- Home

- »

- Automotive & Transportation

- »

-

Solar Vehicle Market Size, Share & Growth Report, 2030GVR Report cover

![Solar Vehicle Market Size, Share & Trends Report]()

Solar Vehicle Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Two Wheelers, Three Wheelers), By Battery (Lithium Ion, Lead Acid), By Solar Panel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-416-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Solar Vehicle Market Summary

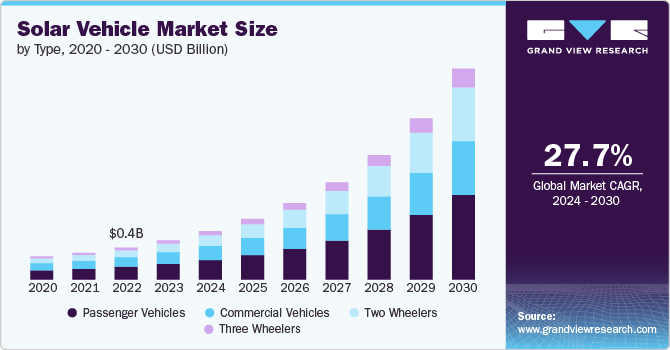

The global solar vehicle market size was estimated at USD 0.46 billion in 2023 and is projected to reach USD 2.47 billion by 2030, growing at a CAGR of 27.7% from 2024 to 2030. Solar vehicles use the energy from the sun by converting it into energy.

Key Market Trends & Insights

- North America market led the global market and accounted for 35.12% of the global revenue in 2023.

- The U.S. market is anticipated to register a significant growth from 2024 to 2030.

- Based on type, the passenger cars segment led the market and accounted for 40.15% of the global revenue in 2023.

- Based on battery, the lithium-ion battery segment accounted for the largest share of global revenue in 2023.

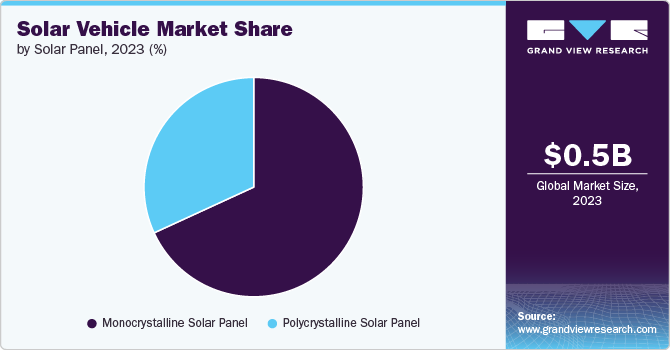

- Based on solar panels, the monocrystalline solar panel segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 0.46 Billion

- 2030 Projected Market Size: USD 2.47 Billion

- CAGR (2024-2030): 27.7%

- North America: Largest market in 2023

The market is driven by the demand for sustainable transportation, growing technological advancements in solar technology, and supportive regulatory frameworks that deter consumers from using traditional fuel-based vehicles. Key market players are actively working to make solar vehicles cost-effective, further propelling their adoption in the market. The market is experiencing robust growth driven by the increasing demand for sustainable transportation solutions. Rising environmental concerns and the global push for reducing carbon footprints have led to heightened consumer awareness and preference for eco-friendly vehicles. Additionally, the cost savings associated with solar energy compared to traditional fuels are encouraging both consumers and businesses to adopt solar-powered vehicles.

Technological innovation plays a crucial role in propelling the market forward. Companies are developing advanced solar panels with higher energy conversion efficiency, lightweight materials, and integrated energy storage systems. These innovations not only enhance the performance and reliability of solar vehicles but also make them more accessible and appealing to a broader audience, driving market expansion.

The regulatory landscape is significantly contributing to the growing adoption of solar vehicles. Governments worldwide are implementing supportive policies, incentives, and subsidies to promote renewable energy usage in transportation. Initiatives such as tax rebates, grants for research and development, and stringent emission regulations are encouraging manufacturers and consumers to invest in solar vehicles, thereby boosting market growth.

