- Home

- »

- Disinfectants & Preservatives

- »

-

Sodium Chlorite Market Size, Share & Growth Report, 2030GVR Report cover

![Sodium Chlorite Market Size, Share & Trends Report]()

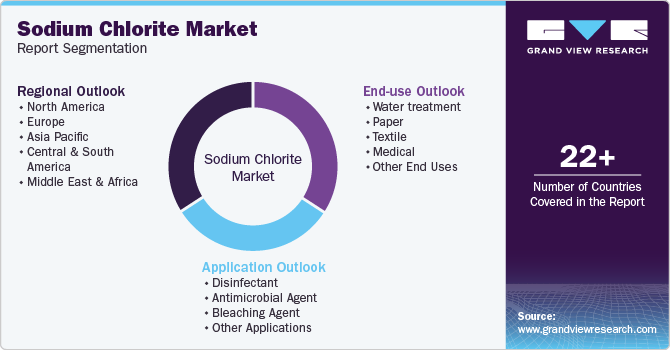

Sodium Chlorite Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Disinfectant, Antimicrobial Agent, Bleaching Agent), By End-use (Water treatment, Paper, Textile), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-682-0

- Number of Report Pages: 201

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sodium Chlorite Market Summary

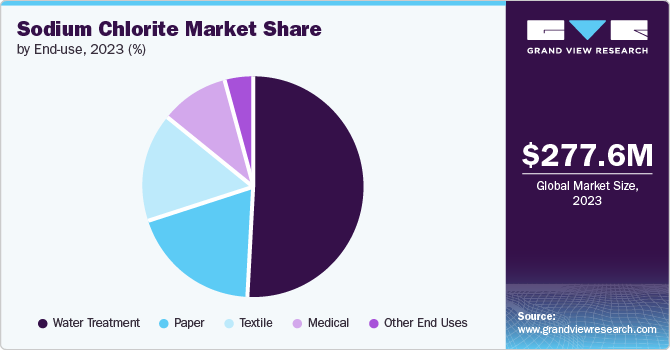

The global sodium chlorite market was estimated at USD 277.6 million in 2023 and is projected to reach USD 353.7 million by 2030, growing at a CAGR of 3.6% from 2024 to 2030. The anticipated surge in demand for sodium chlorite is attributed to its biocidal and antimicrobial properties, particularly in wastewater treatment and water purification applications, driving its market growth over the forecast period.

Key Market Trends & Insights

- U.S. emerged as the fastest growing market in North America with a CAGR of 4.3% from 2024 - 2030.

- Asia Pacific sodium chlorite market dominated globally with a revenue share of 43.1% in 2023.

- Based on application, the disinfectant segment dominated the market with a revenue share of approximately 41.9% in 2023.

- In terms of end-use, the water treatment segment dominated the market with a revenue share of 51.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 277.6 Billion

- 2030 Projected Market Size: USD 353.7 Billion

- CAGR (2024-2030): 3.6%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

Sodium chlorite (NaClO2) is an inorganic chemical compound known for its versatile properties and applications. It is an odorless, pale-yellow crystalline solid that readily dissolves in water. As a powerful oxidizing agent, sodium chlorite exhibits antimicrobial and biocidal properties, making it a valuable component in various industrial and healthcare applications. The chemical is stable in its pure form and is commonly used in water purification and wastewater treatment due to its ability to eliminate pathogens and microbial contaminants.

Drivers, Opportunities & Restraints

The global sodium chlorite industry is being driven by the increasing demand for the chemical in wastewater treatment and water purification applications. Sodium chlorite's biocidal and antimicrobial properties make it an effective solution for disinfecting and purifying water, addressing the need for clean and safe water supplies. This demand is further fueled by the rising awareness of waterborne diseases and the need for effective water treatment solutions. For instance, in the healthcare industry, sodium chlorite is extensively used as a disinfectant and for the treatment of various illnesses, highlighting its crucial role in maintaining public health and safety.

One of the key restraints affecting the global sodium chlorite industry is the stringent regulatory framework governing its usage. The chemical's potential hazards and safety concerns have prompted regulatory bodies to impose strict guidelines and standards for its production, handling, and usage. For instance, the Occupational Safety and Health Administration (OSHA) in the U.S. has established permissible exposure limits (PELs) for sodium chlorite to protect workers from potential health risks. In addition, the European Chemicals Agency (ECHA) has classified it as a hazardous substance, thereby imposing stringent regulations on its usage in various applications.

