- Home

- »

- Renewable Energy

- »

-

Solar PV Panels Market Size, Share & Trends Report, 2030GVR Report cover

![Solar PV Panels Market Size, Share & Trends Report]()

Solar PV Panels Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Thin Film, Crystalline Silicon), By Grid Type (On Grid, Off Grid), By Application (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-611-0

- Number of Report Pages: 128

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Solar PV Panels Market Summary

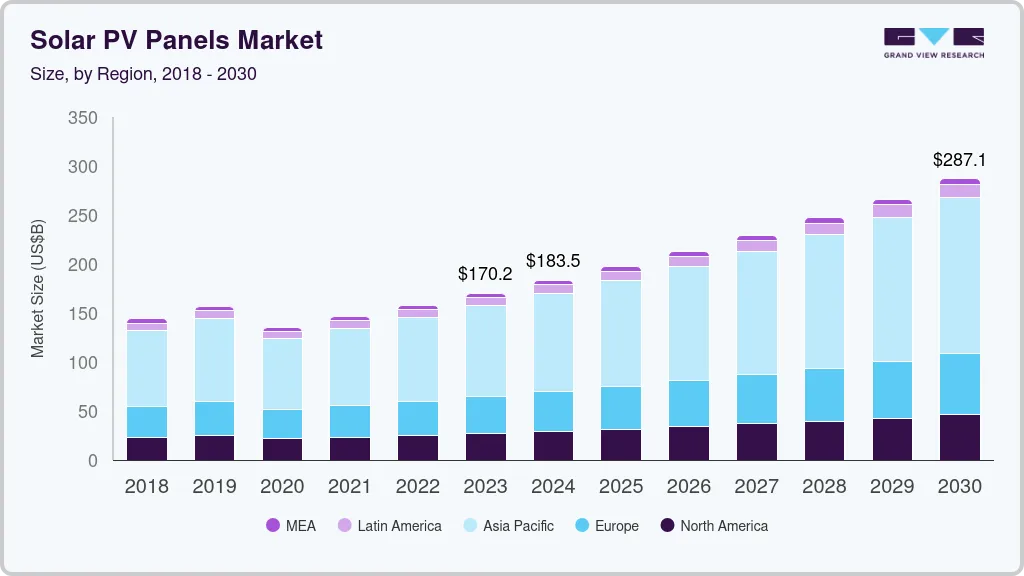

The global solar PV panels market size was estimated at USD 170.25 billion in 2023 and is projected to reach USD 287.13 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.7% from 2024 to 2030. Growing demand for renewables-based clean electricity coupled with government policies, tax rebates, and incentives to install solar panels is expected to drive the growth of solar PV panels industry in the coming years.

Key Market Trends & Insights

- Asia Pacific held the largest market share of over 54.0% in 2023.

- Based on technology, the thin-film segment occupied a dominant market share of over 42.81% in 2023.

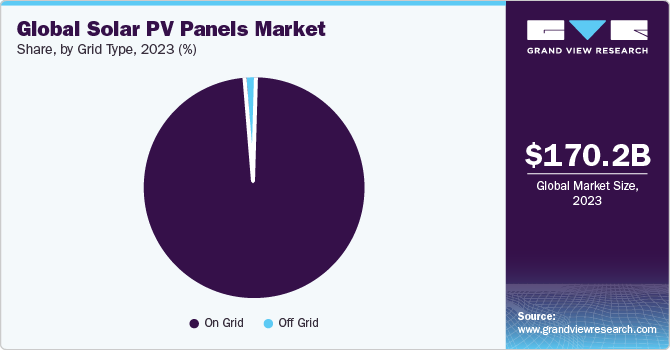

- In terms of grid type, the on-grid segment accounted for a significant revenue share and was valued at USD 167.48 billion in 2023.

- Based on application, the industrial segment accounted for a dominant share of over 40.0% in solar PV panels sector in 2023.

Market Size & Forecast

- 2023 Market Size: USD 170.25 billion

- 2030 Projected Market Size: USD 287.13 billion

- CAGR (2024-2030): 7.7%

- Asia Pacific: Largest market in 2023

Companies in the commercial and industrial sectors are among the major consumers of solar photovoltaic panels owing to the large-scale demand for green energy. Installation economies of scale in these sectors compensate for any loss in panel efficiency, making solar PV systems profitable for large-scale generation. The residential sector is gaining momentum in solar PV panel installations due to net metering schemes for grid-connected systems and the availability of energy storage systems for off-grid systems.

