- Home

- »

- Renewable Energy

- »

-

Sodium-ion Battery Market Size And Share Report, 2030GVR Report cover

![Sodium-ion Battery Market Size, Share & Trends Report]()

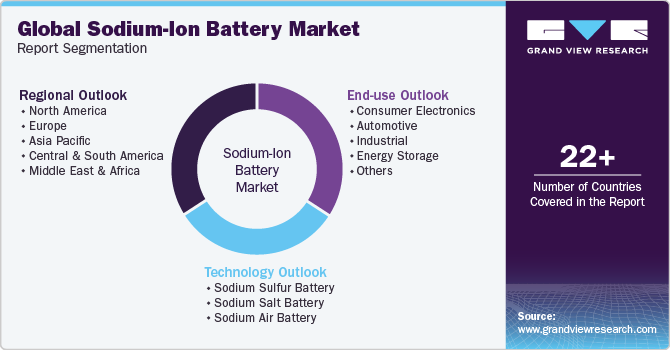

Sodium-ion Battery Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Sodium Sulfur Battery, Sodium Salt Battery, Sodium Air Battery), By End-use (Consumer Electronics, Automotive, Industrial, Energy Storage), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-270-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sodium-ion Battery Market Summary

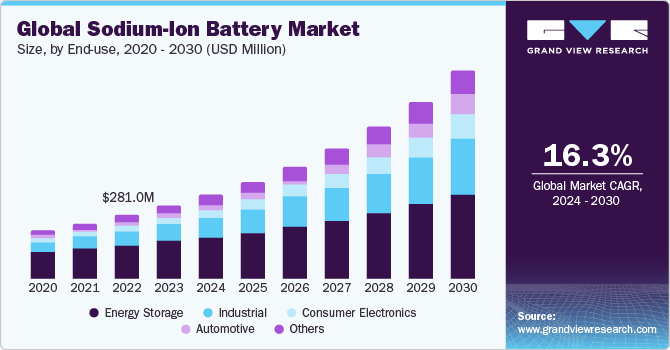

The global sodium-ion battery market size was estimated at USD 321.75 million in 2023 and is projected to reach USD 914.67 million by 2030, growing at a CAGR of 16.3% from 2024 to 2030. The global market is experiencing significant growth and is poised for further expansion in the coming years.

Key Market Trends & Insights

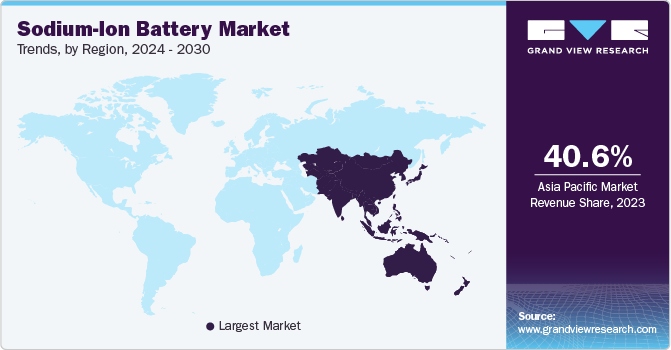

- The Asia Pacific sodium ion battery market dominated the global market and accounted for the largest revenue share of 40.57% in 2023.

- The North America sodium ion battery market is poised for significant growth, exceeding a CAGR of 19.0% between 2024 and 2030.

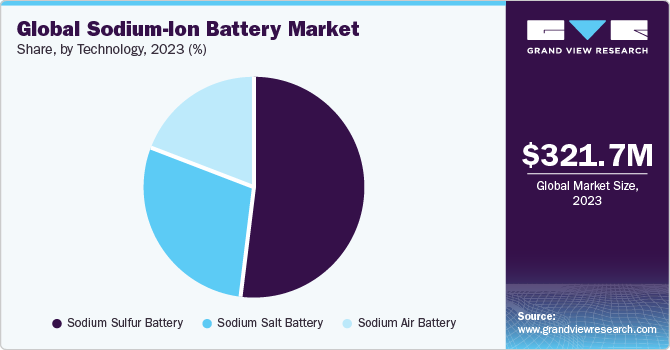

- By technology, the sodium sulfur battery segment accounted for the largest revenue share of about 51.97% in 2023.

