- Home

- »

- Renewable Energy

- »

-

Solar Panel Recycling Market Size, Industry Report, 2030GVR Report cover

![Solar Panel Recycling Market Size, Share & Trends Report]()

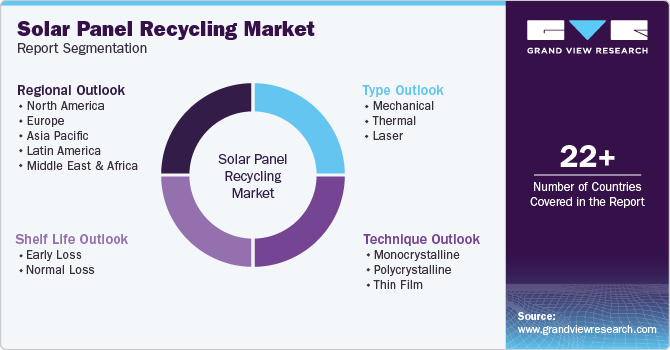

Solar Panel Recycling Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Mechanical, Thermal, Laser), By Shelf Life (Early Loss, Normal Loss), By Technique (Monocrystalline), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-617-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Solar Panel Recycling Market Summary

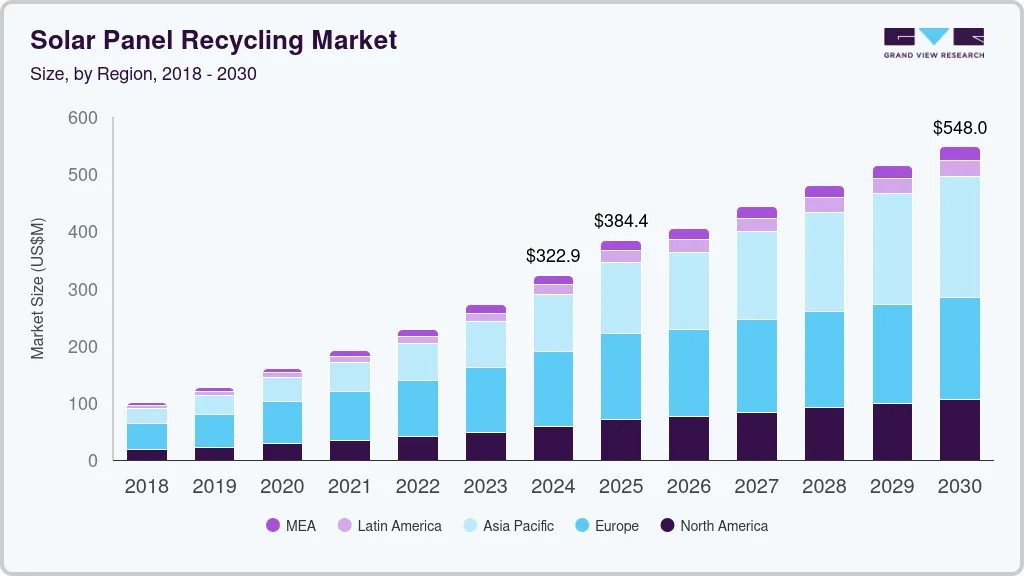

The global solar panel recycling market size was estimated at USD 322.9 million in 2024 and is projected to reach USD 548.0 million by 2030, growing at a CAGR of 7.4% from 2025 to 2030. This growth is driven by the increasing installation of solar energy systems worldwide, leading to a corresponding rise in end-of-life panels that must be managed effectively.

Key Market Trends & Insights

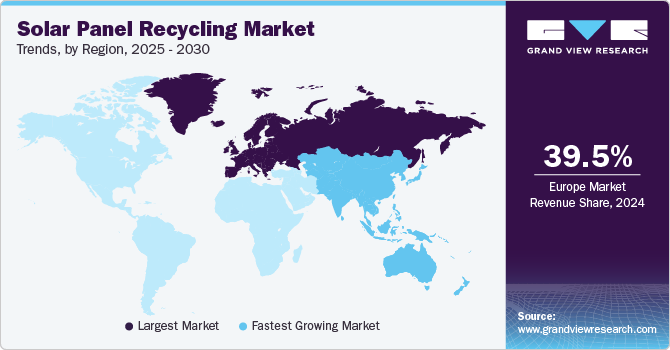

- In terms of region, Europe was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, mechanical accounted for a revenue of USD 228.8 million in 2024.

- Laser is the most lucrative type segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 322.9 Million

- 2030 Projected Market Size: USD 548.0 Million

- CAGR (2025-2030): 7.4%

- Europe: Largest market in 2024

As these panels end their operational lifespan, there is a growing demand for recycling solutions to recover valuable materials such as silver, silicon, and aluminum.

