Sparkling Tea Market Size, Share & Trends Analysis Report By Product (Green Tea, White Tea), By Category, By Packaging, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-401-3

- Number of Report Pages: 115

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Sparkling Tea Market Size & Trends

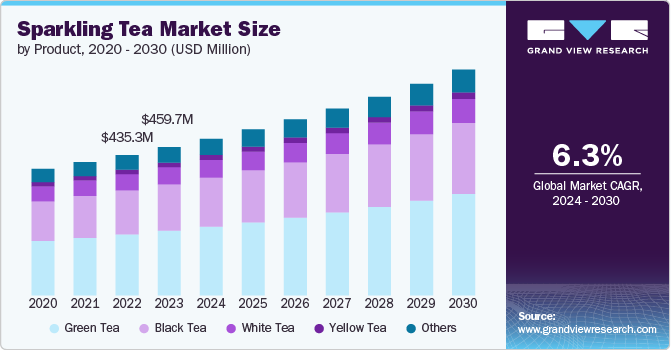

The global sparkling tea market size was valued at USD 459.66 million in 2023 and is anticipated to grow at a CAGR of 6.3% from 2024 to 2030. Sparkling tea offers a unique blend of the refreshing effervescence found in carbonated drinks with the health benefits of tea, such as antioxidants, vitamins, and lower calorie content. This appeal is particularly strong among millennials and Generation Z, who prioritize wellness and are willing to explore niche drinks that align with their lifestyle choices. Furthermore, the rise of plant-based diets and clean-label products has positioned sparkling tea as an attractive option.

As consumers increasingly seek healthier options, the appeal of sparkling tea, which typically combines the refreshing qualities of traditional tea with the enthusiasm of carbonated drinks, has significantly increased. This segment has particularly attracted health-oriented consumers who are moving away from sugary sodas and other carbonated beverages that lack nutritional benefits. With a range of natural ingredients, including herbal blends and fruit infusions, sparkling teas offer not only flavor but also perceived health benefits, further fueling consumer interest.

Social media platforms, influencer partnerships, and health-focused campaigns have become instrumental in promoting the benefits and versatility of sparkling beverages. As consumers are increasingly influenced by lifestyle trends and peer recommendations, brands that effectively utilize digital platforms can enhance their visibility and engagement with potential buyers. In addition, the expansion of distribution channels, including online retail and specialty grocery stores, has made it easier for consumers to access a diverse range of carbonated tea products.

Major participants in the market are focusing on sustainable practices, including the use of organic ingredients, environmentally-friendly packaging, and fair-trade sourcing. The rise of RTD sparkling tea products has contributed to its accessibility, allowing consumers to enjoy this refreshing beverage on the go. Moreover, the ability to incorporate sparkling tea into cocktails and mocktails has opened up new avenues for consumption, appealing to both alcohol and non-alcohol drinkers. This adaptability has made sparkling tea a popular choice among innovative mixologists and home enthusiasts who are exploring new concoctions and flavor pairings.

Major brands are actively experimenting with unique flavor combinations and functional ingredients to capture the attention of consumers. They are introducing a diverse array of options, such as floral-infused sparkling teas, fruit- and spice-infused variations, and those enriched with adaptogens and probiotics, which cater to the evolving taste preferences of the modern consumer. Moreover, technological advancements in manufacturing and flavor extraction are allowing brands to create high-quality sparkling beverages that preserve the delicate aromas and flavors of tea while achieving the desired fizziness. This has led to the emergence of artisanal brands that focus on small-batch production, often employing traditional brewing techniques coupled with modern carbonation methods, thereby elevating the consumer experience.

Product Insights

The green tea segment accounted for a revenue share of 43.63% in 2023. Green tea, renowned for its rich antioxidant content and numerous health advantages such as improved metabolism, enhanced mental clarity, and reduced risk of chronic diseases, aligns perfectly with the rising inclination towards healthier lifestyle choices. Moreover, the growing awareness of the health benefits associated with green tea, particularly its rich antioxidant properties and potential metabolic advantages, is driving the segment growth. As consumers increasingly seek beverages that not only satisfy thirst but also promote well-being, sparkling green tea offers a unique combination of refreshment and health benefits.