The global sodium chlorite industry presents significant opportunities driven by the growing demand for the chemical across diverse industries. Sodium chlorite is extensively used in food and beverage, oil and gas, and other industrial sectors for purposes such as bleaching and disinfection. In the food and beverage industry, the product is utilized to disinfect containers used in the manufacturing and production of various food products, ensuring hygiene and product preservation. Similarly, in the healthcare industry, sodium chlorite solution is widely employed as a disinfectant and for the treatment of various illnesses, highlighting its versatile applications.

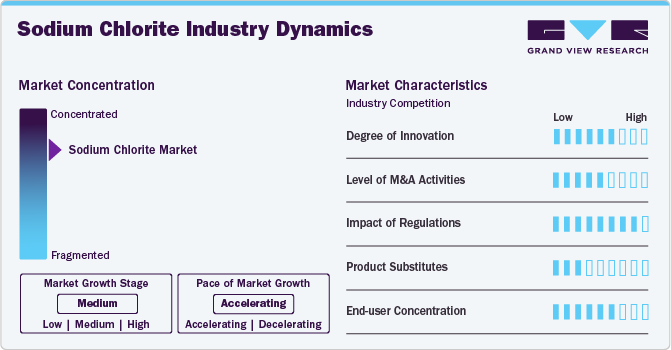

Market Concentration & Characteristics

The sodium chlorite industry is characterized by industry dynamics influenced by various factors, including the degree of innovation, product substitutes, end-user concentration, and the regulatory scenario. The degree of innovation in the industry is evident by the emphasis on research and development to raise product quality and reduce costs through process innovation. For instance, industry participants are investing in research and development to enhance the standard of sodium chlorite products, positioning them competitively in the market at attractive pricing. This focus on innovation reflects the industry's proactive approach to meeting evolving market demands and technological advancements.

Product substitutes play a significant role in shaping the industry dynamics. The industry faces challenges from alternative chemicals and disinfection technologies, such as chlorine dioxide, which is increasingly preferred as a substitute for sodium chlorite in certain applications due to its perceived efficiency and safety profile. In addition, the emergence of advanced oxidation processes (AOPs) and other innovative water treatment technologies presents substitution challenges for sodium chlorite. These competitive dynamics compel manufacturers to innovate and demonstrate the unique benefits of their products to maintain a competitive edge, reflecting the influence of product substitutes on industry dynamics.

The regulatory scenario significantly impacts the market dynamics. The U.S. Environmental Protection Agency (EPA) has declared it as safe for consumption in household applications as well as for industrial purposes, leading to high consumption of the product across major end use industries globally. However, regulatory scrutiny and stringent safety measures may limit the product application due to the higher availability of eco-friendly alternatives. Stringent regulations and safety measures influence the market dynamics by shaping the product's application and market presence, reflecting the industry's responsiveness to regulatory requirements and environmental concerns.

The concentration of end-users in various industries contributes to the market dynamics. The rising demand for sodium chlorite in diverse sectors, including the food and beverage, oil and gas, healthcare, and water treatment industries, underscores the broad end user concentration. For instance, it is extensively used in the food and beverage industry for disinfection and preservation purposes, highlighting its importance in maintaining hygiene standards and preventing microbial contamination in food processing. This widespread usage across industries signifies the market's diverse end user concentration and the potential for continued market expansion.

Application Insights

“Antimicrobial agent emerged as the fastest growing application with a CAGR of 4.3%.”

The disinfectant segment dominated the market with a revenue share of approximately 41.9% in 2023. Sodium chlorite is widely recognized for its significant role as a disinfectant in various applications, including water treatment, surface disinfection, and industrial processes. The use of sodium chlorite as a disinfectant is crucial for protecting human and animal health by effectively eliminating harmful pathogens and microorganisms from equipment, surfaces, and water sources. The chemical's effectiveness in eliminating germs on surfaces and equipment makes it a cost-effective and reliable solution for maintaining hygiene and preventing the spread of infectious diseases.

As an antimicrobial agent, sodium chlorite is widely employed in water treatment and disinfection processes. It is recognized for its ability to effectively neutralize and eliminate harmful microorganisms, including bacteria, viruses, and fungi, making it a crucial component in ensuring the safety and purity of drinking water and industrial water systems. The compound's antimicrobial properties have led to its widespread use in hospital operation theatres, waiting rooms, and critical care units, where maintaining a sterile environment is paramount for preventing the spread of infections.

Sodium chlorite is utilized as a bleaching agent in various industrial processes, particularly in the textile and paper industries. Its bleaching capabilities are harnessed to remove colorants, waxes, gums, and pectins from natural fibers, enhancing surface characteristics and fiber quality. Sodium chlorite's effectiveness as a bleaching agent is evident in its application in textile bleaching, where it offers advantages over traditional chemical treatments by providing a safer and less polluting alternative.

