- Home

- »

- Automotive & Transportation

- »

-

Snowmobile Market Size, Share And Growth Report, 2030GVR Report cover

![Snowmobile Market Size, Share & Trends Report]()

Snowmobile Market (2023 - 2030) Size, Share & Trends Analysis Report By Vehicle Type (Trail, Mountain), By Engine Type (Below 500cc, Above 900cc), By Engine Size, By Seating Capacity, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-099-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Snowmobile Market Summary

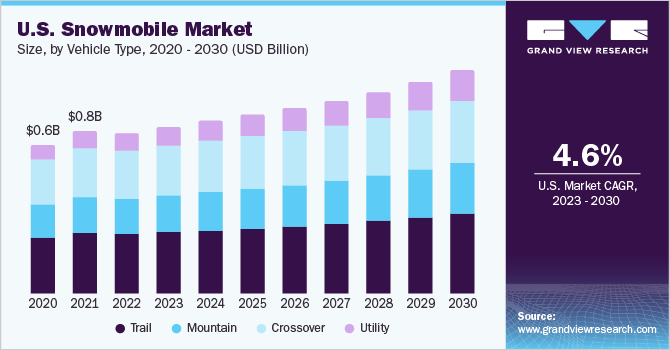

The global snowmobile market size was estimated at USD 1.67 billion in 2022 and is projected to reach USD 2.33 billion by 2030, growing at a CAGR of 4.3% from 2023 to 2030. The increasing popularity of winter sports such as skiing, snowboarding, snow racing, snow-cross, and recreational activities such as ice fishing and backcountry exploration primarily drive the market.

Key Market Trends & Insights

- In 2022, North America held a substantial market share of over 78% in terms of revenue.

- By vertical type, the trail snowmobile vehicle segment held the largest share of over 37% of the global snowmobile industry in 2022.

- By engine size, the 500cc to 900cc segment accounted for the largest share of over 77% in 2022.

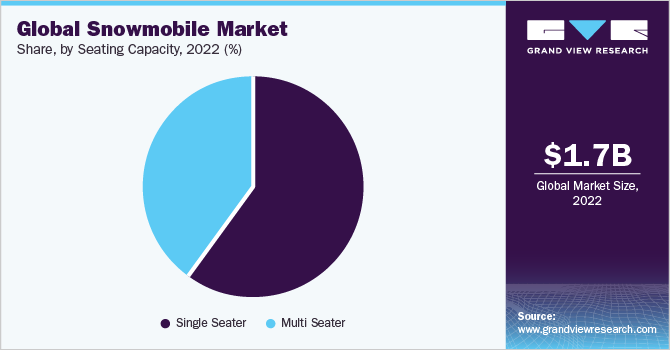

- By seating capacity, the single seating segment led the snowmobile market and accounted for the largest revenue share of over 60% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 1.67 Billion

- 2030 Projected Market Size: USD 2.33 Billion

- CAGR (2023-2030): 4.3%

- North America: Largest market in 2022

In addition, rising consumer preferences for adventure sports, post the COVID-19 pandemic, has been a major trigger in the sales of snowmobiles in the global market. Moreover, the increasing focus of major players in developing battery-powered snowmobiles for recreational and regular commuting purposes is further expected to fuel the global snowmobile industry growth over the forecast period.Conversely, the high upfront total cost of ownership has been a restricting factor in the high growth of the snowmobile industry globally.

The growing popularity of recreational activities such as trail riding, mountain riding, ice fishing, and freestyle riding is spurring the demand for snowmobiles in the global market. With the increasing popularity of snowmobiling, manufacturers see an opportunity for diversifying their product offerings.Several companies are leveraging data analytics to identify loopholes in their production processes as well as increase sales of their products globally. The OEMs are also catering to the growing consumer demands for better vehicle handling dynamics with the use of data analytics. Thus, the companies are anticipated to produce snowmobiles with improved chassis stiffness and technology integration with further other updates.

