Univar Solutions Europe, the Middle East and Africa (“EMEA”), and Univar Solutions Latin America (“LATAM”). The company’s major sales come from Univar Solutions U.S. and the segment accounts for 63% of the total sales of the company. It has a strong customer base in over 130 countries and a distribution network of approximately 650 facilities globally

Biesterfeld AG, Stockmeier Group, REDA Chemicals, Manucharand among others, are some of the emerging market participants in the global market.

-

Biesterfeld AG is a family-ownedspecialty chemical distribution company. It also distributes other products such as plastics, specialty chemicals, and rubber. Initially, the company had salt trade as its core business but later it established its presence in chemicals and fertilizers

-

Stockmeier Group is a family-owned specialty chemical distribution company. It is engaged in the manufacturing and development of specialty chemicals for various industries. The company has 25,000 different chemical standards and specialized products in its portfolio with a presence in 50 locations globally. In chemical distribution, Stockmeier Group is known for its reliable supply in Europe

Key Specialty Chemical Distribution Companies:

The following are the leading companies in the specialty chemical distribution market. These companies collectively hold the largest market share and dictate industry trends.

- Univar Solutions Inc.

- Helm AG

- Brenntag AG

- Ter Group

- Barentz

- Azelis

- Safic Alan

- ICC Industries, Inc.

- Jebsen & Jessen Pte. Ltd.

- Quimidroga

- Solvadis Deutschland GmbH

- Ashland

- Caldic B.V.

- Wilbur Ellis Holdings, Inc.

- Omya AG

- IMCD

- Biesterfeld AG

- Stockmeier Group

- REDA Chemicals

- Manuchar

Recent Developments

-

In November 2023, Azelis, has strengthened its global footprint in flavors & fragrances through the acquisition of BLH SAS (BLH), a distributor of flavors & fragrances focused on the fine perfumery market in France. This acquisition builds upon Azelis' previous acquisitions in the flavors & fragrances sector, including the acquisition of Quimdis in France, Vigon in America, and Ashapura in India over the past two years

-

In February 2023, Univar Solutions Inc. announced its acquisition of ChemSol Group in Costa Rica, El Salvador, Panama, Guatemala, and Honduras to strengthen its footprint in Central America and boost its ingredients and specialties portfolio

-

In June 2023, Brenntag acquired Shanghai Saifu Chemical Development Co., Ltd. In China and is a significant step in boosting its specialty chemicals footprint in the Asia Pacific market

Specialty Chemical Distribution Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 98.22 billion

Revenue forecast in 2030

USD 153.32 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Univar Solutions Inc.; Helm AG; Brenntag AG; Ter Group; Barentz; Azelis; Safic Alan; ICC Industries, Inc., Jebsen & Jessen Pte. Ltd.; Quimidroga; Solvadis Deutschland GmbH; Ashland; Caldic B.V.; Wilbur Ellis Holdings, Inc.; Omya AG; IMCD; Biesterfeld AG; Stockmeier Group; REDA Chemicals; Manuchar

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

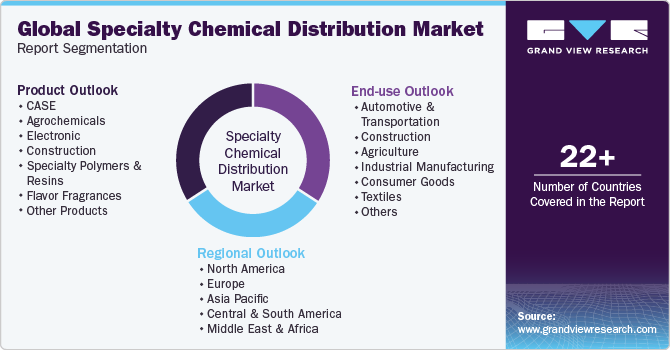

Global Specialty Chemical Distribution Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the specialty chemicals distribution market report based on product, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

CASE

-

Agrochemicals

-

Electronic

-

Construction

-

Specialty Polymers & Resins

-

Flavor & Fragrances

-

Other Products

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Construction

-

Agriculture

-

Industrial Manufacturing

-

Consumer Goods

-

Textiles

-

Pharmaceuticals

-

Other End-uses

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global specialty chemical distribution market size was estimated at USD 93.10 billion in 2023 and is expected to reach USD 98.22 billion in 2024.

b. The global specialty chemical distribution market is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2030 to reach USD 153.32 billion in 2030.

b. Asia Pacific dominated the market and accounted for a 59.10% share in 2023. This is attributed to the rising demand for various chemicals from the end-use industries such as automotive, pharmaceuticals, mining, cosmetics, and plastic additives

b. Some of the key players operating in the market include Brenntag SE and Univar Solutions, Inc., Ashland, Azelis, IMCD, OMYA AG and others.

b. The specialty chemical distribution market is driven by several factors that contribute to its growth of the overall market. The demand for specialty distribution is projected to be driven by rising chemical consumption in a variety of end-use industries, including construction, pharmaceuticals, polymers & resins, and plastics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.