The black tea segment is anticipated to witness a CAGR of 6.3% from 2024 to 2030. Black tea, known for its rich antioxidant properties and potential cardiovascular benefits, resonates well with health-focused individuals who are keen on making informed dietary choices. The incorporation of sparkling elements into black tea not only enhances its appeal by adding a lively and refreshing twist but also aligns with the clean-label movement that emphasizes transparency and natural ingredients. Moreover, the versatility of black sparkling tea in flavor combinations and blends contributes significantly to its market appeal.

Category Insights

The no-alcohol sparkling tea segment accounted for a revenue share of 88.76% in 2023, driven by the increasing popularity of low-calorie and no-calorie beverages. The no-alcohol segment is particularly prominent, appealing to those who seek sophisticated flavors without the adverse effects of alcohol. This segment targets health-conscious consumers, millennials, and Generation Z, who are increasingly opting for beverages that align with their wellness-oriented lifestyles. As restaurants and bars continue to diversify their non-alcoholic offerings, the demand for sparkling teas is likely to gain further traction over the coming years.

The alcohol-based sparkling tea segment is estimated to grow at a CAGR of 7.6% from 2024 to 2030. Bartenders and home mixologists are increasingly experimenting with carbonated tea as a base ingredient, creating a myriad of cocktails that cater to diverse palates. The versatility of sparkling tea allows for endless combinations, from blending it with spirits like gin, vodka, or rum to using it as a refreshing mixer in cocktails. This trend has led to the positioning of sparkling tea not just as a beverage but as an experience, where the emphasis is on craft, flavor profiles, and presentation. Manufacturers are capitalizing on this trend by launching ready-to-drink sparkling tea cocktails and hard-carbonated RTD tea variants, effectively tapping into the evolving social drinking culture that emphasizes quality, creativity, and health.

Packaging Insights

The glass bottle packaged sparkling tea accounted for a revenue share of 47.76% in 2023. Glass is known for its excellent barrier properties, which help maintain the quality and consistency of sparkling tea by avoiding the leaching of chemicals, unlike some plastic bottles. This characteristic is increasingly important to health-conscious consumers who are wary of harmful substances that could impact their well-being. Moreover, glass packaging is perceived as premium and eco-friendly, aligning with the growing consumer preference for sustainable products. Besides, the shift towards on-the-go consumption among consumers has led to the introduction of various sizes and formats in glass packaging.

The aluminum cans packaged sparkling tea are estimated to grow at a CAGR of 7.6% from 2024 to 2030. Aluminum cans are widely recognized for their recyclability and lightweight nature, making them an eco-friendly option compared to traditional glass or plastic bottles. Moreover, cans are renowned for their ability to preserve the freshness and carbonation of beverages, which is crucial for products like sparkling tea that rely on effervescence to provide a refreshing experience. In addition, aluminum cans are less prone to breakage compared to glass bottles, making them a more convenient option for on-the-go consumption. The portable nature of cans appeals to busy consumers who seek quality beverages that fit into their fast-paced lifestyles.