In addition, tightening environmental regulations and sustainability initiatives are pushing stakeholders to adopt recycling practices to minimize environmental impact and promote circular economy principles. Innovations in recycling technologies are also enhancing efficiency and reducing costs, further supporting market growth. The combined effect of these factors is expected to drive the solar panel recycling market forward in the coming years.

Regulatory frameworks and environmental policies encourage the safe disposal and recycling of solar panels, helping to minimize waste and promote sustainable practices. For instance, the European Union's Directive 2002/96/EC on Waste Electrical and Electronic Equipment (WEEE) requires collecting and recycling electrical and electronic waste, including solar panels, specifically covered under the updated 2012 and 2018 directive revisions. This helps ensure the recovery and reuse of valuable materials such as silicon and silver. Similarly, countries including India and China have introduced policies to manage solar photovoltaic waste, driven by ambitious renewable energy targets and the need to address environmental concerns.

Type Insights

The mechanical segment accounted for the largest share of 59.6% in 2024 due to the well-established and cost-effective nature of mechanical recycling processes. Mechanical recycling involves physically breaking down solar panels into constituent materials through shredding, crushing, and grinding. These processes are highly effective in recovering valuable materials such as glass, aluminum, and silicon, which can be reused to produce new solar panels and other products. The widespread adoption of mechanical recycling techniques is driven by their simplicity, scalability, and ability to handle large volumes of end-of-life solar panels.

The laser segment is expected to grow at a CAGR of 9.8% from 2025 to 2030 due to the increasing demand for advanced and efficient recycling methods to recover high-purity materials from end-of-life solar panels. Laser-based recycling technologies offer several advantages, including precision, minimal material loss, and the ability to target specific solar panel components. These technologies are particularly effective in recovering valuable materials such as silver and silicon, essential for manufacturing new solar panels.

Shelf Life Insights

The early loss (UV panel waste) segment held the largest revenue share in the solar panel recycling market in 2024. This segment includes solar panels that fail prematurely, often due to poor installation, midlife failures, or degradation of the anti-reflective coating on the glass. Early loss panels contribute significantly to the overall waste, as they are discarded before reaching their expected lifespan of 25-30 years. The high volume of early loss panels necessitates efficient recycling processes to recover valuable materials and minimize environmental impact.

The normal loss (UV panel waste) segment is projected to grow at a CAGR of 10.2% during the forecast period. This segment comprises solar panels that reach the end of their operational lifespan, typically around 25-30 years. As the global installation of solar panels continues to rise, the volume of panels reaching the end of their life cycle is expected to increase significantly. This growth is driven by the need to manage end-of-life panels effectively and recover valuable materials such as silicon, silver, and aluminum.

Technique Insights

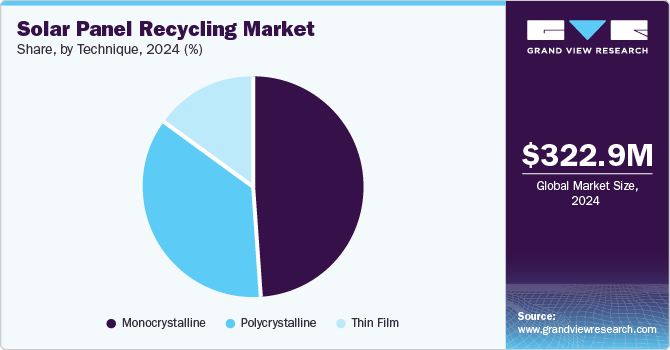

The monocrystalline segment dominated the global solar panel recycling market in 2024. Monocrystalline solar panels, known for their high efficiency and longer lifespan, are widely used in residential, commercial, and industrial applications. As a result, a significant volume of these panels is expected to reach the end of their life cycle in the coming years. The recycling process for monocrystalline panels involves recovering valuable materials such as silicon, silver, and aluminum, which can be reused to produce new panels and other products.

The thin film segment is projected to grow at a CAGR of 10.1% over the forecast period. Thin film solar panels, including cadmium telluride (CdTe) and copper indium gallium selenide (CIGS) technologies, are known for their flexibility and lower manufacturing costs than traditional silicon-based panels. The growing popularity of thin film panels in utility-scale solar projects and emerging markets drives the demand for efficient recycling solutions. The recycling process for thin film panels involves separating and recovering materials such as cadmium, tellurium, and indium, which are critical for manufacturing new panels. The projected growth of this segment is attributed to the increasing installation of thin film panels and the development of advanced recycling methods that enhance the recovery rates of valuable materials.