- By end-use, energy storage emerged as the largest end-use segment with a market share of about 50.51% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 321.75 Million

- 2030 Projected Market Size: USD 914.67 Million

- CAGR (2024-2030): 16.3%

- Asia Pacific: Largest market in 2023

One of the primary drivers of this growth is the increasing demand for sustainable energy storage solutions. With the global shift towards renewable energy sources, such as solar and wind power, there is a pressing need for efficient and reliable energy storage systems, and sodium ion batteries offer a promising solution. Their cost-effectiveness compared to traditional lithium-ion batteries, driven by the abundance of sodium resources, makes them particularly attractive for large-scale energy storage applications.

Moreover, sodium ion batteries are gaining traction due to their potential to address key challenges in energy storage, including grid stability and peak demand management. As advancements in sodium ion battery technology continue to improve their energy density, cycle life, and safety features, they are becoming increasingly viable for a wide range of applications, from grid-scale energy storage to electric vehicles (EVs). This versatility positions sodium ion batteries as a competitive alternative to lithium-ion batteries, especially in markets where cost-effectiveness and sustainability are paramount considerations.

Furthermore, government initiatives and policies aimed at promoting clean energy and reducing greenhouse gas (GHG) emissions are also driving the market growth. Subsidies, incentives, and regulatory frameworks supporting the adoption of renewable energy storage technologies further bolster market expansion. With ongoing research and development efforts focused on enhancing the performance and scalability of sodium ion batteries, the outlook for the global market remains promising, with ample opportunities for growth and innovation over the forecast period.

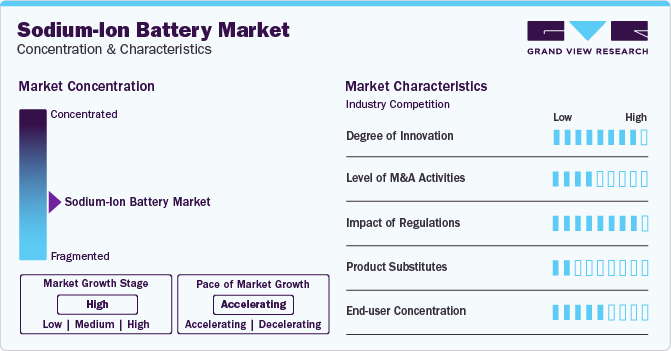

Market Concentration & Characteristics

The global market is a dynamic and competitive space with established players and innovative newcomers vying for dominance. Also, the industry is facing fierce competition from established players in various sectors. Leading companies like Aquion Energy, Faradion Limited, Natron Energy, Inc., and Tiamat Energy have been in industry for years, boasting extensive experience and established customer bases. Startups and smaller companies focus on innovating technologies and disruptive business models.

Companies are also focusing on new sodium-ion battery product launches to strengthen their foothold in the market. For instance, in March 2024, BMZ Group, one of the leading German companies, launched sodium-ion battery product with the brand name of NaTE SERIES. These newly launched products are used for applications where energy density is not paramount.

The sodium-ion battery market is currently characterized by low market concentration, with a mix of established players from the lithium-ion battery industry and emerging startups developing sodium-ion technology. This fragmentation is driven by the nascent stage of the market, with various companies experimenting with different material compositions and cell designs. While large corporations like Eaton and LG Chem have shown interest, the market lacks a dominant leader yet. This presents both challenges and opportunities, as competition fosters innovation but also creates uncertainty regarding the future dominant technology and key players.