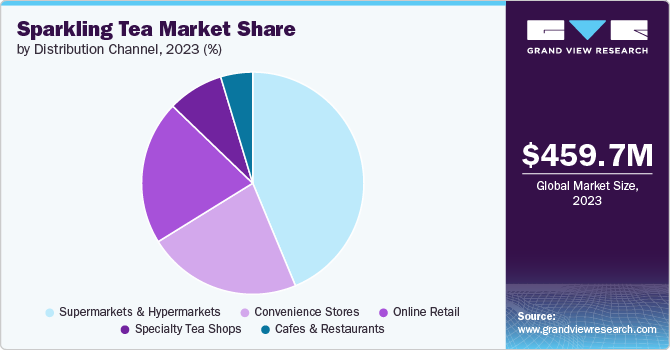

Distribution Channel Insights

The sales of sparkling tea through supermarkets and hypermarkets accounted for a revenue share of 43.72% in 2023. Supermarkets and hypermarkets serve as primary retail environments where consumers can easily access a wide array of sparkling tea products. These large retail outlets benefit from their extensive reach and convenience, attracting health-conscious shoppers who seek alternatives to sugary sodas and carbonated drinks. Moreover, several retail outlets in supermarkets and hypermarkets are implementing dedicated sections for sparkling teas to enhance product visibility and encourage exploration among shoppers seeking alternatives to traditional sugary sodas and energy drinks. Besides, promotions, discounts, and in-store tastings are often leveraged by brands to enhance awareness and propel sales, driving the demand even further.

The online retail segment is estimated to grow at a CAGR of 7.0% from 2024 to 2030. The increasing penetration of smartphones and the internet, coupled with the rise of e-commerce platforms, has empowered consumers to access a wide variety of sparkling tea brands and products from the comfort of their homes. This digital convenience offers a level of accessibility and choice that traditional brick-and-mortar stores often cannot provide, fostering a more personalized shopping experience. In addition, online retailers are able to present detailed information about the nutritional benefits, ingredient sourcing, and unique flavors of sparkling teas, which educates consumers and drives interest.

Regional Insights

The sparkling tea market in North America held over 35% of the global revenue in 2023, driven by increasing consumer preference for health-conscious beverages. A growing segment of the population is shifting away from sugary sodas and traditional soft drinks, leading to a rising demand for healthier alternatives that still deliver refreshment and effervescence. This trend is further supported by a heightened awareness of health and wellness, as well as the rise of the wellness movement, which emphasizes natural ingredients and functional benefits. Besides, key manufacturers in the region are introducing a wide variety of sparkling tea options infused with botanicals, superfoods, and natural flavors, catering to diverse tastes and preferences.

U.S. Sparkling Tea Market Trends

The sparkling tea market in the U.S. is expected to grow at a CAGR of 6.4% from 2024 to 2030. The rising demand for sparkling tea is indicative of a broader shift toward healthier options, with many consumers opting for beverages that provide not only refreshment but also functional benefits. In metropolitan areas such as New York, Los Angeles, and Chicago, the demand for premium and artisanal sparkling teas has seen significant growth in niche markets and specialty retailers. This is largely due to an increasing number of health-conscious consumers who are willing to pay a premium for products that offer unique flavors, high-quality organic ingredients, and innovative brewing methods.

Europe Sparkling Tea Market Trends

The sparkling tea market in Europe is expected to grow at a CAGR of 5.7% from 2024 to 2030. This region is characterized by a diverse demographic, with an array of consumers ranging from health-minded individuals to adventurous millennials seeking innovative beverage options. The surge in demand for low-calorie, naturally flavored drinks has led to the rise of sparkling tea as an appealing alternative to traditional sugary sodas and alcoholic beverages. European consumers are increasingly favoring beverages that offer both refreshment and wellness benefits, which has prompted many beverage companies to innovate and introduce new sparkling tea blends infused with botanicals, fruits, and herbal ingredients.

Asia Pacific Sparkling Tea Market Trends

The sparkling tea market in the Asia Pacific is set to grow at a CAGR of about 6.9% from 2024 to 2030, driven by the region’s rich tea culture and the increasing popularity of tea-based beverages. Countries like Japan, Taiwan, and China have a long-standing tradition of tea consumption, and the infusion of bubbles into traditional tea is being embraced as an innovative twist. Millennials and Gen Z in this region are particularly drawn to novel beverage experiences, leading to a flourishing market for sparkling teas that are not only refreshing but also offer unique flavor combinations and health benefits. Besides, rapid urbanization and a fast-paced lifestyle have prompted a greater interest in convenient, on-the-go beverage options, thus propelling the popularity of sparkling teas packaged in ready-to-drink formats.