Regional Insights

The growth of the North America solar panel recycling market is driven by the increasing number of solar installations reaching the end of their lifecycle and the growing awareness of the environmental benefits of recycling. Implementing stringent environmental regulations and government incentives to promote renewable energy sources also play a significant role. Additionally, advancements in recycling technologies and the presence of key market players further support the development of the solar panel recycling industry in North America.

U.S. Solar Panel Recycling Market Trends

The U.S. dominated the North American solar panel recycling market in 2024 due to the country's large-scale solar installations and the proactive measures taken to manage solar waste. The U.S. government has implemented various policies and incentives to encourage solar panel recycling, including tax credits and subsidies for recycling facilities. The presence of advanced recycling infrastructure and the increasing investments in research and development of efficient recycling methods contribute to the market's growth in the U.S.

Europe Solar Panel Recycling Market Trends

Europe dominated the global solar panel recycling market with a market share of 39.5% in 2024 due to its stringent environmental regulations and well-established recycling infrastructure. The European Union's Waste Electrical and Electronic Equipment (WEEE) Directive plays a pivotal role by mandating the collection and processing of solar panels, which facilitates the recovery of critical raw materials while mitigating ecological impact. Key players in this initiative include Germany, France, and Italy, which have advanced their solar energy adoption rates and implemented comprehensive recycling protocols.

Asia Pacific Solar Panel Recycling Market Trends

The Asia Pacific solar panel recycling market is projected to grow fastest over the forecast period. This growth is driven by the exponential increase in solar installations in countries such as China, Japan, and India. As these installations end their operational life, the demand for efficient recycling solutions is expected to rise significantly. Government initiatives to promote renewable energy and manage electronic waste also boost the market.

Key Solar Panel Recycling Company Insights

Some of the key companies in the solar panel recycling market include First Solar, Inc., Echo Environmental, LLC, Silcontel Ltd., Canadian Solar, Silrec Corp., and SunPower Corp.

-

First Solar Inc. is a pioneer in the solar panel recycling market, offering high-value recycling services that recover over 90% of materials from end-of-life panels. Their state-of-the-art U.S., Germany, and Malaysia facilities are designed to handle high volumes of solar panels, ensuring that valuable resources such as glass, aluminum, and semiconductor materials are efficiently recycled.

-

Echo Environmental, LLC is a prominent player in the solar panel recycling industry, providing comprehensive recycling services for solar panels across North America. They work with major solar manufacturers, installers, and energy companies to ensure that end-of-life panels are recycled responsibly, reducing the environmental impact and recovering valuable materials such as glass, aluminum, and silver.

Key Solar Panel Recycling Companies:

The following are the leading companies in the solar panel recycling market. These companies collectively hold the largest market share and dictate industry trends.

- First Solar Inc.

- Echo Environmental, LLC

- SILCONTEL LTD

- Canadian Solar

- Silrec Corporation.

- SunPower Corporation

- Reiling GmbH & Co. KG

- Trina Solar

- Aurubis

- Envaris

- SiC Processing GmbH

- Yingli Energy Co. Ltd.

- Hanwha Group

Recent Developments

-

In November 2024, SOLARCYCLE announced plans to establish a 5 GW solar panel recycling facility in Georgia, which is set to become the largest in the U.S. This facility is engineered to process up to 10 million solar panels annually, addressing a significant portion of the anticipated 25-30% of solar modules projected to reach their end-of-life by 2030.

-

In September 2024, Canadian Solar Inc. formed a strategic partnership with SOLARCYCLE, positioning itself as a leader in the solar industry by providing extensive recycling services for crystalline silicon solar modules to its U.S. customers. Under this collaboration, SOLARCYCLE will be the exclusive recycling partner for Canadian Solar, which will also function as an OEM partner. This alliance allows Canadian Solar’s customers to access recycling services upfront at purchase.

Solar Panel Recycling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 384.4 million

Revenue forecast in 2030

USD 548.0 million

Growth rate

CAGR of 7.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, shelf life, technique, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Germany, UK, Italy, France, China, India, Japan

Key companies profiled

First Solar, Inc.; Echo Environmental, LLC; Silcontel Ltd.; Canadian Solar; Silrec Corp.; SunPower Corp.; Reiling GmbH & Co. KG; Trina Solar; Aurubis; Envaris; SiC Processing GmbH; Yingli Energy Co. Ltd.; Hanwha Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solar Panel Recycling Market Report Segmetation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global solar panel recycling market report based on type, shelf life, technique, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical

-

Thermal

-

Laser

-

-

Shelf Life Outlook (Revenue, USD Million, 2018 - 2030)

-

Early Loss

-

Normal Loss

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Monocrystalline

-

Polycrystalline

-

Thin Film

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.