End-use Insights

Energy storage emerged as the largest end-use segment with a market share of about 50.51% in 2023 and is expected to witness robust growth over forecast period. From grid-level applications to residential energy storage systems, sodium-ion batteries offer a compelling solution for storing renewable energy efficiently and cost-effectively. As renewable energy sources like solar and wind power become increasingly prevalent, the demand for reliable energy storage solutions grows, driving the adoption of sodium-ion batteries in utility-scale energy storage projects. In addition, sodium-ion batteries find application in off-grid scenarios, providing a reliable power source for remote areas and supporting critical infrastructure during power outages.

Moreover, sodium-ion batteries serve as a key enabler in the electrification of transportation, contributing to the transition towards sustainable mobility. As the automotive industry shifts towards EVs, sodium-ion batteries offer an attractive alternative to lithium-ion counterparts, offering higher abundance and potentially lower cost. With ongoing advancements in sodium-ion battery technology, coupled with expanding infrastructure for EV charging, sodium-ion batteries are poised to play a significant role in powering the next generation of EVs, contributing to reduced emissions and a greener transportation ecosystem.

Technology Insights

The sodium sulfur battery segment accounted for the largest revenue share of about 51.97% in 2023 and is expected to witness robust growth over forecast period. This technology enables high energy density and prolonged cycling stability, making sodium-sulfur batteries suitable for large-scale energy storage applications, such as grid-level energy storage and EVs. Their robust performance, coupled with relatively abundant and low-cost raw materials, positions sodium-sulfur batteries as a competitive alternative to lithium-ion counterparts, particularly in scenarios requiring high energy density and cost-effectiveness.

However, challenges persist in scaling up sodium-sulfur battery technology, primarily related to the high operating temperature requirements and safety concerns associated with the use of molten sodium and sulfur. Mitigating these issues through advancements in materials science and engineering could unlock broader commercial adoption of sodium-sulfur batteries, driving growth within the market. With ongoing R&D efforts aimed at enhancing performance and safety characteristics, sodium-sulfur batteries hold significant potential to reshape the landscape of energy storage solutions, catering to the evolving needs of renewable energy integration and electrification initiatives across the globe.

Regional Insights

The North America sodium ion battery market is poised for significant growth, exceeding a CAGR of 19.0% between 2024 and 2030. Government support for clean energy technologies, including battery research and development, can significantly boost the regional market growth.

U.S. Sodium-ion Battery Market Trends

The sodium ion battery market in the U.S. is expected to grow at a CAGR of 18.9% from 2024 to 2030. Increasing demand for sodium-ion batteries from sectors like electric utilities, transportation (potentially for low-range EVs or commercial fleets), and industrial applications requiring reliable and cost-effective energy storage.

Asia Pacific Sodium-ion Battery Market Trends

The Asia Pacific sodium ion battery market dominated the global market and accounted for the largest revenue share of 40.57% in 2023. The region is expected to maintain its position in the global industry over forecast period as it benefits from a robust manufacturing infrastructure and supply chain network, facilitating efficient production and distribution of sodium-ion batteries.

Moreover, supportive government policies and initiatives aimed at promoting renewable energy adoption and electrification of transportation drive the demand for sodium-ion batteries in this region. In addition, flourishing economies of countries like China, Japan, and South Korea are witnessing rapid urbanization and industrialization, leading to increased energy consumption and the need for reliable energy storage solutions, thereby fueling market growth.

Europe Sodium-ion Battery Market Trends

The sodium ion battery market in Europe is expected to witness significant growth over the forecast period due to increasing demand for energy storage, growing environmental concerns, and ongoing research efforts. Europe is expected to be a leader in this market due to its focus on renewable energy and battery technology.

The France sodium ion battery marketis anticipated to grow at a CAGR of over 15.1% from 2024 to 2030. This growth can be attributed to the country’s strong emphasis on reducing maritime emissions and transitioning towards cleaner energy sources. Government incentives and regulations promoting the adoption of eco-friendly marine propulsion systems are driving demand for sodium-ion batteries in the marine sector.