Despite the growth potential, the market faces challenges such as the limited efficiency of current solar panel technology and the dependency on weather conditions. These limitations can impact the performance and reliability of solar vehicles, especially in regions with less sunlight. To mitigate these issues, companies are investing in research to develop more efficient solar cells and hybrid systems that can use alternative energy sources when solar power is insufficient.

Type Insights

Based on type, the passenger cars segment led the market and accounted for 40.15% of the global revenue in 2023. The growing adoption of solar passenger cars is driven by increasing consumer demand for eco-friendly transportation solutions. Advances in solar technology and supportive government policies for sustainable transportation have further contributed to this segment’s growth. As a result, passenger cars are expected to maintain their dominance in the solar vehicle market over the forecast period of 2024 to 2030.

The two-wheelers segment is expected to register significant growth from 2024 to 2030. With climate change looming large, consumers are shifting towards clean energy alternatives in place of traditional fuel-based two-wheelers. The growing preference for solar two-wheelers, especially in densely populated regions, is contributing to the segment’s growth. In addition, innovations in lightweight solar panels and enhanced battery performance are also contributing to the rapid adoption of solar-powered two-wheelers.

Battery Insights

Based on battery, the lithium-ion battery segment accounted for the largest share of global revenue in 2023. High energy density, longer lifecycle, and enhanced efficiency are among a few of the benefits offered by lithium-ion batteries that are contributing to their increased adoption in the market. This segment benefits from continuous advancements in lithium-ion battery technology, which enhances vehicle performance and reduces costs. The widespread use of lithium-ion batteries in various solar vehicle types is expected to sustain its leading market position.

The lead acid battery segment is expected to register significant growth from 2024 to 2030. Despite being an older technology, lead acid batteries are valued for their reliability and cost-effectiveness. Recent improvements in lead acid battery efficiency and sustainability, coupled with increasing demand for sustainable solar vehicles, are driving this segment’s growth. Additionally, advancements in recycling processes have made lead acid batteries more environmentally friendly. The widespread availability of lead-acid batteries continues to make them a viable option for many solar vehicle manufacturers.

Solar Panel Insights

Based on solar panels, the monocrystalline solar panel segment accounted for the largest market revenue share in 2023. The segment’s dominance in the market can be attributed to its higher efficiency and better performance in low-light conditions. These panels are preferred for their longevity and superior power output, making them a popular choice in solar vehicles. Continuous innovation and decreasing costs of monocrystalline panels are expected to contribute towards the segment’s growth over the forecast period of 2024 to 2030.

The polycrystalline solar panel segment is expected to register the fastest growth from 2024 to 2030. Although less efficient than monocrystalline panels, polycrystalline panels are more cost-effective and easier to manufacture. Increasing demand for affordable solar vehicles and advancements in polycrystalline technology are driving the growth of this segment.

Regional Insights

North America market led the global market and accounted for 35.12% of the global revenue in 2023. The market is experiencing robust growth, driven by strong governmental support, increasing environmental awareness, and technological advancements. The region's focus on reducing carbon emissions and promoting renewable energy sources is further accelerating the adoption of solar vehicles.

The U.S. Solar Vehicle Market Trends

The U.S. market is anticipated to register a significant growth from 2024 to 2030. The market’s growth is supported by federal incentives, state-level initiatives, and a burgeoning interest in sustainable transportation. Moreover, presence of key market players including Tesla, and Aptera in the country, is creating significant growth opportunities for the growth of market in the country.

Europe Solar Vehicle Market Trends

The Europe market is poised for significant growth from 2024 to 2030. The European region’s focus on reducing greenhouse gas emissions is contributing to the market’s growth. European countries are investing heavily in renewable energy solutions, boosting the adoption of solar vehicles.