The U.S. market is expected to witness a prominent growth rate on account of robust federal schemes such as solar investment tax credit, rising demand across public and private sectors for green electricity, and declining panel cost. According to the Solar Energy Industries Association, the U.S. solar industry generated an investment of USD 33 billion in 2021 and achieved an installed capacity of 23.6 GW across the nation. The U.S. government has implemented various new incentive schemes to promote the adoption of solar and other renewable technologies. For instance, in August 2022, the U.S. government launched the Inflation Reduction Act (IRA) which allotted USD 369 billion for promotion of the renewable energy sector.

Many companies have started to construct new solar PV plants and are increasing capacity of their existing plants. For instance, in February 2023, Silicon Ranch announced that it will increase its solar power plant’s energy generation capacity. Also, First Solar will supply 1.5 GW of advanced American thin-film solar modules. This is in addition to its prior agreements which include installation of a total of 4 GW of solar PV panels by 2027.

The value chain of solar PV panels includes raw material suppliers, equipment suppliers, module manufacturers, distributors, and buyers that function in industrial, commercial, and residential markets. The majority of manufacturers in the solar PV panels industry are heavily backward integrated. First Solar, Solar World, and Yingli are among the key companies practicing vertical integration.

However, the COVID-19 outbreak disrupted the global solar PV panel supply chain, resulting in increasing panel prices with manufacturers facing labor shortages, material supply shortages, and stagnant international trading impacting the export market. Delayed projects due to supply chain disruption will further impede the solar industry.

Market Dynamics

Photovoltaic cells or solar cells are primarily employed to convert solar energy into a flow of electrons. These cells produce electricity from sunlight, which can be used to power equipment or recharge batteries. Initially, photovoltaic cells were used to power spacecraft and orbiting satellites. However, over the past few years, they are being increasingly used for grid-connected electricity generation. Photovoltaic systems aim to maximize productivity for better performance. These factors are expected to enhance the growth of solar PV panels industry over the forecast period.

Solar PV technology has been one of the fastest-growing renewable sources of energy over the past few years. Solar PV systems are employed in residential, commercial, and utility applications on account of decreasing cost and high efficiency. Increasing government focus on renewable energy has resulted in the development of PV cells as a sustainable and continuous source of energy generation. Rising capacity expansions in various regions have led to a Levelized Cost of Electricity (LCOE), which has made solar PV competitive with other conventional forms of energy.

Wind power and fuel cells act as direct clean power generation substitutes for solar power in residential applications. Wind power utilizes wind energy to move blades around a rotor that is connected to the main shaft. The main shaft then spins a generator coupled to it to generate electrical energy. Small wind turbines, which are deployed in applications such as residential locations, range in capacity from 400 watts to 20 kW.

Technology Insights

The thin-film segment occupied a dominant market share of over 42.81% in 2023, owing to increased durability and compact design of thin-film solar PV panels. Moreover, these panels are flexible and lightweight. Thin-film solar PV panels are mainly used in utility-scale and commercial applications owing to their low installation costs. These panels are known as cost-effective substitutes for silicon-based solar PV panels as they can be manufactured in bulk.

The crystalline silicon segment is projected to grow at a substantial CAGR over the forecast period, owing to the lightweight and extended lifecycle of these panels, along with low manufacturing costs of silicon semiconductors used in them. Key global suppliers of crystalline silicon solar PV panels are Hanwha Group, JinkoSolar, SHARP CORPORATION, and Canadian Solar Inc.

Grid Type Insights

The on-grid segment accounted for a significant revenue share and was valued at USD 167.48 billion in 2023. The dominant position of the on-grid type is majorly attributed to low operating & maintenance costs and non-complexity of grid-connected PV systems. On-grid PV systems have lower costs as the excess electricity generated is exported to grid and no battery storage needs to be installed near system source. Net metering and feed-in tariff policies have further provided a boost to segment growth.

The off-grid segment is projected to ascend at a CAGR of 16.0% over the forecast period. The expansion of solar PV panel manufacturers and growing capacities of off-grid solar PV panels are expected to drive the off-grid type segment. Challenges faced by traditional solar PV panel systems in the form of limited land availability and high grid installation costs are negated by the adoption of off-grid solar PV panels. Tax benefits and subsidies offered by governments of different countries for installation of off-grid solar PV panels, along with rent benefits offered to reservoir owners, are expected to further augment the growth of the off-grid type segment in the global solar PV panels industry over the forecast period.