Key Sparkling Tea Company Insights

The global sparkling tea industry is characterized by intense competition. Key manufacturers in the market are introducing a diverse array of new products that blend traditional tea with vibrant flavors and carbonation, appealing to a broad demographic, including millennials and health-forward consumers. Moreover, innovations such as organic, low-calorie, and adaptogenic ingredients are reshaping the landscape as brands seek to differentiate themselves in an increasingly crowded marketplace. Strategic mergers and expansions are also prevalent as companies aim to enhance their market presence and leverage synergies that enable them to deliver unique offerings. For instance, collaborations between tea companies and local artisanal producers not only foster regional flavors but also cater to the growing demand for locally sourced and sustainable products.

Key Sparkling Tea Companies:

The following are the leading companies in the sparkling tea market. These companies collectively hold the largest market share and dictate industry trends.

- New Berlin Beverage Co.

- Copenhagen Sparkling Tea Company

- Fortnum & Mason

- Nongfu Spring Co., Ltd.

- DAVIDsTEA

- Glamtì

- Saicho Drinks

- The Real Drinks Co.

- Rita Food & Drink Co., Ltd.

- WANA Beverage

Recent Developments

-

In July 2024, DAVIDsTEA launched its inaugural line of ready-to-drink (RTD) sparkling cold brewed iced teas featuring three enticing flavors: Organic Cream of Earl Grey, Organic Queen of Tarts, and Magic Potion. This initiative aims to diversify the company’s product offering and increase its presence in the growing sparkling tea industry.

-

In June 2023, The Real Drinks Co in the UK launched canned, ready-to-drink versions of its naturally fermented sparkling teas, Royal Flush and Dry Dragon. This initiative aims to expand the company's product range and increase its market presence in the UK

Sparkling Tea Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 486.01 million |

|

Revenue forecast in 2030 |

USD 700.36 million |

|

Growth rate |

CAGR of 6.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, category, packaging, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S, Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, South Korea, Australia & New Zealand, Brazil and South Africa |

|

Key companies profiled |

New Berlin Beverage Co., Copenhagen Sparkling Tea Company, Fortnum & Mason, Nongfu Spring Co., Ltd., DAVIDsTEA, Glamtì, Saicho Drinks, The Real Drinks Co., Rita Food & Drink Co., Ltd., and WANA Beverage |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Sparkling Tea Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sparkling tea market report on the basis of product, category, packaging, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Green Tea

-

White Tea

-

Yellow Tea

-

Black Tea

-

Others

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

No Alcohol

-

Alcohol-based

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass Bottles

-

Plastic Bottles

-

Aluminum Cans

-

Tetra Pak

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Online Retail

-

Specialty Tea Shops

-

Cafes and Restaurants

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sparkling tea market was estimated at USD 459.66 million in 2023 and is expected to reach USD 486.01 million in 2024.

b. The sparkling tea market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 700.36 million by 2030.

b. North America dominated the sparkling tea market with a share of 35% in 2023, driven by shifting consumer preferences towards healthier beverage options and the increasing popularity of functional drinks. Moreover, the robust demand for artisanal and craft beverages has led to the emergence of numerous niche brands that offer unique flavor profiles and premium ingredients, appealing to consumers' desire for authenticity and quality.

b. Some of the key market players in the sparkling tea market are New Berlin Beverage Co., Copenhagen Sparkling Tea Company, Fortnum & Mason, Nongfu Spring Co., Ltd., DAVIDsTEA, Glamtì, Saicho Drinks, The Real Drinks Co., Rita Food & Drink Co., Ltd., and WANA Beverage.

b. The sparkling tea market has experienced significant growth in recent years, driven by the changing consumer taste preferences and increasing health consciousness among consumers. Moreover, the rise of e-commerce platforms has expanded the reach of sparkling tea manufacturers, making these products more accessible to consumers globally.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."