End-use Insights

“Textile emerged as the fastest growing end use with a CAGR of 4.2%.”

The water treatment segment dominated the market with a revenue share of 51.0% in 2023. The compound is widely recognized for its effectiveness in neutralizing and eliminating harmful microorganisms, including bacteria, viruses, and fungi, making it an indispensable component in water treatment facilities. Sodium chlorite-based disinfectants, particularly chlorine dioxide generated from sodium chlorite, are approved by regulatory bodies such as the U.S. Environmental Protection Agency (EPA) for treating municipal drinking water.

In the paper and textile industries, sodium chlorite serves as a key chemical compound with diverse applications, particularly in bleaching and disinfection processes. In the paper industry, oy is primarily utilized for the generation of chlorine dioxide, which is instrumental in the bleaching and stripping of textiles, pulp, and paper. The compound's role in the paper production process contributes to the enhancement of paper brightness and quality, making it an essential component in the manufacturing of high-quality paper products.

Sodium chlorite is extensively used in the textile industry as a bleaching agent, offering advantages over conventional chemical treatments by providing a safer and less polluting alternative. The compound's use in textile bleaching processes contributes to the removal of colorants, waxes, gums, and pectins from natural fibers, enhancing surface characteristics and fiber quality. Sodium chlorite's role as a bleaching agent in the textile industry aligns with its capacity to provide a cost-effective and environmentally friendly solution for textile bleaching processes

Regional Insights

“U.S. emerged as the fastest growing market in North America with a CAGR of 4.3% from 2024 - 2030.”

North America Sodium Chlorite Market Trends

The sodium chlorite market in North America is expected to be driven by high consumption levels of sodium chlorite for water treatment. The region's market dynamics are influenced by factors such as regulatory standards set by the U.S. Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA), which impact the production, distribution, and application of sodium chlorite in various industries.

U.S. Sodium Chlorite Market Trends

The sodium chlorite market in the U.S. is robust and dynamic. The market dynamics in the U.S. are influenced by regulatory standards set by the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA), which impact the production, distribution, and application of sodium chlorite.

Asia Pacific Sodium Chlorite Market Trends

Asia Pacific sodium chlorite market dominated globally with a revenue share of 43.1% in 2023. The region's leading position is attributed to the rising pulp & paper industry application, which is expected to drive the market. Additionally, the availability of land, low raw material, and labor costs, along with a favorable government outlook, are key factors associated with high production volumes of sodium chlorite in countries such as China. This underscores the region's significant influence on the global industry, driven by industrial applications and favorable production conditions.

The China sodium chlorite market is a key player globally and significantly influences market dynamics. The country's dominance is attributed to its high production capacity, low labor costs, and availability of raw materials, which drive the market's competitive pricing and high production volumes. The demand in China is mainly driven by applications in the pulp and paper industry, as well as in water treatment and disinfection processes.

Europe Sodium Chlorite Market Trends

Europe sodium chlorite market plays a significant role in the global market, with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the demand from the pulp and paper industry, which has traditionally been strong in Nordic Europe. In addition, the regulatory scenario in Europe, including environmental regulations and safety standards, significantly influences the market dynamics, shaping the product's application and market presence.

Germany sodium chlorite market is renowned for its strong emphasis on research and development in industrial sectors, including water treatment and pulp & paper industry. The demand for sodium chlorite in Germany is driven by its application in various industries, including pulp and paper, textiles, and chemical processing. The country's emphasis on innovation and sustainable practices positions it as a leading market player in the industry.

The sodium chlorite market in the UK is influenced by regulatory standards, technological advancements, and the demand from key industries such as pulp and paper, textiles, and healthcare. The UK's commitment to environmental sustainability and compliance with safety regulations shapes the market dynamics, driving the adoption of sodium chlorite in various industrial applications.

Central & South America Sodium Chlorite Market Trends

Central and South America sodium chlorite markets are emerging as significant regions for the global market, with Brazil, Argentina, and other Latin American countries playing a pivotal role in the market dynamics. The distribution of global production capacity is shifting towards South America, where pulp capacities are increasing, reflecting the region's growing influence on the market.

Brazil sodium chlorite market is an emerging market for the global industry, with a growing emphasis on applications in water treatment, pulp and paper production, and disinfection processes. The country's market dynamics are influenced by factors such as increasing foreign investments in the manufacturing sectors, rising demand from industrial applications, and the expansion of the pulp and paper industry.