Middle East & Africa Sodium-ion Battery Market Trends

The sodium ion battery market in Middle East & Africa is expected to grow at a CAGR of approximately 19.3% over forecast period due to the growing focus on offshore renewable energy projects, such as wind farms and floating solar installations, leading to increased product demand to store and manage energy generated from these sources.

The Saudi Arabia sodium ion battery market held a dominant revenue share of about 37.08% in 2023. This dominance shows Saudi Arabia's significant influence in the regional maritime industry, driven by substantial investments in infrastructure and renewable energy. With its strategic location and growing maritime sector, Saudi Arabia continues to lead the demand for sodium ion batteries, solidifying its position as a key player in the MEA regional market.

Key Sodium-ion Battery Company Insights

The sodium ion battery market is moderately fragmented with the presence of a sizable number of medium- and large-sized companies. Key players mainly cater to maritime shipping, offshore oil and gas, marine tourism, and naval defense industries. Key companies are adopting several organic and inorganic growth strategies, such as facility expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In March 2024, BMZ Group one of the leading Germany headquartered company launched sodium ion battery product with the brand name of NaTE SERIES. These newly launched products are used for applications where energy density is not paramount

-

In February 2024, Sodion Energy an Indian company launched sodium ion batteries. These newly launched products are used for various applications including home appliances and EVs

Key Sodium-ion Battery Companies:

The following are the leading companies in the sodium-ion battery market. These companies collectively hold the largest market share and dictate industry trends.

- Faradion Limited

- AMTE Power Plc

- Natron Energy, Inc.

- Altris AB

- Tiamat Energy

- Li-FUN Technology Corporation Limited

- Contemporary Amperex Technology Co. Limited (CATL)

- HiNa Battery Technology Co., Ltd

- Indigenous Energy Storage Technologies Pvt. Ltd. (Indi Energy)

- Aquion Energy

- NEI Corporation

Sodium-ion Battery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 369.69 million

Revenue forecast in 2030

USD 914.67 million

Growth rate

CAGR of 16.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

USD Million; and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Technology, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Faradion Ltd.; AMTE Power Plc; Natron Energy, Inc.; Altris AB; Tiamat Energy; Li-FUN Technology Corp. Ltd.; Contemporary Amperex Technology Co. Ltd. (CATL); HiNa Battery Technology Co., Ltd.; Indigenous Energy Storage Technologies Pvt. Ltd. (Indi Energy); Aquion Energy; NEI Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sodium-ion Battery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sodium-ion battery market report on the basis of technology, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Sodium Sulfur Battery

-

Sodium Salt Battery

-

Sodium Air Battery

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Automotive

-

Industrial

-

Energy Storage

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sodium-ion battery market size was estimated at USD 321.75 million in 2023 and is expected to reach USD 369.69 million in 2024.

b. The global sodium-ion battery market is expected to grow at a compound annual growth rate of 16.3% from 2024 to 2030 to reach USD 914.67 million by 2030.

b. Based on technology, sodium sulfur battery was the dominant segment in 2023 with a revenue share of about 51.97% in 2023. This is attributable to their exceptional energy storage capabilities and reliability. This technology's appeal is further bolstered by its efficiency and suitability for diverse industrial applications, driving widespread adoption. Additionally, sodium sulfur batteries have garnered significant attention due to their potential to address energy storage challenges, positioning them as the preferred choice in the market landscape.

b. Some of the key players operating in this industry include Faradion Limited, AMTE Power plc, Natron Energy, Inc., Altris AB, Tiamat Energy, Li-FUN Technology Corporation Limited, Contemporary Amperex Technology Co. Limited (CATL), HiNa Battery Technology Co., Ltd, Indigenous Energy Storage Technologies Pvt. Ltd. (Indi Energy), Aquion Energy, NEI Corporation

b. The sodium-ion battery market is primarily driven by its cost-effectiveness, as sodium is more abundant and less expensive than lithium. Additionally, the growing demand for renewable energy storage solutions and the push for sustainable alternatives further propel the market. Advancements in sodium ion battery technology, improving energy density and cycle life, also contribute significantly to its market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.