Spandex Market Size, Share & Trends Analysis Report By Technology (Wet-spinning, Solution Dry-spinning), By Application (Clothing, Medical), By Region (APAC, North America, MEA), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-709-4

- Number of Report Pages: 103

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

Report Overview

The global spandex market size was estimated at USD 7.39 billion in 2019. It is projected to grow further at a compound annual growth rate (CAGR) of 2.2% from 2020 to 2027. Rapidly increasing population coupled with rising consumer disposable income is projected to propel the demand for sports and active wear, thereby driving the market growth. Growing awareness about following a healthy lifestyle is anticipated to result in increased participation in sports activities, which, in turn, will promote the demand for comfortable sportswear, such as cycling pants. The market in the U.S. was valued at USD 1.5 billion in 2019 and is estimated to expand at a CAGR of 2.7% from 2020 to 2027. Rising demand for clothing, such as innerwear, sportswear, and active wear, on account of the higher disposable income levels and growing popularity of various sports and leisure activities, is anticipated to drive the market further.

The spandex fiber offers excellent strength, weight, and versatility as compared to other fibers, which drives its demand in the manufacturing of clothing and medical applications. In addition, it exhibits superior elasticity and is stretchable hence, it is used in combination with materials including cotton, wool, and others.

Moreover, the material is lightweight, soft, and has excellent resistance against body oils, perspiration, detergent, and abrasions, which is anticipated to promote its usage in the production of a wide variety of clothing and apparel. It is commonly used in casual clothing, trekking pants, undergarments, home furnishing, and others.

However, the laborious manufacturing process and superior properties of these materials have resulted in the high market price as compared to nylon and polyester and organic fabrics, such as wool and cotton. This may have a negative impact on the demand, thereby restricting market growth over the forecast period.

Technology Insights

The solution dry-spinning technology accounted for over 94% of the global share in 2019 and is projected to expand further at the fastest CAGR from 2020 to 2027. The high spinning speed of the solution dry-spinning process helps increase the productivity of the product to a great extent as compared to other processes, such as wet spinning and melt spinning.

The solvent used in the solution dry-spinning process is flammable and post-spinning operations are implemented for the complete removal of solvent. This is anticipated to limit the adoption of the process across various applications. However, the ease and flexibility in implementing the process are estimated to promote its implementation.

The melt-spinning technology is gaining traction as the cost of production using this technology is relatively lower than the wet and dry spinning processes. However, melt-spinning technology requires timely maintenance and replacements due to the short lifespan of the spinneret. In addition, it requires repeated cleanings of the manifold and causes non-uniformity in the yarn. These drawbacks are likely to limit its adoption.

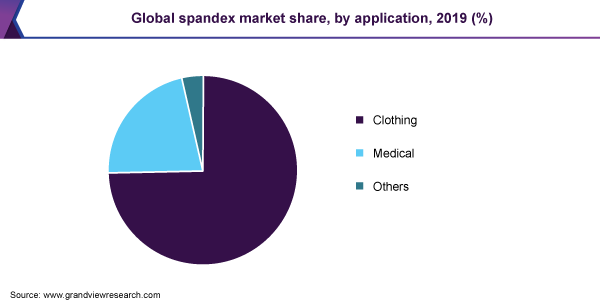

Application Insights

The clothing segment accounted for the largest market share of more than 74% in 2019. It is estimated to expand further at the fastest CAGR from 2020 to 2027 due to the increasing demand for active wear, sportswear, intimate wear, yoga pants, cycling shorts, jerseys, swimwear, etc.

Spandex has the superior stretching property that avoids restrictions on the wearer’s movements, which boosts its demand in sportswear. In addition, excellent elasticity, durability, and resistance to UV light are projected to drive the demand further.

The medical application segment is estimated to register significant growth over the forecast years due to extensive usage of spandex in manufacturing compress bandages, stretchable bandages, etc. Product properties, such as high elasticity, smoothness, and softness, propel its application in the manufacturing of medical products, thereby benefiting segment growth. Spandex is also used in the film industry to manufacture motion capture suits that actors wear in front of green screens. This is projected to fuel the product demand, thereby driving the market growth.

Regional Insights

The Asia Pacific accounted for the maximum market share of 35.9% in 2019 owing to the rapid expansion of the manufacturing industry in the developing economies, such as China, India, Indonesia, and Japan. In addition, rising foreign investments in the region are anticipated to promote market growth over the forecast period.

China accounted for a major market share in the regional market on account of the rising number of manufacturing facilities in the country. Rapid industrialization, low-cost production, and processing along with increased foreign investments are also supporting the market growth in the country.

Improved standard of living coupled with increasing disposable incomes are likely to promote the demand for spandex in North America. In addition, rising health consciousness and growing production facilities in the U.S. coupled with the expansion of healthcare facilities are likely to augment the product demand in several end-use sectors, thereby driving the regional market.

In addition, the rapidly expanding residential construction sector in Canada and U.S. will propel the demand for home-furnishing products, such as bathroom linen, curtains, cushions, and carpets. This, in turn, is projected to fuel the demand for spandex in various applications, thereby promoting the growth of the regional market.

Key Companies & Market Share Insights

Companies in this market are focusing more on the expansion of their production capacities by establishing manufacturing facilities across economies, such as Brazil and Indonesia. In addition, they are implementing R&D programs for product utilization across the medical, automotive, and home furnishing applications. Major companies have also undertaken several marketing strategies, such as mergers & acquisitions, partnerships, and new product launches, to establish a stronger position in the global industry. Some of the prominent players in the global spandex market include:

-

Hyosung

-

DuPont de Nemours, Inc.

-

TK Chemical Corp.

-

Taekwang Industrial Co. Ltd.

Recent Development

- In April 2023, Hyosung TNC announced the launch of eco-friendly black spandex products to the global textile market under its trademark creora®. The products are made of bio-based or recycled materials and do not require dyeing, which saves water and reduces environmental impact

Spandex Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2020 |

7.36 Billion |

|

Revenue forecast in 2027 |

8.8 Billion |

|

Growth Rate |

CAGR of 2.2% from 2020 to 2027 |

|

Base year for estimation |

2019 |

|

Historical data |

2016 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Quantitative units |

Volume in Kilotons, Revenue in USD million, and CAGR from 2020 to 2027 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, technology, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; Spain; Italy; China; India; Japan; Brazil |

|

Key companies profiled |

Hyosung; DuPont de Nemours, Inc.; TK Chemical Corp.; Taekwang Industrial Co. Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global spandex market report on the basis of application, technology, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Clothing

-

Medical

-

Others

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Solution Dry-spinning

-

Wet-spinning

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global spandex market size was estimated at USD 7,399.5 million in 2019 and is expected to reach USD 7,369.3 million in 2020.

b. The global spandex market is expected to grow at a compound annual growth rate of 2.2% from 2020 to 2027 to reach USD 8,833.1 million by 2027.

b. Asia Pacific dominated the spandex market with a share of 35.9% in 2019. This is attributable to rising disposable incomes among the consumers in the developing economies including China, India, Indonesia, and others.

b. Some key players operating in the spandex market include DuPont, BASF, Mitsubishi Chemical Corporation, Zhejiang Huafon Spandex, Hyosung, Asahi Kasei Corporation, Yantai Tayho Advanced Materials Co., Ltd., Indorama Industries Limited, TK Chemical Corp., and others.

b. Key factors driving the spandex market growth include rising demand for products including sportwear, intimate wear, cycling pants, yoga pants, active wear, sports bra, under garments, and others. Moreover, improved standard of living coupled with rising spending capability of the consumers is anticipated to fuel the market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."