Middle East & Africa Sodium Chlorite Market Trends

The Middle East and Africa sodium chlorite market relies on imports for sodium chlorite due to the lack of raw material availability and production units in the region. However, increasing foreign investments in the manufacturing sectors in these regions are expected to have a positive impact on industry growth over the projected period. The region's market dynamics are influenced by factors such as the rising demand from various industrial applications, including water treatment and disinfection.

The sodium chlorite market in Saudi Arabia, with its production capacity, export-oriented approach, and growing demand from various industries, is positioning it as a key player in the global market.

Key Sodium Chlorite Company Insights

Some of the key players operating in the global sodium chlorite market include

-

DuPont has been a major player in the development and production of a wide range of chemicals and polymers, including products such as Vespel, neoprene, nylon, Teflon, Kevlar, and many others. DuPont's expertise in chemical manufacturing and its global presence position it as a significant contributor to the sodium chlorite industry, with a focus on innovation and product development.

-

Airedale Chemical Company Limited is a UK-based, award-winning manufacturer and distributor of specialty and commodity chemicals. The company serves customers in various sectors, including agriculture, water treatment, food production, manufacturing, and industrial cleaning. Airedale Chemical Company Limited offers a wide range of chemical solutions, including functional and industrial chemicals for multi-industry applications, specialty chemical solutions for metal surface treatment, and new product development.

American Elements and ABI Chem Germany are some of the emerging market participants in the global sodium chlorite market.

-

American Elements is a global manufacturer and distributor of advanced materials. The company's product portfolio includes a wide range of chemicals, metals, and materials used in various industries, including pharmaceuticals, electronics, and advanced technologies.

-

ABI Chem Germany is a German chemical company that focuses on providing chemical solutions for industrial applications. It offers a wide range of solutions, including functional and industrial chemicals for multi-industry applications, specialty chemical solutions for metal surface treatment, and new product development.

Key Sodium Chlorite Companies:

The following are the leading companies in the sodium chlorite market. These companies collectively hold the largest market share and dictate industry trends.

- Alfa Aesar

- Nanjing Kaimubo Pharmatech Company Limited

- Shree Chlorates

- Dongying Shengya Chemical Co., Ltd.

- Airedale Chemical Company Limited

- Shandong Gaomi Gaoyuan Chemical Industry Co., Ltd.

- Debyesci

- DuPont

- ERCO Worldwide

- Finetech Industry Limited

- Sigma-Aldrich Co. LLC.

- Occidental Petroleum Corporation

- Tractus Company Limited

- American Elements

- ABI Chem Germany

Recent Developments

-

In June 2024, DuPont, a major player in the sodium chlorite industry announced its decision to split itself into three separate public entities. The split is aimed at separating its water and electronics businesses, with the ‘New DuPont’ continuing as the entity indulged in the production of industrial chemicals.

-

In February 2023, Ercros announced the opening of a new sodium chlorite manufacturing facility on its Sabinanigo site. The new facility is the company's third plant and effectively doubles the firm's production capacity.

Sodium Chlorite Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 285.9 million

Revenue forecast in 2030

USD 353.7 million

Growth Rate

CAGR of 3.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait; Qatar; Oman

Key companies profiled

Alfa Aesar, Nanjing Kaimubo Pharmatech Company Limited, Shree Chlorates, Dongying Shengya Chemical Co., Ltd., Airedale Chemical Company Limited, Shandong Gaomi Gaoyuan Chemical Industry Co., Ltd.Debyesci, ERCO Worldwide, Finetech Industry Limited, Sigma-Aldrich Co. LLC., Occidental Petroleum Corporation, Tractus Company Limited, American Elements, ABI Chem Germany

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sodium Chlorite Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sodium chlorite market report based on application, end-use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Disinfectant

-

Antimicrobial Agent

-

Bleaching Agent

-

Other Applications

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Water treatment

-

Paper

-

Textile

-

Medical

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Qatar

-

Kuwait

- Oman

-

-

Frequently Asked Questions About This Report

b. The global sodium chlorite market size was estimated at USD 277.6 million in 2023 and is expected to reach USD 285.9 billion in 2024.

b. The global sodium chlorite market is expected to grow at a compound annual growth rate of 3.6% from 2024 to 2030 to reach USD 353.7 million by 2030.

b. Asia Pacific dominated the sodium chlorite market with a share of 39.7% in 2023. This is attributable to the growing demand for the product in the water treatment application in the region.

b. Some key players operating in the sodium chlorite market include Occidental Petroleum Corporation, LabChem, ERCO Worldwide, International Dioxcide Inc, and others.

b. Key factors that are driving the market growth include high demand for the chemical in wastewater treatment and water purification applications owing to its biocidal & antimicrobial properties .

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.