Application Insights

The industrial segment accounted for a dominant share of over 40.0% in solar PV panels sector in 2023 and is projected to grow at a significant CAGR of 7.6% over the forecast period. The growth of solar PV panels in the residential segment is attributed to numerous benefits such as lower carbon footprints, lower electricity bills, and higher home values. With the help of solar systems, consumers are eligible for tax credits introduced by governments. The launch of new solar PV panel products in residential applications is expected to increase product demand over the forecast period. In December 2022, Soloes launched next-generation solar panels, ANTARES BI 144, with high radiation capacity and proof against negative effects from sunlight.

Increasing adoption of solar energy as a power source in corporate offices, hospitals, and hotels is expected to drive demand for solar PV panels in commercial sector with increased power demand in data centers and communication base stations. Improved solar PV panel efficiency, improved energy yields, and module-level monitoring are some of the key factors contributing to the adoption of solar PV panels in this segment. Growing demand for clean energy is anticipated to propel the development of utility projects and fuel solar PV panels sector growth across industrial sector. According to the Solar Energy Industries Association, as of 2022, there were 6,000 solar projects in the U.S. with a capacity of 182 GW.

Regional Insights

Asia Pacific held the largest market share of over 54.0% in 2023, with China being the largest contributor to revenue generation. The presence of large market players and supportive government policy of providing subsidies and financial incentives for photovoltaic projects are key factors for the growth of the industry in China. The North American market is expected to grow at a CAGR of about 7.9% over the forecast period. Proliferating capacity of residential consumers coupled with the announcement of new utility projects is expected to enhance product penetration across the country over the forecast period.

Apart from being the largest hub of panel manufacturing, China has several solar farms including the world’s largest floating farm that can generate 40 MW of electricity. In addition, the country accounts for a prominent position in solar PV panel exports to the world. However, some countries like the U.S. and India have applied restrictions on amount of PV panels imported from China, thereby disrupting solar industry profits in the country.

Key Companies & Market Share Insights

The global solar PV panels industry is competitive with key participants involved in R&D and constant innovation. It has become one of the most important factors for companies to perform in this industry. The high degree of forward integration, security of raw material feedstock, technology sourcing, skilled manpower, and strong R&D are among the prominent factors governing the competitiveness of solar PV panel industry. Globally, rising renewable energy demand in addition to growing energy security concerns is driving market growth.

Key Solar PV Panels Companies:

- JinkoSolar

- JA Solar

- Trina Solar

- LONGi Solar

- Canadian Solar

- Hanwha Q-CELLS

- Risen Energy

- GCL-SI

- First Solar

- SunPower Corporation

Solar PV Panels Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 183.53 billion

Revenue forecast in 2030

USD 287.13 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Technology, grid type, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; UK; France; Italy; Spain; Turkey; Croatia; China; Japan; India; South Korea; Australia; Brazil; Colombia;Paraguay; Saudi Arabia; South Africa; Egypt; UAE

Key companies profiled

JinkoSolar; JA Solar; Trina Solar; LONGi Solar; Canadian Solar; Hanwha Q-CELLS; Risen Energy; GCL-SI; First Solar; SunPower Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solar PV Panels Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global solar PV panels market report based on technology, grid type, application, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Thin Film

-

Crystalline Silicon

-

Others

-

-

Grid Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

On Grid

-

Off Grid

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

U.K.

-

Spain

-

Italy

-

France

-

Turkey

-

Croatia

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Colombia

-

Paraguay

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global solar PV panels market size was estimated at USD 170.25 billion in 2023 and is expected to reach USD 183.53 billion in 2024.

b. The global solar PV panels market is expected to grow at a compounded annual growth rate of 7.7% from 2024 to 2030 to reach USD 287.13 billion by 2030.

b. Asia Pacific dominated the solar PV panels market with the highest share of about 54.0% in 2023. The presence of large market players, along with favorable government policies providing subsidies and financial incentives to PV projects, are among the key factors contributing to the industry growth in China.

b. Some key players operating in the solar PV panels market include Canadian Solar, Solar Power Rocks LLC, Yingli Solar, HelioPower, SMA Solar Technology, Greenlight Planet, Schneider Electric, Backwoods Solar, and SuKam Power Systems among others.

b. Key factors driving the solar PV panels market growth include growing demand for renewable-based clean electricity coupled with government policy tax rebates and incentives to install solar panels is expected to drive the Solar PV Panels Market growth in the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.