Asia Pacific Solar Vehicle Market Trends

The Asia Pacific market is anticipated to register a significant growth from 2024 to 2030. The Asia Pacific market is experiencing rapid growth, fueled by increasing urbanization, rising environmental concerns, and supportive governmental policies. Countries such as China, Japan, and India are investing heavily in solar technology and infrastructure to promote green transportation, boosting the regional market’s growth.

Key Solar Vehicle Company Insights

Key players in the market are heavily investing in R&D to improve solar panel efficiency, enhance battery life, and integrate advanced energy management systems. The focus is on creating highly efficient and reliable solar vehicles that meet the diverse needs of consumers and businesses alike.

In February 2024, Squad Mobility offered its solar buggy Special Edition at CES 2024 in Las Vegas. The solar buggy is an affordable and compact solar car, which charges itself on solar energy through an integrated panel on the roof. The solar buggy is expected to be available in the U.S. in 2025 starting at a USD 6,250 (excluding tax) price. Such affordable solar vehicle launches are expected to drive the market’s growth from 2024 to 2030.

Key Solar Vehicle Companies:

The following are the leading companies in the solar vehicle market. These companies collectively hold the largest market share and dictate industry trends.

- Lightyear

- Sono Motors

- Aptera Motors Corp.

- Kandi America, Inc.

- Squad Mobility B.V.

- Tesla

- Hyundai Motor Company

- Fisker, Inc.

- Cruise LLC

- GENERAL MOTORS

Solar Vehicle Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 0.57 billion

Revenue forecast in 2030

USD 2.47 billion

Growth rate

CAGR of 27.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, battery, solar panel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, China, India, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, South Africa

Key companies profiled

Lightyear, Sono Motors, Aptera Motors Corp., Kandi America, Inc., Squad Mobility B.V., Tesla, Hyundai Motor Company, Fisker, Inc., Cruise LLC, GENERAL MOTORS

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solar Vehicle Market Report Segmentation

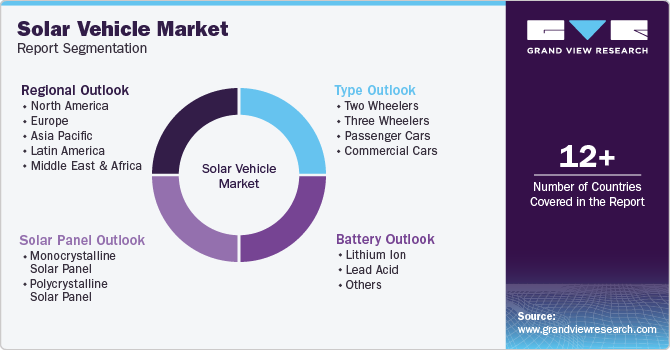

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global solar vehicle market report based on type, battery, solar panel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Two Wheelers

-

Three Wheelers

-

Passenger Cars

-

Commercial Cars

-

-

Battery Outlook (Revenue, USD Million, 2018 - 2030)

-

Lithium Ion

-

Lead Acid

-

Others

-

-

Solar Panel Outlook (Revenue, USD Million, 2018 - 2030)

-

Monocrystalline Solar Panel

-

Polycrystalline Solar Panel

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global solar vehicle market size was estimated at USD 0.46 billion in 2023 and is expected to reach USD 0.57 billion in 2024.

b. The global solar vehicle market is expected to grow at a compound annual growth rate of 27.7% from 2024 to 2030 to reach USD 2.47 billion by 2030.

b. North America dominated the solar vehicle market with a share of 35.12% in 2023. The North America solar vehicle market is experiencing robust growth, driven by strong governmental support, increasing environmental awareness, and technological advancements.

b. Some key players operating in the solar vehicle market include Lightyear, Sono Motors, Aptera Motors Corp., Kandi America, Inc., Squad Mobility B.V., Tesla, Hyundai Motor Company, Fisker, Inc., Cruise LLC, and GENERAL MOTORS.

b. Key factors that are driving the market growth include increasing demand for sustainable transportation, growing technological advancements in solar technology, and supportive regulatory frameworks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.