The rising popularity of electric vehicles is attributed to their compliance with emerging environmental regulations, offering advantages over traditional gas-powered snowmobile models. Electric snowmobiles require minimal maintenance and have fewer components in motion while in operation, thereby minimizing the likelihood of mechanical breakdowns. In addition, snowmobile manufacturers are increasingly investing to develop technologically advanced and energy-efficient vehicles, driving the market's growth. Automotive players such as Bombardier Recreational Products Inc., Arctic Cat Inc., Polaris Inc., and Alpina Snowmobiles are investing heavily in their electric vehicle manufacturing plans. In February 2023, Bombardier Recreational Products Inc. announced the launch of its new electric snowmobile models, Ski-Doo and Lynx.

However, the higher cost of snowmobiles is hindering its market growth. In addition, factors such as early discharge of the battery, frequent fuel drainage in the middle of the voyage, and freezing of fuel at low temperatures are some of the concerns causing hesitancy in consumers before purchasing a new snowmobile. Thus, the key vendors are planning on optimizing the battery technology and introducing electric snowmobiles that require less maintenance but offer a similar thrilling experience to the riders. Therefore, market players are poised to overcome this challenge over the forecast period, thereby enabling more growth opportunities for the stakeholders.

Vehicle Type Insights

The trail snowmobile vehicle segment held the largest share of over 37% of the global snowmobile industry in 2022. The segment growth is attributed to the increasing popularity of the vehicle type among people due to its ease of use, which has led to increased interest in winter sports and recreational activities in North America, Eastern Europe, and Asia Pacific. In addition, several cities in Nordic countries have started witnessing growth in snowmobile sales due to growth in tourism activities.

The mountain snowmobile vehicle segment is expected to grow at the fastest CAGR over the forecast period. The growth is ascribed to several key factors, including the increasing tourism in mountain terrain, advancements in snowmobile technology, and the allure of exploring remote areas accessible through snowmobiling. As per the European Commission, in January 2023, a project known as Visit Arctic Europe, a cross-border project between Norway, Finland, and Sweden, witnessed increasing popularity as a holiday destination. The winter excursion appeals to snowmobile enthusiasts who journey for one hour to partake in ice fishing on a frozen lake. Furthermore, snowmobiles adhere to an environment-friendly standard, minimizing pollution.

Engine Type Insights

The 2-stroke engine segment accounted for the largest share of over 64% of the global snowmobile industry in 2022. The growth of the segment is attributed to the growing demand for various enhancements such as higher power-to-weight ratio, lighter weight, and simple design popular among snowmobile enthusiasts, which is expected to drive the growth of the 2-stroke engine segment. Moreover, the growing popularity of off-road snowmobiles due to rising off-road activities is witnessed across the tourist places situated in the hilly regions.

The 4-stroke engine segment is expected to grow at the fastest CAGR over the forecast period.The growth of this segment can be attributed to superior fuel efficiency, reduced emissions, and enhanced power delivery of this engine type. This surge is partially propelled by the increasingly stringent emission regulations in numerous countries, prompting manufacturers to prioritize the development of more eco-friendly engines.

Engine Size Insights

The 500cc to 900cc segment accounted for the largest share of over 77% in 2022. The rising popularity of snowmobiling can be attributed to a combination of factors, including the increasing demand for high performance, changing demographics, and technological advancements. The popular range of snowmobiles offers a balance between power and maneuverability, making them suitable for riders of all levels. With safety measures in place, stunning destinations to explore, and a sense of community among enthusiasts, snowmobiling continues to captivate the hearts of adventure seekers worldwide.

The above 900cc engine size segment is expected to grow at the fastest CAGR over the forecast period.The segment growth is attributed to the riders who increasingly seek higher performance and power from their machines to climb steep mountains and deep snow with a higher power output to deliver exhilarating acceleration and top speeds, providing thrilling experiences on the snow. Manufacturers can leverage this opportunity to create high-performance models that cater to adrenaline-seeking enthusiasts who crave the excitement of pushing their limits on the trails.

Seating Capacity Insights

The single seating segment led the snowmobile market and accounted for the largest revenue share of over 60% in 2022. The growth of the segment is attributed to factors such as demand for customized snowmobiles, affordable cost, lighter weight, and more agility than a two-seater enabling high performance, easy accessibility to transport, and more preferred and popular in racing events and solo riding.

The multi-seater segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is attributed to the increasing family and group tourism and the safety of snowmobiles in harsh weather conditions, as passengers can distribute the weight of the snowmobile and stabilize it, need for comfort, versatility, and more cost-effectiveness. Manufacturers can leverage this opportunity to manufacture models that meet customer-specific needs and preferences in the snowmobile industry.

Regional Insights

In 2022, North America held a substantial market share of over 78% in terms of revenue. This share is attributed to the increasing demand for winter sports activities, and the presence of significant snowmobile manufacturers is driving the market. According to the International Snowmobile Manufacturers Association (ISMA), in 2022, more than 130,000 snowmobiles were sold worldwide, most of which were sold in the U.S. and Canada. In addition, the rise of the snowmobile industry has created over 100,000 full-time employees in North America. Thus, the demand for snowmobiles in North America is also bound to rise over the forecast period.

Europe is projected to emerge as one of the most lucrative regions for the market in terms of revenue during the forecast period. The growth of the region is attributed to the growing popularity of winter sports, such as snowmobiling, snowboarding, and skiing, which are becoming increasingly popular in countries such as Norway, Sweden, Finland, and Russia. In addition, the increasing number of winter tourists and government initiatives to promote tourism also have propelled the growth.

Key Company & Market Share Insights

The market is consolidated and characterized by the presence of major players such as Arctic Cat Inc.; Polaris Inc.; Bombardier Recreational Products Inc.; Yamaha Motor Co., Ltd.; and Alpina Snowmobiles. These companies are engaged in acquisitions, mergers, regional expansion, and strategic partnerships to gain a competitive advantage in the market. For instance, in October 2022, Bombardier Recreational Products Inc. acquired Kongsberg Inc. (KA Shawinigan), a subsidiary of Kongsberg Automotive ASA. This acquisition aims to strengthen its product portfolio associated with the electrification plan with the support of KA Shawinigan's expertise in developing and manufacturing electronic and mechatronic products. Some prominent players in the global snowmobile market include:

-

Alpina Snowmobiles

-

Arctic Cat Inc.

-

Bombardier Recreational Products Inc.

-

Crazy Mountain

-

Deere & Company

-

Moto MST

-

Polaris Inc.

-

TAIGA MOTORS INC.

-

Yamaha Motor Co., Ltd.

Snowmobile Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.74 billion

Revenue forecast in 2030

USD 2.33 billion

Growth rate

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, engine type, engine size, seating capacity, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; Russia; Finland; Sweden; Norway; China; India; Japan; South Korea; Brazil; Mexico; Chile; Argentina

Key companies profiled

Arctic Cat Inc.; Polaris Inc.; Bombardier Recreational Products Inc.; Yamaha Motor Co., Ltd.; Alpina Snowmobiles; Deere & Company; TAIGA MOTORS INC.; Crazy Mountain; Moto MST

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Snowmobile Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global snowmobile market report by vehicle type, engine type, engine size, seating capacity, and region:

-

Vehicle Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Trail

-

Mountain

-

Crossover

-

Utility

-

-

Engine Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

2-stroke engine

-

4-stroke engine

-

-

Engine Size Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Below 500cc

-

500cc to 900cc

-

Above 900cc

-

-

Seating Capacity Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Single Seater

-

Multi Seater

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Finland

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Chile

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global snowmobile market size was estimated at USD 1.67 billion in 2022 and is expected to reach USD 1.74 billion in 2023.

b. Key factors that are driving the snowmobile market growth include the increasing popularity of winter sports such as skiing, snowboarding, snow racing, snow-cross, snowshoeing, snowmobiling, and recreational activities such as ice fishing and backcountry exploration, along with increasing consumer preferences for adventure sports, post the outbreak of the COVID-19 pandemic.

b. The trail snowmobile vehicle segment is estimated to account for the largest share of over 37% of the global snowmobile market in 2022. The segment growth is attributed to the increasing popularity among people due to ease of use developing more interest in winter sports and recreational activities in North America, Eastern Europe, and Asia Pacific.

b. Some key players operating in the snowmobile market include Arctic Cat Inc., Polaris Inc., Bombardier Recreational Products Inc., Yamaha Motor Co., Ltd., and Alpina Snowmobiles.

b. The global snowmobile market is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 to reach USD 2.33 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.